The Haas connections that help alumni reimagine business.

Members of the Haas community have been reimagining business for 125 years. But how do fresh ideas and strong determination turn into novel business practices? Well, for one thing, no one breaks new ground in a vacuum. Here, we celebrate some recent graduates aiming to change the world for the better and the members of the Haas community who helped them take their problem-solving to the next level. Their assistance runs the gamut: from a simple introduction or piece of advice to help securing crucial funding. Whatever the support, it was the connection these alumni needed to begin reimagining business.

Bringing Artistry to Venture Capital

Asha Culhane-Husain, BS 18

“I believe that entrepreneurs are artists,” says Asha Culhane-Husain. It’s not surprising she emphasizes the artistic side of entrepreneurship: As a business student, Culhane-Husain also double-majored in theater, dance, and performance studies. Now she’s using her diverse talents to infuse artistry into venture capital.

While at Haas, Culhane-Husain interned at a VC firm and thought she might work there after graduation. But being awarded Haas’ Thomas Tusher Scholarship for Study Abroad her junior year changed her life. The scholarship, sponsored by Thomas Tusher, BA 63 (political science), the retired president and COO of Levi Strauss & Co., was created after Tusher’s own “life-altering” study-abroad experience led him to a career in international business. “Not only has Asha turned her time abroad into a unique career trajectory,” says Tusher, “but she’s taken that experience to a new level.”

Culhane-Husain attended Ireland’s National Theater School. After graduating from Haas, she spent three years at France’s national drama academy, the Conservatoire National Supérieur d’Art Dramatique, where she gained extensive conservatory training. She now works as a writer, producer, filmmaker, and actor, yet she remained interested in VC and began to explore how she might apply her artistic talents in the business world.

“In venture capital, the early rounds of funding are largely based on stories—on the team and the idea—because they don’t yet have data,” Culhane-Husain says. And while CEOs are the experts of their field and product, they don’t always have the tools to tell their company’s story effectively—which can mean the difference between securing early-stage funding or not. What if she could help them deliver a pitch that would seal the deal?

Culhane-Husain teaches speakers to…communicate effectively and captivate a boardroom or audience.

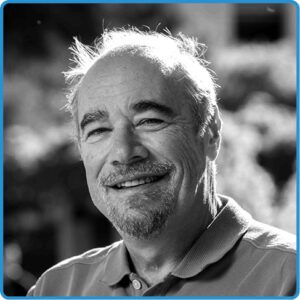

Her former Haas instructor Stephen Etter, BS 83, MBA 89 (shown right), had never heard of anyone doing what she was proposing. “I’ve been teaching for 27 years, and no day has there been such a talented individual in arts and business,” he says of Culhane-Husain.

This past year, Culhane-Husain worked with the same VC firm where she once interned, helping management teams use their natural strengths to deliver an effective pitch. Much like a director would bring out the abilities of an actor, Culhane-Husain teaches speakers to control the timbre of their voice, rhythm of speech, and body position to communicate effectively and captivate a boardroom or audience.

Culhane-Husain is forging her path as she goes. The Tusher Scholarship supported her in pursuing her artistic passion, and now, consulting for the VC firm, she gets to combine her skills in business and the arts. “It’s all coming full circle,” she says

Making Four-Year Colleges Accessible

Manny Smith, MBA 21

Community colleges were intended to be an on-ramp to a bachelor’s degree for millions of American students. But as Manny Smith (shown left) discovered, the transfer process from a community college to a four-year institution is broken. So he founded EdVisorly to fix it.

Smith didn’t attend community college himself, but he was a first-generation student, and college was never a given. He was offered an appointment to the U.S. Air Force Academy, which included a scholarship and a career path as an Air Force officer. He jumped at the opportunity.

After Smith graduated, his commission included developing technology for the Air Force and Space Force. In 2018, he accompanied a friend to a conference focused on services to support community college students. There he learned how hard it is for talented and motivated students to eventually complete a bachelor’s degree. Across 5 million U.S. community college students who want to obtain a bachelor’s, Smith says, only 2.4% will transfer to a four-year university within two years of beginning their education.

One reason is that the transfer process is complicated: Admissions requirements vary from school to school, and there are few reliable resources for community college students. EdVisorly seeks to bridge the gaps students face through its innovative approach and partnerships with university enrollment teams.

There are few reliable transfer resources for community college students. EdVisorly seeks to bridge the gaps.

On EdVisorly, students can easily connect with admissions teams at universities, discover transfer requirements, create a transfer plan, and apply to schools.

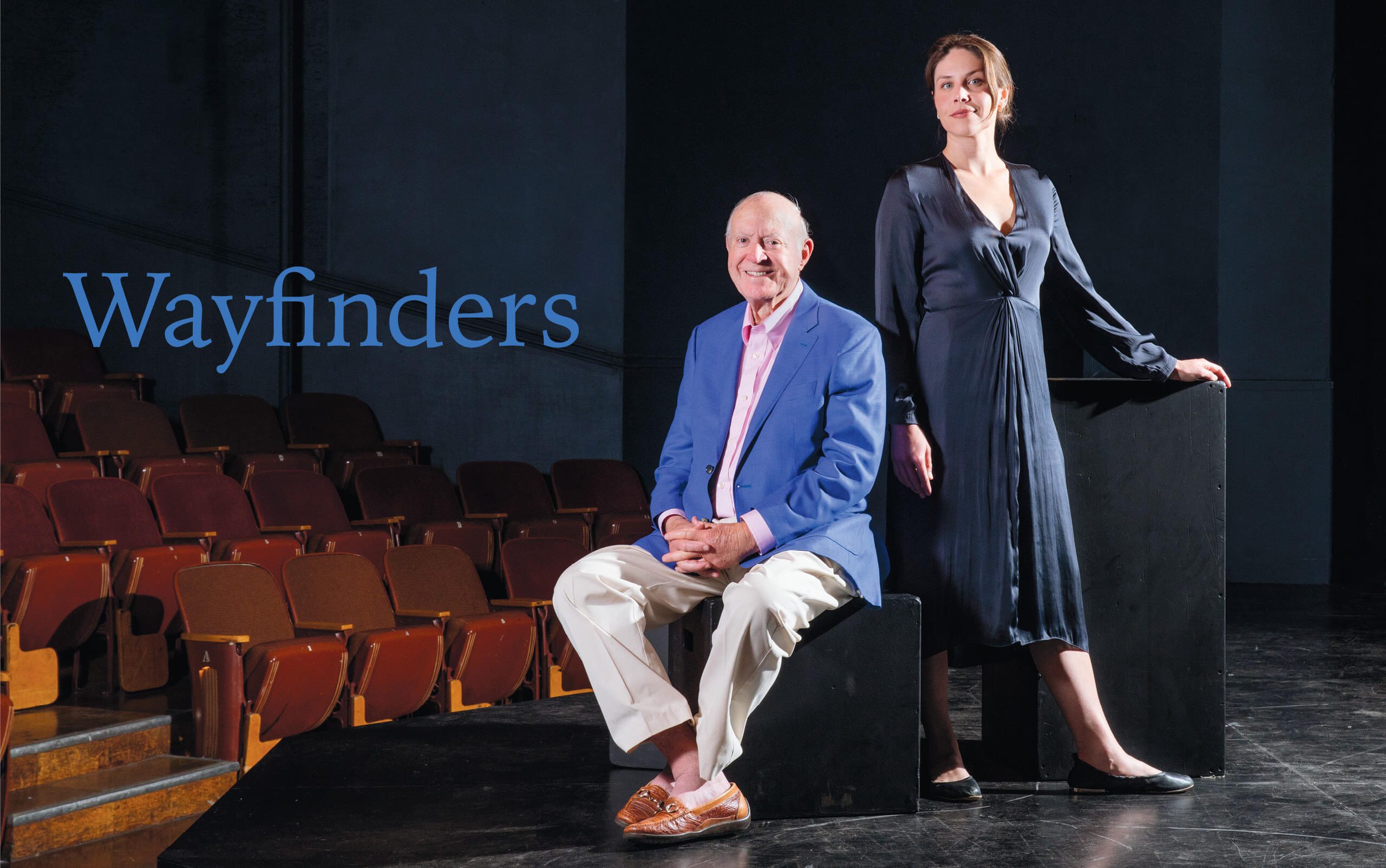

Six months after he began building EdVisorly, Smith took an entrepreneurship class with Kurt Beyer (shown left), which was pivotal. “I knew Dr. Beyer’s class would be catalyzing and provide a foundation for our company to thrive,” Smith says. Beyer, a Navy veteran, emphasized a lot of the principles Smith gained from his military training as being invaluable in starting a company.

This year, EdVisorly received funding from the California Innovation Fund, which invests solely in UC alumni and which Beyer founded. Beyer says he recognized in Smith the makings of a successful founder. “As a former Air Force officer, Manny brought far more leadership acumen than many MBA students. That military background makes him an outstanding entrepreneur.”

With the latest round of funding, EdVisorly is expanding its partnerships across four-year universities nationwide to help more community college students earn their bachelor’s degrees and realize the many opportunities that come with them.

Helping Clean Technologies Break Through

Harshita Mira Venkatesh, MBA 21

In many industries, the climate crisis demands new ways of doing things. That’s why Harshita Mira Venkatesh has spent the last two years working to bring some of the most promising cleantech innovations to market as a business fellow at Breakthrough Energy, an umbrella organization founded by Bill Gates. This multi-arm organization is working to develop and accelerate climate solutions in sectors that are particularly hard to decarbonize: think steel, heating, transportation, and food. The focus, Venkatesh explains, “is on technologies that at scale can reduce greenhouse gas emissions by half a gigaton a year or 1% of greenhouse gas emissions annually.”

For Venkatesh, it all started with a simple introduction. She’s always cared deeply about the climate crisis, but before coming to Haas, she had no direct climate experience. That changed when she took Cleantech to Market, an experiential, interdisciplinary program that brings together graduate students from across campus to help entrepreneurs nationwide commercialize emerging cleantech solutions. Each year, C2M Co-director Brian Steel (shown right) invites speakers to talk to the class, and that year, he asked Ashley Grosh, the director of Breakthrough Energy’s Fellows Program, to discuss funding climate solutions.

Venkatesh was intrigued by Grosh’s presentation, and she asked Steel if he would introduce her. Steel was only too happy to oblige. “Harshita clearly realized that this was one of those moments that if left unappreciated for its potential significance would pass her by,” he says. “And she didn’t let that happen.”

Venkatesh and Grosh discussed the Fellows Program, which was just getting off the ground. Later, when Grosh sought input from Steel, he gave Venkatesh a ringing endorsement.

Breakthrough Energy’s Fellows Program pairs two groups of fellows: scientists and engineers who have a climate technology to commercialize and businesspeople like Venkatesh, who use their expertise to help innovators de-risk their technology so it’s marketable. “It’s like Cleantech to Market on steroids,” Venkatesh says. While at Breakthrough Energy, she worked with a pioneering green cement company to develop its go-to-market strategy and helped a climate-friendly ammonia company research beachhead markets and supply chains.

As part of the program’s inaugural cohort, Venkatesh’s two-year tenure ended in September. Now she’s looking forward to her next role and continuing to support climate tech innovations.

Reimagining Online Reviews

Reimagining Online Reviews

Michael Ebel, MBA 17

Working as a bartender while an undergraduate, Michael Ebel (shown left) saw the power of review sites like Trip Advisor and Yelp. Specifically, he noted the outsized impact a bad review can have on the bottom lines of small businesses. “The average person has a good experience and doesn’t do anything,” Ebel says. “But if they have a bad experience, they run online seeking retribution.”

Ebel thought there had to be a better way, and several years later, while working at Meta, he realized video was it. That epiphany gave birth to Atmosfy, an app that allows users to share videos of their experiences at local businesses so people can see for themselves what an establishment is like.

Atmosfy launched at the height of the pandemic, a period that was brutal for small businesses. “We thought, if we could get people in San Francisco to take a video of a good experience and say, ‘Hey, this place is still open, come on down and support it,’ wouldn’t that be a difference maker?” says Ebel. “And that is the core mission that kicked us off.”

Atmosfy is a deeply Haas-centric startup. “In almost any helpful dimension you can imagine, we have leveraged that from Haas,” Ebel says. Professor Toby Stuart (shown right) has been a particularly valuable resource. Stuart offered advice and made crucial introductions that helped Ebel secure financing. “Toby was instrumental in helping us think about strategically raising our first round and how to avoid the various pitfalls of fundraising,” Ebel says. “He also provided sound advice on how to build a world-class team that would be critical to our success.”

By the time Ebel called Stuart to talk about Atmosfy, he’d already made enormous progress on an alpha version of the app. Stuart was impressed by how much he’d accomplished. “Usually someone wants to outsource thinking; they come by with a half-baked idea and before making much headway,” Stuart says. “But Michael had done a lot, and he did it on very little money. He demonstrated a ton of conviction and an incredible work ethic.” Stuart also noticed that Ebel never said “I,” he always used the pronoun “we” even though he was a solo founder working mostly on his own. “I thought that was a great sign for someone who’s going to build and lead a team,” Stuart says.

And that team has grown rapidly. Atmosfy is now in 150 countries, showcasing restaurants, bars, and hotels in 10,000 cities. And no doubt more are on the way. In August the company raised $14 million in seed funding, led by Redpoint Ventures.

Editor’s note: In February 2024, Atmosfy was named to Business Insider‘s list of 18 startups disrupting the social media scene with alternative ways to connect online.

Putting Homebuyers in the Driver’s Seat

Matt Parker, EMBA 23

If you’re looking to buy a home, the first order of business is hiring a real estate agent, right? Not necessarily. Matt Parker, the co-founder and CEO of Alokee, wants to transform the real estate landscape by enabling people to buy a home without the expense of an agent. Parker, who founded the company with five Haas classmates, has worked as a real estate agent, so he knows the industry’s downsides. “The way the system is structured, all the business models are based on selling as many homes as fast as possible,” he says. The buyer’s best interest isn’t necessarily a priority.

Alokee is a virtual real estate agent designed for DIYers who may not need an intermediary when shopping for a home.

Alokee wants to change that. Using AI, automation, and the founders’ expertise, Alokee is a virtual real estate agent designed for do-it-yourselfers who may not need an intermediary when shopping for a home. Everything you’d call an agent for, you can do yourself with Alokee, Parker says. “Instead of asking someone when you can view a home, you simply set up a tour. Instead of asking someone to make an offer for you, you just make an offer.” For some buyers, the whole process can be wrapped up in a day. For those who want more help, Alokee provides expert advice from a real estate attorney. The company, currently operating in California with plans to expand, charges a flat fee, which ends up saving buyers a lot of money.

With an all-Haas startup team, the community’s DNA is embedded in the company, and input from Haas advisors is also woven in. Parker and his co-founders were working on Alokee while they took two classes with professional faculty member Maura O’Neill, BCEMBA 04, who instantly knew they had a winning idea. “That part of real estate was just waiting to be disrupted,” O’Neill says. “And here was somebody who actually had the knowledge and had been smart about putting the team together with different kinds of expertise.”

Parker says O’Neill’s vast experience as a serial entrepreneur was indispensable. Yet he says what mattered most was her continual motivation. “She understands that being an entrepreneur is hard. You have these valleys, and Maura is right there telling you these valleys are part of the process.” She told Parker what they were doing well and where they needed to up their game.

Earlier this year, O’Neill and her son were in the market to buy a family house in Oakland, and they used Alokee. “I became the biggest fan imaginable,” she says.

An explosion of possibilities

An explosion of possibilities  Sales and service

Sales and service Bias and ethics

Bias and ethics Planning for the future

Planning for the future

If you’ve ever felt overwhelmed with work, you’re not alone. Nick Sonnenberg heard the complaint so often that he wrote a book to solve the problem: Come Up for Air: How Teams Can Leverage Systems and Tools to Stop Drowning in Work.

If you’ve ever felt overwhelmed with work, you’re not alone. Nick Sonnenberg heard the complaint so often that he wrote a book to solve the problem: Come Up for Air: How Teams Can Leverage Systems and Tools to Stop Drowning in Work. Anchored by his North Stars—impact and access—Olaseni Bello has always sought to serve a larger purpose through his work and to elevate those around him.

Anchored by his North Stars—impact and access—Olaseni Bello has always sought to serve a larger purpose through his work and to elevate those around him. Soon after the 2022 Club Q massacre in Colorado Springs, Colorado, Jackson Block took action to advance LGBTQ+ investment and support.

Soon after the 2022 Club Q massacre in Colorado Springs, Colorado, Jackson Block took action to advance LGBTQ+ investment and support. During her 12-year career at One Medical, Amy Finney held many leadership positions. But her most consequential role came in February 2020, when she led One Medical’s emergency response to the COVID-19 pandemic.

During her 12-year career at One Medical, Amy Finney held many leadership positions. But her most consequential role came in February 2020, when she led One Medical’s emergency response to the COVID-19 pandemic. Priya Saiprasad often doesn’t look like other venture capitalists in Silicon Valley boardrooms. But she does look like the consumers of many products under consideration for funding—a perspective that adds value to the discussions happening.

Priya Saiprasad often doesn’t look like other venture capitalists in Silicon Valley boardrooms. But she does look like the consumers of many products under consideration for funding—a perspective that adds value to the discussions happening. To spur the global market to act faster to address the climate change crisis, Haas has launched the Sustainable Business Research Prize.

To spur the global market to act faster to address the climate change crisis, Haas has launched the Sustainable Business Research Prize.  The advent of no-fee trading on platforms such as Robinhood has helped fuel an explosion in retail investing—and raised concerns that novices would be tempted to trade too often and lose more money.

The advent of no-fee trading on platforms such as Robinhood has helped fuel an explosion in retail investing—and raised concerns that novices would be tempted to trade too often and lose more money. Olaf Groth doesn’t like to make predictions, but he’s nonetheless become adept at helping executives see around corners and navigate the chaos of recent years.

Olaf Groth doesn’t like to make predictions, but he’s nonetheless become adept at helping executives see around corners and navigate the chaos of recent years. A member of Haas’ professional faculty and a senior adviser at the Institute for Business Innovation, Groth is also chairman and CEO of think tank Cambrian Futures. In a new book, The Great Remobilization: Strategies and Designs for a Smarter World (MIT Press, 2023), he and co-authors Mark Esposito and Terence Tse focus on what they call the Five Cs—COVID; the cognitive economy, crypto, and web3; cybersecurity; climate change; and China—and show leaders how to power human and economic growth by replacing fragile global systems with smarter, more resilient ones.

A member of Haas’ professional faculty and a senior adviser at the Institute for Business Innovation, Groth is also chairman and CEO of think tank Cambrian Futures. In a new book, The Great Remobilization: Strategies and Designs for a Smarter World (MIT Press, 2023), he and co-authors Mark Esposito and Terence Tse focus on what they call the Five Cs—COVID; the cognitive economy, crypto, and web3; cybersecurity; climate change; and China—and show leaders how to power human and economic growth by replacing fragile global systems with smarter, more resilient ones. When done right, the gig economy can mutually benefit companies and workers. Companies can tap into deep and vast labor pools, and workers can create their own schedules. But such flexibility challenges gig platforms in committing to a service capacity. What incentives, then, can entice workers to work more hours more often?

When done right, the gig economy can mutually benefit companies and workers. Companies can tap into deep and vast labor pools, and workers can create their own schedules. But such flexibility challenges gig platforms in committing to a service capacity. What incentives, then, can entice workers to work more hours more often? Post-pandemic workspaces have become increasingly fluid, and companies are trying out hot desks and hoteling spaces as they struggle to entice workers back to the office. But new research suggests that leaders wanting to build employee engagement should think less about rearranging the furniture and more about how employees relate the office space to their own work.

Post-pandemic workspaces have become increasingly fluid, and companies are trying out hot desks and hoteling spaces as they struggle to entice workers back to the office. But new research suggests that leaders wanting to build employee engagement should think less about rearranging the furniture and more about how employees relate the office space to their own work.

Buy on a Tuesday. Search in your browser’s incognito mode. Use a VPN to pretend you live in Suriname.

Buy on a Tuesday. Search in your browser’s incognito mode. Use a VPN to pretend you live in Suriname.

…prompted insights into financial markets.

…prompted insights into financial markets.

Our commitment to sustainability…

Our commitment to sustainability…

Associate Professor Andrew W. Shogan, 74, an expert in operations research, died on May 30 in Orinda, Calif. Shogan joined Berkeley Haas in 1974 and spent his entire professional career at the school until his retirement in 2007. He was beloved by faculty and staff alike. His passion for teaching and advancing the use of mathematical models to formulate and solve problems arising in business, industry, and government earned him several teaching awards, including the Earl F. Cheit Award for Excellence in Teaching—the highest honor given to faculty by students.

Associate Professor Andrew W. Shogan, 74, an expert in operations research, died on May 30 in Orinda, Calif. Shogan joined Berkeley Haas in 1974 and spent his entire professional career at the school until his retirement in 2007. He was beloved by faculty and staff alike. His passion for teaching and advancing the use of mathematical models to formulate and solve problems arising in business, industry, and government earned him several teaching awards, including the Earl F. Cheit Award for Excellence in Teaching—the highest honor given to faculty by students.  ORGANIZATIONS &

ORGANIZATIONS &  Energy

Energy Michelle Florendo has made a career out of teaching people how to make better, faster decisions and to lead with confidence.

Michelle Florendo has made a career out of teaching people how to make better, faster decisions and to lead with confidence.