While working as a senior consultant at Deloitte, Stephanie Wenclawski, MBA 22, noticed that many of her clients lacked access to digital tools that could help them efficiently manage their finances. Employees at one women’s empowerment organization, for example, spent hours manually uploading travel receipts to an outdated accounts payable system. “It was time they could have spent focusing on their mission,” she said.

Now, as one of 13 full-time MBA students named among this year’s Berkeley Haas Finance Fellows, Wenclawski said she wants to tap what she’s learned in previous roles to develop fintech products that will help women better manage their money.

Haas grants finance fellowships annually to full-time MBA students. Fellows receive a $5,000 scholarship, priority enrollment for elective classes, and a mentor in their field of interest, usually a Haas alum who provides career guidance and support. Fellows are evaluated and selected based on work experience in their chosen field, career goals, and interviews.

Fellows receive a $5,000 scholarship, priority enrollment for elective classes, and a mentor in their field of interest.

The Finance Fellowship Program, now in its 15th year, has doubled in size and expanded its scope as student interests have evolved over time, said William Rindfuss, executive director of strategic programs for the Haas Finance Group. In addition to investment banking fellowships, the program now offers fellowships to students interested in private equity, venture capital, impact investing, public-markets investing, and fintech.

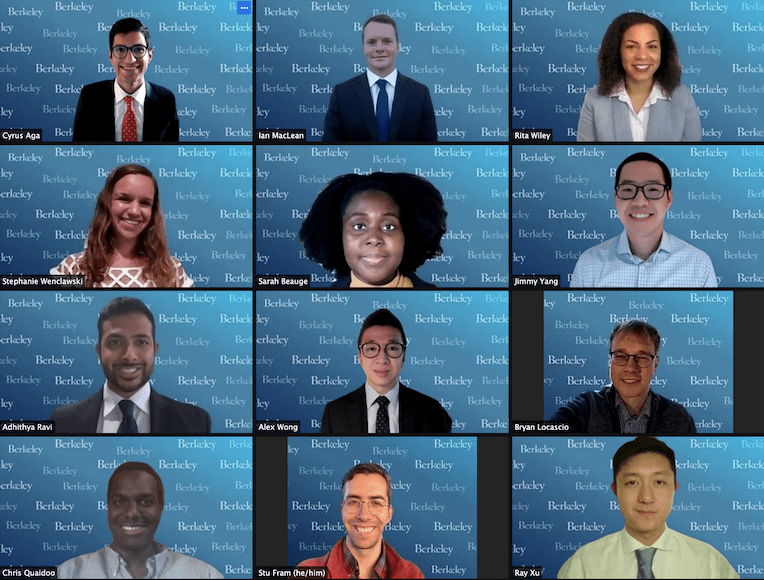

This year’s fellows are:

Investment Management: Ray Xu, Sarah Beauge, Cyrus Aga

Entrepreneurial Finance: Chris Quaidoo, Stuart Fram, Stephanie Wenclawski

Investment Banking: Ian MacLean, Adhithya Ravi, Alex Wong, Rita Wiley

C&J White Finance Fellows (selected last spring): Jimmy Yang, Eric Edelstein, Bryan Locascio

Before coming to Haas, Chris Quaidoo, MBA 22, worked as a research analyst at Snow Capital Management, picking technology stocks. Now, he’s shifting gears, setting his sights on becoming a partner at a venture capital firm. Moving toward that goal, he’s already secured an associate position at venture capital and private equity firm Griffin Gaming Partners.

Quaidoo, the son of Ghanaian and Jamaican parents, said one of his goals is to create more diversity in the venture capital industry and a pathway for more people of color to follow in his footsteps.

“If you don’t have a seat at the table, you can’t truly create change,” he said. “I want to create an industry that includes more people who have backgrounds like mine.”

“If you don’t have a seat at the table, you can’t truly create change,” — Chris Quaidoo, MBA 22.

Rita Wiley, MBA 22, said she’s looking forward to tapping her undergraduate life sciences degree with her MBA to launch a career in healthcare investment banking. Wiley, a former U.S. Army military police officer, is already reaping the benefits of her fellowship.

“I just accepted an early offer for a summer internship with Piper Sandler’s healthcare team, so I’m pretty excited about that,” she said. “They’re definitely one of the top companies I’d like to work for after graduation.”