Source: Alumni Magazine

Google Earth, Maps, and Street View

John Hanke, MBA 96, brings the world into view

John Hanke, MBA 96, is the man who brought the globe to your web browser. He led the development of Google Earth, whose 3D views of satellite and streetscape imagery are consulted by diverse users ranging from motorists and military leadership seeking directions and topography information to scientists predicting disease outbreaks. Google Earth is the world’s most widely used geographic information system (GIS) service, with more than a billion people using its products, including Google Maps and Google Street View, every month. These days, Hanke is indulging his other passion: video games. He led Niantic Labs, Google’s in-house augmented reality gaming unit, then guided a split from the parent company and developed the game sensation Pokémon Go. Read on for his success story.

2001

Hanke co-founds Keyhole, a geospatial data visualization firm, where he develops an “earth browser” designed to be the “ultimate geographic reference platform.”

2003

The war in Iraq puts Keyhole on the map—with media coverage by CBS, 60 Minutes, Forbes, and more—for its ability to provide fluid 3D digital images, including close-ups of Baghdad. Keyhole now has more than 12,000 customers in sectors like real estate, engineering and architecture, media, and government. Investments come from Sony, Nvidia, and In-Q-Tel.

2004

Google acquires Keyhole for $35 million. As VP of product management for Google’s Geo division, Hanke leads the development of Keyhole into Google Earth a year later.

2005

Driving to your destination goes high tech, as Google Maps, a component of Google Earth, uses satellite imagery and aerial photography—along with real-time traffic conditions—to direct terrestrial travelers along the streetscape.

2008

A feature of both Google Maps and Google Earth, Street View is introduced to provide interactive panoramas of neighborhoods and throughways from across the planet. Images are collected using an innovative six-lens camera, usually mounted on a tripod atop a vehicle, capable of snapping 360-

degree photos.

2010

Hanke founds a skunkworks gaming division within Google called Niantic Labs.

2012

The seventh version of Google Earth includes 3D imagery and a tour guide who shows users famous landmarks. It’s the last update before the company makes the service free.

2015

Hanke spins off Niantic Labs from Google, taking the company independent.

2016

Pokémon Go is released. By 2023, it will have generated more than $4.2 billion in revenue. As for Google Earth, it launches in virtual reality, allowing users with a VR headset to stand atop Mount Kilimanjaro, fly like their favorite superhero over the Grand Canyon, or wander the streets of Tokyo.

Jeffrey R. Bohn, PhD 99

Chief Strategy Officer, One Concern

The forecasts are calamitous: by 2090, the sea level is expected to rise three feet in the Bay Area, leaving the San Francisco and Oakland airports underwater, according to studies by nonprofit news service Nexus Media.

The forecasts are calamitous: by 2090, the sea level is expected to rise three feet in the Bay Area, leaving the San Francisco and Oakland airports underwater, according to studies by nonprofit news service Nexus Media.

Epic rainfall will create widespread flooding stretching from San Francisco Bay south into San Jose—along with loss of life and significant property damage.

To Jeffrey R. Bohn, these potential scenarios guide his professional life and present an important question: Can disasters be made less disastrous?

The answer is yes. “Resilience analytics,” as the young field is known, provides critical insights into minimizing risk on a warming planet by suggesting where to avoid building commercial spaces and housing and where to use climate-change mitigation budgets.

“There’s been a massive increase in computing power, so we can do simulations and machine learning today that were unthinkable when I was getting my PhD,” says Bohn, the chief strategy officer at One Concern, whose climate analytics software provides information on the potential financial impacts of weather and climate-related “loss events.”

The company’s tools could change the way insurance, banking, and asset management firms incorporate climate risk into their pricing and services.

Bohn was called to the role after working as a senior advisor and chief research and innovation officer for Swiss Re, a reinsurance company.

“I’ve become more mission driven, trying to figure out a way to make the world more resilient to things like climate change that impact people’s lives,” he says.

Caroline Yeh, EMBA 15

Co-founder & Co-owner, TSUMo Snacks

It was a cookie that changed the career path of Caroline Yeh. As a Haas student visiting and researching Seattle-based companies, some of her classmates brought Yeh a cannabis cookie from a dispensary, sparking an interest in improving the snack. With years in consumer-packaged goods, Yeh used her experience to investigate her new interest in cannabis edibles.

It was a cookie that changed the career path of Caroline Yeh. As a Haas student visiting and researching Seattle-based companies, some of her classmates brought Yeh a cannabis cookie from a dispensary, sparking an interest in improving the snack. With years in consumer-packaged goods, Yeh used her experience to investigate her new interest in cannabis edibles.

After graduation, Yeh landed her first position in the edible industry. On the eve of cannabis legalization in California, it appeared that the industry would grow exponentially. But regulations, high tax rates, the cost of compliance, product saturation, and the illicit market continue to severely impact the industry. Nevertheless, Yeh enjoys the challenge. “Getting to help build an industry from scratch, it’s not something that often happens in a lifetime,” she says.

In 2021, Yeh co-founded TSUMo Snacks, introducing one of the first savory cannabis treats. TSUMo has garnered much attention, in part due to its notable partnerships with Snoop Dogg—who co-founded the VC firm that led TSUMo’s $4M seed round—and celebrity chef Roy Choi, who created some of TSUMo’s most popular items, including Choi’s Spicy Cheesy Ramen Curls.

Yeh reflects on the impact of the moment: “Right now, we’re running partnerships with a few other Asian-owned cannabis brands to offer a bundle that benefits Asian Americans for Cannabis Education. It’s great that I get to use my position to invest in my community and things that I care about.”

Yoav Gilat, BCEMBA 05

Founder & CEO, Share a Splash Wine Co.

After working for a few years as an attorney, Yoav Gilat realized his interests lay elsewhere. So he changed course and joined the wine industry. “There’s something magical about wine that brings people together,” Gilat says. “Wine is like pixie dust that creates uplifting experiences. You don’t find that in other industries.”

After working for a few years as an attorney, Yoav Gilat realized his interests lay elsewhere. So he changed course and joined the wine industry. “There’s something magical about wine that brings people together,” Gilat says. “Wine is like pixie dust that creates uplifting experiences. You don’t find that in other industries.”

While at Haas, Gilat did a case study on Bonny Doon Vineyard and met John Williams, owner and winemaker of Frog’s Leap. Those experiences helped clarify his own path forward.

In 2006, he founded Cannonball Wine Company. Rather than buying a vineyard, Gilat outsourced that part of the business and hired a talented winemaker to work closely with growers. “Even though we don’t own the vineyards, we have input in the way the vines are grown,” he says.

His initial vision was to create a delicious cabernet sauvignon priced under $20, a gap in the market, as he saw it. Cannonball released its first 5,000 cases in 2007. The next year, the recession hit. This could have been disastrous for the company, but the attractive price tag—around $15—made it an affordable luxury and instead marked the beginning of exceptional growth. Since then, the company has expanded to produce a selection of wines under different labels—including Angels & Cowboys and Atelier—and has partnered with New Zealand and Portuguese wineries, all under the parent name Share a Splash Wine Co.

Future Sense

Spotting prescient ideas

Subtle shifts in how people use language can foretell big changes in how we think about the world. For example, when followers of astronomer Copernicus stopped calling the sun a planet, it signaled the beginning of the end of the belief that the earth was the center of the universe.

Getting out ahead on far-sighted ideas can yield big financial or reputational rewards, but these can be difficult to spot, even though signals about the next big idea may be lurking in everyday language. Advances in natural language processing are now making it possible.

Professor Sameer Srivastava and co-authors have developed a deep learning model that can identify where and when prescient ideas—those that go against convention but later become widely adopted—first emerge.

By parsing millions of public utterances by senators, judges, and executives, they found that far-sighted ideas tend to emerge not from established leaders but rather in the language first used by those on the fringes.

“This is a way to go back and actually find when somebody first used an idea in a way that became prescient,” says Srivastava, whose research with Haas post-doc researcher Paul Vicinanza and Stanford’s Amir Goldberg was published in PNAS Nexus. “Our research suggests there’s a reasonable chance that those people were more likely to be on the periphery of their field.”

Srivastava and his co-authors used a deep neural network known as Bidirectional Encoder Representations from Transformers (BERT) to unearth the linguistic markers of prescient ideas in politics, law, and business and trace how they became mainstream. They defined prescient ideas as those that are not only novel—words or phrases used for the first time in a new context—but that rethink the dominant assumptions in a particular field. To be considered prescient, the idea must also foreshadow how the domain will evolve in the future.

Political outsiders

Among nearly five million floor speeches delivered by members of the U.S. Congress from 1961 to 2017, the model identified Mississippi Senators John Stennis as the most prescient and James Eastland as the least prescient. Both fiercely opposed civil rights legislation in the 1960s, but the well-connected and powerful Eastland made his case with overtly racist rhetoric. Stennis, meanwhile, was “among the first to base his objections on the principles of ‘color blindness,’ limited government, and individual freedom,” the researchers wrote. This indirect set of arguments proved highly prescient, “laying the groundwork for contemporary conservative talking points on race relations in the U.S.”

The model flagged smaller firms as more prescient than larger, established players. More prescient firms also had above-average stock returns.

Landmark lower courts

The same idea held true for the law. In examining 4.2 million digitized federal and state legal rulings, the researchers found that landmark U.S. Supreme Court decisions, such as legalizing gay marriage or affirming the Affordable Care Act, tended to originate in lower courts. The most prescient decisions—those with the highest number of citations—were 22 times more likely to come from state appellate courts than the U.S. Supreme Court.

Prescient businesses

In the business world, the researchers had a smaller dataset to work with, analyzing transcripts of the Q&A portion of public quarterly earnings conference calls—a relatively recent practice compared to similar records in law and politics. In these calls, managers often reveal strategy not found in press releases or official filings. The model flagged smaller firms as more prescient than larger, established players. More prescient firms also had above-average stock returns. (The authors are doing more work on business figures to expand the data pool.)

Implications

The findings have big implications across many disciplines, says Srivastava, the Ewald T. Grether Professor of Business Administration and Public Policy. One result, he says, may be more recognition for people who have been historically marginalized—such as women and minorities. “They may be the ones generating a lot of the ideas, even if they aren’t getting credit for all of them.”

Negotiation Frustration

Who says women don’t negotiate?

For decades, a closet industry of books and workshops has promised to make women better negotiators and help close the gender pay gap. But new research by Professor Laura Kray shows that believing women don’t ask for higher pay is not only outdated, but it may be hurting pay equity efforts.

“Continuing to put the blame on women for not negotiating away the gender pay gap does double damage, perpetuating gender stereotypes and weakening efforts to fight them,” says Kray, the Ned and Carol Spieker Chair in Leadership.

Last year, women earned about 22% less than men, on average. But broken down by income level, the gap for middle- and lower-wage women has decreased over the past 20 years while the gap for those with higher salaries—where there is often more room for negotiation—has increased.

Women MBA grads earn 88% of what men make after finishing their degree but only 63% of what men make 10 years later, past research by Kray and others has found.

Women Do Ask

The researchers’ survey of a nationally representative sample confirmed the perception that women negotiate less than men and are less successful when they do. Yet when Kray and her co-authors analyzed a survey of students graduating from a top MBA program between 2015 and 2019, they found that significantly more women than men reported negotiating their job offers—54% versus 44%.

The researchers then delved into a 2019 alumni survey of 1,900 MBA grads and found, again, that the women earned 22% less than men. But other than women’s lower pay, the only differences that emerged along gender lines were that more women than men said they had attempted to negotiate—and more women reported being turned down.

“Continuing to put the blame on women for not negotiating away the gender pay gap does double damage, perpetuating gender stereotypes and weakening efforts to fight them.”

Revisiting past conclusions

Kray and her co-authors also used an updated statistical approach to revisit a 2018 meta-analysis of studies on gender and negotiations. Focusing on nine studies published from 1982 to 2015 that measured gender differences in initiation of salary negotiations, they found no difference overall. But when they looked at changes over time, they found that men did report higher rates of negotiating versus women early in the era. The gender difference appeared to disappear around 1994 and reversed beginning around 2007. The trend has continued to grow since then, Kray says.

Many factors may have contributed to women’s greater assertiveness over the past two decades, including the “lean-in” movement sparked by Sheryl Sandberg’s book of the same name. But the downside of such messages has been to “blame the victim,” Kray says—putting the onus on women to fix the pay gap by working more and trying harder.

Another experiment exploring attitudes about the pay gap’s causes and support for solutions found that people who believed more strongly that women’s lower negotiation rates fueled the pay gap for MBA graduates were less likely to support salary-history bans and more likely to justify the current system.

“Negotiating for pay or promotions is clearly beneficial, and there’s room for everyone to do more negotiating,” Kray says. “But it’s time to end the notion that women don’t ask.”

Celebrating Haas

Looking back to look forward

With this issue we recognize a huge milestone in the history of our business school: 125 years. But it is not just an anniversary. It is 125 years of breakthrough ideas, of improving economic outcomes for people worldwide, of guiding the policies that shape our lives. In short, 125 years of reimagining business.

With this issue we recognize a huge milestone in the history of our business school: 125 years. But it is not just an anniversary. It is 125 years of breakthrough ideas, of improving economic outcomes for people worldwide, of guiding the policies that shape our lives. In short, 125 years of reimagining business.

To that end, we wanted to create an anniversary issue that challenged convention. You will not see any sepia-toned photos or timelines stressing important dates. Instead, we aim to show you how our pioneering achievements of the past have led to even more groundbreaking achievements. We would like to connect the dots for the story of Berkeley Haas, so you see not just where we have been but where we are headed.

For those of you who may not know, I am taking a semester-long sabbatical to focus on my research and to recharge before my second term as dean begins in January. Haas will be in excellent hands while our Associate Deans of Academic Affairs, Jenny Chatman and Don Moore, serve as acting deans. I look forward to rejoining you in January. Enjoy the issue!

Sincerely,

Ann Harrison

Bank of America Dean

Shake On It

Personal relationships matter in lending

Numbers are important when it comes to loans. Lenders look at companies’ financial statements and loan history when determining interest rates or loan terms.

But in the competitive landscape of loan acquisition, it’s not just about crunching numbers. Loan officers and borrowing managers are people, after all, and those who do repeat business build relationships. New research co-authored by Asst. Prof. Omri Even-Tov shows that the soft information accumulated in these relationships can reduce the costs of screening and monitoring and thus reduce the cost of debt.

“These relationships foster trust and reduce information gaps, allowing lenders to gain valuable information about a borrower’s sense of responsibility and overall creditworthiness,” says Even-Tov.

In fact, established relationships between loan officers and borrowing managers not only increase the likelihood of a loan but tend to improve loan conditions for the borrower without increasing risk for the lender.

Using a sample of loans from 1996 to 2016, Even-Tov and his colleagues compared one-off interactions with loans conducted by the same parties. In established relationships, the borrowers saw better interest rates and the lenders got better screening and monitoring as evidenced by fewer rating downgrades.

They also found that when a borrowing manager and loan officer left their jobs, the two firms were roughly 70% less likely to engage in business together.

Health Check

Management strategy influences medical treatment

In today’s healthcare landscape, physicians generally have the option to keep running their own practice, sell to a hospital and become a salaried employee of that facility, or sell to a physician practice management company (PPMC). For doctors, it can seem like a no-brainer: Management experts, often private equity firms, offer to handle the logistical and financial drudgery of their practices, leaving the doctors to focus on patient care.

However, Assistant Professor Ambar La Forgia has found that even PPMCs claiming to preserve physician autonomy can alter clinical outcomes for better or worse.

C-sections are more profitable than vaginal births because insurance companies typically pay out more in reimbursements.

The study, published in Management Science, examined the strategies adopted by PPMC-owned obstetrician and gynecologist practices and found they influenced rates of cesarean sections for low-risk patients.

La Forgia tracked three PPMC-owned practices that together accounted for more than 40% of Florida’s OB-GYNs between 2006 and 2014. One PPMC focused on attracting “value”-based contracts, which link payment to clinical performance by providing clinical management services, while two focused on raising revenue by providing financial management services and negotiating higher-paying, fee-for-service contracts, which link payment to quantity of services.

C-sections are more profitable than vaginal births because insurance companies typically pay out more in reimbursements. But unnecessary C-sections can increase risks for both mother and infant, so a rise in C-sections performed on mothers at low risk for childbirth complications can raise suspicions.

La Forgia found that the OB-GYN practice focusing on clinical management cut C-sections for low-risk women by 22%. Those that focused on financial management showed a 10% to 11% rise in C-sections.

Notably, the two financially managed PPMCs performed more C-sections on privately insured patients than those insured by Medicaid, the government insurance program that typically covers people with lower incomes. Florida, La Forgia notes, is one of the few states where Medicaid reimburses physicians at the same rate for C-sections and vaginal births.

“Even though PPMCs say they preserve physician autonomy, managerial changes do appear to influence physician treatment choices,” says La Forgia.

Investing in the Future

Preparing Black teens for financial success

Alexandria Williams had taken economics at Oakland’s Skyline High School, but she didn’t learn much about how to actually budget and manage money. So for eight Saturdays during her senior year, she headed to class at Berkeley Haas, learning not only about personal finance but also about investing, home ownership, and building intergenerational wealth.

Her efforts paid off. Williams (shown above), along with 23 other high school seniors who graduated in May from the Economic Equity and Financial Education Pilot Program, walked away with an $8,000 college scholarship from Pacific Gas and Electric. The students also gained financial knowledge well above the average high school graduate plus a new network of supporters and mentors.

“What I would tell my friends would be to invest as much as you can for however long as you can, because the length of time makes a difference,” says Williams, who is headed to UC Irvine in the fall.

The pilot program, created by PG&E in collaboration with Haas, Berkeley Executive Education, and Mills College at Northeastern University, aims to equip African American high school students from under-resourced Oakland and Bay Area high schools with financial tools for success. It also has a more ambitious goal: to make a dent in the pervasive wealth gap between white and Black and Latinx U.S. households.

According to a 2021 U.S. Federal Reserve study, the average Black and Latinx U.S. household earns about half as much as the average white household and owns only about 15% to 20% as much net wealth.

Jimi Harris, chief of community relations at PG&E, created the program in the wake of George Floyd’s murder, to channel his anger and frustration into something positive, and PG&E committed $500,000 from its community charitable Better Together Giving Program.

Harris’ Morehouse College classmate Jason Miles, founder and managing director of Amenti Capital, worked with Associate Professor Panos N. Patatoukas to co-develop the curriculum. For Patatoukas, the program appealed to his passion for equalizing access to financial education. “Technology has been transforming education in profound ways, but access to financial education still remains within the reach of only a few,” Patatoukas says.

For Harris, the true benefits of the program have yet to be realized. “These kids have demonstrated a tremendous amount of discipline, and they’re investing in themselves, which is the biggest investment they can make,” he says.

Game Changer

Fellowship proves crucial to career success

In 2005, John Fernandez, MBA 07, was considering his next career steps and whether earning an MBA would help him get there. “I’d just gotten married. I was having a kid. I bought a house,” says Fernandez. “So an MBA meant a lot of sacrifice, and I didn’t know if it made more sense to just keep moving up at my current company instead.”

He decided on Berkeley Haas largely because he received the Torres Family Fellowship. “The Torres fellowship was a game changer for me,” Fernandez says. “It made me say ‘I’m going to go do this.’”

The decision to pursue an MBA turned out to be a good one for Fernandez, who today is CFO at Forge Rock. He’s seen the company grow from 80 employees and around $4 million in revenue to nearly a thousand employees and around $250 million in revenue.

Foundations of Success

Once at Haas, Fernandez was impressed with the strong sense of community at the school. Michael Torres, BA 82 (architecture), MBA 86, CEO of Adelante Capital Management, a registered investment advisor, and founder of the Torres Family Fellowship, was a focal point of that community.

Fernandez recalls gathering at Torres’ office with other fellowship recipients. “We were all sitting there with this very successful individual at his beautiful office, and he talked about creating a network among people and among Torres fellows to help each other be successful,” he says.

For a first-generation MBA student like Fernandez, who didn’t have a built-in network of business contacts, the connections Torres created through the fellowship were a crucial foundation for his career.

Setting an Example

Torres has long been an active Berkeley alumnus, including as a member of the UC Berkeley Foundation, for which he’s now a trustee emeritus. He created the Torres Family Fellowship in 2005 in part to serve as an example to other foundation members and alumni. Since that time, 16 students have benefitted from the fellowship.

Torres continues to connect with current and former fellows. He’s also the proud parent of a current Haas MBA student. Fernandez and Torres stay in contact, including the occasional round of golf. Both unequivocally agree Torres is the better golfer.

Torres says it’s always fulfilling to hear about the success of fellowship recipients, a testament to the community he’s fostered. “Giving back pays dividends in life,” he says. “You just don’t know when and how. It isn’t necessarily monetary.”

Pop Quiz Answers

Question 1

Answer: B. The CRB was established in 2002 with the support of several prominent socially responsible leaders, including actor and philanthropist Paul Newman; former Bank of America Chairman Rudolph Peterson, BS 1925; former Chairman of Goldman Sachs John C. Whitehead; and Founder and former Chairman of Kontiki Mike Homer, BS 81

Question 2

Answer: C. In 1958, Prof. John Wheeler introduced the concept of computer-based business games and simulation exercises as a basic teaching technique for graduate business education. The Bay Area Simulation Study, an interdisciplinary study chaired by Prof. Paul Wendt in 1968, was one of the first computer-based land-use simulation studies. The doctoral thesis by Wayne Boutell, PhD 63, titled Auditing with the Computer, pioneered a more efficient way of accounting versus manual audits. Profs. Fred Balderston and Austin Hoggatt produced “Simulation of Market Processes” in 1962 by creating and manipulating a computer model of the West Coast lumber industry.

Question 3

Answer: A. Miracle Goggles was a complete fiction crafted by co-teacher Leo Helzel, MBA 68, the night before the first class. Helzel was not originally slated to teach but stepped in when someone canceled. “There was no material at all—zero—so I invented a case called Miracle Goggles, because you had to have a case,” he said. “Edison Einstein was the protagonist. The [fictitious] goggles were shatterproof and magnified 100 times.” Helzel thereafter turned to live cases, inviting entrepreneurs to tell their stories to the class.

Question 4

Answer: E. Haas was among the first business schools whose students organized a Women in Leadership conference. The event continues nearly 30 years later and is the longest-running conference at Haas.

Question 5

Answer: A. Though accounting was considered the strongest field at Berkeley early on and its program one of the most respected nationwide, we were not the first to teach it. Marketing was first taught in 1902 by Simon Litman, an acknowledged leader in the development of both marketing education and international marketing. Market Analysis was first taught by future dean E. T. Grether in 1926. Haas pioneered teaching the combination of business law and the broader societal framework of business in a course called The Political and Social Environment of Business, launched by Prof. Dow Votaw in 1959; it soon became a requirement for both undergrads and MBAs.

Question 6

Answer: D. While our school’s namesake, Walter A. Haas Sr., BS 1910, was president and chairman of Levi Strauss, he did not found the company; Levi Strauss did in 1873. Life360 was co-founded by Chris Hulls, BS 06. Traveling Spoon was co-founded by Aashi Vel and Stephanie Lawrence, both MBA 13. Club Quarters was founded by the late Ralph Bahna, MBA 65. Taylor Farms salads were created by Bruce Taylor, BS 78. And Hot Pockets were developed by Paul Merage, BS 66, MBA 68.

Question 7

Answer: G. Henry Mowbray, who taught from 1910 to 1948, wrote Insurance, Its Theory and Practice in the United States (1930). Principles of Labor Economics was written in 1920 by Prof. Solomon Blum. Carl Copping Plehn, who became dean in 1898, wrote Introduction to Public Finance (1896), the standard text used in such courses. Financial Statement Analysis and Security Valuation (2001) was written by Prof. Stephen Penman, a pioneer in developing the modern conceptual framework for financial statement analysis and applying it to the valuation of equity securities. The late Prof. Louis “Pete” Bucklin wrote the influential book A Theory of Distribution Channel Structure (1966), which presented a general framework for the analysis of business networks and distribution systems; he’s considered a pioneer in the field. Introduction to Operations Research (1957), co-written by the late Prof. Emeritus C. West Churchman, was the backbone of most university offerings in the emerging area. Churchman helped develop the field of operations research/management science and coined the term

“wicked problems.”

Question 8

Answer: C. Data & Decisions was rolled out online to evening and weekend students in June 2012. A close second was the online version of Power and Politics, which was launched in fall 2012.

Question 9

Answer: D. The California Business Alumni group launched the San Francisco Bay Area and Tokyo chapters in 1977, later expanding by forming chapters in Sacramento and Los Angeles and by dividing the Bay Area into three sections: East Bay, South Bay, and San Francisco. By 1981, 36 chapters had been established worldwide. Today, there are 26 regional chapters and 68 regional reps worldwide as well as six affinity groups.

Question 10

Answer: B. In the late 1960s, joint MBA/JD programs were developed with the law schools at Berkeley and UC Davis; in 1975 a joint program was created with Hastings College of the Law. The MBA/MPH was launched with the Berkeley School of Public Health in 1983. The joint MBA/MA degree was established in 1987 with the Department of Asian Studies; today it’s an MA degree in global studies taken in the year following completion of the MBA. The joint master’s degree in business and engineering enrolled students starting in the fall of 2020.

Advising Germany

Negotiating the Future

Inspiration amid upheaval

We live in a changed world since the pandemic started, and this issue tackles a question on many minds: What is the future of work? How might technology impact the evolution of work as we know it? I have thought about this constantly as dean of Haas and as a leader during the pandemic. How will we mitigate inequality as the world of work is transformed? One impact of our altered work lives has been an acknowledged need for greater balance and the recognition of mental health concerns. Increasingly, employers are working to address these pervasive issues, and many Haas alumni are leading the charge.

Elsewhere in this issue we look at global trends. Professor Ulrike Malmendier, a policy advisor for her native Germany, describes how that country is weathering economic storms. We also celebrate an alumnus who has changed the educational landscape in Ghana and catalyzed young leaders to transform their communities. His accomplishments are truly inspirational, and here at Haas, we are aiming to nurture that talent by waiving application fees for prospective MBA students from Africa. Enjoy the issue!

Sincerely,

Ann Harrison

Bank of America Dean

Advising Germany

Professor Ulrike Malmendier discusses her role as a top economic expert in Europe.

As a pioneering behavioral economist, Professor Ulrike Malmendier has made it her life’s work to illuminate the ways that human psychology and systematic biases influence economic behavior. Her research stands out for its originality and creativity: She’s shown that the economic conditions that prevail during a person’s life so far strongly influence their views on money for years and decades to come. In 2013, she won the prestigious Fischer Black Prize from the American Finance Association, given biennially to the top finance scholar in the world under the age of 40. She’s the only woman ever to do so.

Malmendier, the Edward J. and Mollie Arnold Professor of Finance, recently turned her attention from academia to public service when she was appointed to her native Germany’s Council of Economic Experts, the top advisory board to the national government. Berkeley Haas spoke with her about what it’s like to work in the policy arena.

Q&A

Q: How did you get appointed to advise Germany’s government?

A: It started with me writing an op-ed, together with a colleague, on why no self-respecting economist would ever join the German Council of Economic Experts. I lamented that whenever we have a new administration here in the U.S., half of my department gets emptied out because people are called to Washington to help. It just happened again with Biden. Germany doesn’t have that tradition of seeking out the top minds to advise on policy, and I felt that this should change. The next thing I knew, I got a call from the German chancellery, then still under Chancellor Angela Merkel, asking whether I wanted to join the council. Initially I declined. But people kept telling me: If you really want to change it, be a part of it. So I decided I wanted to help modernize the council and make it more, and differently, relevant.

The council was traditionally known as the “five wise men,” but it now includes three women. What’s your impact as a woman in the male-dominated field of economics and finance?

I think it was a big mistake to leave out an entire gender from policy advising. What we’ve lived through in our lives shapes us, and we bring a different perspective to the table. So it’s good that the situation has changed and the “wise men” are now working alongside women. But the bigger change in the work of the council today is that economics has become more evidence-based. Rather than having opinions about whether a policy like, say, a minimum wage, is bad or good, we say, “What does the data tell us? Let’s look at what has happened in different places where it was implemented, so we can draw evidence-based conclusions.” So, I don’t know whether you can attribute the changes in the council’s work today to its gender composition.

How does your perspective as a behavioral economist differ from classical economists, and how does it contribute to this role?

The classical model of the “homo economicus,” who rationally maximizes their economic self-interest, is only half the truth. Behavioral economics offers a more realistic image of humanity. For example, we know that experiences from our lives impact us in the future, and one big topic on the table this year is inflation—not only in the U.S. but also in Europe. When inflation was scratching the double-digits in Germany, I was not happy. But I kept telling policymakers: Let’s not only think about fixing it right now, but let’s keep in mind that there might be long-term implications if we stay there too long. People get risk-averse, they assume different attitudes toward saving and investment. We can prevent such cycles if we don’t panic and address the economic problem with determination. Politicians and policy leaders can help by communicating clearly.

Did you want to influence the council toward a particular policy direction?

If you ask some of my predecessors, they might have come in with strong positions on certain issues, like raising or lowering taxes, for example. I have a hard time assuming such absolute positions. Typically, there are good arguments on both sides, and neither of them is 100% right under all circumstances. In the case of the tax example, there can be lots of inefficiency in what governments do with tax revenue. Maybe that money could be used better by people who are providing employment for others. But we also want to provide a social safety net, so why not ask more from people who have more than enough and, in the current situation, aren’t feeling the energy crisis and inflation as much? When people have a hardened position one way or another they stop listening. We always need to think through the human impacts of economic policies and be able to explain them. The result we want is a working economy with a strong safety net.

What have you learned about having an impact as policy advisor?

I had not realized how much it is simply about being in the right place at the right time. Here is an example: In December, the German government wanted to help people get through the winter of high energy prices by paying the bills for people heating with gas. I understand the impulse, but if you just pay people’s bills, they have no incentive to conserve—and that was very urgently needed in light of the reduced supply of energy from Russia. If the government is paying, you might just turn up the heat and open the window at the same time. So economists helped design a structure where the government would subsidize the December gas bill but based on past consumption. In terms of their current consumption, people would still have incentive to save. If they consumed less, they would get the excess money back. It took a lot of work to convince the politicians. At one point a high-level official said, “It’s so complicated, why don’t we just pay the December bills?” And in that moment it was key that an economist was there to say, “No—remember incentives?” Luckily, it passed. But it could have gone the other way.

“With the worker potential we have in Germany right now, we need more active thinking about how to reorient everybody toward the skills that will be in demand in the future. … At the same time, it is clear that Germany needs more people to keep the economy growing.”

You released your first annual report with the Council of Economic Experts in November. Were there surprises?

In many respects, Germany is doing much better than many of us economists predicted or feared. We’ve certainly heard people say that the crisis will lead to a deindustrialization of Germany, and the GDP will come crashing down as a result of this energy crisis. We’ve seen none of this happening.

Why is that?

For starters, we have taken good steps to address the crisis. Germany is a country that has a buffer. Our chancellor was able to announce that we are putting together a special package of 200 billion euros to address the fallout. But the “forced savings” from the COVID pandemic and the backlog of orders on industry also played an important role.

“When inflation was scratching the double-digits in Germany, I was not happy. But I kept telling policymakers: Let’s not only think about fixing it right now, but let’s keep in mind that there might be long-term implications if we stay there too long.”

Since Russia’s invasion of Ukraine, Germany has been working to reduce its dependence on Russian oil and gas. Do you see the current energy crisis as temporary?

Germany has shown that we are able to react both on the government side—including fast-tracking LNG (liquid natural gas) terminals—and on the business side—they’ve been able to adjust their production and how they get their energy. But longer term, prices will not go back to where they were before. They may be twice what they are in the U.S. And that makes Germany inherently a much less attractive country, in particular for energy-intensive industries. We have to work hard not only on our transition to renewables but also more broadly on the advantages of our location—a country with a good legal system, a good infrastructure, and a well-educated population that is prepared for the types of jobs we will need over the next decades. Things are changing rapidly in terms of worker potential and training. It is important that both industry and government work together. Otherwise, we might not only drop into a deep economic hole right now, but we will slide into an even deeper hole in the long run.

What can Germany do?

My suggestions are first on the side of labor. With the worker potential we have in Germany right now, we need more active thinking about how to reorient everybody toward the skills that will be in demand in the future. The behavioral economist in me would recommend we seek out people in industries that are shrinking more actively and make it easy for them to retrain. You lower the hurdle, you almost nudge them into reorienting themselves. You provide mentoring, counseling, and training. At the same time, it is clear that Germany needs more people to keep the economy growing. Studies say Germany needs about 400,000 net immigrants per year. Accounting for people leaving, that’s about one million new people coming in per year.

Immigration has been a polarizing issue in Germany—as in the U.S. Will pro-immigration policies generate more backlash?

We all need to be concerned about polarization in society and also the lack of true integration of immigrants into German society. But as an economist, I’m looking at how our economy can continue to grow and thrive, and we simply won’t be able to sustain the level of services needed and the production needed without immigration. In Germany, people often recognize it when they have an elderly relative in the hospital or in need of care. They see how much labor is needed to support them, and Germans are just not able to fill all these spots. We need to take an active stance to address this need. It’s not enough just to change rules and laws and think we are done with the problem. We also need to keep thinking about how to create a more welcoming culture in our workplaces and society.

“Things are changing rapidly in terms of worker potential and training. It is important that both industry and government work together. Otherwise, we might not only drop into a deep economic hole right now, but we will slide into an even deeper hole in the long run.”

President Biden’s Inflation Reduction Act has been controversial in Europe. Why?

As much as everybody in Europe is excited about the U.S. turning to green energy, there was serious concern and disappointment after people read the fine print. The U.S. said, “We’re going to support electric vehicles and battery production, but it has to be produced 80% in the U.S; the final assembly has to be in the U.S.” This comes at a moment when Europe is already grappling with energy prices that will be significantly higher than in the U.S. over the long run, which means that a lot of companies are thinking about leaving. That’s very tough for Europe.

The U.S. and Europe are trying to find ways to make this disadvantage for European industries less severe. In my view, it’s important to keep talking rather than throwing around words like “trade war” or even “subsidization war.” Some people are saying, “If they do ‘buy-American,’ we’ll do ‘buy European.’” You can see where that’s going. I think we should instead step back and focus on where we can be leaders and in which industries we might leverage our advantages. We have to think further into the future.

Rosa Montes Vaca, BS 90

Business Development Executive

Large, established companies can be appealing when pursuing a finance position, but for Rosa Montes Vaca, bigger doesn’t necessarily mean better.

Large, established companies can be appealing when pursuing a finance position, but for Rosa Montes Vaca, bigger doesn’t necessarily mean better.

“I like supporting the underdog, because it makes me want to fight more,” says Vaca.

Throughout her 32-year career in investment banking and business development, Vaca has often worked at small firms. After graduation, she joined Artemis Capital Group, Inc., the first women-owned investment bank on Wall Street, founded by six former Goldman Sachs executives.

She started as a financial analyst and later assumed the duties of a vice president, gaining experience she never would have received early in her career had she worked at a firm with more resources, she says. Artemis’ leaders quickly promoted her to the pitch team competing for multimillion dollar deals. Later, Vaca became a VP at E. J. De La Rosa & Co., California’s first Mexican-owned investment bank.

Like the firms she grows, Vaca sees herself as a powerful underdog. She grew up in a low-income, single-parent home with six siblings in Alameda, Calif., and applied to Cal—her dream school—despite an instructor discouraging her from doing so. “I’ve walked both sides of the track,” she says. “I see opportunities other investment bankers and business development people do not—and I’m relentless with relationship building and service.”

Now, Vaca is focusing her talents on consulting for social impact and climate investing firms. It’s a change from banking, but she’ll carry the same drive she brings to all her work. “You learn about yourself building a company,” she says. “You find out just how powerful you really are.”

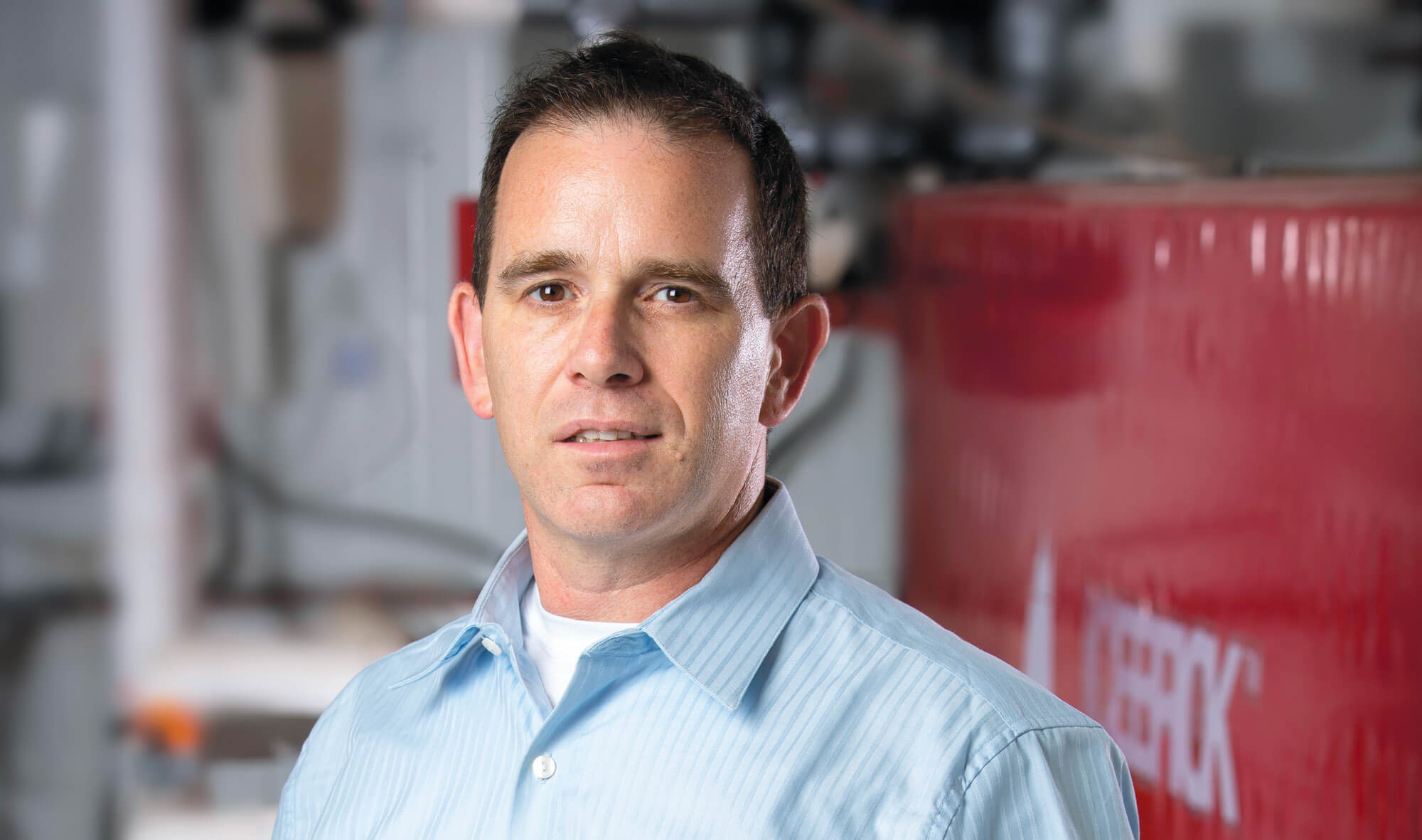

Boaz Ur, MBA 09

Chief Business Development Officer, Nostromo Energy

By Boaz Ur’s final year at Haas, he knew he wanted to impact the clean tech industry. But he took an unconventional route to get there.

By Boaz Ur’s final year at Haas, he knew he wanted to impact the clean tech industry. But he took an unconventional route to get there.

His first job upon graduating was at Pacific Gas & Electric, where he managed its demand response portfolio, including residential and third-party aggregator programs. The experience proved pivotal to his clean tech career. “My time at PG&E gave me an understanding of utilities, regulators, and customers and has been extremely valuable for me and the companies I work with today,” he says.

Ur went on to become vice president of business development and partnerships at Lightapp Technologies, which develops AI bots to help manufacturers manage energy use. Meanwhile, he was working on his own invention: a device that could offer real-time response to oil spills.

The idea won the energy track of the 2012 UC Berkeley Startup Competition (now called LAUNCH). Shortly after, he established HARBO Technologies.

Six years and 350 prototypes later, the HARBO Boom—a lightweight, portable device that could slow an oil spill within minutes—became a commercial success, credited with mitigating damages including in the second largest oil spill in the Port of Rotterdam.

Today, Ur is the chief business development officer for Nostromo Energy, a company that turns commercial buildings into energy storage assets using the IceBrick. This water-based technology stores cold energy in buildings during off-peak hours and then uses that energy to cool buildings during peak hours, reducing energy costs and carbon emissions.

It’s one more step on his crusade to positively change the world.

John Tallichet, BCEMBA 06

Chairman & CEO, Specialty Restaurants Corporation

John Tallichet is no stranger to crisis. Just as he was finishing his Haas degree, his father was diagnosed with cancer. The elder Tallichet had founded Specialty Restaurants Corporation, of which John was serving as president. When his father died a year later, Tallichet became CEO—just as the nation was heading toward a recession.

John Tallichet is no stranger to crisis. Just as he was finishing his Haas degree, his father was diagnosed with cancer. The elder Tallichet had founded Specialty Restaurants Corporation, of which John was serving as president. When his father died a year later, Tallichet became CEO—just as the nation was heading toward a recession.

“It was challenging, but I was confident I had the tools to take the company to the next level,” he says. “I don’t think I would have had that same confidence if I hadn’t been to Haas.”

SRC is a pioneer in the themed restaurant industry, and Tallichet, who started out as a restaurant “salad boy,” today oversees the corporation’s 18 eateries nationwide as well as its real estate and aviation divisions.

During the pandemic, Tallichet prioritized the well-being of customers and employees, giving up to two weeks’ pay to help employees through the initial lockdown and distributing groceries from their restaurants’ inventories for months. SRC also launched a beach-focused venue—Whiskey Joe’s Bar & Grill—at five waterfront locations in Florida. “It’s outside on the sand with a tiki bar,” Tallichet says. “When businesses reopened, those restaurants thrived.” SRC continues to grow, with four new restaurants opening and more planned.

Named chairman of the California Restaurant Association Board of Directors last year, Tallichet is also helping guide his battered industry.

“The challenges restaurants face are not over, and there are regulations coming down that will be difficult for them,” he says. “We want to defend restaurants against more costs when many are not fully recovered.”

Ashesi University

Patrick Awuah, MBA 99, propels an African renaissance

From the time he enrolled at Haas, native Ghanaian Patrick Awuah had a singular focus: to transform Africa by inaugurating a new type of higher education institution. It would be at the forefront of Africa’s socioeconomic transformation by preparing ethical, entrepreneurial leaders. Awuah spent his time at Haas gaining the skills he’d need to found and lead such a school. Launched in Ghana in 2002, Ashesi University was the continent’s first liberal arts college. It pioneered a multidisciplinary core curriculum teaching critical thinking, creative problem solving, ethical reasoning, and communication skills that went against the dominant rote learning culture in many African schools. Ashesi, which means “beginning” in the Ghanaian language Akan, is now recognized as one of the finest universities in Africa and has graduated more than 2,000 students determined to revitalize their communities and transform the continent. Here’s how a world-class university develops.

1998

1998

Patrick Awuah and three classmates, including Nina Marini, MBA 99, conduct a feasibility study for a private university in Ghana as part of Haas’ International Business Development program.

1999

The Ashesi University Foundation is founded by Awuah, its president, and Marini, its vice president.

2002

Having raised $2.5 million, Ashesi opens in a rented house with 30 students.

2005

The first class graduates—all finding quality placement.

2008

Ashesi students adopt an honor system to take exams unproctored, triggering a national conversation on the importance of values-based education. A capital campaign for a permanent campus begins. Ashesi achieves operational financial sustainability.

2011

Phase one of the new campus in Berekuso, 100 acres overlooking Ghana’s capital Accra, is completed on schedule and on budget ($6.4 million).

2012

Awuah is awarded Haas’ Leading Through Innovation Award and named Ghana’s 4th most respected CEO.

2015

Ashesi launches an engineering program with 76 students (40% women) and a new facility. A record 55% of students receive need-based scholarships—29% fully funded.

2018

The President of Ghana awards Ashesi a Charter, making it an autonomous degree-granting institution free from the supervision of a public university.

2020

In March, Ashesi students are among the first in Africa to resume learning after COVID lockdowns, thanks to learning systems already being online.

2023

Ashesi now offers nine degrees (three of them master’s) and enrolls over 1,400, 18% of whom are international (from 31 countries). Some 90% of grads find jobs, start businesses, or attend grad school within six months of searching.