Topic: Entrepreneurship

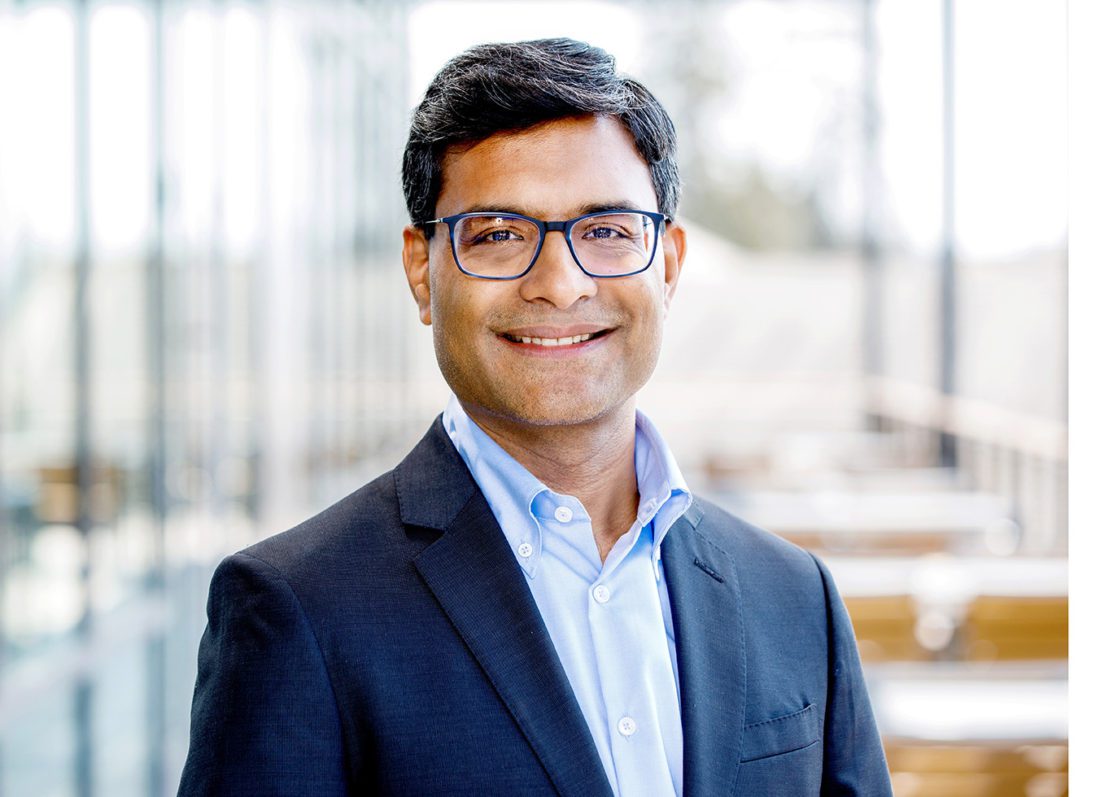

Why the tech layoffs offer opportunity for a reset: Q&A with Saikat Chaudhuri

While tech employment remains strong, a wave of layoffs is shaking up the industry. According to the tracking site layoffs.fyi, about 137,000 people have lost their jobs since layoffs started ticking up in May.

To find out more about what is driving this shakeup, we spoke with Saikat Chaudhuri, faculty director of the Management, Entrepreneurship, & Technology (MET) Program and of the Berkeley Haas Entrepreneurship Hub. Chaudhuri, an expert on corporate growth and innovation, mergers and acquisitions, outsourcing, and technological disruption, says the upheaval offers the opportunity for a reset and a chance to pursue growth in emerging areas.

The economy and labor markets are going strong. So why are so many tech companies laying off workers?

Many people are confounding two different things. We should not mix up the events specific to the tech industry with all the other issues that are going on in the broader economy due to the challenges of macroeconomic shocks, like Russia’s war on Ukraine, the aftereffects of the pandemic including supply chain problems, and the general inflationary pressures. The technology industry is also affected by those events, but there are additionally more fundamental factors at play.

“I am not worried about the jobs coming back. What we are seeing are structural changes. The jobs will be shifting, and will grow in up-and-coming areas.”

What’s happening in the tech industry is really a natural shakeout after over a decade of phenomenal growth. It is not unlike when the dotcom bubble burst in 2001. The sector was overheated and it could not continue as it had. The same is true now, as many startup and unicorn valuations skyrocketed over the last years, especially because the pandemic accelerated the growth to record levels as the deployment of technology and digital transformation became necessary everywhere. On the bright side, it’s actually not all bad. While I recognize that layoffs are painful for many people right now, the industry as a whole needs this adjustment to bring us to a path of more sustainable economic growth in tech. Because what was happening, especially with hiring over the last few years, was just completely unrealistic.

How did we get here?

During the pandemic, we went more digital. People worked remotely and they could work from anywhere—Hawaii, the countryside, anywhere. Tech became a big factor as the economy shifted entirely online: online retail, online banking, online instruction, online meetings, online therapy. It brought significant disruption to all industries.

We need to keep in mind that the pandemic was a different kind of economic crisis. Usually in an economic crisis, everybody loses, but that didn’t happen here. Some industries actually gained significantly, especially most of the technology sectors. The growth rate that they experienced, whether hardware, software, e-commerce, healthcare apps, fintech, crypto—you name it—was completely unsustainable. Just take a look at tech hiring last year: Tech job postings hit their peak in March 2022 and have been declining sharply since. We hit the point where the trend reverses. It was going to happen, either now or a year or two from now. It coincides with what’s going on in the overall economy and world politics, leading to a perfect storm.

“Once that first domino falls, it is easy for others to follow.”

This situation also poses a great excuse for employers. They say: A recession is coming. I will have to let people go.” Once that first domino falls, it is easy for others to follow.

Are you saying there was an inflation of the workforce inside the tech industry?

Yes. The reason for this is very simple: You don’t get penalized for growing your workforce while the sector is growing so fast. Everybody knows it will have to stop at some point, but there’s no penalty for riding the wave.

In fact, there’s a loss for your firm if you don’t ride the growth. If you said, “We should be more prudent because some sort of adjustment is going to happen,” there’d be no gain and you’d be losing out on the potential benefits—profits, funding, talent. Because when the correction happens, you can simply lay people off by the thousands. Two years later, the same people who got laid off will come back to the industry (whether at the same kinds of firms or new areas that emerge), and the same VCs will invest. There are no consequences for these actions. That’s just the way of Silicon Valley and the tech world, as they go through cycles.

Is this correction just a tightening of the belt, or is the industry reorganizing itself to make room for a new wave of technologies that require new skills or a reallocation of resources?

There will be some reorganization happening, because some areas are growing faster than others. For example, Amazon decided that not all of its devices are doing so well. Companies have been carrying losses in some areas for a while. But it didn’t matter because there was so much growth overall, and they didn’t want to miss out on that wave. It is not unlike the dotcom bubble, where for instance network equipment companies were investing in an array of optical networking products that never properly worked, because regular routers and switches were minting money.

“A re-evaluation of talent needs will also play a role.”

Moreover, re-evaluation of talent needs will also play a role. I’ve been puzzled for a while about all the anxiety surrounding the shortage of software developers, and the salaries they were being offered in the mad scramble to secure such talent. So much basic programming work has become well-defined, codified, and routine that those skills can be learned at scale by a wider base of employees. If you think about it, thousands of software developers, even at companies like Microsoft and Google, are engaged to implement enhancements to products such as adjusting fonts or updating visuals or adding simple features—not product design or creation of new functionality. Those jobs don’t require computer science graduates, as IBM realized five years ago, when they began hiring non-college graduates with programming experience, at that time out of necessity.

In fact, there are tools now that can automate basic code writing, which are already being deployed. It won’t stop there, because we now also have algorithms which can do many sophisticated tasks; just look at Open AI’s ChatGPT, which is writing essays, poems, lecture notes, speeches, and other creative pieces at the click of a button!

Why now? Is there anything in particular that started this domino effect this year?

Now, with increased scrutiny from investors and others who look at a firm’s financial viability, this overstaffing approach is getting reined in. There have been excesses in view of rosy projections and seemingly limitless valuations. Now the bubble has popped, as it does in every tech cycle, and it’s been a great opportunity (and excuse) for firms to make adjustments, tighten their belts, and reduce their workforce.

Where do you see opportunities?

The next wave of growth will come from emerging sectors, like cleantech and green tech, new materials, breakthroughs in the life sciences, and novel products and services resulting from the maturation of general purpose technologies like AI. Just like the dotcom era was about the internet and all that it spawned—cloud services, big data, the internet of things, and other advances in information technology—there will be a wave of new technologies that will disrupt a lot of different sectors.

In many industries, the disruption has just begun and exciting new transformations are taking place that’ll unfold over the next decade—whether in education, healthcare, finance, automobiles, or aerospace, just to name a few. I am not worried about the jobs coming back. What we are seeing are structural changes. The jobs will be shifting, and will grow in up-and-coming areas.

“If I could give one piece of advice, it’s this: Don’t get sidetracked by group think and FOMO. To become a leader, you’ll need to be comfortable charting new paths and challenging conventional approaches.”

What does that mean for the students at Haas, and those considering an MBA?

For our own graduates, it would be healthy to see this as an opportunity. The most entrepreneurial people are the ones who look at these situations and say, “Change is good, and uncertainty has two sides. It’s what creates the opportunity for new things.”

Instead of defining your career in terms of a particular job at a particular company, you could think about which problem you want to solve. That is where you will find the opportunity to lead and to make a real impact.

It’s great to aspire to work your way up to an executive job at a large firm, and many of our graduates will do that and be very successful. Others will go against the grain. They will be the ones we hear about, because they actually change how Goldman Sachs works or McKinsey works or Google works for the next era. And of course there will be the entrepreneurs who will pursue startups that will redefine entire industries.

Take Stuart Bernstein, BS 86, former Goldman Sachs managing director and partner who shook up investment banking with his passion for clean energy and the environment. A true leader by definition changes things. That’s why we pay attention to them and learn from them.

A lot of our students come in wanting to make an impact early in their careers. What does it take to get there?

If I could give one piece of advice, it’s this: Don’t get sidetracked by group think and FOMO. To become a leader, you’ll need to be comfortable charting new paths and challenging conventional approaches. Leaders have confidence, without attitude—confidence in their vision and in their ability to make it happen, and the humility to learn and acknowledge challenges and risks.

The good news is, you don’t have to be born with it. An MBA program like Berkeley’s gives you the opportunity to develop that kind of confidence. You can train yourself to see the opportunity in ambiguity, embrace serendipity, and take intelligent risks.

Along the way you also learn key the business skills—finance, marketing, management, operations, and so forth—that you will need as a leader. All that will help you develop this vision for your path to make an impact, and the confidence and network to make it happen.

What opportunities are there at Haas and Berkeley to get ahead of the next wave?

As part of our strategic priorities, we are building a new entrepreneurship hub at Haas that will be a game changer for our students and students across Berkeley. It will draw people from all over the campus. The great thing about Berkeley is that it has so many top-rated departments, and we will be able to bring them to one place to talk to each other and collaborate. So many of our Haas signature programs are about this kind of cross-pollination. Take Cleantech to Market’s partnership with the Lawrence Berkeley National Lab, or the Berkeley Skydeck accelerator, or the dual degree programs we have with Public Health, Engineering, Law, and that we are developing with the Rausser College of Natural Resources.

The most pressing problems of global society today require interdisciplinary perspectives. The hub we are developing will not only allow diverse people to connect, but it will provide them with the space and resources to create community, build their ventures, and be discovered by investors. What is novel is that we will not only support those who have a good sense of the entrepreneurial path, but also those who simply would like to be exposed to what it’s all about—the “entrepre-curious,” as we call them. And anyone from around the university will be able to drop in to simply ask an expert for guidance on how to navigate the vast innovation and entrepreneurship ecosystem at Berkeley based on what they need.

“While the tech industry is doing a reset, it may be a great time for you to do a reset as well.”

What’s your big-picture advice?

Silicon Valley is our backyard. While the tech industry is doing a reset, it may be a great time for you to do a reset as well. Beef up your skills, develop your leadership potential, build your network, and embrace your inner entrepreneur.

Napa 10 Questions: Part of her heart belongs to iconic San Francisco business

Grant Muir Inman, MBA 69

Berkeley emeritus trustee, VC pioneer

Grant Muir Inman, 80, a visionary leader and philanthropist, died at home in Orinda, Calif. in June.

After earning his Berkeley MBA, Inman blazed trails in the world of venture capital. Early on, he was a general partner of many VC firms, including Hambrecht & Quist, before co-founding Orinda-based VC firm Inman & Bowman in 1985. He then went on to found Inman Investment Management where he worked until his death.

Inman left an indelible mark on the Cal community, including serving on the Haas School Board and chairing the UC Berkeley Foundation’s Investment Committee, where he helped ensure the university’s long-term financial stability. In recognition of his extraordinary contributions, UCBF honored Inman with both the Wheeler Oak Meritorious Award for leadership in fundraising and its most prestigious honor, the Chancellor’s Award.

Inman also generously donated to numerous schools and programs on campus, including Haas, the College of Engineering, and Cal Athletics. He was named, along with his wife of 56 years, Suanne, a Builder of Berkeley.

IN MEMORIAM

Giles Cropsey, BS 34, MS 36

Carolee Todd, BS 45

Richard Brooding, BS 49

Frank Anderson, BS 50

Donald Schroyer, BS 50

Babette Barton, BS 51

Richard Lewis, BS 51

Edward Presten, BS 52

Reid Johnson, BS 53

Herman Trutner, BS 53

Donald Timmerman, BS 54

Howard Wiggins, BS 54

Sheldon Wolfe, BS 55

Michael Hughes, BS 56

Walter Schaetz, MBA 56

Donald Foster, BS 58

Laurence Kay, BS 58

Sam Saghera, BS 58

Gordon Huber, BS 60

Richard Hungate, MBA 61

John Boyl, BS 62

Richard Lieser, MBA 63

William James, MBA 65

Jeanne Yeh, BS 67

Richard Beacham, MBA 68

Gerald Vaught, MBA 72

Melvin Burruss, BS 73

Ray Reynolds, BS 74

Mitchell Lee, BS 75

David Bowen, PhD 76

Jennie Hoopes, BS 80

John Obana, BS 81

David Makofsky, MBA 81

Grace Spiridon, BCEMBA 12

Daniel Freitas, Friend

Henrique Ceribelli, MBA 07

SVP of Product Management, Bill.com

When native Brazilian Henrique Ceribelli was accepted into Haas after working as a computer engineer for five years, he was eager for professional opportunities unavailable in his homeland.

But it almost didn’t happen. With no employer to fund his continuing education, the costs were daunting. Plus, bank loan requirements at the time demanded a co-signer, which Ceribelli found only by chance in a friend of a friend. He also received a fellowship from Haas earmarked for international students.

But it almost didn’t happen. With no employer to fund his continuing education, the costs were daunting. Plus, bank loan requirements at the time demanded a co-signer, which Ceribelli found only by chance in a friend of a friend. He also received a fellowship from Haas earmarked for international students.

“People I didn’t know helped me,” says Ceribelli, a trend that continued when he was looking for a job post-graduation. Classmate Vijay Raghuraman, MBA 07, connected him with a product manager post at year-old startup Bill.com, a cloud-based payment platform.

Fifteen years later, Ceribelli is now senior vice president of product management and the company has since gone public and acquired three other startups. As Ceribelli’s professional life has blossomed, he’s never forgotten his good fortune. “The friends and network I had at Haas got me to Bill.com and the success that I have today,” he says.

Which is why Ceribelli is committing $500,000 over 10 years to support MBA fellowships for full-time students, with a preference for those who earned their undergraduate degrees in Latin America.

“I was lucky enough that Haas gave me a chance,” says Ceribelli. “I want to provide financial aid for those who are trying their luck and working hard, because they also deserve the chance.”

Shock and Awe

The pandemic’s effect on innovation

In 2014, when Jerome Engel and colleagues presented a framework to describe innovation communities in Global Clusters of Innovation, the world was different. Now Engel has refined that framework with Clusters of Innovation in the Age of Disruption, a collection of essays from business leaders and teachers. Berkeley Haas asked Engel, the founding executive director emeritus of the Lester Center for Entrepreneurship (now the Berkeley Haas Entrepreneurship Program), about his new findings.

What inspired this book?

What inspired this book?

In my first book, we demonstrated how innovative technology companies tend to emerge in clusters in certain regions—and we questioned what drives that process. The world has since entered a period of severe economic, cultural, and environmental disruption due to an ongoing series of shocks. We wanted to investigate what was happening in these innovative communities and whether they demonstrate enhanced resilience. We found that the answer was yes. Clusters of Innovation have entrepreneurial agility that enhances their resilience to external shocks, contributing significant social and economic value to society.

How do they do this?

Through innovation, which I define as the positive response to change. Truly innovative tech trends are often pursued by venture capital-backed entrepreneurial firms. Their market entry strategy is often to approach niche markets, which provide a beachhead opportunity because incumbent firms are not serving their needs exactly. Many of the entrepreneurial firms that blossomed during the pandemic had been in place for years, refining their technology and products. This allowed them to quickly provide solutions when the shock occurred.

Can you provide an example?

Zoom, which displaced slower-moving incumbents to (seemingly overnight) revolutionize business, personal, and educational communications. Its quick mass adoption revolved around product-led growth, an evolution of the freemium model emphasizing ease of user adoption (no logins, no hassle). This allowed the rapid behavior change that enabled a greater collective agility—a greater resilience.

2022 UC Berkeley holiday gift guide

Boosting the odds of securing venture capital and achieving startup success in a challenging economy

Winemakers and their muses

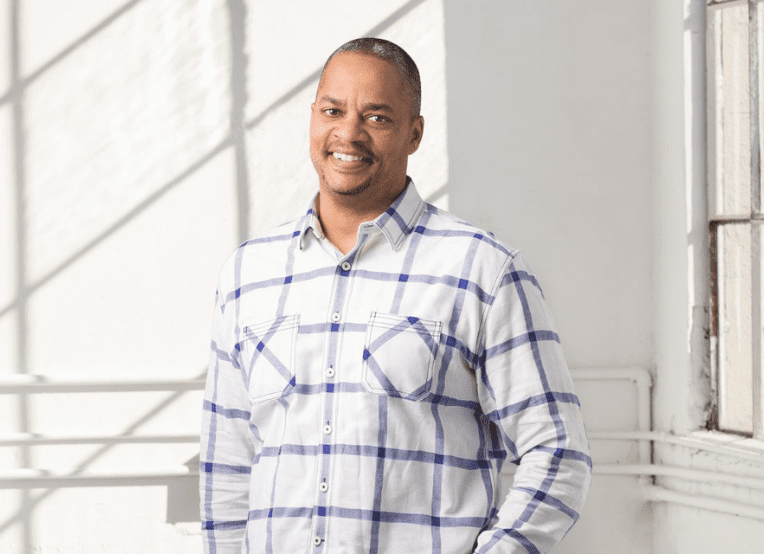

Dean’s Speaker Series: Footwork Co-Founder Mike Smith, MBA 98 on ‘embracing the zig-zags’

When Mike Smith, MBA 98, was 16 years old he mapped out a plan that would help achieve his career goal of becoming a CEO of a public company by age 42. But after working for a dot-com startup that would later go bust shortly after its launch, Smith learned quickly that the best laid plan doesn’t always work out.

“These [career] journeys are super windy, they’re rarely up and to the right,” said Smith. “My advice is to embrace the zig zags.”

Smith said he’s grateful for those who helped him build his career as previous COO of Walmart.com and Stitch Fix, and now as general partner and co-founder of venture capital firm Footwork. He spoke with MBA students and the Haas community about his career successes and failures, talent management, and cultivating a workplace culture at a recent Dean’s Speaker Series talk held on Nov. 1. The event was co-sponsored by the Berkeley Culture Center.

In his current role, Smith, along with business partner, Nikhil Basu Trivedi, backs early-stage startups focused on consumer technology, many of which are founded by BIPOC entrepreneurs and women. Their portfolio includes Table 22, an online tool that helps restaurants build subscription models, and Cradlewise, a smart crib that helps babies and their parents get better sleep.

The former Stitch Fix COO also talked about his experience with leading diverse teams, hiring employees who have forced him to be an excellent leader, and the value of mentorship.

Watch the complete DSS talk here:

‘Magic’ disruption in the transportation industry lures MBA grads to jobs

As a strategy manager at self-driving car startup Zoox last summer, Yiannos Vakis, MBA 23, spent a lot of time thinking about the challenges of rolling out robotaxi fleets in cities.

“Watching self-driving cars navigate the complex streets of San Francisco is pure magic,” Vakis said. “But to commercialize at scale, the industry has big strategic questions to work on that no one has fully solved so far.”

Vakis, co-president of the Berkeley Haas Transportation and Mobility Club, is among a growing number of students drawn to the rapidly-changing and fast-growing transportation/mobility industry. At Berkeley Haas, interest in the sector reflects that growth, with eight students in the Class of 2022 taking full-time jobs in the industry, (up from previous years), and 15 students in the 2023 class accepting internships. One lure, aside from the fun of being immersed in new technology, is the impressive pay. Mean base salaries for the 2022 FTMBA grads reached the higher end of the school’s employment report, coming in at $152,000 with a mean $23,000 bonus.

The Haas Mobility Club is hosting its annual Haas Mobility Summit 2022 Saturday, Nov. 5, at Chou Hall’s Spieker Forum.

Doug Massa, a relationship manager in the transportation and mobility sector for the Berkeley Haas Career Management Group, said the rise in interest comes at a time when companies that spent years on the technical aspects of building their products and services are looking to scale.

“That’s why these companies are recruiting strong MBA talent,” Massa said. “MBA roles like corporate strategy, product management, and operations are what get our students excited and these are the types of roles that they’re landing.”

Many current students are meeting and networking through the Haas Mobility Club, which is hosting its annual Haas Mobility Summit 2022 Saturday, Nov. 5, at Chou Hall’s Spieker Forum. The summit, UC Berkeley’s largest transportation-focused conference, focuses this year on “reimagining sustainable and accessible mobility,” with senior executives from Zoox, Rivian, General Motors, Spin, Autotech Ventures, and others joining. The student-run Haas Mobility Club, now more than 175 members strong, welcomes graduate students from beyond Haas—in the Engineering, Data Science, and Urban Planning programs.

Disrupting industries

As the market has heated up, Massa said he’s fielding about 20 calls a week from first and second-year students who want to talk about job opportunities in transportation. In addition to Uber and Lyft, Massa helps students recruit for roles at upstarts as well as big automakers like GM and Ford, electric auto leaders like Tesla and electric adventure vehicle maker Rivian, and autonomous vehicles like Cruise.

Haas Mobility Club member Minjee Kang, MBA 23, landed an internship in strategic operations at Rivian. Kang, who worked in operations at Air Korea before coming to Haas, said her goal and her reason for getting an MBA is to be part of sweeping industry-wide change.

“I believe the airline industry is going to be disrupted soon, just like Uber and ride sharing disrupted the traditional auto industry,” she said. “I think the transportation and mobility industry is facing a variety of opportunities as a whole, and I want to be a part of it.”

Sarah Thorson, MBA/MEng 23, who studied mechanical engineering as an undergraduate, landed an internship in product management at Nvidia, where she worked on autonomous vehicle development tools.

Thorson said she’s always been pulled to the technical side of the auto industry and knew she could study both business and engineering in her dual degree program. “I wanted to come to Haas to explore a product role in tech and to learn about the impact of technology innovations on transportation and mobility,” said Thorson, co-president of the Haas Mobility Club.

Investment opportunities in transportation also lures MBA students. Logan Szidik, MBA 23, pivoted toward early stage venture capital investment at Haas, working as an intern at Menlo Park-based Autotech Ventures.

“With companies staying private longer than ever before, private capital has an outsized impact on the future of the automotive industry,” he said. “As someone with a deep interest in technologies addressing the climate crisis, I wanted to better understand how investors approach start-ups focused on emerging spaces like vehicle-to-grid and fleet electrification.”

Alumni ecosystem

As more Haas grads move into transportation, the alumni community has expanded, with about 180 members of the Haas Mobility Network’s WhatsApp group.

That community includes transportation industry entrepreneurs like Ludwig Schoenack, MBA 19, co-founder of Kyte, a cars-on-demand service, and Arcady Sosinov, MBA 15, CEO of FreeWire, which makes fast electric vehicle chargers and battery generators. Both Bay Area companies have found success in raising $239 million and $230 million respectively, to expand their businesses.

This rich alumni network will continue to serve students well, Massa said. (Carlin Dacey, MBA 22, for example, recently joined Kyte as a market manager)

“The network has led to internships and full-time jobs,” he said. “It’s become a really nice ecosystem.”

The changemaker mindset with Alex Budak

New book explores pandemic’s effect on innovation

When Jerome Engel and colleagues presented a framework to describe innovation communities in 2014, the world was a different place. That book, Global Clusters of Innovation: Entrepreneurial Engines of Economic Growth around the World, explored the explosion and global trendsetting impact of Silicon Valley new venture development business practices. Now Engel has refined and extended that framework with Clusters of Innovation in the Age of Disruption (Edward Elgar Publishing, 2022), a collection of essays from business leaders and teachers worldwide. Berkeley Haas asked Engel, the founding executive director emeritus of the Lester Center for Entrepreneurship (now the Berkeley Haas Entrepreneurship Program), about his new findings.

What made you want to revisit your study of clusters of innovation?

In my first book, we outlined and demonstrated how innovative technology companies tend to emerge in clusters in certain regions—and we questioned what drives that process. The world has since entered a period of severe economic, cultural, and environmental disruption due to an ongoing series shocks. We wanted to investigate what was happening in these innovative communities and whether they demonstrate enhanced resilience. We found that the answer was a profound “yes”. Clusters of Innovation demonstrate an entrepreneurial agility that enhances their resilience to external shocks, contributing significant social and economic value to society.

How do they do this?

Through innovation, which I define as the positive response to change. Trends are obvious, especially technology trends which tend to be of relatively long duration. While a tech trend is not in itself innovation, its adoption into a valuable good or service is. Commercialization of such tech trends is often pursued by venture-capital backed entrepreneurial firms. Their initial market entry strategy is often to approach niche markets that provide a beachhead opportunity because incumbent firms are not serving their needs exactly. So smaller firms gain traction by providing these niche markets with products and services that provide a tight product market fit. Many entrepreneurial firms that blossomed in the midst of the pandemic were prepared for years before the pandemic. Their work in refining their technology and products put them in a position to provide solutions of huge impact quickly when the pandemic hit. This agility enhanced the resiliency, as they were already in the market with a limited but proven track record—so their businesses were positioned to explode into an “overnight success” when the shock occurred.

Can you provide examples of this?

Two clear, and very different, examples are Zoom in telecommunications and mRNA vaccine development in health care. Zoom had an innovative business model and mRNA developers embraced deep technology innovation. Zoom displaced slower- moving Cisco (WebEx), Microsoft (Skype/Teams), and other incumbents in revolutionizing business, personal, and education communication. Zoom became a verb, a place, a way of conducting much of our daily life. Zoom’s quick mass adoption revolved around a subtle business model innovation: Product-Led-Growth [PLG]. PLG is an evolution of the freemium model, where ease of user adoption is emphasized (just click the link, no log-ins, no hassle) and is often free. Traditional marketing is initially de-emphasized and that investment pored back into product development and viral marketing. Revenue evolves eventually from upselling to universities and larger businesses with value-added full-featured SaaS subscriptions. This ease of adoption drove the rapid behavior change that enabled a greater collective agility and a greater resilience.

A different type of innovation-driven agility is demonstrated in mRNA technology, which enabled the creation of vaccines in months rather than many years. Startups commercialized the novel mRNA vaccine technology, based on university research, before the pandemic. While the fundamental technology was revolutionary, its impact on the health of the general population was minimal. But during the pandemic, the benefits of this novel approach and the urgent need for a vaccine made its advantages clear, gaining the full attention major pharmaceutical firms. The rapid development and deployment of the various Covid-19 vaccines often depended on partnerships with major pharmaceutical companies, providing a perfect combination of speed and scale. The smaller firms’ product development speed combined with the larger firms’ capacity to scale trials, manufacture, and distribute.

What’s the takeaway from the book?

Economic regions such as Silicon Valley and other Clusters of Innovation around the world have proven to have enhanced resiliency to economic and environmental shocks. At the heart of such Clusters of Innovation are entrepreneurs, collaborating with venture investors and major corporations. Their constructive interactions build the resiliency required to quickly adapt and rebound from shocks. The process is helped by supportive government, universities, service firms, and other supporting actors in the community.

WeTravel books $27M to build fintech and more for bespoke group travel

Poets & Quants’ most successful MBA startups of 2022

Haas MBA student featured on new season of hit Netflix dating show ‘Love is Blind’

Hoping to meet the love of his life, Sikiru “SK” Alagbada, MBA 23, joined the Season 3 cast of “Love is Blind,” the hit Netflix dating show.

The show asks 30 single people to spend 10 days inside “pods,” where they interview potential love matches from behind a wall that separates them. Couples who agree to get engaged during the experiment exit the pods to see each other for the first time.

In this interview, Alagbada, who plans to work in early-stage venture capital investing after graduating, discusses his Netflix adventure, life before Haas, and juggling the demands of the show with the MBA program. The first episodes of the new season—which features Alagbada—airs October 19.

Haas News: The Season 3 “Love is Blind” cast promo came out yesterday. How do you feel?

SK Alagbada: It’s a mixture of excitement and feeling anxious because this remains the craziest, most out-of-place thing I’ve ever done—crazier than moving to Poland from Nigeria by myself when I was 19. I’m a little worried about how the show will be edited. We filmed so many hours and you don’t know what will make it to the final cut.

Do your classmates know yet?

I kept this secret from my classmates even though so many of them watch the show. I haven’t stepped into a class since the announcement so I am just preparing myself for the 21 questions. I kept this from them because of the confidentiality agreement, and also to try to have as normal a first-year MBA experience as possible.

Watch the “Love is Blind” cast announcement.

Had you watched “Love is Blind” before you were on the show?

No, but my mom had. She loves the show.

Tell us a little bit about your background.

I left Nigeria as an international exchange student to study in Poland. I still speak some Polish and three other languages. I lived all over Europe for a few years before moving to the U.S. 13 years ago by myself, and settled in Texas, attending Baylor University as an undergraduate. My brothers and mom are in the U.S. now. I am from the Yoruba tribe in southwest Nigeria, so I take my African culture, food, and Afrobeat music with me everywhere.

So how did Netflix find you?

Every season is scouted in a certain city. This one was in Dallas, where I lived. Someone reached out after they saw my Instagram account. I initially thought it was a scam and didn’t respond for several weeks. One day, I responded. From Instagram we did FaceTime auditions and interviews during COVID. They’re looking for responsible, emotionally stable people in their 20s to mid-30s. They look at your interests, your career, your lifestyle, and whether you are an eligible bachelor.

Why did the reality show idea of finding a wife appeal to you?

I was at the point in my life when I wanted to settle down. I didn’t want to hear my mom’s constant reminder anymore about getting married. Also, in the past couple of years I’ve lived in different places where I haven’t had stability in my life. I tried the conventional ways of finding partners, through friends and family introductions and dating apps, but nothing seemed to stick. But a lot of things in my life happen in unusual ways, most unexpected ways, so this was not foreign to me. It’s the story of my life.

I was at the point in my life when I wanted to settle down. I didn’t want to hear my mom’s constant reminder anymore about getting married.

How did you juggle filming “Love is Blind” with your MBA program schedule?

We finished filming the season before I started my first year of class, but I was still working at JP Morgan as a senior data engineer during my first year to cover the higher Bay Area costs and occasionally support my family back in Nigeria. Juggling that first year was tough. I’m so grateful for my classmates at Haas. They’re very gracious and were especially understanding when I had so much going on, willingly volunteering their time to help me understand unclear concepts in class. As a community, we are always there for each other.

I’m so grateful for my classmates at Haas. They’re very gracious and were especially understanding when I had so much going on, willingly volunteering their time to help me understand unclear concepts in class. As a community, we’re always there for each other.

In the show promo they asked about your most annoying habit and you said “snacking.” Snacking doesn’t seem so bad!

I work from home and study a lot and I always have a snack with me. My favorite snacks right now are Smartfood popcorn and Walkers shortbread cookies. My girlfriends in the past learned to accommodate it—or they picked up snacks for me when they went shopping.

You are very involved with the LAUNCH accelerator program. How does the student-led startup accelerator program align with your career goals in venture capital?

Prior to Berkeley, I worked at large companies like General Motors and JP Morgan, but I wanted an immersive startup experience and to learn the business of technology, grow my network, and boost my startup pipeline. Serving as LAUNCH co-chair of strategy and partnerships helps me to achieve this goal. I’m responsible for shaping the vision by managing and growing our relationships with investors, raising funds for our startups, and developing initiatives to strengthen our program experience. To date, LAUNCH startups have raised over $700 million and LAUNCH remains completely student run.

You are also president of the Africa Business Club. Can you talk a bit about investing in African startups?

This is very personal. I left Nigeria at the onset of a tech revolution that’s led to one of the fastest growing ecosystems in the world. I’ve stayed connected to home, but still have major FOMO from leaving the country at such a pivotal time. That’s why I’ve been dedicated to helping connect startups on the continent to capital, mentorship, and resources in Silicon Valley. In April, my team and I hosted the first in-person Africa Business Forum at Haas since COVID. This event laid groundwork for new connections and startup investment in Nigeria.

What’s your favorite thing about Haas?

Haas does a very good job of assembling a class of genuinely good people. In addition to being so accomplished and having done such interesting things in their lives and careers, they are genuinely good people.

What do you like to do outside of school?

I love soccer, tennis, and Scrabble. I also like to cook. There is a dearth of African food in the Bay Area, so I usually find myself cooking a lot. My mom also ships me food sometimes.

Have you picked up anything new since moving to California?

Recycling! I came from Texas. It’s a huge shift for me.