Topic: Management

Head in the game: LA Clippers exec shares life and career advice

In TEDx talk, professor Juliana Schroeder shares ways to fight loneliness

With approximately 44 million Americans having reported daily feelings of loneliness, U.S. Surgeon General Dr. Vivek Murthy earlier this year declared that we are facing a “loneliness epidemic.”

Juliana Schroeder, the Harold Furst Chair in Management Philosophy and Values Professor and Barbara and Gerson Bakar Faculty Fellow at Berkeley Haas, explored this crisis in a recent TEDxMarin talk, sharing strategies to fight loneliness and live a more connected life. Schroeder is a behavioral scientist who researches the psychological processes behind how people interact and make social inferences about others.

In fact, Schroeder herself once felt plagued by loneliness. She shared that while riding public transit early in her career, she used to feel particularly disconnected from those around her. Technology is only exacerbating our loneliness, she added.

“Avoidance is easier for us than ever,” she said in her talk. “Online avoidance feels convenient, but it carries an inconvenient consequence.”

“Avoidance is easier for us than ever.”

This “inconvenient consequence” extends beyond the emotional impacts of loneliness. In fact, Schroeder noted a meta-analytic review in the journal PLOS Medicine that found sustained loneliness is potentially as harmful to human health as smoking 15 cigarettes a day.

When people refuse to interact with others and instead retreat into their tech devices, Schroeder explained, the cycle is only perpetuated.

“The paradox of loneliness is that people who are lonely don’t want others to think there is something wrong with them,” she explained. “So they further isolate themselves, creating a cycle of loneliness.”

“The paradox of loneliness is that people who are lonely don’t want others to think there is something wrong with them. So they further isolate themselves, creating a cycle of loneliness.”

Strangers on a train

Schroeder, who also holds affiliations with the Social Psychology Department, Cognition Department, and Center for Human-Compatible AI at UC Berkeley, has explored this paradox in her own research, looking at not only the causes behind the loneliness epidemic but also at potential solutions. When completing her doctorate in social psychology at the University of Chicago, for instance, she ran an experiment inspired by her own experiences on the train.

She found that people expected that talking with a stranger on the train would result in the least positive commute experience—but, in reality, it did the exact opposite. Those who engaged with others on the train reported having the most positive commute experience, leading her to beg the question: Why do people choose to avoid each other if they’d be happier connecting?

One of the main reasons, she finds, is that people tend to overestimate the social risk that comes with connecting with others. Citing the rule of social reciprocity, however, Schroeder noted that nearly all participants received a response when engaging with another person on their commute.

Fostering deeper connections

Curing loneliness is about more than just making small talk—it also requires establishing deeper connections with colleagues, friends, and more. In another study published in the journal Psychological Science, Schroeder found that the medium through which communication occurs is crucial to its quality. That is, voice-based communication like in-person and phone conversations—as opposed to text-based communication like texting, emailing, or DMing on social media—changes how words are received and understood, influences word choice, and affects the synchronicity of exchanges.

In fact, research suggests voice conversations enhance brain wave and heart rate synchrony—the neurological and cardiovascular evidence of psychological alignment.

“Combating loneliness means making the deliberate choice to connect when all you want to do is avoid,” Schroeder concluded. “These choices might feel small, but in aggregate, they have the power to change us from feeling lonely to feeling connected.”

Navigating narrow-mindedness, reaping the benefits of dissent, and cultivating curiosity: A conversation about leadership with Maura O’Neill

New research blasts outdated myths that women lack ambition at work

The idea behind ‘Bare Minimum Monday’ highlights burnout and poor mental health at work. Should you try it?

New book explores how companies can navigate a volatile future

Olaf Groth doesn’t like to make predictions, but he’s nonetheless become adept at helping executives see around corners and navigate the chaos of recent years.

A member of the Berkeley Haas professional faculty, a senior adviser at the school’s Institute for Business Innovation, and the faculty director for the Future of Tech program at Berkeley Executive Education, Groth is also chairman and CEO of thinktank Cambrian Futures.

In a new book, The Great Remobilization: Strategies and Designs for a Smarter World (MIT Press), Groth and coauthors Mark Esposito and Terence Tse (and editor Dan Zehr) focus on what they call the Five Cs—COVID; the cognitive economy, crypto and web 3; cybersecurity; climate change; and China. They show leaders how to power human and economic growth by replacing fragile global systems with smarter, more resilient ones.

In a new book, The Great Remobilization: Strategies and Designs for a Smarter World (MIT Press), Groth and coauthors Mark Esposito and Terence Tse (and editor Dan Zehr) focus on what they call the Five Cs—COVID; the cognitive economy, crypto and web 3; cybersecurity; climate change; and China. They show leaders how to power human and economic growth by replacing fragile global systems with smarter, more resilient ones.

In one chapter, the authors imagine a harrowing scenario they call “the Great Global Meltdown of 2028,” the economy collapses after a hack of a critical global payments system in the midst of recurring climate and COVID crises; nearly 1 billion people suffer mental health issues from the strain.

But with the help of the ideas in the book and a bit of practice, leaders can learn to “flip the chaos forward into opportunity,” the authors argue. The book, shortlisted for the Thinkers50 Strategy Award, launches on Oct. 17.

We talked with Groth about how executives can learn to turn turmoil into opportunity.

Your book talks about the need for humanity to make the leap from the “raging 2020s” to a “great remobilization” in the late 2020s and beyond. What will need to happen?

We’re looking at utter volatility over the next 10 years. We can’t afford to sit on the couch and just watch. We have an opportunity now to redesign how business leaders generate growth—both for their shareholders as well as for a broader set of stakeholders—that takes into account how the global economy has changed and continues to change. The book is all about: Where do we go from here? Are we going to accept that we’re going to have a fragmented world where people don’t trust each other, where trade and investment are inhibited, and where growth is limited?

“We can’t afford to sit on the couch and just watch. We have an opportunity now to redesign how business leaders generate growth—both for their shareholders as well as for a broader set of stakeholders—that takes into account how the global economy has changed and continues to change.”

What will the next era of globalization look like amid an era of rising economic nationalism, fragile supply chains, and recurring pandemics and natural disasters?

The globalization everyone keeps talking about is how many bananas get shipped from Argentina to China with the greatest degree of efficiency. And of course that’s important for jobs today. But what we really have to ask is, who controls the flow of any given thing from one place to another? At the end of the day, the people who have the power in what we call the “cognitive economy” can influence these flows. There are traditional flows—of capital, of intellectual property, of people, of goods and services. But there are also new flows of behavioral data, genetic material, and crypto currency. And that’s not even including the ecological flows of energy, air, water, and pathogens.

You define the cognitive economy as a world of algorithms automating or augmenting human decisions and tasks and spinning out valuable insights that can be used to improve businesses, governments, and society. What’s at stake for managers and leaders in a cognitive economic future?

In the cognitive economy, cybernetics functions are getting injected into everything we do—essentially intelligent, digital, command-and-control functions that are at the moment centrally steered by the likes of Google, Amazon, Baidu, and Alibaba. We need to see the new principles bubbling up now from the cognitive economy. Leaders need to be able to perceive the new operating logic in their domain and in their industry.

Take supply chains: 46% of supply chain managers are saying that investments in AI and automating human decisions is their top priority. That means we’ll see new types of integration of human and machine predictions and decisions. Or take the mobility industry. Electrified, autonomous cars use AI to create applications inside the car, and cars are now starting to be tied to a new charging infrastructure around the smart home. You need to design cars like they’re an iPhone: you start with a chip and you build everything around that. Essentially, the automotive industry is being scrambled, as is the energy industry, the home appliances industry, etc. Who controls these complex systems? How do you see those new patterns if you’re an executive any given industry?

Your book describes a FLP-IT (forces, logic, phenomena, impact, and triage) model for strategic leadership. How should executives approach the triage step, which requires them to make tough decisions about what to keep, discard, or build from scratch?

I was at the World Economic Forum meeting in Tianjin and a senior executive in the petrochemicals industry told me that after 30 years of building megafactories in China, his company now needed to throw that out the window and create chains of “nanofactories” across 12 different markets to create resiliency. To solve that kind of challenge you need to understand what to invest in and what to divest of. Because strategy is just as much about what you do as it is about what you no longer do.

Most executives are bad at dropping things that they hold dear. They need to make conscious choices.

“Most executives are bad at dropping things that they hold dear. They need to make conscious choices.”

Once you understand the new operating logic in your industry or domain, you need to redraw its boundaries and diagnose changed power relations. To address those changes, you have to then free up resources from activities that are not aligned with the new arena to create new ones that are. For instance, if you are a food conglomerate with most of its agricultural activities in the global south, how will you need to reconfigure that for massive labor migration coming in the face of climate change? Do you have the cognitive technologies, including AI, data science and automation in place to make your supply chains more intelligent, agile and resilient?

You argue that China is an indispensable partner for any global systems redesign. How will leaders in the rest of the world need to reimagine their engagement with a rapidly aging and slowing China while navigating rising economic and military tensions?

Not every investment in China is bad and we’re not advocating for a wholesale withdrawal from all activities in China. That total decoupling is not desirable for anybody. In fact, there are lots of new opportunities for joint solutions that serve both our economic and national security interests as Americans and Chinese. Let’s talk about the fact that China’s coastal cities are as screwed as America’s cities are with sea levels rising. Hundreds of millions of people will be migrating north. That could mean joint investment in climate change mitigation and adaptation solutions, in new approaches to education, in regulating and managing migration, in innovation for public health and early pandemic detection and warning systems.

At some level, we’re going to get down to technologies that are sensitive, like chips and AI. And granted, you can weaponize almost anything these days. But there are technical ways to govern that, design protocols for dispute resolution and risk mitigation. We can watermark and forensically trace content, technical components and code. We can figure out where specialized microchips are going. We can put protocols in place to jointly identify and settle infractions and misunderstandings. It’s not perfect, to be sure. Nothing ever is. But we have to try, because the alternatives are even worse.

So there’s some optimism in your message?

I have a conviction that a lot of these problems are truly solvable with the right design. Executives need to get out there and try things with risk-bounded experiments. This is a craft you can learn. We give leaders a roadmap to lead people into a new future that’s better than one of distrust, fear, and fragmentation.

Study using Airbnb data sheds light on whether incentivizing customer reviews makes a difference

Key Takeaways:

- Incentivizing online reviews may not give you the types of reviews you want.

- Incentivized reviews don’t improve—and may even hurt—business.

New research focused on whether incentivizing would-be online reviewers to post reviews can make a difference for the seller has shed light on the role those reviews play in sales and revenue outcomes.

Researchers worked with Airbnb to conduct a large-scale and costly experiment to find out just how those incentivized reviews impact day-to-day marketing. They found that although incentivizing reviews does lead to an increased number of reviews, the induced reviews tend to be more negative in nature, and have no impact on the number of nights sold or total revenue.

The study published in the INFORMS journal Marketing Science, “Do Incentives to Review Help the Market? Evidence from a Field Experiment on Airbnb,” is authored by Andrey Fradkin of Boston University and David Holtz of the Haas School of Business, UC Berkeley, and the MIT Initiative on the Digital Economy.

The Airbnb experiment divided participants into two groups: treatment and control. The treatment group was sent an email offering them $25 Airbnb coupons in exchange for a review if they had not already posted a review within the typical eight or nine days after checkout. The control group was sent an email simply reminding them to leave a review with no financial incentive offered.

“We found that reviews induced by incentives were more likely to contain information about lower quality experiences,” Fradkin says. “We also found that when compared to non-incentivized reviews with the same star ratings, incentivized reviews corresponded to worse guest experiences. In other words, a seller may have received the same star rating from both study groups, but the incentivized guest was more likely to post a negative review, while upholding an inflated star rating.”

“While the incentivized review program impacted the number and type of reviews left by guests, it had neutral-to-negative impacts on the actual business outcomes of the platform and its sellers,” says Holtz. “Incentivized reviews did not affect the total quantity (nights) sold for study listings, but they did cause a change in the composition of those transactions. More to the point, incentivized listings led to more transactions, but those transactions lasted fewer nights on average. Thus, a poorer match.”

The study found that as a consequence, the revenue impacts of incentivized reviews did not represent either a positive or negative material change. Incentivized reviews failed to improve transaction quality, and according to some measures, resulted in worse matches. At the same time, the incentivized treatment did not lead to higher complaint rates or reduced likelihood of repeat business.

“Ultimately, we found that while reviews do play a meaningful role in the overall marketing efforts for online sellers, incentivizing those reviews may not deliver the results many would assume,” Fradkin says.

Read the full study.

About INFORMS and Marketing Science

Marketing Science is a premier peer-reviewed scholarly marketing journal focused on research using quantitative approaches to study all aspects of the interface between consumers and firms. It is published by INFORMS, the leading international association for operations research and analytics professionals. More information is available at www.informs.org or @informs.

This news release has been republished from the INFORMS News Room.

Peloton co-founder Tom Cortese is stepping down

Women are more likely to negotiate than men, but are told ‘no’ more often

The surprisingly simple mindset shift that helped this CEO eradicate workplace drama

Friendships in the office

Women make strides in closing the pay gap, but have more work to do: Berkeley Haas study

Points of Pride

Moments showcasing Haas’ pioneering impact on the business world

From its outset, business at Berkeley has proved trailblazing. Launched by a gift from Cora Jane Flood in 1898, Berkeley Haas—previously called the College of Commerce and the School of Business—is the only leading business school founded by a woman, the first founded at a public university, and the second-oldest in the U.S. It was launched, in part, to help California expand economically, with the forward-looking goal of enriching trade and cultural exchange in the Pacific Rim. Throughout the twentieth century, business schools—and Berkeley Haas in particular—took on evermore prominent roles in shaping the world economy and the character of business itself. In this, our 125th year, we celebrate some of Haas’ pivotal moments reimagining business and business education.

Pioneering the study of social impact…

Professor Earl Cheit ushered in the study of corporate social responsibility via his research and teaching starting in the late 1950s. The future dean also organized the first national CSR symposium in 1964. New coursework, with support from Professors Dow Votaw and Edwin Epstein, became the model for leading business schools. Today, Haas prepares students to become ethical, socially focused leaders via myriad courses, experiential learning opportunities, and co-curricular activities.

…helped pandemic-ravaged small businesses.

Professors Adair Morse and Laura Tyson worked with the State of California and the nonprofit and banking sectors to create a public-private partnership as a small business loan fund for vulnerable companies. They then launched the California Rebuilding Fund for small businesses in under-resourced communities.

…created a competitive advantage.

The Center for Responsible Business, founded by faculty member Kellie McElhaney in 2002, brought Haas to the forefront of the corporate social responsibility and business sustainability movements. The Wall Street Journal ranked Haas the No. 2 b-school for CSR in 2006 and 2007. The Financial Times rated Haas No. 1 worldwide in 2008.

…launched the first and largest student-led SRI fund.

Debuting in 2008 and featured in the Wall Street Journal, the Socially Responsible Investment Fund (now called the Sustainable Investment Fund) offers MBA students real-world experience in delivering strong financial returns and positive social impact. Student fund managers have grown the $1 million investment to over $4 million.

…prioritized socially conscious entrepreneurship worldwide.

The Global Social Venture Competition, launched in 1999 by five Haas MBA students, turned the nascent idea of creating viable companies with social impact into a global triumph. In its 20 years of existence, the GSVC distributed more than $1 million in prize money and helped more than 7,000 teams better the world.

Codifying our culture…

Codifying our culture…

Our Defining Leadership Principles Question the Status Quo, Confidence Without Attitude, Students Always, and Beyond Yourself had been latently capturing Haas’ essence for generations. In 2010, spearheaded by then-Dean Rich Lyons, BS 82, and anchored by the organizational culture research of Professor Jennifer Chatman, we took them public.

…distinguishes us from other prestigious business schools.

Our DLPs are a source of competitive advantage as well as pride and engagement. They are also our leadership brand, defining our graduates as Berkeley Leaders who practice responsible business. In 2018, Poets&Quants deemed us “the archetype for a values-driven MBA program.”

…positions Haas as the powerhouse for culture research.

Our new Berkeley Culture Center, founded and led by Professors Chatman, PhD 88, and Sameer Srivastava, helps business leaders create and nurture healthy and effective workplace cultures and is a hub for connections between academic research and corporate best practices. An annual conference convenes leaders from industry and academia to discuss new research and explore how to help organizations function more effectively. Chatman and Srivastava will soon launch the Culture Fix podcast to offer solutions to work dilemmas.

…cultivates community.

Since 1994, the alumni relations program at Haas has flourished in its mission to connect alumni to the school and to one another by adding traditions and signature events, expanding regional chapters and affinity/identity groups, developing career resources, creating a volunteer pipeline, providing mentorship opportunities for students and alumni, and much more.

Catalyzing the study of innovation…

The groundbreaking theories of dynamic capabilities, created by Professor David Teece in 1997, and open innovation, created by Adjunct Professor Henry Chesbrough, PhD 97, in 2003, led Haas to become one of the top business schools for innovation management and strategy.

…changed business education.

Previously, common belief held that established corporate structures were poorly suited for innovation, but Teece’s dynamic capabilities framework explains how large organizations can be entrepreneurial too. He also launched interdisciplinary programs with Berkeley’s engineering and law schools to help infuse innovation deep into research and teaching at Haas and to apply innovation management principles in private and public settings, including in the management of universities.

…facilitates global companies sharing innovative solutions.

Haas’ Garwood Center for Corporate Innovation helps companies expand markets, manage innovation, and facilitate strategic alliances via the membership-based Berkeley Innovation Forum. The World Open Innovation Conference, founded by Chesbrough and now hosted by a university in the Netherlands, allowed Haas to play a key role in bringing novel ideas to market.

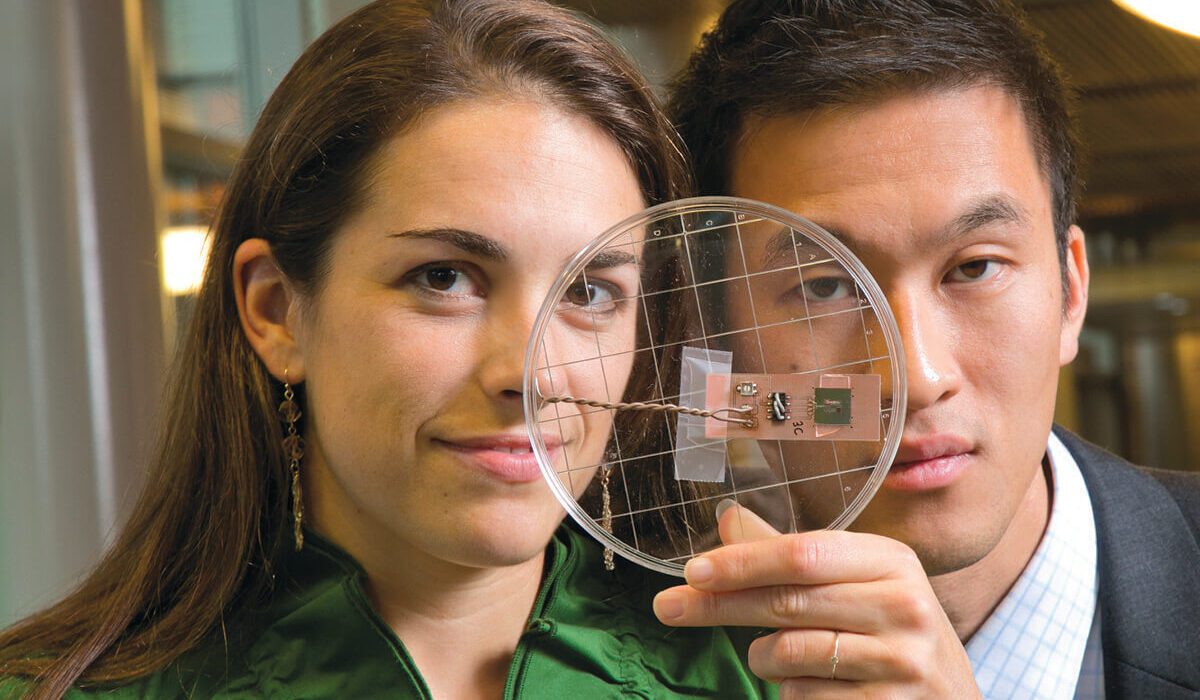

…commercializes cleantech advancements.

The Cleantech to Market accelerator program pairs students with entrepreneurs to help bring promising climate tech innovations to market—more than 120 since its launch 15 years ago.

…helps students make innovation a competitive advantage.

The semester-long Haas@Work course acts as a faculty-run/student-staffed innovation agency—with teams of MBAs using a variety of innovation methodologies to assist corporate partners in developing and testing novel solutions to key challenges.

…inspires changemakers.

The Berkeley Changemaker initiative, established in 2020 and inspired by Lecturer Alex Budak’s Becoming a Changemaker course (later a book), has helped thousands of incoming students identify their passions and use their leadership traits to transform Berkeley and the world. Offered through the College of Letters and Science and Haas, the class is part of the campuswide initiative led by Laura Hassner, EMBA 18, and supported by former Dean Rich Lyons, BS 82, Berkeley’s chief innovation and entrepreneurship officer.

Early teaching of entrepreneurship…

Begun in 1970 (six years before Apple Computer was founded), Dean Richard Holton initiated one of the nation’s first courses in entrepreneurship, which he team-taught with Leo Helzel, MBA 68, for many years. It was likely the only such class that provided students direct contact with entrepreneurs. When the Lester Center for Entrepreneurship & Innovation opened in 1991, Executive Director Jerome Engel continued building Haas’ renowned entrepreneurship curriculum by partnering with the venture capital community, creating career opportunities for students, and training faculty worldwide.

…allowed Haas to pioneer the Lean LaunchPad method.

Created in 2011 by Lecturer Steve Blank and now taught worldwide, Lean LaunchPad was an entirely new way to teach entrepreneurship. Inspired by a Haas MBA course, it challenges students to develop business models rather than business plans and to iterate their models frequently based on customer feedback.

…inspires unlikely entrepreneurs.

Professor Toby Stuart changed entrepreneurship teaching at Haas by restructuring the full-time MBA entrepreneurship course, gearing it not only to students with startup ideas but to students investigating entrepreneurship as a career as well. He also created a star-studded, career-changing Silicon Valley Immersion Week for the Berkeley MBA for Executives Program.

…positions Haas as the campus entrepreneurship hub.

A new entrepreneurship and innovation initiative, spearheaded by Dean Ann Harrison, is enhancing Haas’ efforts on three fronts: endowing thought leadership through faculty chairs, expanding programming, and creating a three-floor Entrepreneurship Hub for all of campus. Renovation has begun on the Hub, which is adjacent to Haas and features spaces for students to gather and work.

Dominating in finance…

In the late 1960s, when students were requesting courses providing creative approaches to financial markets and investment theory (thanks to new technologies), Berkeley embraced an innovative and highly quantitative approach to finance, becoming a national leader with its analytical quantitative curriculum.

…prompted insights into financial markets.

…prompted insights into financial markets.

In the 1970s, Professor Emeritus Mark Garman pioneered early stock exchange simulations and studied market microstructures, minute trading activity in asset markets that today play a role in algorithmic and electronic trading.

…changed how financial assets are created and priced.

In 1979, the late Professor Emeritus Mark Rubinstein developed the binomial options pricing model (aka the Cox-Ross-Rubinstein model), which can be used to price a range of complex options. It remains one of Wall Street’s most important valuation tools and no doubt contributed to the subsequent growth of derivatives. In the early 1990s, Rubinstein, Professor Hayne Leland, and Adjunct Professor John O’Brien launched the SuperTrust, an S&P 500-based fund that traded as a single security, essentially the first exchange-traded fund.

…allowed us to take the lead in the crowdfunding revolution.

In 2008, Danae Ringelmann and Eric Schell, both MBA 08, co-founded Indiegogo, one of the world’s first crowdfunding sites, democratizing access to capital and entrepreneurship while navigating unchartered regulatory waters. In 2015, Haas, the Fung Institute for Engineering Leadership, and the Kauffman Foundation partnered to establish CrowdBerkeley, a premier hub of education and research on crowdfunding.

Championing new teaching modalities…

As business evolved, Haas adapted its teaching to respond to challenges and opportunities taking shape worldwide, often blazing new academic trails. In 1959, when the famous Ford Foundation and Carnegie Corporation reports criticized most of American business education for its overall low standards and overly strong vocational bent, both cited Berkeley’s program, which was broader and more rigorous, as an excellent model.

…led to the first MFE Program at a business school.

The Master of Financial Engineering Program was launched in 2001 to prepare students to use skills in math, theoretical finance, and computer programming to make technically complex financial decisions. Today, it consistently ranks first among programs nationwide. The program recently added a data science curriculum that’s supported by a high-tech lab offering students and faculty access to real-time financial data and leading analytical software.

…created one of the few international management consulting programs.

Our International Business Development course debuted in 1992, assigning teams of MBA students to real-world consulting projects that include several weeks overseas, mostly in developing economies. IBD has since dispatched more than 1,800 students to work in 89 countries, helping organizations worldwide redefine how they do business.

…made Haas the first Top 10 b-school to offer a remote MBA.

In 2021, Haas announced its Flex cohort for the evening & weekend program. Students take live, virtual core courses from Haas professors teaching in new state-of-the-art video classrooms and can choose to take their electives virtually or on campus. (See sidebar, Linking Up.)

…offers unprecedented education of cross-sector leaders.

The Center for Social Sector Leadership, founded by Nora Silver, who serves as faculty director, pioneered three unique experiential b-school programs to prepare students for the nonprofit and public sectors. Social Sector Solutions, a professional management consulting partnership between Haas and McKinsey, launched in 2006 and has involved over 900 students who have served 170 nonprofits and public/social enterprises. Philanthropy Fellows, begun in 2008, is a partnership with the David and Lucile Packard Foundation that places recent MBAs with program officers at the foundation for two years—allowing new grads to enter a foundation at a professional (rather than administrative) level. Impact CFO, created with Assistant Professor Omri Even-Tov, will launch this fall with 15–20 alumni to help meet the market demand for chief financial officers in social impact organizations.

…integrated problem framing and solving approaches into a business curriculum.

Teaching Professor Sara Beckman developed three pioneering b-school courses: Managing the New Product Development Process and Design as a Strategic Business Issue (both in 1993), and Problem Finding, Problem Solving, which was part of the MBA core starting in 2012. PFPS, which included everything from systems thinking to human-centered design approaches, taught students how to think about complex business problems. Since 2017, undergrads can pursue the Berkeley Certificate in Design Innovation, a first-ever collaboration among Haas, the College of Engineering, the College of Environmental Design, and the College of Letters and Science’s Arts & Humanities Division.

Embracing behavioral economics…

Behavioral economics was born at UC Berkeley in 1987 with an interdisciplinary PhD course taught by two future Nobelists: economist George Akerlof and psychologist Daniel Kahneman. Professor Terrance Odean, MS 92, PhD 97, was encouraged by Kahneman to be the first at Haas to research behavioral finance, an area that was fertile ground for psychological analysis in an era of asset bubbles and market crises.

…established the vanguard of a new generation of behavioral economics researchers.

Haas faculty have since propelled the discipline into the mainstream while taking it into the future. Associate Professor David Sraer has investigated investor behavior and speculative bubbles. The late Professor John Morgan, who founded Haas’ Experimental Social Science Laboratory (XLab) for conducting experiment-based research, focused some of his work on inattention to shipping costs in eBay auctions and on behavioral biases in voting. Professor Ulrike Malmendier, the only woman ever to have won the prestigious Fischer Black Prize, has researched how individual biases affect corporate decisions, stock prices, and markets in general. She and Professor Stefano DellaVigna will lead the new O’Donnell Center for Behavioral Economics, which launches this fall, and will continue to make Berkeley the epicenter of behavioral economics research and a beacon for the brightest intellectual talent in the field.

Committing to diversity, equity, inclusion, justice, and belonging…

Socioeconomic mobility is core to both the UC Berkeley and Haas missions. The 2018 DEI strategic plan—the first such action plan at a major business school—translated aspirations for inclusion into intentional and comprehensive action at all levels of Haas. As a result, Haas has made substantive changes over the past six years to increase diversity and representation, engender lifelong learning around equity and inclusion, and cultivate belonging. Haas was also the first leading b-school to publicly share its DEI demographic data.

…created a unique and robust DEIJB team.

Dean Ann Harrison quickly made DEIJB a priority when she began her tenure in 2019. She met with student leaders; significantly increased scholarship funding for the incoming class; diversified the demographics of the Haas School Board, faculty, and senior leadership teams; modified the core MBA curriculum to require a course on leadership communications in diverse work environments; and appointed one of the first chief diversity, equity, and inclusion officers at a leading business school. Today, CDEIO Élida Bautista oversees a team of four focusing on admissions, student experience, staff community and capacity-building, and, uniquely, faculty support (see sidebar, Teaching Aid).

…advances gender and diversity in policy and business.

Research by Professor Laura Kray, a leading expert on the social-psychological barriers influencing women’s career attainment, has debunked popular gender stereotypes. Kray’s work has shown that the popular perception that men outperfom women as negotiators is false and hurts pay equity efforts. The Center for Equity, Gender & Leadership, founded in 2017 by faculty member Kellie McElhaney, develops “equity fluent” leaders to drive positive change and build an inclusive and equitable world. EGAL does this via hands-on education and learning opportunities, resources (like playbooks), and support for academic research. Kray is EGAL’s faculty director.

…improves access to Haas.

During the pandemic, Haas launched two programs to expand, diversify, and strengthen access to the school. Accelerated Access allows students who wish to pre-commit to business school while acquiring important work experience to apply to Haas in their senior year of college and gain conditional acceptance. Cal Advantage offers talented University of California undergraduates a streamlined application process.

…enriches the diversity of the venture community.

The Black Venture Institute, created by Berkeley Executive Education in collaboration with BLCK VC and Salesforce Ventures, teaches Black executives the foundational elements to become angel, scout, and venture investors.

…provides social mobility opportunities for local youths.

In 1989, Dean Raymond Miles started the Boost@BerkeleyHaas program—formerly known as the East Bay Outreach Program then Young Entrepreneurs at Haas (YEAH)—to teach business and academic skills to under-resourced high school students. It is one of the only university-based youth entrepreneur programs to support teens from disadvantaged communities throughout their entire high school career. Since its founding, the program has helped more than 1,200 students (many first-generation) go to college.

…supports alumni professional development.

Alumni may enroll in a three-part, self-paced online DEI workshop featuring CDEIO Bautista that focuses on best practices for creating and promoting a diverse and inclusive workplace culture. Since 2021, alumni committed to DEIJB have gleaned insights from top industry leaders at the annual virtual Alumni Diversity Symposium.

…expands partnerships with HBCUs.

Haas recently launched an HBCU MBA Fellowship with founding gifts from five alumni. The first-of-its-kind endowment will provide tuition support to MBA students who have attended a Historically Black College or University.

Pioneering the study of urban economics…

The Center for Real Estate and Urban Economics was founded in 1950, one of the first such university centers nationwide. It allowed Professors Sherman Maisel and Albert Schaaf to author the first major study of the structure of the California real estate industry, looking at the role of race and gender and finding a rising trend of women employed in the field. Later, Maisel would help create the current national U.S. mortgage market that relies on bond financing rather than on the strength and liquidity of local banks.

…advanced an unprecedented analysis of real estate markets and risk management.

Professor Nancy Wallace and researchers at the Fisher Center for Real Estate and Urban Economics mapped the massive mortgage market and built groundbreakingly accurate housing price indices that monitor the characteristic dynamics of the housing stock. Wallace and Professor Richard Stanton, along with Paulo Issler, MBA 98, PhD 13, and Carles Vergara-Alert, MFE 04, PhD 08, recently combined these comprehensive databases with wildfire prediction models to estimate residential real estate value-at-risk in California.

…led to a renowned gathering of experts and a legendary forecast.

The Fisher Center hosts an annual Real Estate and Economics Symposium, a high-powered event known for the reputation of the speakers—and for Professor Emeritus Ken Rosen’s revered economic and real estate forecasts for California.

Our commitment to sustainability…

Our commitment to sustainability…

No other business school matches the breadth of Haas’ work in sustainability. The new Office of Sustainability and Climate Change, led by climate finance expert Michele de Nevers, coordinates curriculum and activities in five key areas: energy, food and agriculture, the built environment, sustainable and impact finance, and corporate responsibility.

…launched the preeminent university research center on energy economics.

Ever since Professor Severin Borenstein began leading the Energy Institute at Haas in 1994, it has been a place where serious academic researchers influence public policy at the state and federal levels, where the curriculum in energy and cleantech evolves to meet student and marketplace needs, and where collaboration flourishes. No other business school has as much depth, breadth, or influence in the energy field as Haas. Borenstein also co-developed the unique—and indispensable—Energy and Environmental Markets course and the energy market simulations used in the class. The course was the first of its kind at a top b-school and has been emulated at many peer institutions.

…allows Haas to pioneer green architecture and operations.

Chou Hall, which opened in 2017, is the nation’s greenest academic building, having earned LEED Platinum certification for its energy efficient design and operation, TRUE Zero Waste certification at the highest level after more than a year of efforts to divert over 90% of landfill waste, and WELL Gold, which is given to buildings that promote user health and well-being. Haas recently appointed its first full-time director of campus sustainability to oversee numerous initiatives—such as the campus renewable energy transition and elimination of single use plastic—to move Haas to carbon neutrality by 2025.

…inspired an unrivaled array of sustainability courses.

In 2021, Professor Nancy Wallace shifted the focus of the real estate program to consider high-efficiency, mixed-use development and financing strategies to fund real estate sustainability. Haas faculty members are now retooling all core MBA courses to address climate change and other sustainability challenges in various business disciplines. The revamped Sustainable and Impact Finance program keeps pace with rapid changes in climate finance and impact investing to best prepare students for careers. One focus for the Center for Responsible Business is reimagining capitalism and Executive Director Robert Strand, who teaches a course called Sustainable Capitalism in the Nordics?, is now the executive director of the new UC Berkeley Nordic Center.

…led to new degrees and certificates.

With Berkeley’s Rausser College of Natural Resources, Haas offers an undergraduate minor in sustainability and is developing a dual MBA/master’s in climate solutions. Haas also offers the Michaels Graduate Certificate in Sustainable Business.

Our faculty’s public service work…

Since its earliest days, Haas faculty have applied their insights to issues advancing the public good. Our first dean, Carl Copping Plehn, is credited as one of the fathers of the California tax system. Professor Lincoln Hutchinson, an expert in South America and Russia, left Berkeley in 1922 to become one of the State Department’s earliest commercial attachés. In the 1930s, Dean E.T. Grether lent his expertise of markets and pricing structures to the Great Depression’s wave of business regulations—among many others.

…guides national economic policy in groundbreaking ways.

Professor Emeritus Janet Yellen is the first person to have served in the nation’s three top economic roles: treasury secretary, head of the Federal Reserve, and chair of the President’s Council of Economic Advisers (during the Clinton administration). Her four years as Fed chair were considered near perfect, marked by job and wage growth amid low interest rates. Former dean Laura Tyson was the first woman to chair the Council of Economic Advisers (1993–95) and to direct the National Economic Council (1995–96), among other roles.

…helped navigate e-commerce, communications, and horizontal mergers.

As the chief economist for the Federal Communications Commission in the mid-1990’s, Professor Emeritus Michael Katz informed an important revision of cable television price regulations. He later addressed Congress about how to allow consumers to safely make payments via phones. Professor Emeritus Carl Shapiro played a central role in the first big update in almost 20 years of the guidelines on horizontal mergers as the chief economist in the Antitrust Division of the U.S. Department of Justice (2009–11). Both men continue to serve as expert witnesses in the country’s most high-profile antitrust cases.

…advances global gender parity.

As a longtime co-author of the World Economic Forum’s Global Gender Gap Report, Tyson helped quantify the magnitude of gender-based disparities and develop initiatives for change. She also served as lead author in 2016 for two reports for the UN Secretary-General’s High-Level Panel on Women’s Economic Empowerment that included action-oriented recommendations to hasten improved economic outcomes for women.

…gives voice to the voiceless.

A former World Bank director, Dean Ann Harrison has earned international acclaim for her research on foreign direct investment and multinational firms. In proving that job losses in U.S. manufacturing are driven primarily by labor-saving technology such as investments by U.S. multinationals in automation, she has shown that free-trade economists miscalculated the costs of globalization and failed to ensure that policies were in place to compensate the losers, including many workers in rural communities.

What’s the Big Idea?

Revolutionary findings by Haas faculty that have advanced business

All established wisdom had to start somewhere, often in the form of fresh insights that went on to become common knowledge. Here are some of those big ideas that started at Haas and became deeply embedded in business thinking.

Social Responsibility

Business firms and their leaders should govern with accountability and be socially responsible in their relationships with diverse sectors of society affected by their operations. Leaders failing to do so may eventually lose their leadership roles and see their own organizations collapse.

The late Professor Emeritus Dow Votaw was a pioneer in the field of corporate social responsibility and looked at how corporations evolved amid a society growing increasingly complex.

Wages

Paying workers more than the market wage boosts productivity and morale and reduces turnover.

Professor Emeritus Janet Yellen’s scholarship has focused on a range of issues related to wages, unemployment, and economic cycles. Her most-cited work on “efficiency wages,” written with her husband, George Akerlof, found that businesses offering better pay and better working conditions are often making a wise decision and are rewarded with more productive workers.

Employees

Human assets are as important as the financial and physical assets of a company and need to be managed in a strategic way.

As a scholar, the late Professor Emeritus and former Dean Raymond Miles positioned human resources as a strategic function, defining HR management styles commonly taught today.

NOBEL PRIZE WINNERS

Even in games where players don’t know what their opponents know or what the parameters are, it’s still possible to develop a framework to analyze strategic decision-making.

In 1994, the late Professor John Harsanyi (along with John Nash from Princeton University and Reinhard Selten from Bonn, Germany) won the Nobel Memorial Prize in Economic Sciences for his work in game theory that used probabilities to model how rational people will interact strategically when they have imperfect information. The spark for Harsanyi’s research came from his inability to advise the U.S. Arms Control and Disarmament Agency in 1964 on negotiations with the Soviet Union, because neither side knew much about the other; it was a game of incomplete information. Game theory is now a significant tool for analyzing myriad conflicts, including global political clashes, labor negotiations, and price wars.

Analyzing the boundaries between firms and the markets they operate in is critical to understanding how to best design productive activities.

In 2009, the late Professor Oliver Williamson won a Nobel (along with Elinor Ostrom of Indiana University) for his insights into what’s known as the “make or buy” decision, a way of analyzing whether an organization should contract out for parts or make them in-house. Williamson brought together multiple disciplines to invent the field of transaction cost economics, which sheds light on optimal contracting, the boundaries of the firm, the design of bureaucracies, and more. His work was path-breaking because economic research at the time was focused on market transactions and not what happened inside organizations. Williamson’s insights have influenced everything from electricity deregulation in California to human resource management in the technology industry.

ORGANIZATIONS & INNOVATION

ORGANIZATIONS & INNOVATION

Natural selection processes akin to those in bioecology drive the emergence, growth, evolution, and decline in groups of related organizations.

This vibrant field of research, called organizational ecology, was co-developed by the late Professor John Freeman and former Professor Glenn Carroll.

Reliable performance by an organization may require a well-developed collective mind in the form of a complex, attentive system tied together by trust.

Professor Emeritus Karlene Roberts pioneered a new way to understand human-made disasters, looking beyond human error and technical glitches to the organizational causes of catastrophes in industries requiring nearly error-free operations, like commercial aviation and nuclear power plants. The quality of interactions among team members, she found, was a critical part of highly reliable organizations.

Knowledge gives companies competitive advantage and is contained within a company’s people.

Ikujiro Nonaka, MBA 68, PhD 72, pioneered theories about knowledge management and transformed how people drive innovation together. Along with Hirotaka Takeuchi, MBA 71, PhD 77, Nonaka co-authored the business best-seller The Knowledge-Creating Company. In 1997, Nonaka became the Haas School’s Xerox Distinguished Professor in Knowledge, the first professorship in the world dedicated to the study of knowledge management.

It isn’t enough for companies to innovate—they also must be able to profit from those ideas. This requires good strategic management and access to manufacturing, marketing, distribution, and other complementary assets and technologies on favorable terms—which is just as important to financial success as great R&D.

Professor David Teece is known for this theory of dynamic capabilities, which puts the management team front and center in the innovation process. Gary Pisano, PhD 88, co-authored the first article on the topic, in 1997.

Companies used to rely on their internal labs for their innovations, but they can retain their competitive edge by partnering with other companies—even competitors—to create useful and lucrative products and services.

This concept, known as open innovation, was created by longtime Adjunct Professor Henry Chesbrough, PhD 97.

Branding

A brand is an asset involving relevance and image (functional and emotional) and having a loyal customer core. The implication is that a brand is the responsibility of the whole organization including the executive suite.

Professor Emeritus David Aaker is widely considered the father of modern branding. His pioneering work defined brand equity and detailed ways to build and manage brands and portfolios that are used by organizations worldwide.

Open Science

Widely accepted research practices in the social sciences leave too much room for bias and manipulation and need to be reformed.

Professor Leif Nelson’s 2011 paper, “False Positive Psychology” (co-authored with Joseph Simmons and Uri Simonsohn), helped launch the open science movement, which has upended the field of psychology, toppled famous studies, and sent waves throughout the social sciences. Open science focuses on rooting out biases, replicating important studies, and—on rare occasions—exposing fraud. Many researchers have since adopted more rigorous practices, and reforms are ongoing.

Culture

Person-culture fit is a useful predictor of organizational commitment and extra-role behavior, which in turn affect firm performance.

Professor Jennifer Chatman, PhD 88, co-created the Organizational Culture Profile in the early 1990s with Charles O’Reilly, MBA 71, PhD 75, and Dave Caldwell. It illustrates how organizational culture can be quantified, has defined the agenda for the scientific study of culture for decades, and remains the most robust and reliable measure of organizational culture to date.

Finance

The balance sheet approach should be used to analyze accounting issues as opposed to the income statement approach.

Articles by the late Professor Maurice Moonitz, BS 33, MS 36, PhD 41, played an important role in the gradual switch to the balance sheet approach by the bodies that establish the generally accepted accounting principles followed by publicly held American corporations. He also influenced the conceptual frameworks eventually adapted by accounting standard setters both in America and abroad.

Securities with various risks and returns can be combined into a mutual fund that mimics the S&P 500.

The concept of a “SuperFund” index, a radical innovation in security markets that paved the way for exchange-traded funds, was developed by Professor Emeritus Nils Hakansson in 1976.

Prior to the Global Financial Crisis that started in 2007, banks were selecting the riskiest pools of home mortgages—the lemons that were more likely to contain mortgages in which borrowers prepaid or defaulted on their loans—to sell into the securitized bond market.

The late Professor Dwight Jaffee, along with Professor Nancy Wallace and Christopher Downing, were the first to document loan cherry-picking by banks and Freddie Mac. Their research drew intense scrutiny from Freddie Mac and helped to pressure the quasi-governmental entity into disclosing more information about underlying mortgages. Jaffee made seminal contributions aimed at influencing the public policy debate on questions related to the causes of the Global Financial Crisis, which he anticipated years before its onset.

Behavioral Economics

Humans tend to remain committed to a losing course of action (think bad investments or relationships) rather than pull the plug and try something different.

Professor Emeritus Barry Staw coined this phenomenon “escalation of commitment,” a discovery that is one of the most highly cited in organizational behavior. He helped pioneer the field of behavioral decision theory, a sub-area of behavioral economics.

Individual experiences of macroeconomic shocks affect financial risk-taking, as often suggested for the generation that experienced the Great Depression.

Professor Ulrike Malmendier proved econometrically what had been observed only anecdotally and has continued her groundbreaking research into how the economic conditions that prevail during a person’s life so far strongly influence their views on money for years and decades to come.

Homeownership

Lending discrimination has not disappeared with the shift online, since algorithms incorporate human biases.

Professors Adair Morse, Richard Stanton, and Nancy Wallace were the first to merge large datasets with details on interest rates, loan terms and performance, property location, and borrower’s credit with race and ethnicity. Their 2021 research found that both online and face-to-face lenders charge higher interest rates to African American and Latino borrowers, and these differentials lead to over $450 million in extra interest payments per year.

Energy

Energy

Californians have been paying a “mystery gasoline surcharge”—which has ranged from 28 to 65 cents a gallon in any given year—since 2015.

Professor Severin Borenstein discovered this surcharge, finding that between 2015 and 2022, it cost Californians $48 billion—over $4,000 for a family of four. He’s been fighting to get government officials to understand it ever since. Earlier this year, the state legislature and governor passed a bill that will establish a special state office to investigate the cause of the surcharge and possible remedies.

TECHNOLOGY & ENTREPRENEURSHIP

Lack of total transparency limits the liquidity that firm owners can obtain through an IPO.

Professors Emeriti Hayne Leland and David Pyle’s 1976 paper was a seminal contribution in the field of corporate finance, investigating what happens when entrepreneurs cannot be expected to be entirely straightforward about their projects to lenders, since there may be substantial rewards for exaggerating positive qualities.

“Smart markets,” defined as a turbulent, information-intensive environment with constantly changing products, consumers, and competitors, will require a shift in performance goals from profitability per product to profitability per customer.

Professor Rashi Glazer’s trailblazing theory about smart markets—which he first introduced in 1991, years before the Internet boom—positioned Haas as a thought leader in the data-driven marketing movement.

Durable economic principles can guide you in understanding today’s frenetic business environment in information-based products and the technology sector.

Haas Professors Emeriti Carl Shapiro and Hal R. Varian co-authored Information Rules: A Strategic Guide to the Network Economy (1999), a widely acclaimed book that deconstructs the economic factors affecting information technology markets. Though the book pre-dated Facebook, the iPad, and big data, it continues to guide leaders through the information age.

Perception is reality in entrepreneurship.

Professor Toby Stuart has investigated the nuances of how startups build momentum by establishing the right set of affiliations. In building a company, entrepreneurs proactively architect exchange relationships that enhance the legitimacy of their endeavors. His work finds that the more uncertain the prospects of a new venture, the more essential it is to enlist the support of those already held in high esteem in the space.

Despite it seeming easy to shop around online, information gatekeepers design markets so that prices vary widely and are hard to compare.

The late Professor John Morgan was a prolific researcher, with notable contributions to the area of pricing and competition in online markets. His most-cited work sheds light on the reasons that prices can vary so widely on the internet when it’s easy to shop around: So-called “information gatekeepers” have an incentive to design markets in ways that prices across sellers vary.

Michelle Florendo, MBA 10

Founder and Principal, Powered by Decisions LLC

Michelle Florendo has made a career out of teaching people how to make better, faster decisions and to lead with confidence.

Michelle Florendo has made a career out of teaching people how to make better, faster decisions and to lead with confidence.

“Most people have never been taught a specific process for decision-making, and yet it’s something that we’re expected to do innumerable times a day,” she says.

The self-described “decision engineer” is the founder and principal of Powered by Decisions, a leadership coaching and training firm. Florendo has coached executives at some of the most influential companies, including Microsoft, Google, and Amazon.

Recently, she taught an MBA workshop at Haas focused on addressing emotions associated with making decisions. “Instead of ignoring the emotions, I teach students how to observe and decipher their feelings and how to either manage those emotions or integrate that data into a structured decision process,” she says.

While business schools teach students frameworks for financial decision-making, people don’t usually get instruction for issues not involving the bottom line, she adds.

Another passion of Florendo’s is working with the Berkeley Executive Coaching Institute where she supports professionals in developing coaching skills.

“It felt like coming full circle because the co-founder of the Institute, Lecturer Mark Rittenberg, introduced me to coaching while I was a student at Haas,” Florendo says. “He helped me understand how much I loved it and how good I’d be at it.”

Future Sense

Spotting prescient ideas

Subtle shifts in how people use language can foretell big changes in how we think about the world. For example, when followers of astronomer Copernicus stopped calling the sun a planet, it signaled the beginning of the end of the belief that the earth was the center of the universe.

Getting out ahead on far-sighted ideas can yield big financial or reputational rewards, but these can be difficult to spot, even though signals about the next big idea may be lurking in everyday language. Advances in natural language processing are now making it possible.

Professor Sameer Srivastava and co-authors have developed a deep learning model that can identify where and when prescient ideas—those that go against convention but later become widely adopted—first emerge.

By parsing millions of public utterances by senators, judges, and executives, they found that far-sighted ideas tend to emerge not from established leaders but rather in the language first used by those on the fringes.

“This is a way to go back and actually find when somebody first used an idea in a way that became prescient,” says Srivastava, whose research with Haas post-doc researcher Paul Vicinanza and Stanford’s Amir Goldberg was published in PNAS Nexus. “Our research suggests there’s a reasonable chance that those people were more likely to be on the periphery of their field.”

Srivastava and his co-authors used a deep neural network known as Bidirectional Encoder Representations from Transformers (BERT) to unearth the linguistic markers of prescient ideas in politics, law, and business and trace how they became mainstream. They defined prescient ideas as those that are not only novel—words or phrases used for the first time in a new context—but that rethink the dominant assumptions in a particular field. To be considered prescient, the idea must also foreshadow how the domain will evolve in the future.

Political outsiders

Among nearly five million floor speeches delivered by members of the U.S. Congress from 1961 to 2017, the model identified Mississippi Senators John Stennis as the most prescient and James Eastland as the least prescient. Both fiercely opposed civil rights legislation in the 1960s, but the well-connected and powerful Eastland made his case with overtly racist rhetoric. Stennis, meanwhile, was “among the first to base his objections on the principles of ‘color blindness,’ limited government, and individual freedom,” the researchers wrote. This indirect set of arguments proved highly prescient, “laying the groundwork for contemporary conservative talking points on race relations in the U.S.”

The model flagged smaller firms as more prescient than larger, established players. More prescient firms also had above-average stock returns.

Landmark lower courts

The same idea held true for the law. In examining 4.2 million digitized federal and state legal rulings, the researchers found that landmark U.S. Supreme Court decisions, such as legalizing gay marriage or affirming the Affordable Care Act, tended to originate in lower courts. The most prescient decisions—those with the highest number of citations—were 22 times more likely to come from state appellate courts than the U.S. Supreme Court.

Prescient businesses

In the business world, the researchers had a smaller dataset to work with, analyzing transcripts of the Q&A portion of public quarterly earnings conference calls—a relatively recent practice compared to similar records in law and politics. In these calls, managers often reveal strategy not found in press releases or official filings. The model flagged smaller firms as more prescient than larger, established players. More prescient firms also had above-average stock returns. (The authors are doing more work on business figures to expand the data pool.)

Implications

The findings have big implications across many disciplines, says Srivastava, the Ewald T. Grether Professor of Business Administration and Public Policy. One result, he says, may be more recognition for people who have been historically marginalized—such as women and minorities. “They may be the ones generating a lot of the ideas, even if they aren’t getting credit for all of them.”

Negotiation Frustration

Who says women don’t negotiate?

For decades, a closet industry of books and workshops has promised to make women better negotiators and help close the gender pay gap. But new research by Professor Laura Kray shows that believing women don’t ask for higher pay is not only outdated, but it may be hurting pay equity efforts.

“Continuing to put the blame on women for not negotiating away the gender pay gap does double damage, perpetuating gender stereotypes and weakening efforts to fight them,” says Kray, the Ned and Carol Spieker Chair in Leadership.

Last year, women earned about 22% less than men, on average. But broken down by income level, the gap for middle- and lower-wage women has decreased over the past 20 years while the gap for those with higher salaries—where there is often more room for negotiation—has increased.

Women MBA grads earn 88% of what men make after finishing their degree but only 63% of what men make 10 years later, past research by Kray and others has found.

Women Do Ask

The researchers’ survey of a nationally representative sample confirmed the perception that women negotiate less than men and are less successful when they do. Yet when Kray and her co-authors analyzed a survey of students graduating from a top MBA program between 2015 and 2019, they found that significantly more women than men reported negotiating their job offers—54% versus 44%.

The researchers then delved into a 2019 alumni survey of 1,900 MBA grads and found, again, that the women earned 22% less than men. But other than women’s lower pay, the only differences that emerged along gender lines were that more women than men said they had attempted to negotiate—and more women reported being turned down.

“Continuing to put the blame on women for not negotiating away the gender pay gap does double damage, perpetuating gender stereotypes and weakening efforts to fight them.”

Revisiting past conclusions

Kray and her co-authors also used an updated statistical approach to revisit a 2018 meta-analysis of studies on gender and negotiations. Focusing on nine studies published from 1982 to 2015 that measured gender differences in initiation of salary negotiations, they found no difference overall. But when they looked at changes over time, they found that men did report higher rates of negotiating versus women early in the era. The gender difference appeared to disappear around 1994 and reversed beginning around 2007. The trend has continued to grow since then, Kray says.

Many factors may have contributed to women’s greater assertiveness over the past two decades, including the “lean-in” movement sparked by Sheryl Sandberg’s book of the same name. But the downside of such messages has been to “blame the victim,” Kray says—putting the onus on women to fix the pay gap by working more and trying harder.

Another experiment exploring attitudes about the pay gap’s causes and support for solutions found that people who believed more strongly that women’s lower negotiation rates fueled the pay gap for MBA graduates were less likely to support salary-history bans and more likely to justify the current system.

“Negotiating for pay or promotions is clearly beneficial, and there’s room for everyone to do more negotiating,” Kray says. “But it’s time to end the notion that women don’t ask.”