Oliver Williamson, a professor with an unconventional approach to research and a yen for welding metal sculpture, revolutionized the way economists look at organizations.

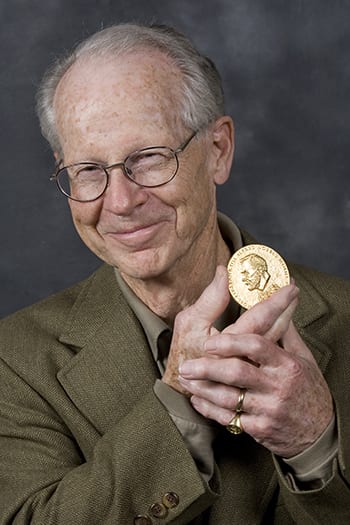

For the past several years, Haas School Professor Emeritus Oliver Williamson had been on the so-called “short list” to receive the Nobel Prize in Economics.

For the past several years, Haas School Professor Emeritus Oliver Williamson had been on the so-called “short list” to receive the Nobel Prize in Economics.

So, when his son, Oliver Williamson Jr., visited in October, Williamson asked him to please answer the phone if it were to ring early in the morning of Oct. 12. Sure enough, Williamson and his son heard the phone at 3:30 a.m. Williamson Jr. jumped out of bed, picking it up on the second ring. After a Scandinavian voice asked for Professor Williamson, he told his father, “Dad, I think this is the call!”

Then Williamson’s life changed forever. The first reporter arrived at his Berkeley hills home before sunrise, kicking off a day full of nonstop interviews and celebrations until Williamson returned home for dinner 15 hours later. Within two days, his inbox was flooded with hundreds of congratulatory emails from people he did and didn’t know. Six weeks later, Williamson was off to Washington, DC, to join the other 2009 American Nobel winners to meet President Obama — an annual White House tradition. Then he was off to Europe for more festivities —

first a conference in Oslo in his honor, followed by “Nobel Week” in Stockholm. The award ceremony on Dec. 10 at the Stockholm Concert Hall was followed by the Nobel Banquet at the Stockholm City Hall, where Williamson was seated with Sweden’s Princess Madeleine, and his wife, Dolores, was seated with the ambassador from Great Britain.

It’s been more than a whirlwind, Williamson, 77, says after returning to Berkeley. “More like a typhoon.”

“But,” he adds with a grin, “how can I complain?”

Essence of business enterprise

Journalists speculated Williamson received the Nobel in 2009 because of his work’s applications to the economic crisis and financial regulation, but those who know Williamson as “Olly” — colleagues and past students — say he was long overdue to receive the most prestigious prize in economics. Haas School Professor David Teece declared Williamson would win the Nobel Prize in 1974 after reading Williamson’s third book, Markets and Hierarchies (1975). Teece read a draft manuscript while earning his PhD at the University of Pennsylvania, where Williamson was a professor at the time.

“I returned to his office three days later and reported, ‘This is a great book. Why has it taken me four years at Penn to discover a framework that addresses deep questions about the business firm and its organization?’” recalls Teece, noting that before Williamson, the economic frameworks and models to understand the business enterprise were “quite frankly pathetic.”

“Oliver outlined a conceptually elegant new framework for thinking about the very essence of business enterprise — how it is structured internally and how managers can invent new business organizations,” Teece explains. “Secondly, he outlined what he called a ‘discriminating alignment framework’ for helping us think through how firms should choose what to do inside and what to do outside — the outsourcing decision we currently think of.”

Williamson’s research was path-breaking in part because he analyzed the firm through a more interdisciplinary lens than his peers. “The connective tissue between the departments at Berkeley is really part of the DNA here. In the same way, Oliver Williamson’s work is not only profound but spans so much intellectual space,” says Dean Rich Lyons. “When we start thinking about firms and how managers do their work, there are members of our faculty who think not only of the formal organization of the firm but also the culture and social norms. Olly was spanning both of those areas very, very early on. The Nobel prize couldn’t have gone to a more wonderful person.”

To make or to buy?

The Royal Swedish Academy of Sciences said it awarded the Nobel to Williamson “for his analysis of economic governance, especially the boundaries of the firm.” (Williamson shared the prize with Elinor Ostrom of Indiana University.) In the simplest terms, those boundaries refer to when a firm decides whether to outsource a process, service, or manufacturing function or perform it in-house — the “make-or-buy” decision.

But that understates Williamson’s contribution: Building on a paper written in 1937 by Ronald Coase, also a Nobel laureate, Williamson pioneered a new way of analyzing business enterprises, through the lens of transaction cost economics, in which he explored how variations among transaction attributes warrant one structure of organization rather than another. Because his analysis has been so methodical, detailed, and thorough, Williamson and hundreds of others have been able to apply his framework to many situations and enterprises beyond just the firm and its outsourcing decision.

“I originally thought of make-or-buy as a stand-alone problem,” Williamson explains. “But now I think of it as being an exemplar. If you understand make-or-buy, which is a simple case, you can understand more complex cases.”

Those more complex cases include joint ventures and decisions on industry privatization, labor contracts, antitrust, and regulation. Williamson, for instance, has applied his framework to evaluate cable TV franchises and antitrust enforcement for vertically integrated firms.

Williamson spawned a huge new wave of empirical literature testing his framework in a wide range of industries, from aerospace to semiconductors — an estimated 800 empirical studies, according to a 2006 survey done by his students. Indeed, Williamson’s work has impacted such diverse fields as public policy, law, strategy, and sociology. Markets and Hierarchies and his subsequent book, The Economic Institutions of Capitalism: Firms, Markets, Relational Contracting (1985), are among the most cited books in the social sciences.

Midwest roots

Williamson himself is similarly multi-faceted — a hard-working, demanding, and deep-thinking academic with a dry wit who enjoys welding metal sculpture in his spare time and spending summers with his wife and family (five now-grown children plus spouses and grandchildren) at their summer home on Lake Nebagamon in Wisconsin.

Williamson was born in Superior, Wisconsin, the son of two teachers, raised with an inquisitive mind and the assumption that he would go to college. “I had originally thought of becoming a lawyer, but I was attracted to math and science in high school and began talking instead of becoming an engineer,” Williamson recalls in his fifth book, The Mechanisms of Governance (1996).

Williamson spent two years at Ripon College in Wisconsin and three years at MIT, where he studied engineering and management. After graduating, he worked as a project engineer for the US government in Washington, DC — an experience that gave him an appreciation for the real workings of bureaucracy. He then earned an MBA at Stanford in 1960 and transferred to the Carnegie Institute of Technology (now Carnegie-Mellon) to earn his PhD in economics in 1963. Williamson calls his PhD training “by far the most important event in my intellectual development.”

“Carnegie was an incredible place,” he says. “It had a lot of Young Turks, right at the height of their research powers. You walked in the door, you took a deep breath, and you just knew that this place was committed to leading-edge research, and you picked up the enthusiasm and a sense that you, too, could start doing things.”

Those Young Turks included future Nobel laureates Herbert Simon, Franco Modigliani, Merton Miller, and Robert Lucas, a roster to which their students Edward Prescott, Finn Kydland, and Williamson have since been added. Carnegie’s highly interdisciplinary approach would go on to influence how Williamson combined law, economics, and organization to explore the boundaries of the firm through the lens of transaction cost economics and develop a more realistic, behavioral view of the firm and its participants.

Berkeley and back

After earning his PhD, Williamson landed his first job in academia at Berkeley. But his request for tenure was denied. “It was presumptuous of me,” Williamson says now of his Berkeley bid for tenure, chuckling at his youthful hubris while sitting in his modest Haas School office. “I mean, I’d only been here a year and three months.”

Williamson went on to take a position in 1965 at the University of Pennsylvania, where he stayed until 1983, when he moved to Yale. In 1988, Teece and Al Fishlow, now a professor emeritus at Columbia University, helped woo Williamson back to Berkeley, which appealed to Williamson’s interdisciplinary tendencies by offering him appointments in not only business and economics but also law.

While at Berkeley, Williamson created a world-renowned PhD workshop on institutional analysis (now renamed the Williamson Seminar on Institutional Analysis).

“It was a fantastic window on research on institutions and organizations across a broad range of disciplines,” says Rotman Associate Professor Joanne Oxley, who earned her PhD under Williamson at Haas in 1995. “Lots of very famous or soon-to-be famous professors came through.”

“Olly also would invite a couple of PhD students along to dinner with the speaker after the workshop,” recalls Oxley. “That is unique in my experience of faculty seminars and says a lot about his commitment to his students.”

Williamson speaks just as positively about his Berkeley students.

“We get pleasure from the good students that

we have, and the good colleagues that we have, and the wonderful surroundings of which we are a part,” Williamson says.

“Berkeley is a glorious place,” he adds. “Everywhere you turn you find this commitment to excellence.”

Indeed, Williamson demonstrated his strong affection for Berkeley by deciding to give a large portion of his Nobel prize money to Haas to help create a new endowed faculty chair in the economics of organization.

“Another thing about Berkeley is the extraordinary energy that this place communicates,” Williamson says. “You can’t step onto this campus and not pick it up.”