Mark Rubinstein, a finance professor emeritus whose work had a profound impact on Wall Street by forever changing how financial assets are created and priced, died May 9 in Tiburon, California. He was 74.

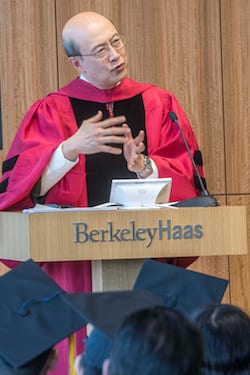

Rubinstein, who retired in 2012 after nearly 40 years on the University of California, Berkeley’s Haas School of Business faculty, was a pioneer in applying mathematical tools to financial markets. He was best known for his contributions in options pricing, as well as the development of the first Exchange Traded Fund (ETF).

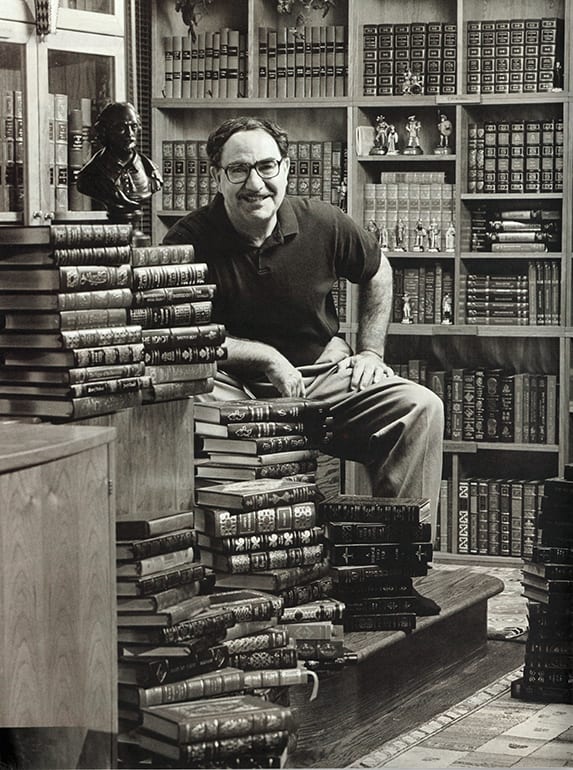

Rubinstein was intellectually fearless and known by his students as a sincere mentor who had extraordinary passion. He was also a quintessential Renaissance man whose curiosity and love of learning led him to acquire an impressive knowledge of Shakespeare, Ancient Greek, and Roman history.

“Mark was unusually honest and open-minded,” said Prof. Terry Odean, a colleague in the Haas Finance Group. “He was one of the few people I’ve known who would actually change his opinion when confronted with new facts or a better argument.”

Simplified options pricing

Rubinstein grew up in Seattle, the son of Sam and Gladys Rubinstein. After earning a bachelor’s degree at Harvard, an MBA at Stanford, and a PhD at UCLA, Rubinstein joined the Haas faculty in 1972.

His research efforts soon focused on options markets, which had just begun trading in Chicago. In 1979, working with John Cox and Stephen Ross of MIT, he developed the Cox-Ross-Rubinstein (CRR) Model, a “binomial” model for valuing a wide range of complex options. The model contributed to the growth of derivatives around the world and remains one of the most important valuation tools on Wall Street. A subsequent book, Options Markets (with John Cox), made option pricing theory accessible to a broad audience.

“His most famous contribution was in simplifying the option pricing model not only to a level that everyone could understand, but also to a point where everyone could use it effectively in the real world,” said Prof. Emeritus Hayne Leland, a finance colleague who worked closely with Rubinstein.

Leland O’Brien Rubinstein’s (LOR) influence

In 1981, Rubinstein joined with Leland and Haas Adjunct Prof. John O’Brien to form Leland O’Brien Rubinstein (LOR). The firm grew rapidly, and in 1987 the three founders were named among Fortune’s “Businessmen of the Year.” LOR developed a risk-hedging algorithm called “portfolio insurance.” To stem losses, the algorithm required selling off assets when markets declined, and portfolio insurance was accused of being a major accelerant of the October 1987 crash— when the stock market fell more than 20% in a day. These events and the role of LOR are recounted in Diana Henriques’ A First-Class Catastrophe: The Road to Black Monday, the Worst Day in Wall Street History.

The market eventually recovered, and the crash may have warded off a real recession by bringing stock prices back down to reality, according a later analysis. Traders today still use strategies that are roughly equivalent to portfolio insurance.

First Exchange Traded Fund

In an effort to protect investors without dynamic selling, LOR then pioneered the SuperTrust, an S&P 500-based fund that traded as a single security—which in 1992 became the first Exchange Traded Fund (ETF) in the United States. Rubinstein and Leland provided the economic arguments that convinced the SEC to give the first exemption to rules in the 1940 Investment Act that had prevented ETFs. These exemptions later became standard, and helped form the regulatory framework for what has arguably become the most important financial innovation in the last quarter century. In the years since, ETF funds’ assets have grown to more than $5 trillion globally.

Founded the Master of Financial Engineering Program

Rubinstein was elected President of the American Finance Association in 1992, and was named as the IAQF Financial Engineer of the Year in 1995. In 2001, he helped to found the Berkeley Haas Master of Financial Engineering (MFE) Program, which was the first such program in a U.S. business school and is consistently ranked #1.

MFE Program Executive Director Linda Kreitzman called Rubinstein a giant in his field. “He had a huge impact on our students’ lives and also our alumni. He was a brilliant, kind person and he’ll be deeply missed.”

An avid student of history, Rubinstein examined the development of modern theories of investment in his 2006 book, A History of the Theory of Investments: My Annotated Bibliography. He continued his academic research and mentoring of doctoral students at Berkeley throughout his career, and after his retirement, continued to nurture his intellectual curiosity with research and writing on classical Greece, Rome, and the early history of Christianity.

Rubinstein is survived and dearly missed by his wife Diane, and his children Judd and Maisie.

A memorial service will be held at 1:30 p.m. on Sunday, June 9 at Fernwood Mortuary, 301 Tennessee Valley Rd., Mill Valley.

The Berkeley Master of Financial Engineering (MFE) ranked #1 again this year in the US, according to a 2018

The Berkeley Master of Financial Engineering (MFE) ranked #1 again this year in the US, according to a 2018