Gearing up to welcome a new year is the perfect opportunity to look back at highlights from 2023 at Berkeley Haas. A toast to 2023 wouldn’t be complete without marking the big celebrations, distinct milestones, grand achievements, and more than a few welcomes (alongside some farewells). In no particular order, here are our Top 10 picks for 2023.

-

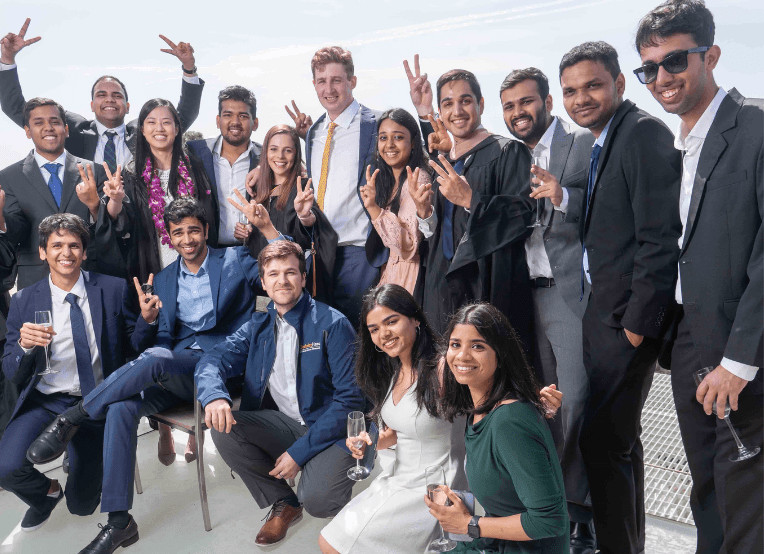

- 125 years of reimagining business: We celebrated a BIG milestone with a big party on the 125th anniversary of the day that Cora Jane Flood announced the gift that launched the College of Commerce—now the Haas School of Business. Students, staff, alumni, campus and Haas senior leaders, and founding donor Flood’s family member gathered to honor the school’s trailblazers —and our ongoing impact on business and society

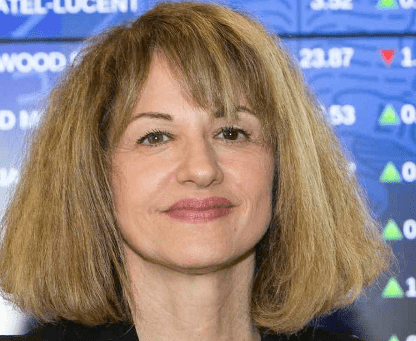

- Dean of the Year: Dean Ann Harrison was recognized by the business school publication Poets & Quants, which lauded Harrison for leading a major diversity, equity, inclusion, justice and belonging effort; broadening the profile of the Haas faculty, school board, and student body; and helping fundraise a total of $227 million for the school, among other successes. She also made the cover of our fall issue of Berkeley Haas Magazine. Harrison returns from sabbatical in early January.

Harrison gracing the pages of Berkeley Haas Magazine. Photo: Brittany Hosea-Small. - More major milestones: Berkeley Executive Education (BEE) celebrated its 15th anniversary and Cleantech to Market (C2M) turned 10. Exec Ed has provided top programs to thousands of individuals in leadership, entrepreneurship, and strategy and finance, as well as customized programs for companies, government, and university partners. Promising climate technologies that addressed everything from water desalination to Earth element extraction to lightening-fast battery charging took center stage at a bigger and better than ever December Cleantech to Market (C2M) Climate Tech Summit.

Students in the Cleantech to Market program at the 2023 C2M Summit. - Our generous community: The Berkeley Haas Development and Alumni Relations team (DAR) team reported a record three-year period in the school’s fundraising history, raising more than $171 million from alumni, faculty, staff, students, parents, and friends. The funds raised this fiscal year—about $56 million—brought Haas to the finish line of its five-year campaign.

-

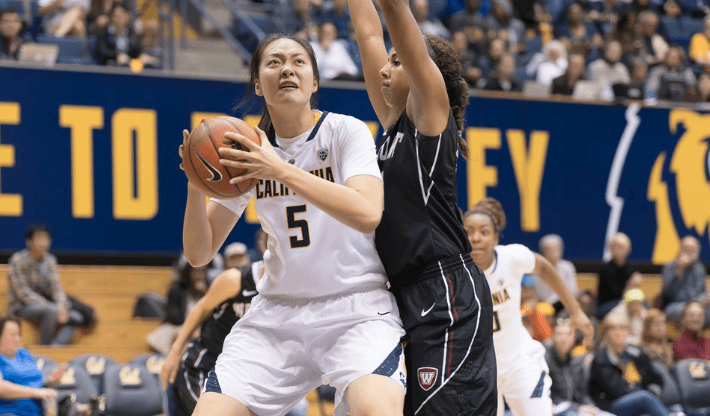

Photo: Noah Berger 5. Undergrad’s big shift: We began to bid farewell to our incredible two-year undergraduate program as the Berkeley Haas Undergraduate Program Office received its first round of applications from prospective first-year students for our inaugural Spieker class. The first class of four-year students will enter in the fall.

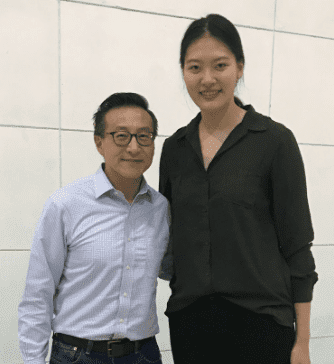

Dean Ann Harrison with Ned Spieker, BS 66, who with his wife, Carol, funded the undergraduate program’s transformation. - The rise of the Flex cohort: As part of the evening & weekend MBA program, students in the Flex cohort completed their first year of live remote courses, demonstrating an innovative educational model that will serve a greater range of students. Flex provides what many students say they need most: schedule flexibility in a top program.

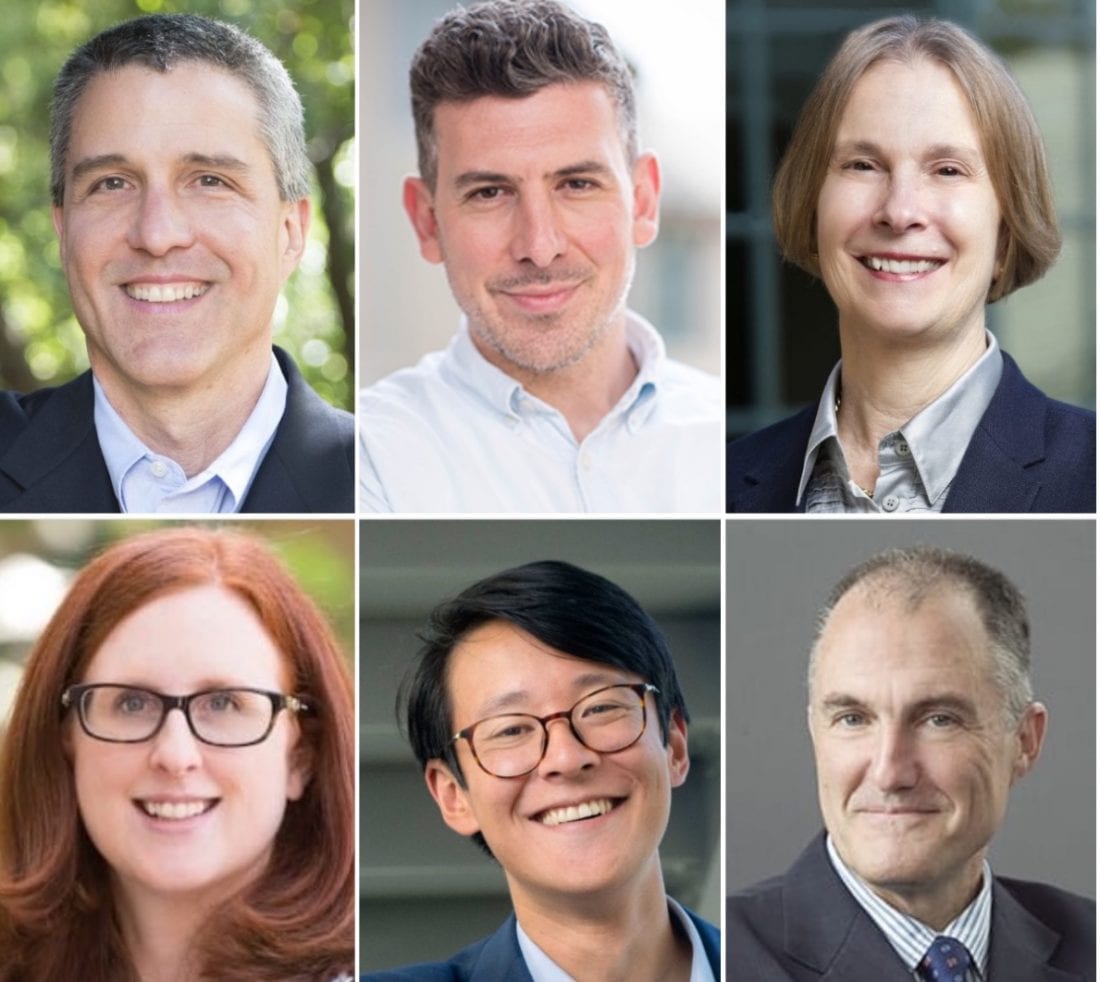

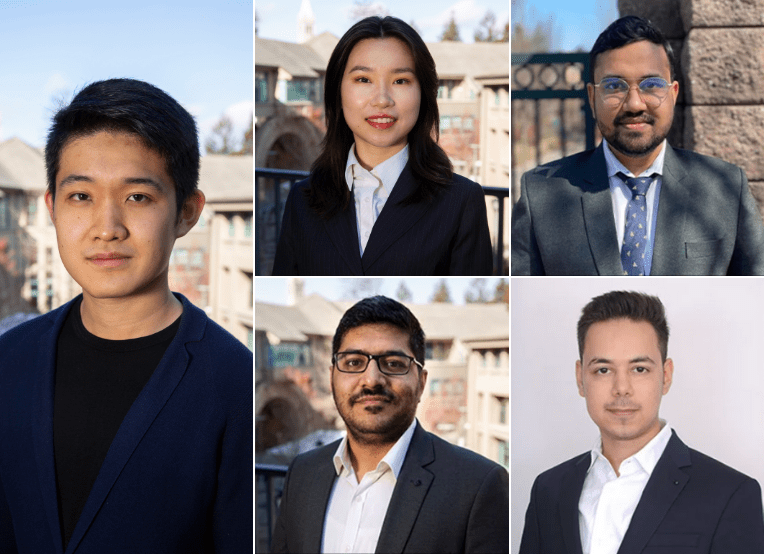

- New brain power: Eight new ladder and 22 professional faculty members joined Haas in fall, bringing their intellect, passion, and unique perspectives to the school. With the new tenure-track arrivals, the ladder faculty—at 96 members—is now the largest it’s ever been and is closing in on Dean Harrison’s goal of 100.

From top row, left to right: New Berkeley Haas assistant professors Eben Lazarus, Cailin Slattery, Shawn Kim, Antoine Levy, Sam Kapon, Erica Bailey, returning professor Alexandre Mas, and new assistant professor Rachel Gershon. -

Making headlines: Our faculty were featured in national media outlets more than 500 times this year, bringing expertise to everything from the rising price of gas, to the Silicon Valley Bank fallout, to tech layoffs, to the future of AI.

Image: AdobeStock -

Growth space: Construction continued on the new Berkeley Haas Entrepreneurship Hub, which will allow entrepreneurs at Haas—and across the university—to meet, brainstorm, and invent new startups. The Hub is expected to be completed in fall 2024.

A photo illustration of the home of the new hub, a Julia Morgan designed building under renovation. The building was constructed in 1908. - Chart toppers: All of Haas’ degree programs once again performed well in key rankings. U.S. News & World Report ranked the EWMBA program #1 (again) and the undergraduate program #2; The Financial Times ranked the FTMBA program #7 globally and #4 in the U.S.; and the MFE program was ranked #4 by QuantNet.

- 125 years of reimagining business: We celebrated a BIG milestone with a big party on the 125th anniversary of the day that Cora Jane Flood announced the gift that launched the College of Commerce—now the Haas School of Business. Students, staff, alumni, campus and Haas senior leaders, and founding donor Flood’s family member gathered to honor the school’s trailblazers —and our ongoing impact on business and society