Haas Voices is a first-person series that highlights the lived experiences of members of the Berkeley Haas community.

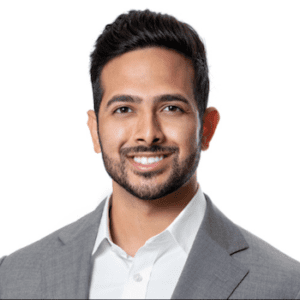

In honor of Black History Month, we spoke with Jordan Bell, MBA 23, an Oakland native who’s determined to rise to the C-suite and open doors for younger generations of Black youth interested in finance careers.

Bell is the community engagement officer for the Haas Black Business Student Association; a “manbassador” for the Women in Leadership Club; and a fellow of the Robert Toigo Foundation and the Consortium for Graduate Study in Management. He’s also one of 11 Finance Fellows at Berkeley Haas. This summer, he will work at Amazon as a senior product manager.

Tell us about your family and upbringing?

I was born and raised in East Oakland, California, the second oldest of three sons. My parents are college-educated, working-class people. They strongly believed in the value of getting a quality education as the way to change the future. They scraped every extra dollar they had to send my brothers and me to private schools. I went to St. Mary’s College High School in Berkeley, and after graduation, I went to Morehouse, a historically Black, all-male college in Atlanta, Georgia. To this day, I wouldn’t have gone anywhere other than Morehouse.

What led you to go to a historically Black college (HBCU)?

I wanted to go to a college outside of California where I could grow and learn more about being a Black man. I also wanted to study in a place where I was not a minority. For many Black people in the U.S., there’s this extra thought process that we go through whenever we leave our homes and enter public places. Things like, “Do I belong?” “Am I doing enough?” “Do I fit in?” “Am I assimilating into a society that is not really built for me?” All of these questions are burdensome. Studying at Morehouse alleviated that stress because almost every other person around me was an African American man. There is literally no place in America where an African American of any sex can see so many Black professionals in one setting other than at an HBCU.

I chose Morehouse specifically because it has an amazing history and legacy of producing Black leaders. I think about the alumni who came before me—Dr. Martin Luther King, Jr., actor Samuel L. Jackson, civil rights activist Julian Bond—and I think about all of the barriers they broke through to lay the groundwork for future generations of young Black men. They inspire me to be the greatest I can be. There’s no excuse but to be great.

What led you down a career in finance, and why did you choose Haas?

During sophomore year at Morehouse, I attended a speaker series featuring former CEO of Goldman Sachs Lloyd Blankfein. He spoke about how going to college and choosing a career in finance changed the trajectory of his life. His speech convinced me to explore the world of corporate finance and capital markets.

After college, I landed a full-time job at J.P.Morgan as a capital markets research analyst. There, I learned the importance of networking and honed my technical, presentation, and client-facing skills that are transferable to any industry. Two years later, I moved west to work at the Federal Reserve Bank of San Francisco as a financial regulator. I worked my way through the ranks from a junior to a senior examiner. After seven years, I was at a crossroads: Should I keep going down the financial regulator path, or should I go to business school? I chose the latter. Haas was one of the best decisions I ever made. I appreciate how collaborative Haas is. While business schools can feel very competitive or cutthroat, there’s a different kind of competition at Haas. We bring out the best in each other. We rise together is how I see it.

While business schools can feel very competitive or cutthroat, there’s a different kind of competition at Haas. We bring out the best in each other. We rise together is how I see it.

What does Black History Month mean to you?

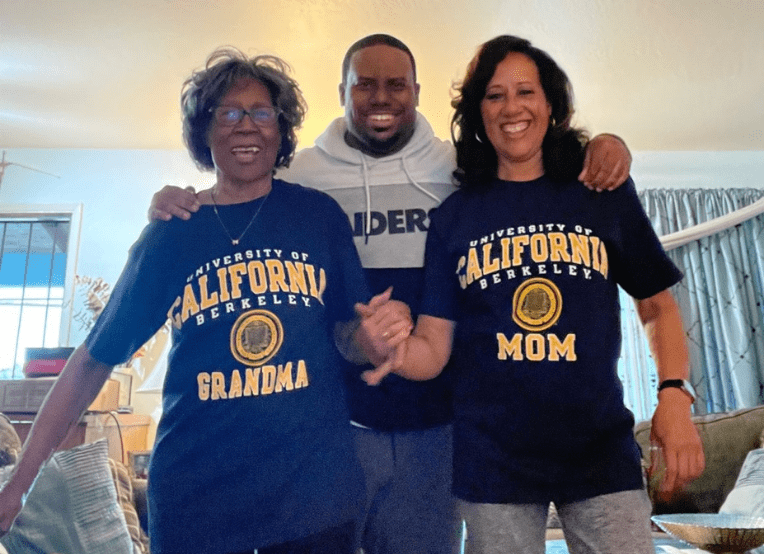

Black History Month means recognizing the accomplishments and struggles of African Americans. It allows us to tell our own narrative on our own terms. Black people were brought and enslaved here. We didn’t come here voluntarily like other cultural groups. And yet, we survived and are thriving. Our collective stories make me feel so proud to be a Black man. I wouldn’t want to be anything other than a Black man. During the month, I celebrate by reading a story daily about a historical figure, or I talk to the elders in my family to soak up their wisdom, especially the Black women in my family. They’re the strongest people that I know and the structural glue of my family.

Our collective stories make me feel so proud to be a Black man. I wouldn’t want to be anything other than a Black man.

What are your goals, and what kind of legacy do you want to leave behind?

In the short term, I hope to become a senior product manager or fintech strategist. My long-term goal is to be in the C-suite. I want to be a chief executive officer for a technology or financial services company. I want little Black boys and girls to see that there are Black people performing at the highest levels in executive positions. I want to show them that it’s possible to occupy these spaces.

Still to come:

Still to come: