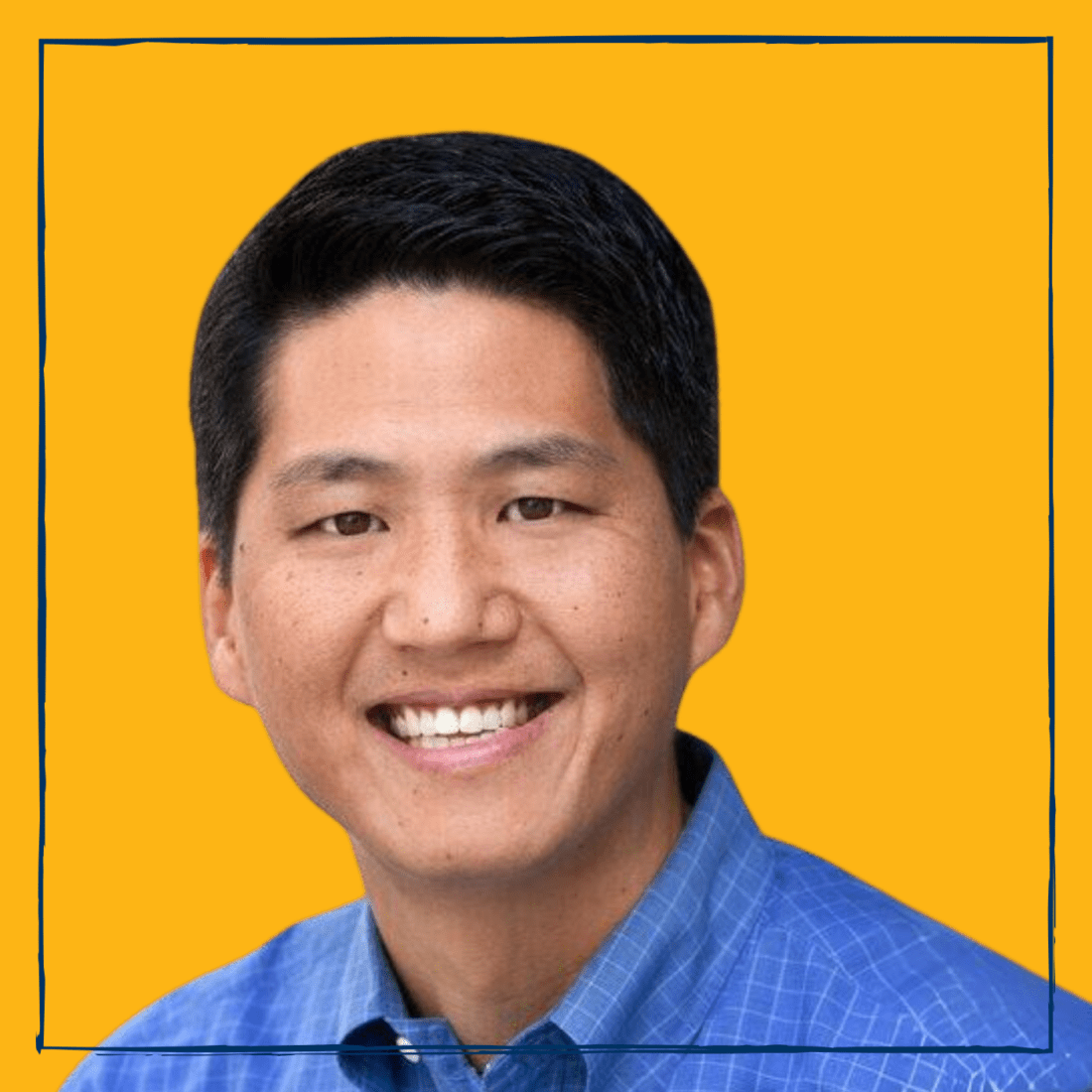

Albert Lee, MBA 04 – Entrepreneurship Through Everyday Problem Solving

From left to right, top to bottom: Swamit Mehta, Austin Nalen, Luis Reina, and Shawn Meyer.

The decision to buy a publicly listed clinical research company and take it private landed a team of MBA students first place in the inaugural Oxford Global Private Equity Challenge. The competition, which was supposed to be held at the University of Oxford Saïd Business School, took place remotely on March 26.

Team members: Swamit Mehta, Shawn Meyer, Luis Reina, all MBA 20, Austin Nalen, MBA/MPH 21.

The field: Ten teams from the world’s top business schools competed for a grand prize of $5,000. Finalists included Haas, University of Oxford’s Saïd Business School, University of Chicago’s Booth School of Business, London Business School, Cornell University’s Johnson School of Management, and INSEAD.

The challenge: Playing the role of a private equity firm, the team had to conduct market research and recommend a take-private buyout of a public company valued between one to four billion.

The plan: The team decided to do a take-private buyout of Medpace, a clinical research organization focused on small to medium-sized pharmaceutical companies. The team built a detailed financial model of Medpace, spoke to healthcare professionals to understand the business and industry dynamics, and created an investment strategy to successfully convert Medpace into a private company.

Secret sauce: “The Haas community was our secret sauce,” said Swamit Mehta, MBA 20. “The CRO (clinical research organization) segment of the healthcare industry is incredibly complicated and opaque,” he said. “Fortunately, we were able to rely on our healthcare-focused classmates for our research.”

The Haas factor: “Huge thanks to Lecturer Steve Etter. Steve went above and beyond in terms of helping us draft our investment presentation and provoking us to think about the gaps in our investment thesis,” Mehta said.

Posted in:

Topics: