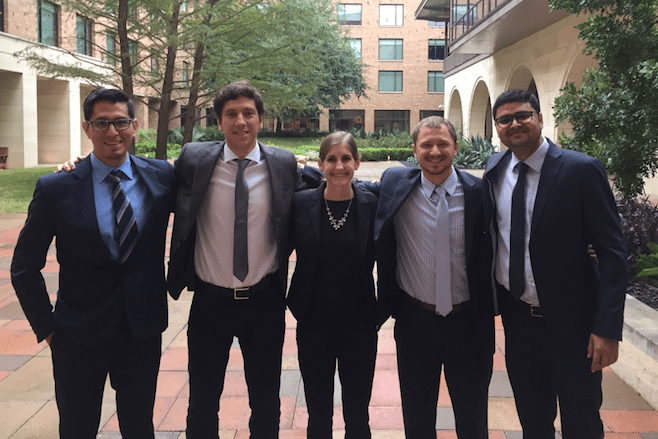

The first place team in the Future of Mobility Case Competition. Holding check, left-right: Andy Min, Johnny Lin, Rebecca West, and Yifeng Wang.

A team of MBA students working with a Berkeley architecture student placed first in the University of Michigan’s Future of Mobility Case Competition for designing a mobile network that would allow customers to access multiple modes of transportation on demand. The 3rd annual case competition was held in Ann Arbor on Nov. 8 and sponsored by Ford Mobility.

The Team: Johnny Lin, MBA 21, Rebecca West, MBA 21, Andy Min, MBA/MEng 21, and Yifeng Wang, MA (architecture) 21.

The Field: Eight teams were selected from a pool of 24 teams to compete for a $5,000 prize. Finalists included the University of Michigan’s Ross School of Business, UCLA’s Anderson School of Management, University of Chicago’s Booth School of Business, Notre Dame’s Mendoza School of Business, and the University of Texas’s McCombs School of Business.

The Challenge: Create a new profitable business venture that focuses on customer experience and innovation within the current transportation ecosystem, which includes cars, buses, e-scooters and bikes.

The Team’s Plan: The Haas team designed a mobile network that customers could use to access different modes of transportation at any time using the FordPass App. By re-purposing the car share program, vehicles would not only serve as short-term rentals, but also as a pick-up and drop-off location for Ford’s SPIN scooters. Trunk space would act as a storage and charging station for scooters. This transportation network would allow Ford to meet customer needs for multiple transit modes.

What set them apart: Drawing from all of their experiences, both professional and educational, the Haas team presented a unique proposal. Lin contributed to the development and structure of the presentation; Wang, with his environmental and service design background, worked on the customer experience; Min, drawing on his Marine Corps experience and MBA courses, identified technical specifications for the project; and West, using her economic development background, identified stakeholders and community growth opportunities.

“Our team stood out because of our diverse perspectives that led us to a very creative solution and presentation,” said Rebecca West, MBA 21. “We approached the initial prompt from four very distinct backgrounds, and through Andy’s leadership, were able to weave them all together. Johnny and Yifeng then drove the development of the presentation forward.”

“I was so impressed by all three of my teammates,” said Johnny Lin, MBA 21. “We each lead from and collectively integrated our different experiences. Our solution focused on the user experience, civic responsibility, engineering, and profitable business, and it was really thanks to every member of the team that we were able to deliver a winning proposal.”

The Berkeley factor: “The course Reimagining Mobility taught by Prof. Purin Phanichphant (taught through the Jacobs Institute for Design Innovation) helped us gain empathy with users and put people in the center of our design,” said Yifeng Wang, MA 21.

The most memorable experience from the competition: Andy Min, MBA/MEng 21, said the brainstorming session was the most memorable experience. “We all had differing approaches and ideas, but we were able to come up with a solution that melded those thoughts together,” Min said.

though the Clean Fuel Reward Program run by utilities, but the current tracking system is costly and inaccurate and does not incentivize enough behavior change. “Blockchain helps to reduce a lot of back-end inefficiencies,” Yao said. Vinculara’s blockchain platform, when used by electric vehicle owners, fleet managers, and regulators, would help reduce the cost and complexity of tracking and verifying credits and in doing so, open up the LCFS market to smaller players who are currently unable to get involved and claim their credits. “I think the market-opening part is the most interesting part of our proposal,” Tomlinson said.

though the Clean Fuel Reward Program run by utilities, but the current tracking system is costly and inaccurate and does not incentivize enough behavior change. “Blockchain helps to reduce a lot of back-end inefficiencies,” Yao said. Vinculara’s blockchain platform, when used by electric vehicle owners, fleet managers, and regulators, would help reduce the cost and complexity of tracking and verifying credits and in doing so, open up the LCFS market to smaller players who are currently unable to get involved and claim their credits. “I think the market-opening part is the most interesting part of our proposal,” Tomlinson said.

Judges at the 2018 UC Berkeley

Judges at the 2018 UC Berkeley