Being Black at Berkeley Haas

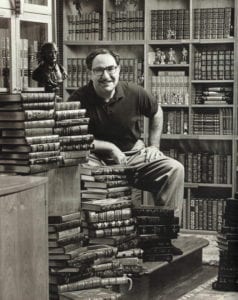

Mark Rubinstein, a finance professor emeritus whose work had a profound impact on Wall Street by forever changing how financial assets are created and priced, died May 9 in Tiburon, California. He was 74.

Rubinstein was best known for his contributions in options pricing as well as the development of the first exchange-traded fund. A quintessential Renaissance man, his intellectual curiosity led him to acquire an impressive knowledge of Shakespeare as well as ancient Greek and Roman history.

After earning a bachelor’s degree at Harvard, an MBA at Stanford, and a PhD at UCLA, Rubinstein joined the Haas faculty in 1972.

His research efforts focused on options markets, which had just begun trading in Chicago. In 1979, working with John Cox and Stephen Ross of MIT, he developed the Cox-Ross-Rubinstein Model for valuing a wide range of complex options. The model contributed to the growth of derivatives around the world and remains one of the most important valuation tools on Wall Street. A subsequent book, Options Markets(with John Cox), made option-pricing theory accessible to a broad audience.

In 1981, Rubinstein joined with Haas Prof. Emeritus Hayne Leland and Haas Adjunct Prof. John O’Brien to form Leland O’Brien Rubinstein (LOR). The firm grew rapidly, and in 1987 the three founders were named among Fortune’s Businessmen of the Year. LOR developed a risk-hedging algorithm called “portfolio insurance,” the strategies of which are still used by traders today.

LOR then pioneered the SuperTrust, an S&P 500-based fund that traded as a single security—which in 1992 became the first exchange-traded fund (ETF) in the U.S. ETFs helped form the regulatory framework for what has become arguably the most important financial innovation in the last quarter century. In the years since, ETF assets have grown to more than $5 trillion globally.

In 2001, Rubinstein helped to found the Berkeley Haas Master of Financial Engineering Program, which was the first such program in a U.S. business school and is consistently ranked #1. After his retirement, he wrote about classical Greece, Rome, and the early history of Christianity.

IN MEMORIAM LIST

Jessie Shew, BS 40

Harold Jow, BS 41

Jane Galvan, BS 46

Donald McNary, BS 46

Kenneth Booth, BS 47

Kenneth Ashcraft, BS 48

John Daniels, BS 48

Leslie Foppiano, BS 48

Floyd Pickett, BS 49

Tetsushi Uratsu, BS 49

George Armstrong, BS 50

Allan Buchanan, BS 50

Yutaka Kobori, BS 50

Kenneth Murray, BS 50

Augie Ong, BS 50

Allen Blanc, BS 51

Arnold Brown, BS 51

Don Deming, BS 51

Sydney Hammill, BS 51, MBA 54

John Vohs, BS 51

Savino Cavaliere, BS 52

George Spence, BS 52

Theodore Mah, MBA 52

Ronald Britting, BS 54

Henry Angerbauer, BS 55

Donn Bearden, BS 55

Alan Ghidossi, BS 55

Stanley Loeb, BS 55

Marian Vantress, BS 56

Robert Bishop, BS 57

James Johnson, BS 57

John Vanderveen, BS 57

Donald Hill, MBA 57

William Awbrey, BS 58

Robert Beatty, BS 58, MBA 59

Alan Holloway, BS 58

Whitney Newton, BS 58

Joseph Ryan, BS 58

Paul Cooper, BS 59

Joseph Innis, BS 59

Daniel Moore, BS 59

Glenn Quick, BS 59

Robert Brodie, BS 60, MBA 62

Robert Ehrhart, BS 60

Ernest Lee, BS 60

David Peterson, BS 60

Lawrence Broeren, MBA 60

Robert Mayer, BS 61

Wilmer Post, MBA 62

Johann Koo, MBA 64

Arthur Stonehill, PhD 65

Ury Beary, BS 66

John Fox, BS 66

Erle Winkler, BS 66

Robert Crandall,vMBA 66, PhD 68

William Balamuth, BS 67

John Kjellman, MBA 67

James Pellissier, BS 69, MBA 70

Garth Johnson, MBA 70

Stephen Yee, BS 71

Douglas Wholey, MBA 79, PhD 84

Gregory Martin, BS 82

Helen Andritsakis, BS 84

Kristi Kali Berquist, MBA 95

Carolyn Carlson, Friend

William Cole, Friend

Dennes Coombs, Friend

Charles Goldberg, Friend

James Love, Friend

Denny McLeod, Friend

Earle Pendarvis, Friend

Dorothy Sanderson, Friend

James Williams, Friend

Posted in:

Topics: