When election cycles really pay off

Every four years, presidential elections roil the stock market amid uncertainty over who will hold power in Washington.

Yet for investors, the more important election milestone may be the midterms. New research by Berkeley Haas Prof. Emeritus Terry Marsh has documented significantly above-average returns in the six months following midterm elections over the past 145 years.

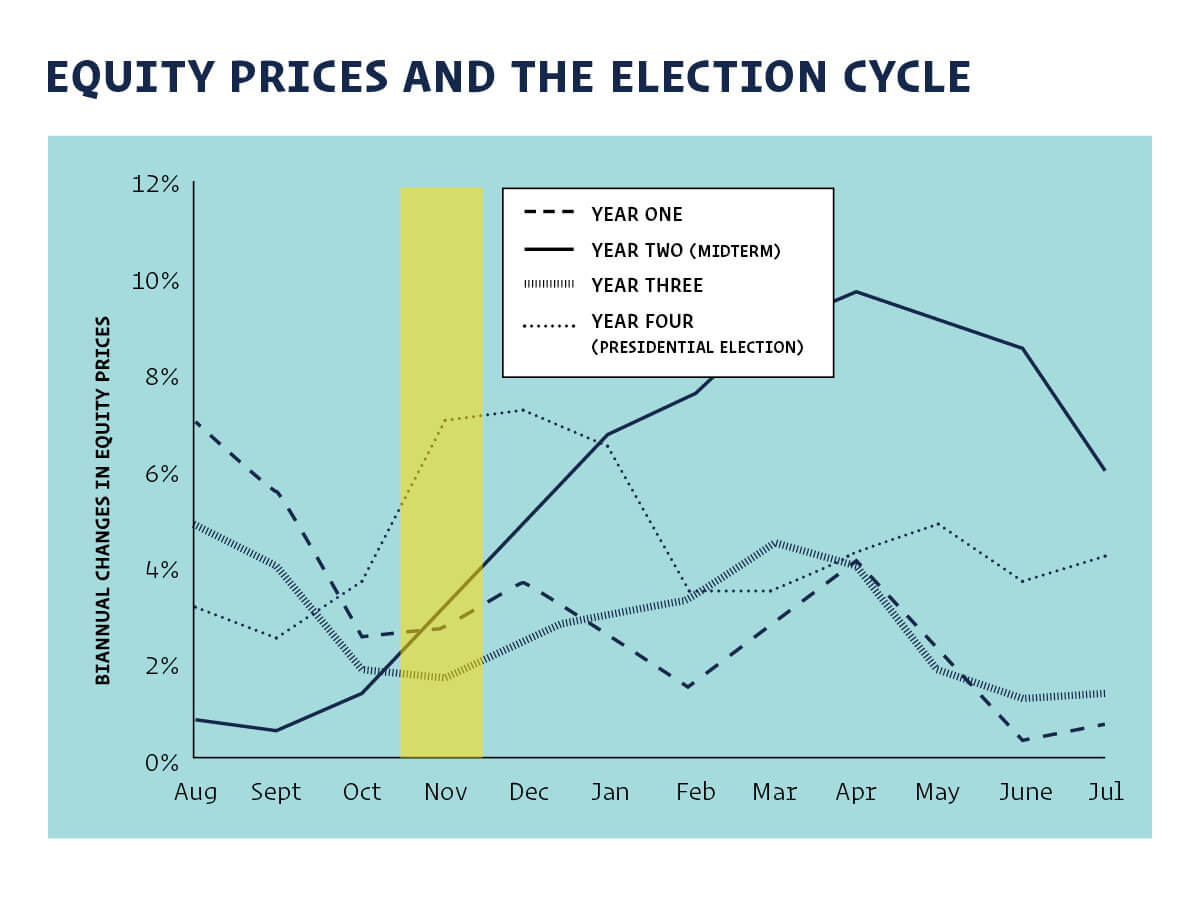

In fact, since 1872, average annualized equity market returns were over 15.4% in the months following midterms, compared with just under 3% in other months, Marsh and co-author Kam Fong Chan documented. They found the post-midterm months outperformed the post-presidential months in roughly two-thirds of the past 36 election cycles.

Marsh says he was puzzled at first about the significance of the midterms. He and Chan speculated that the cause is a decrease in uncertainty—a theory the researchers were able to back up by analyzing indices that measure economic uncertainty and partisan conflict monthly.

“When you’re dealing with the stock market you’re dealing with expectations,” says Marsh, CEO of risk-management firm Quantal International. “Midterm voters tend to penalize the president’s party to maintain checks and balances. Uncertainty about the political division in Washington—and what that means for economic policy—peaks in the months leading up to the midterm.”

Above: Six-month average returns in U.S. equity prices surrounding November for the different years of the election cycle (data period: 1871–2015).

Above: Six-month average returns in U.S. equity prices surrounding November for the different years of the election cycle (data period: 1871–2015).

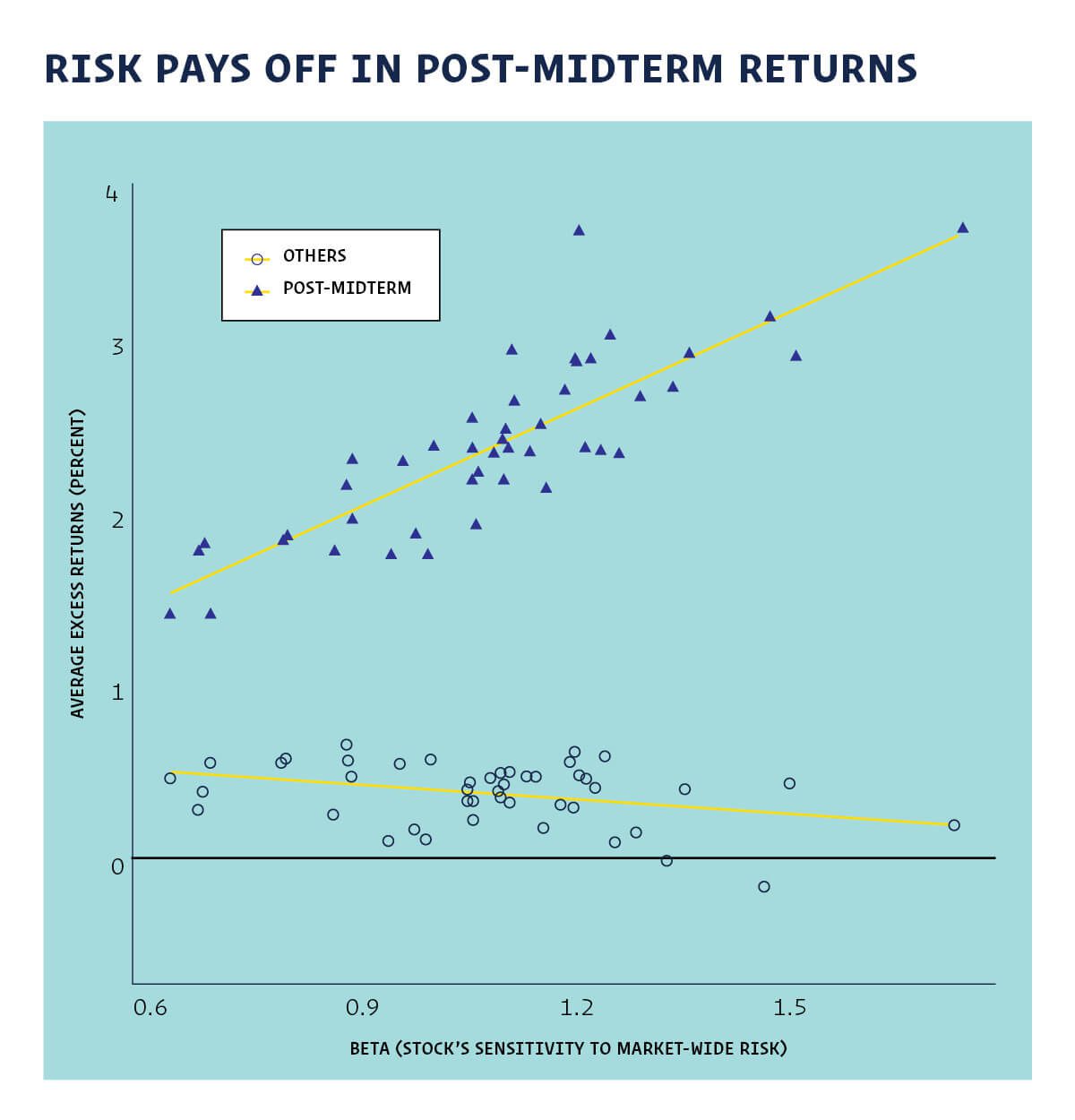

Above: The researchers plotted returns for a range of portfolios from December to April in midterm years versus other years. They found that riskier investments (portfolios with higher beta, a measure of volatility relative to a benchmark) yield higher returns in midterm years. In other years, risk decreases returns.

Above: The researchers plotted returns for a range of portfolios from December to April in midterm years versus other years. They found that riskier investments (portfolios with higher beta, a measure of volatility relative to a benchmark) yield higher returns in midterm years. In other years, risk decreases returns.