Leo Helzel, MBA 68, LLM 70, an honored faculty member who guided the school’s first forays into entrepreneurship and was a dedicated and generous supporter of Haas for decades, passed away Thursday, March 21, in his home, surrounded by family. He was 101.

Helzel’s history at Haas includes a series of firsts. He taught the business school’s first entrepreneurship class—one of the first such courses offered at a U.S. business school. He was also the first chair of the Haas School Board, which advises the dean, and the first Haas instructor to be honored with an “adjunct professor emeritus” title upon retirement in recognition of his nearly forty years of service.

Helzel was instrumental in establishing the school’s entrepreneurship program. In addition to teaching, he provided the funding to endow the Leo B. and Florence Helzel Chair in Entrepreneurship and Innovation in 1986. He worked closely with then-Dean Richard Holton to create the business school’s Lester Center for Entrepreneurship and Innovation, which opened in 1991.

Helzel summarized his entrepreneurial verve and lifelong learnings—alongside wisdom from the CEOs of the Gap, Bank of America, and Williams-Sonoma—in his 1995 book, A Goal is a Dream with a Deadline: Extraordinary Wisdom for Entrepreneurs, Managers, and Other Smart People, and donated the proceeds to Haas.

“Leo was one of those people who changed the game whenever he was around, raising standards and pushing people to reach for more together,” said Professor and former Dean Rich Lyons, who worked closely with Helzel on the board and beyond. “He taught me a lot. It’s hard to imagine a stronger exemplar of our school’s defining leadership principles.”

Helzel was born in New York City on November 1, 1917, to Philip and Hannah Helzel; he had two older siblings, Sylvia and Max. His parents had immigrated from Podhajce, a shtetl that was part of the Austro-Hungarian Empire, before World War I. He graduated from Townsend Harris, a tuition-free honors school for the City College of New York. He then worked full-time at his uncle’s accounting firm, Gerber & Landau, while attending ROTC and night classes at City College, graduating in 1938.

Called up to serve during World War II, Helzel flew as a navigator on Navy planes and served as a navigation flight instructor. His home base was the Alameda Naval Air Station, and after the war he stayed on in Oakland, launching several successful careers—as an accountant, a lawyer, and an entrepreneur.

In 1946, Helzel founded Leo B. Helzel & Company, now called the RINA Accountancy Corp., in Oakland. Aspiring to become a lawyer, Leo took night classes at Golden Gate University while also teaching tax and accounting there. In 1957, he decided he wanted to concentrate on law full time and left the firm as a partner, but remained as a client. He eventually took a risk on new technology for drilling oil wells and was successful in that arena as well.

Helzel began sharing the knowledge acquired during his multiple careers when he began teaching international business at Berkeley’s business school in 1967. While teaching, he decided to get an MBA, and upon completing the program at age 51 joked that he was “probably the oldest MBA in the books.” He went on to earn his Master of Laws (LLM) from Berkeley Law in 1970.

In 1970, Richard Holton, dean at the time and a friend of Helzel’s, came up with the idea of creating an entrepreneurship course and hired him to teach it. Helzel initially presented a case about a fictitious startup, Miracle Goggles. He later invited entrepreneurs whom he knew to share their stories with his class. Interest in the companies emerging in Silicon Valley was so intense that the course soon had to be moved to an auditorium. The course may have been the first to provide students with direct contact with successful entrepreneurs, according to Business at Berkeley by Sandra Epstein.

“Leo was a thought leader decades ahead of others in bringing real business practices and live case studies into the classroom from the time he began teaching here in 1967,” said his former student Jerry Weintraub, BS 80, MBA 88, and president of Weintraub Capital. “As a depression-era child who came from humble beginnings, Leo took immense pride in Haas—the opportunity this public institution gives to students and the impact education can have on improving the lives of others. Leo has left a legacy as an incredible agent of change in education, philanthropy, and the community through his mentorship and friendship to those of us lucky enough to have known him as a teacher.”

Helzel also taught business law and commercial law at Haas, creating the course called Top Down Law with Adj. Prof. Noel Nellis, JD 66. The course taught business from the perspective of an entrepreneur who encounters legal problems.

“Leo was indeed a friend, mentor, and educational innovator. His leadership role in creating our entrepreneurship program is well known. More subtle perhaps, and one of his biggest innovations at Haas, was recruiting accomplished professionals to join our professional faculty,” said Jerome Engel, founding executive director emeritus of the Lester Center for Entrepreneurship and Helzel’s long-time faculty colleague. “We at Haas will benefit from his foresight, leadership, and generosity for generations. We will miss him. May his memory be a blessing to all of us.”

Helzel gave generously to the Haas School’s original campus that opened in 1995 and to its new building. In return, the Helzel Boardroom and a “Helzel Family” breakout room are named in his honor. He was also a Trustee for Golden Gate University and for the California College of the Arts, served on the board of BerkeleyLaw, and was active in several Bay Area nonprofit organizations.

He is survived by his loving family—his wife of 72 years, Florence; his two children and their spouses, Larry Helzel (Rebekah) and Deborah Kirshman (David); grandchildren Rachel Concannon (Jason) and Daniel Kirshman, MBA 2011 (Jennifer); great-grandchildren Riley and Jacob Concannon and Sienna and Skylar Kirshman; great-nephew Zachary Pine; and several other family members with whom he maintained close relationships.

A private family service has been held.

Contributions in Helzel’s memory may be made to the Magnes Collection of Jewish Art & Life, UC Berkeley, 2121 Allston Way, Berkeley, CA 94720-6300; givetocal.berkeley.edu/magnes.

Episode 1 of Technopolis starts at the beginning, in a sense: it’s all about venture capital, and why tech investors are so interested in cities all of a sudden. They look at what that means for city leaders, and how the venture capital influx has transformed jobs as city halls.

Episode 1 of Technopolis starts at the beginning, in a sense: it’s all about venture capital, and why tech investors are so interested in cities all of a sudden. They look at what that means for city leaders, and how the venture capital influx has transformed jobs as city halls.

Prof. Severin Borenstein has been appointed by Gov. Gavin Newsom to the board of the California Independent System Operator (CAISO), which oversees the state’s massive electric power system, transmission lines, and wholesale electricity market.

Prof. Severin Borenstein has been appointed by Gov. Gavin Newsom to the board of the California Independent System Operator (CAISO), which oversees the state’s massive electric power system, transmission lines, and wholesale electricity market.

Prof. Andrew Rose, an expert in international finance, trade, and economics who has worked with the World Bank, U.S. treasury department, and central banks in 14 countries around the world, has been appointed dean of the

Prof. Andrew Rose, an expert in international finance, trade, and economics who has worked with the World Bank, U.S. treasury department, and central banks in 14 countries around the world, has been appointed dean of the

The surge of bitcoin brought cryptocurrencies from tech-nerd toy to household name, and they’re increasingly showing up in investment portfolios. Yet it’s still a mystery to most people how these digital currencies work. Are they even currency? And do they belong in an everyday person’s portfolio?

The surge of bitcoin brought cryptocurrencies from tech-nerd toy to household name, and they’re increasingly showing up in investment portfolios. Yet it’s still a mystery to most people how these digital currencies work. Are they even currency? And do they belong in an everyday person’s portfolio?

Dean Rich Lyons has been honored by

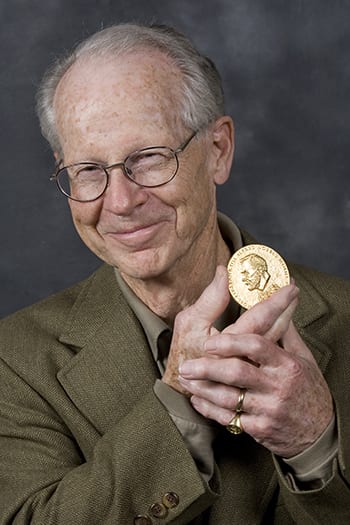

Dean Rich Lyons has been honored by  For the past several years, Haas School Professor Emeritus Oliver Williamson had been on the so-called “short list” to receive the Nobel Prize in Economics.

For the past several years, Haas School Professor Emeritus Oliver Williamson had been on the so-called “short list” to receive the Nobel Prize in Economics.

As an undergrad at Berkeley, Ori Brafman had been many things—a peace and conflict studies major, anti-war protestor, and vegan activist whose McVegan campaign had taken on McDonald’s and won. The last place he thought he’d find himself a decade later was in the office of a 4-star army general. “At the time, I had no idea what a 4-star general was,” admits Brafman, BA 97, a Berkeley Haas lecturer who teaches improvisational leadership in the MBA and undergraduate programs. “My first question was, ‘Is there a 5-star general?’”

As an undergrad at Berkeley, Ori Brafman had been many things—a peace and conflict studies major, anti-war protestor, and vegan activist whose McVegan campaign had taken on McDonald’s and won. The last place he thought he’d find himself a decade later was in the office of a 4-star army general. “At the time, I had no idea what a 4-star general was,” admits Brafman, BA 97, a Berkeley Haas lecturer who teaches improvisational leadership in the MBA and undergraduate programs. “My first question was, ‘Is there a 5-star general?’”