How institutional investing dictates politics

In 1950, institutional investors—such as mutual funds, pensions, and insurance companies—owned roughly 6% of publicly traded companies. In 2017, that figure was 65%. Such a dramatic increase raises many questions but central among them for Associate Professor Matilde Bombardini is what it implies for the function of American politics—even American democracy.

In 1950, institutional investors—such as mutual funds, pensions, and insurance companies—owned roughly 6% of publicly traded companies. In 2017, that figure was 65%. Such a dramatic increase raises many questions but central among them for Associate Professor Matilde Bombardini is what it implies for the function of American politics—even American democracy.

“By controlling large equity shares in many companies, institutional investors can potentially affect the political orientation of the firms they invest in,” Bombardini says.

With colleagues from Haas, the University of Chicago, Boston University, and the Hong Kong University of Science and Technology, Bombardini monitored the connection between an investor’s acquisition of a large stake in a portfolio firm and subsequent donations by the firm’s political action committee. The researchers found that when a firm is acquired by an investor, it shifts its PAC giving to more closely mirror that of the new investor. This political shift is more pronounced when a highly partisan investor is involved or when somebody from the investment side assumes a seat on the board of the portfolio firm. “Whether this is dictated by the investor or simply understood by the firm as a way to align with the investor, it has the potential to lead to more concentration of political influence,” Bombardini says.

These findings suggest a need to more carefully interrogate the governance role of institutional investors. Beyond that, they reveal the diffuse and largely invisible amplification of political influence afforded a small collection of fund managers.

“Although we’ve shown that much of corporate political giving can be rationalized by profit maximization,” Bombardini says, “this study reveals that perhaps firms’ giving also reflects the political preferences of some of their shareholders.”

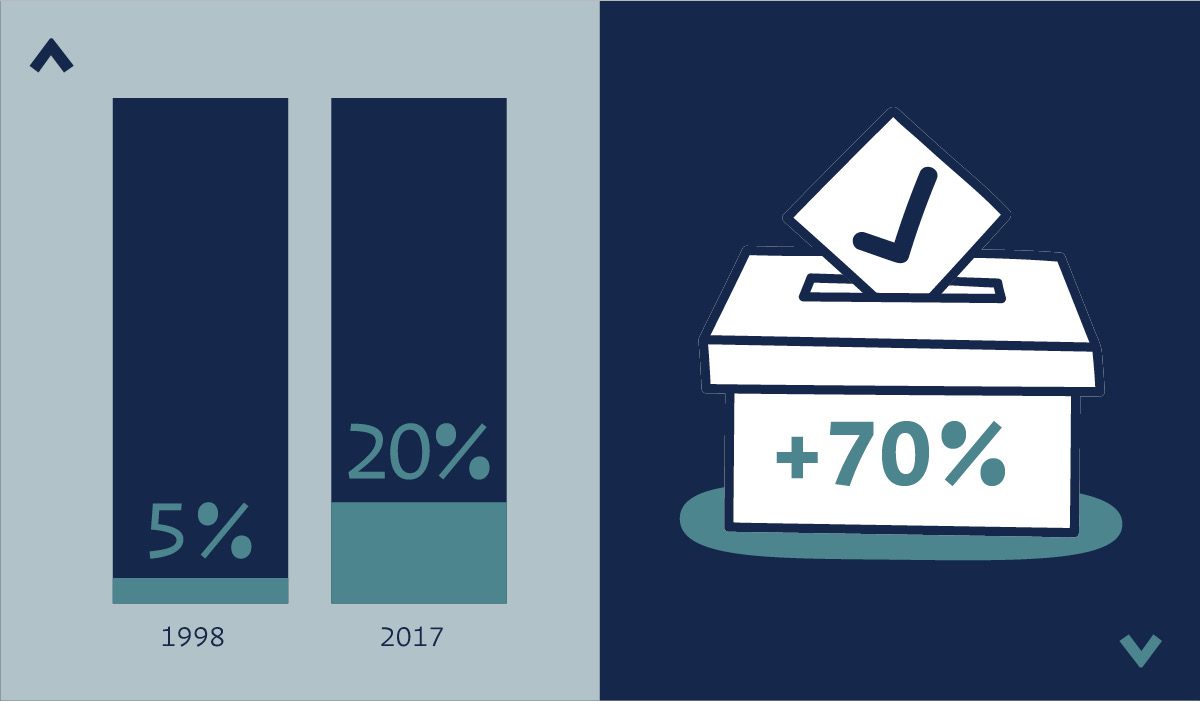

The “Big Three” of BlackRock, Vanguard, and State Street Global Investors held more than 20% of S&P 500 shares in 2017 as compared to 5% in 1998.

Political giving often shifts after an acquisition. The probability of a portfolio firm giving to a particular congressional district increases by up to 70% after a large acquisition by an investor that also gives to that congressional district.

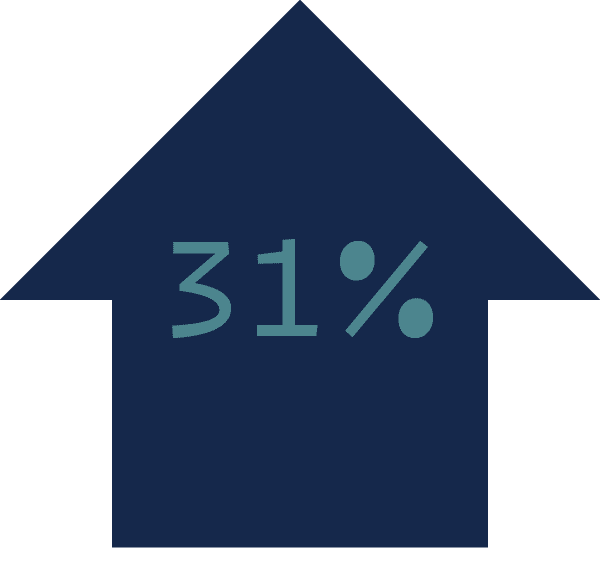

31% Increase in the probability that a firm’s PAC will donate to a politician supported by an investor’s PAC after an acquisition.

When an investor obtains a seat on the portfolio company’s board after an acquisition, the effect on political donations is more than three times that of an acquisition alone. Investors attained board seats in about 5% of the companies studied. (Sample includes 2,456 firms.)