Category: Research

The latest research news and insights from the faculty at UC Berkeley’s Haas School of Business

Harnessing the wisdom of the crowd to forecast

Forecasters often overestimate how good they are at predicting geopolitical events—everything from who will become the next pope to who will win the next national election in Taiwan.

Forecasters often overestimate how good they are at predicting geopolitical events—everything from who will become the next pope to who will win the next national election in Taiwan.

But Berkeley-Haas management professor Don Moore and a team of researchers found a new way to dramatically improve forecast accuracy by training ordinary people to make more confident and accurate predictions over time as superforecasters.

The team, working on The Good Judgment Project, had the perfect opportunity to test its future-predicting methods during a four-year government-funded geopolitical forecasting tournament sponsored by the United States Intelligence Advanced Research Projects Activity. The tournament, which began in 2011, aimed to improve geopolitical forecasting and intelligence analysis by tapping the wisdom of the crowd. Moore’s team proved so successful in the first years of the competition that it bumped the other four teams from a national competition, becoming the only funded project left in the competition.

Some of the results are published in a Management Science article “Confidence Calibration in a Multi-year Geopolitical Forecasting Competition.” Moore’s co-authors, who combine best practices from psychology, economics, and behavioral science, include husband and wife team Barbara Mellers and Philip Tetlock of the University of Pennsylvania, who co-lead the Good Judgement Project with Moore; along with Lyle Unger and Angela Minster of the University of Pennsylvania; Samuel A. Swift, a data scientist at investment strategy firm Betterment; Heather Yang of MIT; and Elizabeth Tenney of the University of Utah.

The study differs from previous research in overconfidence in forecasting because it examines forecast accuracy in forecasting over time, using a huge and unique data set gathered during the tournament. That data included 494,552 forecasts by 2,860 forecasters who predicted the outcomes of hundreds of events.

Wisdom of the crowd improves forecast accuracy

Study participants, a mix of scientists, researchers, academics, and other professionals, weren’t experts on what they were forecasting, but were rather educated citizens who stayed current on the news.

Their training included four components:

- Considering how often and under what circumstances a similar event to the one they were considering took place.

- Averaging across opinions to exploit the wisdom of the crowd.

- Using mathematical and statistical models when applicable.

- Reviewing biases in forecasting—in particular the risk of both overconfidence and excess caution in estimating probabilities.

Over time, this group answered a total of 344 specific questions about geopolitical events. All of the questions had clear resolutions, needed to be resolved within a reasonable time frame, and had to be relatively difficult to forecast—“tough calls,” as the researchers put it. Forecasts below a 10 percent or above a 90 percent chance of occurring were deemed too easy for the forecasters.

The majority of the questions targeted a specific outcome, such as “Will the United Nations General Assembly recognize a Palestinian state by September 30, 2011?” or “Will Cardinal Peter Turkson be the next pope?”

The researchers wanted to measure whether participants considered themselves experts on questions, so they asked them to assess themselves, rating their expertise on each question on a 1-5 scale during their first year. In the second year, they placed themselves in “expertise quintiles” relative to others answering the same questions. In the final year, they indicated their confidence level from “not at all” to “extremely” per forecast.

Training: Astoundingly effective

By the end of the tournament, researchers found something surprising. On average, the group members reported that they were 65.4 percent sure that they had correctly predicted what would happen. In fact, they were correct 63.3 percent of the time, for an overall level of 2.1 percent confidence. “Our results find a remarkable balance between people’s confidence and accuracy,” Moore said.

In addition, as participants gathered more information, both their confidence and their accuracy improved.

In the first month of forecasting during the first year, confidence was 59 percent and accuracy was 57 percent. By the final month of the third year, confidence had increased to 76.4 percent and accuracy reached 76.1 percent.

The researchers called the training the group received “astoundingly effective.”

“What made our forecasters good was not so much that they always knew what would happen, but that they had an accurate sense of how much they knew,” the study concluded.

The research also broke new ground, as it is quantitative in a field that generally produces qualitative studies.

“We see potential value not only in forecasting world events for intelligence agencies and governmental policy-makers, but innumerable private organizations that must make important strategic decisions based on forecasts of future states of the world,” the researchers concluded.

Read additional research by Moore on managers’ hiring decisions.

Prof. Catherine Wolfram: Do Utilities Like Heat Waves?

Prof. Patatoukas wins prestigious accounting award

Assoc. Prof. Panos N. Patatoukas has received the prestigious 2017 Notable Contributions to Accounting Literature Award for his research on the implications of major customer relationships for supplier firm performance and valuation.

The annual accounting award from the American Accounting Association, sponsored by the American Institute of Certified Public Accountants (AICPA), was given for his paper, Customer-Base Concentration: Implications for Firm Performance and Capital Markets. He will be honored August 8 at the American Accounting Association’s annual meeting in San Diego, CA.

For his research, Patatoukas compiled a large sample of business-to-business links along the supply chain.

His paper challenged the conventional view that customer-base concentration—or doing business with only few major customers—impedes supplier-firm performance. The widely-held belief was that major customers pressure their dependent suppliers to provide concessions such as lowering prices, extending trade credit, and carrying extra inventory.

But Patatoukas discovered that while suppliers with a few big customers do report lower gross margins, that negative effect is offset by lower selling expenses and higher inventory turnover rates. He concluded that these operating efficiencies offset weaknesses in dealing with major customers—and found a net positive impact on the supplier’s performance and valuation especially as the major customer relationships mature.

Paper inspires follow-up studies

The paper, which was judged for “originality, breadth of potential interest, soundness of methodology, and potential impact on accounting education,” inspired a series of follow-up studies. It also grabbed interest among academics across disciplines.

“It’s extremely fulfilling to be recognized for creating a new line of interdisciplinary capital markets research that combines elements from accounting, finance, and operations management,” said Patatoukas, who joined the Haas Accounting Group in 2010 after graduating from Yale University. “This research has implications for academics and practitioners alike.”

His previous awards for both research and teaching include the Earl F. Cheit Outstanding Teaching Award (in 2012, 2015, and 2017), the highest teaching award bestowed upon instructors by Berkeley MBA students; the Schwabacher Award, the highest honor for distinction in research and teaching bestowed upon Haas tenure-track professors; and the Hellman Fellows Award, given by the U.C. Berkeley Chancellor for excellence in research.

Patatoukas was also named a top business school professor under the age of 40 by both Poets & Quants and Fortune Magazine.

Prior to arriving at Haas, Patatoukas earned a PhD in accounting and finance from Yale University, plus two master’s degrees in management from Yale, a master’s in accounting and finance from the London School of Economics, and a BA in accounting and finance from Athens University of Economics and Business, where he graduated as valedictorian.

Patatoukas’ areas of research include corporate valuation, financial statement analysis for measuring and forecasting economic activity at the firm level and at the aggregate macroeconomic level, and supply chain management.

Bringing Fairness to Energy Programs

Prof. Severin Borenstein: Creative Pie Slicing to Address Climate Policy Opposition

How A Founder’s Personality Powers Startup Growth

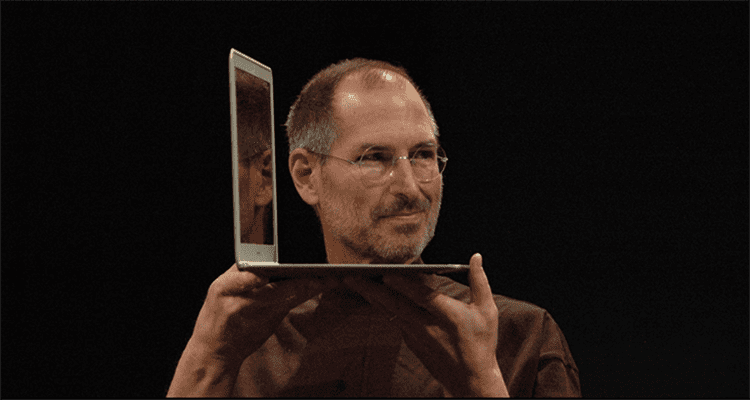

Steve Jobs, Elon Musk, and Mark Zuckerberg have all built entrepreneurial empires. Yet these titans of tech have very different personalities.

In their new book, Built for Growth, John Danner and Chris Kuenne, (Harvard Business Review Press, June 6) explore the personalities of successful entrepreneurs, or business builders. Danner and Kuenne identify four builder personalities—the Driver, the Explorer, the Crusader, and the Captain—to help readers better understand their own personality type and become better builders as startup founders, or as executives within their organizations.

Danner is a senior fellow at UC Berkeley’s Haas School of Business. Kuenne is a lecturer at Princeton University and founder and managing director of Rosemark Capital.

Watch John Danner discuss the four personality types of successful entrepreneurs in our Facebook Live “Chalk Talk.”

Danner and Kuenne maintain that who you are shapes how you build.

“Most entrepreneurship research is about how to build a startup and what steps an entrepreneur needs to take. We felt what was missing was the who,” Danner says. “After all, it’s not the recipes or ingredients that make a standout restaurant, it’s the chef and how his or her personality puts those resources together.”

Identifying one’s personality type takes two minutes answering 10 questions on the Built for Growth website. The authors determined the questions by asking a panel of successful entrepreneurs more than 100 questions about how they build businesses of enduring value. The panelists’ companies must have had a minimum of $3 million in sales and have been in business for at least three years—a critical survival threshold for most startups. An algorithm then narrowed down the least number of questions that identify homogeneous and heterogeneous characteristics of builder personality types.

The quiz presents statements such as, “I always knew I would start my own business one day,” “When framing a problem, I rely mostly on the facts vs. I rely mostly on my intuition,” and “I consider the company as MY company vs. OUR company.” Current and would-be startup founders respond on a scale of one (completely disagree) to seven (completely agree).

The four personality types are recognizably different based on their motivation to be an entrepreneur, their decision-making mode, management approach, and leadership style.

The Driver (Apple’s Steve Jobs) is relentless, commercially focused, and highly confident. The Driver is focused, almost fixated, on the product or service and believes it is the next big thing. At the same time, Drivers have difficulty sharing the wheel with the team and can run into trouble when a market shift contradicts their confidence. Drivers are people who have always seen themselves as entrepreneurs.

The Explorer (Facebook’s Mark Zuckerberg) is curious, systems-centric, and dispassionate. The Explorer is fascinated by the puzzle or challenge and the opportunity to find the solution. This personality type also excels at uniting talent whose problem-solving styles complement each other; however, Explorers often struggle with the more human aspects of scaling a business.

The Crusader (Twitter’s Jack Dorsey) is audacious, mission-inspired, and compassionate. When a Crusader launches a business, it’s all about a long-term mission and making a fundamental change in the world. Consequently, businesses founded by a Crusader personality type resonate with consumers who support those missions. Danner says Crusaders often struggle with the operations side of the business. They also avoid conflict more than Drivers and Explorers.

The Captain (Alibaba’s Jack Ma) is pragmatic, team-building, and direct. The Captain is more focused on “we” than “me.”Generating a team culture and an environment of reciprocity and collaboration are the primary drivers of Captains. Unlike their three counterparts, Captains are often more comfortable changing direction based on consensus among their colleagues.

While a builder’s personality is ingrained, the best builders also learn how to incorporate the strengths of other personality types.

While a builder’s personality is ingrained, the best builders also learn how to incorporate the strengths of other personality types.

“Everyone starts with their own innate wiring. But when it comes to how to become a better builder, our book explains two strategic choices,” says Danner.

First, the book explains how to become the “expert builder” or the best version of your builder type by elevating your particular strengths and delegating tasks related to your weaknesses. This strategy may be the easier path to improving your game.

The second strategy is to become a “master builder” who borrows from other personality types to broaden one’s repertoire by engaging help from peers or colleagues. For example, Drivers can help Crusaders with execution, whereas Crusaders can help Drivers with conceptualizing a culture of meaning around their businesses.

“When employees lose motivation about selling more products in a Driver-led organization, a Crusader can inspire the Driver to think about why they are slowing down,” Danner says. “In turn, the Driver can help the Crusader carve a more direct path to accomplishing visionary goals.”

The book is also filled with interviews with successful builders, both prominent and lesser-known across various industries, including, Ben Cohen and Jerry Greenfield of Ben & Jerry’s, Brian O’Kelley of AppNexus, Ben Weiss of Bai5, Jenny Fleiss of Rent the Runway, Margery Kraus of APCO Worldwide, and many more.

Prof. Lucas Davis: Stop Blaming Drivers for Mexico City’s Smog

How Your Nationality Matters to Employers

Where you come from could decide whether a prospective employer hires you—or not.

A new study finds employers are a startling 82 percent less likely to hire an applicant from a particular country if they previously had a negative experience with an applicant for a similar job from that same country.

Berkeley-Haas Asst. Prof. Ming Leung analyzed 3.9 million applications from freelancers worldwide for more than 290 thousand jobs and found that employers react more strongly to negative hiring experiences than to positive ones.

Leung studies labor markets and hiring at UC Berkeley’s Haas School of Business. His findings can be found in “Learning to hire? Hiring as a dynamic experiential learning process in an online market for contract labor,” conditionally accepted at Management Science.

Leung found that when employers have any kind of negative experience with workers from other countries, they are 15 percent less likely to hire people from those countries again—for any type of job. The unlikelihood climbs to 82 percent when a similar job is involved.

Conversely, positive experiences with freelancers led employers to be 25 percent more likely to hire from that country for similar jobs compared to a mere three percent for hiring from the same country for dissimilar jobs.

In addition to the hiring results, Leung found that freelancers from countries deemed less desirable are also paid less. In order to have the winning job bid, they must offer to do the work for two-thirds less than their peers from other countries.

Leung obtained data on transactions from Elance, an online market for hiring freelancers, from between 2000 and 2013 analyzing which applicants applied and who was eventually hired. This longitudinal approach revealed a trend of profiling based on nationality across a variety of job categories encompassing jobs as diverse as logo design, website programming, article writing, legal advice, and voiceovers.

“The comprehensive data allowed me to observe multiple employers hiring from different countries over time,” Leung says. “I was able to see how well an employee did and how employers subsequently reacted to these experiences with workers from those countries.”

Elance, now known as UpWork, was one of the first online platform for freelance or so-called gig jobs, representing eight million registered employers and four million registered freelancers from 223 countries. In order to find work, job seekers completed an application on the Elance website. The job postings included responsibilities, budget requirements, expected timeframe for completion, and required skills. On the freelancer’s profile, employers were able to see his or her country of origin.

Leung says understanding how employers stereotype job applicants from past hiring experiences is important.

“I found one negative experience can dramatically alter an employer’s beliefs. However, the study implies that nationality profiling in the hiring process potentially hurts employers, too, because they may lose out on good talent,” says Leung.

Leung suggests one possible solution: if employers were encouraged to hire people they typically would not hire, employers may learn how successful these workers can be.

“If you are already predisposed to believe that a worker from a particular country is going to be bad and they prove you right, you will be even less likely to hire from that country again,” Leung says. “But that means you may be missing out on other good workers from that country.”

In additional analyses, Leung finds that switching countries after a negative experience does not result in an employer hiring from a ‘better’ country or necessarily having a better subsequent experience.

As the global gig economy grows, Leung hopes the findings will be useful in helping employers hire the best workers without being discriminatory.

One Stone, No Birds: Policy Undermines CA’s Climate Change Leadership

Judging Moral Character: A Matter of Principle, Not Good Deeds

People may instinctively know right from wrong, but determining if someone has good moral character is not a black and white endeavor.

According to new research by Berkeley-Haas Assoc. Prof. Clayton Critcher, people evaluate others’ moral character—being honest, principled, and virtuous—not simply by their deeds, but also by the context that determines how such decisions are made. Furthermore, the research found that what differentiates the characteristics of moral character (from positive yet nonmoral attributes) is that such qualities are non-negotiable in social relationships.

“Judgments about moral character are ultimately judgments about whether we trust and would be willing to invest in a person,” says Critcher.

Critcher, who studies social psychology in the Haas Marketing Group, writes about his findings in a recent book chapter, “What Do We Evaluate When We Evaluate Moral Character?” co-authored with Erik Helzer of the Johns Hopkins Carey Business School. The chapter will soon be published in the Atlas of Moral Psychology, from Guilford Press.

Critcher, who studies social psychology in the Haas Marketing Group, writes about his findings in a recent book chapter, “What Do We Evaluate When We Evaluate Moral Character?” co-authored with Erik Helzer of the Johns Hopkins Carey Business School. The chapter will soon be published in the Atlas of Moral Psychology, from Guilford Press.

But how do people detect whether good moral character is present? The findings suggest that people can do what is considered the wrong thing but actually be judged more moral for that decision. How?

Imagine a social media company with access to its clients’ personal information and interactions. The government wants access to the user database for terrorist surveillance purposes, but it is up to the CEO to decide whether to violate the company’s privacy code. Is he considered a more moral person by complying with the request, or by refusing it? Critcher’s work shows that even people who think the CEO should hand over the data to the government consider the CEO to have better moral character if he does the opposite and adheres to the privacy policy.

“For the CEO who sticks to a moral rule—even when we think a deviation could be justified—we are more confident he will behave in sensible, principled ways in the future,” says Critcher.

In one experiment, Critcher asked 186 undergraduates to evaluate 40 positive personality traits by rating them on two dimensions: 1) how much each trait reflected moral character, and 2) whether the participants would or would not be willing to have a social relationship with someone who lacked that quality.

“The two dimensions were correlated at .87, which means the two are almost the same thing. It is about the highest correlation I have ever seen in psychological research,” Critcher says. “What makes moral traits special is that their absence is a deal breaker, even when compared to qualities that the participants deemed just as positive.”

But did people see these traits as essential because they were seen to be moral? The research team answered that question by leading people to construe the exact same trait as either moral or nonmoral. Research participants were shown 13 traits that the researchers deemed ambiguously moral (e.g., reasonable). Some participants were first exposed to traits that were clearly non-moral (e.g., imaginative); afterward, they found the ambiguous traits morally relevant. In contrast, other participants who first saw traits that were clearly moral (e.g., honorable) deemed the ambiguous traits as non-moral.

Inducing people to see these 13 ambiguous qualities as more moral also caused them to deem these qualities as more essential for their social relationships. In short, participants considered good moral character to be synonymous with justifying a social investment.

But here’s the conundrum: If people don’t want to invest in others who lack moral character, how do they ever learn whether new potential relationship partners have that requisite character? Perhaps people escape this dilemma by assuming the best about an individual’s moral character until they learn otherwise.

“When we first meet someone, we can directly observe their attractiveness, and a short conversation can reveal a lot about their basic social graces, but typically their moral character is not on direct display. In fact, learning if someone is trustworthy often requires us to trust them first,” says Critcher.

To that end, a third experiment revealed how optimism about an individual’s moral character helps people avoid this conundrum.

“When people first meet someone, they tend to give them the benefit of the doubt when it comes to morality. People don’t start with the same optimism about their sense of humor, musical, or intellectual ability,” says Critcher. “It’s an adaptive optimism—one that encourages us to operate on enough faith that we can at least learn whether they are worthy of a social investment—until they prove us wrong.”

Be More Patient? Imagine That.

Neuroscientists find links between patience and imagination in the brain

How often do you act impulsively without considering the consequences? What if you could learn how to be more patient?

By using functional MRI (fMRI) to look inside the brain, neuroscientists Adrianna Jenkins, a UC Berkeley postdoctoral researcher, and Ming Hsu, an associate professor of marketing and neuroscience at UC Berkeley’s Haas School of Business, found that imagination is a pathway toward patience. Imagining an outcome before acting upon an impulse may help increase patience without relying on increased willpower.

By using functional MRI (fMRI) to look inside the brain, neuroscientists Adrianna Jenkins, a UC Berkeley postdoctoral researcher, and Ming Hsu, an associate professor of marketing and neuroscience at UC Berkeley’s Haas School of Business, found that imagination is a pathway toward patience. Imagining an outcome before acting upon an impulse may help increase patience without relying on increased willpower.

Scientists call this technique, “framing effects,” or making small changes to how options are presented or framed. And the method may increase a person’s ability to exercise patience.

The findings can be found in Jenkins and Hsu’s study, “Dissociable contributions of imagination and willpower to the malleability of human patience,” forthcoming in Psychological Science.

The authors’ approach stands in contrast to previous research, which has mostly focused on the exertion of willpower to positively affect a person’s patience.

“Whereas willpower might enable people to override impulses, imagining the consequences of their choices might change the impulses,” Jenkins says. “People tend to pay attention to what is in their immediate vicinity, but there are benefits to imagining the possible consequences of their choices.”

Hsu and Jenkins conducted two experiments to explore the role of imagination and willpower on patience. In the studies, participants made choices about when to receive different amounts of money depending on how the offer is framed. The actual reward outcomes were identical, but the way they were framed differed.

For example, under an “independent” frame, a participant could receive $100 tomorrow or $120 in 30 days. Under a “sequence” frame, a participant had to decide whether to receive $100 tomorrow and no money in 30 days or no money tomorrow and $120 in 30 days.

The first experiment replicated past research, which found that framing outcomes as sequences promotes patience. 122 participants saw both independent and sequence framed options and expressed stronger preferences for the larger, delayed reward when choices were framed as sequences.

The second experiment involved 203 participants who had to make a choice based on one frame: 104 people had to choose under an independent frame; the other 99 had to choose under a sequence frame.

The result: participants in the sequence frame reported imagining the consequences of their choices more than those in the independent frame. One participant wrote, “It would be nice to have the $100 now, but $20 more at the end of the month is probably worth it because this is like one week’s gas money.”

In contrast, participants exposed to the independent frame demonstrated less imagination. One participant commented, “I’d rather have the money tomorrow even if it’s a lesser amount. I can get the things I need instead of waiting. Why wait a month for just $20 more?”

By framing the options in the second experiment, the researchers found that the participants escalated their use of imagination. The more participants imagined the consequences of their choices, the more they were able to be patient in order to receive the greater reward.

In the fMRI portion of the experiments, Jenkins and Hsu measured participants’ brain activation while the participants made a series of choices in both frames. They found the areas of the brain that process imagination became more active when participants were more patient during sequence framing. In contrast, in the independent framing, the researchers found patience more strongly linked to brain regions associated with willpower.

“There is a long tendency of behavioral interventions, ranging from promoting healthy eating to reducing drug dependence, to appeal to willpower. For example, ‘commit to be fit’ or ‘don’t do drugs’,” Hsu says. “Our findings highlight the potential benefits of interventions that change the nature of the impulses themselves by encouraging people to imagine the consequences of their choices.”

The researchers acknowledge that using brain scans to study human cognition has its limitations because it relies on certain assumptions about the links between brain regions and their functions. This is why the experiments combined several methods, which all converge on a similar conclusion.

“We know people often have difficulty being patient,” Jenkins says. “Our findings suggest that imagination is a possible route for attaining patience that may be more sustainable and practical than exerting willpower.”

Energy Institute: Benefitting from Green Jobs

Can Trump Please Populists and Corporate Leaders?

As a presidential candidate, Donald Trump accused Amazon CEO Jeff Bezos of buying The Washington Post three years earlier to benefit Amazon, and to gain a public forum to criticize Trump, as reported by CNN.

“And believe me, if I become president, oh do they have problems. They’re going to have such problems,” Trump threatened at a campaign rally.

Statements like those prompted economists at Berkeley and Georgetown to examine the probable approaches to antitrust enforcement under the new administration.

In “Whither Antitrust Enforcement in the Trump Administration?” published in The Antitrust Source (February 2017), Professor Carl Shapiro at UC Berkeley’s Haas School of Business and Steven Salop, a professor of economics and law at the Georgetown Law Center, voice concern about the potential abuse of presidential power in using antitrust to punish political enemies. They recommend that the president proactively enforce antitrust rules, following established principles, to maintain confidence in the market system.

Shapiro and Salop outline two courses of action that may frame the Trump administration’s antitrust policy: a “laissez-faire” or permissive approach and a “reining in corporate power” approach which would be more reflective of President Trump’s earlier campaign rhetoric. While they believe the president will lean toward less intervention, they acknowledge policy options could run the gamut from lax to populist.

“The question is where the new White House will draw the line between a laissez-faire approach and the populists’ cry for reining in corporate power,” says Shapiro.

A Marketplace poll prior to November’s presidential election found that 62 percent of Americans believe the economy is rigged to benefit the wealthy, politicians, banks—and corporations. President Trump campaigned on a platform to eliminate such corruption.

Antitrust laws are designed to protect consumers. Shapiro and Salop warn against using antitrust enforcement for broader purposes, such as favoring U.S. companies or domestic employment, and note that such an approach would require legislative changes.

“Our antitrust laws are not designed to consider broader objectives such as employment. They are concerned with preserving market competition to protect consumers,” says Shapiro. “A broad and vague ‘public interest’ standard is not what our antitrust laws call for, and moving in that direction would be hazardous.”

Shapiro served as the Deputy Assistant Attorney General for Economics at the U.S. Department of Justice, Antitrust Division, from 2009 to 2011 and from 1995 to 1996. More recently he also was a member of the President’s Council of Economic Advisers from 2011 to 2012.

The regulatory environment can be challenging for the Department of Justice (DOJ) and Federal Trade Commission (FTC) antitrust enforcement officials who police merger proposals. Sector-specific regulators are often “friendly” with the industries they regulate or are “captured” by them.

“Often it’s unpopular with politicians and their contributors when the DOJ or FTC goes after a large American company, but the Obama administration showed a lot of feistiness in blocking mergers. Antitrust enforcement is a great strength that America has, which is continually tested by companies who seek political favor,” says Shapiro.

The article cites as an example the deal Trump made with Carrier, a division of United Technologies, to keep a furnace plant in Indiana. For the most part it was deemed an unusual approach for a president-elect. “The concern is that it was implemented by way of an ad hoc threat of retaliation rather than as part of a rule-based process,” Shapiro and Salop write.

As a result, Shapiro believes President Trump may be tempted to continue to cut deals with corporate CEOs going forward, rather than let the DOJ perform its law enforcement mission based on the facts and the law, without political influence.

Shapiro and Salop also suggest the use of “merger remedies” may help protect consumers while maintaining market confidence. For example, in 2015 the FTC allowed Dollar Tree to acquire Family Dollar stores if it first sold 330 stores in certain cities to preserve competition in those markets. “A merger remedy should be applied case by case after a detailed analysis,” says Shapiro. “The FTC has a lot of discretion in determining what is an acceptable divestiture.”

President Trump has yet to name the incoming antitrust leaders at the DOJ and the FTC, but Shapiro believes the future of corporate America—and a country divided between the wealthy one percent and the working class—will be affected by that leadership, according to Shapiro. He says if federal antitrust enforcement wanes, state attorney generals may be more compelled to step in.

To Be or Not to Be an Entrepreneur

How a company’s incorporated vs. unincorporated status distinguishes entrepreneurs from other business owners

Today, more and more self-employed business owners may call themselves entrepreneurs, a label that connotes creativity, innovation, and success.

But not all business owners are alike.

Prof. Ross Levine found evidence that a company’s legal status—incorporated or unincorporated—can be used as a reliable measure to distinguish entrepreneurs from other business owners. By identifying this distinction, the research shows that incorporated business owners open companies that are entrepreneurial and require high-level cognitive skills. On the other hand, unincorporated business owners tend to lead companies that demand more manual talents.

The findings are detailed in “Smart and Illicit: Who Becomes An Entrepreneur and Do They Earn More?,” forthcoming in the Quarterly Journal of Economics and co-authored by Levine, a professor of economics at UC Berkeley’s Haas School of Business, and Yona Rubinstein, a professor at the London School of Economics and Political Science.

Their latest study is part of a larger body of work aimed at defining the key characteristics of entrepreneurs, and how to predict their success beyond a one dimensional definition of self-employment.

Levine and Rubinstein determined that self-employment status alone does not provide an adequate measure for studying entrepreneurs. Instead, they differentiated between two types of self-employed business owners: owners of incorporated businesses and owners of unincorporated businesses.

A typical example of an entrepreneur or incorporated business owner might be the founder of a digital advertising agency or a mobile app startup. Another type of business owner may be an unincorporated plumber, contractor, or cleaning person.

“When people think of entrepreneurs, they think of somebody creating something novel, something nonroutine, something risky, and cognitively challenging,” says Levine. “We found that people who open such businesses tend to open incorporated businesses. In contrast, when people open businesses that perform fairly routine activities, the founders tend to have less formal education and open unincorporated businesses.”

“When people think of entrepreneurs, they think of somebody creating something novel, something nonroutine, something risky, and cognitively challenging,” says Levine. “We found that people who open such businesses tend to open incorporated businesses. In contrast, when people open businesses that perform fairly routine activities, the founders tend to have less formal education and open unincorporated businesses.”

An incorporated business benefits by limited liability and a separate legal identity. Armed with that protection and less financial exposure, owners of incorporated businesses tend to venture into larger and riskier investments than their unincorporated counterparts.

This differentiation allowed the authors to determine which type of business owner is financially more successful.

Levine and Rubinstein used data from the Current Population Survey (CPS) for the period between 1995 and 2012 and the National Longitudinal Survey of Youth (NLSY79), a survey of 12,686 people who were 15 to 22 years old when they were first surveyed in 1979. Each participant was surveyed annually through 1994 and biennially ever since.

The study found that prior to launching their own companies, incorporated entrepreneurs 1) exhibit greater self-esteem; 2) want to be more in charge of their own futures; 3) engage in more illicit, break-the-rules type of activities than others; 4) are usually involved in jobs that primarily rely on intellect; and 5) are more likely than salaried workers to come from high-earning families with two well-educated parents. And before working at all, the entrepreneur scored high on learning aptitude test and engaged in more illicit, risky activities such as cutting classes, vandalism, shoplifting, gambling, assault, and using alcohol and marijuana. These “smart and illicit” entrepreneurs, who tend to be white males, full-time workers, and 25 years or older,are also twice as likely to launch an incorporated business than others who open businesses.

Meantime, unincorporated business owners tend to 1) have responsibilities that require more manual skills, and 2) were previously employed in similar work.

Incorporated entrepreneurs are also more likely to have many employees while unincorporated business owners have few or no employees. And they earn more than unincorporated business owners. According to the study, this group reported an increase of $6,600 in median annual earnings when they became entrepreneurs relative to their previous salary; that compares to a mere $716 increase for those not demonstrating the common traits of an entrepreneur.

The analysis also revealed that incorporated business owners had higher salaries before they became entrepreneurs than unincorporated owners who typically held lower paying jobs. Those who switched from a salary job to unincorporated self-employment earned only 85 cents on the dollar compared to when they worked for someone else.

The research findings appear to mirror how many business owners already think of their roles.

“We found that over time incorporated business owners are more likely to describe themselves as “entrepreneurs” than unincorporated business owners,” says Levine.

Profs. Dal Bó and Finan spearhead global economies program to improve life in developing countries

Multi-million dollar grant will fund field experiments on institutions and development

Berkeley-Haas Professors Ernesto Dal Bó and Frederico Finan are leading a five-year, multi-million dollar research program to support randomized controlled trials that advance partnership programs between non-government organizations and local governments in developing nations.

Administering randomized controlled trials is the focus of the Economic Development and Institutions (EDI) initiative, supported with aid from the UK government. The EDI initiative is being implemented by UC Berkeley’s Center for Effective Global Action (CEGA) in partnership with Oxford Policy Management Limited, the University of Namur, the Paris School of Economics, and Aide a la Decision Economique.

Dal Bó says one of the challenges of improving policy and institutions is generating consensus about which programs work best. Randomized controlled trials provide an unbiased tool and critical data from the field to inform decision makers and help researchers determine how favorable results might be achieved on a larger scale in order to ultimately help more people.

Dal Bó says one of the challenges of improving policy and institutions is generating consensus about which programs work best. Randomized controlled trials provide an unbiased tool and critical data from the field to inform decision makers and help researchers determine how favorable results might be achieved on a larger scale in order to ultimately help more people.

“Government officials are thirsty to know what programs and institutional features deliver good results, and that is where matching governments with academics can help,” Dal Bó said. “Collaboration yields better programs and reliable knowledge about what works. At the end of the day getting public policy right is a huge step towards improving economic performance and quality of life.”

Dal Bó, the Phillips Girgich Professor of Business, and Finan, an associate professor of economics, are members of the Business and Public Policy Group at UC Berkeley’s Haas School of Business. They are joined by Edward Miguel, a UC Berkeley economist and CEGA faculty director. Together they will be leading multiple teams of researchers funded by this grant.

EDI unites economists and social scientists around the globe to study how positive institutional change can be achieved. Some research activities within EDI include developing pathfinding papers, institutional diagnostics, and case studies. The largest research component, led by CEGA, involves developing a coordinated portfolio of randomized controlled trials in low-income countries to understand the impact of institutional programs on development.

EDI unites economists and social scientists around the globe to study how positive institutional change can be achieved. Some research activities within EDI include developing pathfinding papers, institutional diagnostics, and case studies. The largest research component, led by CEGA, involves developing a coordinated portfolio of randomized controlled trials in low-income countries to understand the impact of institutional programs on development.

Non-governmental organizations, known as NGOs, implement programs to provide much needed services and education in developing countries. EDI’s purpose is to identify NGOs and local government officials who want to partner in randomized controlled trials.

Frederico Finan

The goal of the field experiments is to determine how effective programs can scale and survive over the long term, and in other locations.

“We want to fund experiments that depart from the frequent practice of deploying programs that bypass the local institutional channels. We want to generate projects that take place within the same channels through which they may be scaled up, for instance by directly partnering with governments. We also hope to see studies link with each other in various ways, to create a more cohesive and reliable body of knowledge,” says Dal Bó.

The program called, “Randomized Controlled Trials to Evaluate Strategies to Enhance the Effectiveness of Public Institutions in Developing Countries,” is already underway. In April 2016, Dal Bó and Finan held a “matchmaking” workshop in Washington D.C. to create partnerships between researchers and government officials.

In August, Dal Bó and Finan published a white paper, “At the Intersection: A Review of Institutions of Economic Development,” that explains the role of institutions in development.

Funding applications are being accepted through Feb. 27. Additional calls for proposals will occur over the next three years.

Berkeley-Haas Professors Ernesto Dal Bó and Frederico Finan are leading a five-year, multi-million dollar research program on randomized controlled trials in developing countries. By funding socio-economic programs with local government partnerships, the project aims to better broad policies in order to improve individual lives.

Plan to Reduce Air Pollution Chokes in Mexico City

Study finds Saturday driving restrictions fail to improve air quality

Decades ago Mexico City’s air pollution was so poor, birds would fall out of the sky—dead. Locals said living there was like smoking two packs of cigarettes a day, according to one report. In response, Mexico City took several steps to try to improve air quality including restricting driving one or two days during the weekdays. The program has had negligible results.

In 2008, the city added driving restrictions on Saturdays in hopes of moving the needle. But according to new research by Lucas W. Davis, an associate professor at UC Berkeley’s Haas School of Business, extending the program one more day also isn’t working.

“Saturday driving restrictions are a flawed policy,” says Davis, who is also the faculty director at the Energy Institute at Haas. “It’s a big hassle for people and does not improve air quality.”

“Saturday driving restrictions are a flawed policy,” says Davis, who is also the faculty director at the Energy Institute at Haas. “It’s a big hassle for people and does not improve air quality.”

The study, “Saturday Driving Restrictions Fail to Improve Air Quality in Mexico City,” published today in Scientific Reports, is the first to examine the effects of restricted driving on Saturdays. It compares pollution levels of eight major pollutants before and after the program went into effect. Having fewer motorists on the road on Saturdays led to close to zero impact. Proponents of the Saturday program had estimated vehicle emissions would be reduced by 15% or more.

Mexico City has the worst air quality in the Western Hemisphere with particulate levels that are three to four times higher than in New York, Los Angeles, São Paulo, or Buenos Aires, the paper states. Mexico City has tried many different approaches to improving air quality, including the city’s well- known driving restrictions, which were first introduced in 1989.

The program employs restrictions that are based on the last number of a vehicle’s license plate. For example, vehicles with license plates ending in the numbers 5 or 6 cannot be used on Mondays. The ban is in effect from 5 a.m. to 10 p.m. for both personal and commercial vehicles.

To determine the impact of Saturday restrictions, Davis analyzed hourly air pollution data from 29 monitoring stations around Mexico City between 2005 and 2012. He studied emission levels for carbon monoxide, nitric oxide, nitrogen dioxide, nitrogen oxide, ozone, large particulates, small particulates, and sulfur dioxide. None of these pollutants decreased as a result of Saturday driving restrictions.

Trying to figure out why pollution did not decrease, Davis next examined ridership data from Mexico City’s public transportation systems. From city buses to light rail to electric buses, he found no discernible increase in Saturday riders.

“People have found other ways to get around the driving restrictions,” he said. “Some purchase multiple cars, others take taxis or Uber.”

Davis argues that as Uber and other taxi-like services become increasingly available, driving restriction policies will continue to struggle to improve air quality. Instead, he suggests that Mexico City and other cities plagued by dangerous pollution need to require stricter vehicle emission tests.

“Test every car, test every year. If you have a car that’s polluting the air, you can’t drive it. Period,” says Davis.

In 2008, Mexico City added driving restrictions on Saturdays in hopes of moving the needle to improve air quality. But according to new research by Assoc. Prof. Lucas W. Davis, extending the program one more day also isn’t working.

How After-Hours Trading Sheds Light on Investor Sentiment

Paying attention to overnight stock market returns may help investors develop profitable trading strategies, according to a new study.

Omri Even Tov, an assistant professor of accounting at UC Berkeley’s Haas School of Business, found that overnight market activity—between the time the market closes and re-opens the next day—provides a goldmine of information about investor sentiment at the firm level, or pertaining to specific stocks rather than the broader market.

Omri Even Tov, an assistant professor of accounting at UC Berkeley’s Haas School of Business, found that overnight market activity—between the time the market closes and re-opens the next day—provides a goldmine of information about investor sentiment at the firm level, or pertaining to specific stocks rather than the broader market.

Even Tov measured how much returns moved after the market closed and found that in the short term, up to 12 weeks, prices continued to trend in the same direction; what financiers called price “persistence.” The effect was even stronger for firms that are typically more difficult to value.

The findings likely reflect investor sentiment because private investors are more likely to place orders when the market is closed. Also, private investors tend to rely more on sentiment and less on underlying fundamentals (a firm’s intrinsic, not market, value) when making their trading decisions.

The study, “Overnight Returns and Firm-Specific Investor Sentiment,” forthcoming in the Journal of Financial and Quantitative Analysis, is co-authored with David Aboody and Brett Trueman of the UCLA Anderson Graduate School of Management and Reuven Lehavy of the University of Michigan’s Ross School of Business.

“Previous sentiment measures proposed in the literature focus on market-wide sentiment,” says Even Tov. “In contrast, overnight returns allow us to capture what individual investors think and expect at the firm level.”

The researchers studied overnight returns in the U.S. stock market between July 1992 and December 2013. In addition to short-term persistence, they also studied how stocks performed overnight over the longer term, or 12 months. High overnight returns underperformed while those with low overnight returns outperformed. The 12-month return on a strategy of buying and selling stocks based on overnight returns yielded a premium of 7.4 percentage points.

“People want to know the extent to which prices are efficient. Our measure is useful for investors by giving them a new way to determine whether stocks are overpriced or underpriced, which can help them make better decisions,” says Even Tov.

Asst. Prof. Omri Even Tov found that overnight market activity—between the time the market closes and re-opens the next day—provides a goldmine of information about investor sentiment at the firm level, or pertaining to specific stocks rather than the broader market.

Mobile Marketing 2.0: It’s Not Just Where You Are But Whom You’re Near

How GPS network science is evolving to help mobile marketers prosper

Companies love knowing where potential customers are hanging out at any given moment. By “geo-fencing” or using GPS data, companies can target customers based on their exact location and send promotional messages directly to their phones.

Location data can also help to discover customers’ personal preferences. Research now shows that consumers are more likely to respond similarly to a mobile marketing offer or coupon if they have recently been in the same physical place.

A new study found that location data is a better predictor—up to 19% more accurate—of consumer behavior than information about demographics (age, income, education) and psychographics (values, lifestyle, and personality).

Zsolt Katona, an associate professor of marketing at UC Berkeley’s Haas School of Business, calls this response a “co-location effect” in his study, “ Predicting Mobile Advertising Response Using Consumer Co-Location Networks.” The paper is co-authored with Peter Pal Zubcsek of Tel Aviv University, and Miklos Sarvary of the Columbia Business School.

Zsolt Katona, an associate professor of marketing at UC Berkeley’s Haas School of Business, calls this response a “co-location effect” in his study, “ Predicting Mobile Advertising Response Using Consumer Co-Location Networks.” The paper is co-authored with Peter Pal Zubcsek of Tel Aviv University, and Miklos Sarvary of the Columbia Business School.

The researchers hypothesize that redemption responses may be similar because people with similar tastes typically visit the same places. “If you have similar tastes, you are more likely to go the same location, even if you do not actually know each other,” says Katona. “That may cause you to respond similarly to the same coupon. We saw the biggest effect with people who are closely located, within a roughly 400-foot radius.”

The researchers used GPS data obtained by a major Southeast Asian cell phone company and modeled how 217 study participants in a metropolitan area responded to a variety of coupon offers for coffee, food, and entertainment sent out at random times and random locations.

While like-minded consumers may visit similar locations, the co-location relation between consumers is not necessarily social. That’s good for marketers who don’t have access to people’s social networks. In order to study how well customers respond to coupons while controlling for similar habits of socially connected individuals, Katona and his colleagues constructed two participant networks: co-location and referral.

Co-located participants must have been at the same location during at least one of the GPS observations the day before the offer.

Participants in the referral network were deemed connected if one of them had invited the other to the program.

When participants recently visited the same location and received the same mobile coupon, they reacted to the offer at a higher rate and with more similar responses than those who were not near each other. For instance, a participant in the proximity of someone with a 20% coupon redemption rate (in the consumer packaged goods or CPG category) redeemed the same offers at roughly double the rate of participants who had not visited the same location.

The research team also conducted similar tests to determine if consumers are more or less likely to redeem offers in a similar fashion if they had met in so-called “hot spots”—popular and populated locations such as those in urban centers—compared to “cooler” or less-visited locations.

The study found that it is easier to predict customers’ behavior when they have visited the same cool spots rather than the same hot spots. By definition, hot spots attract everyone irrespective of tastes and preferences.

In contrast, when people tend to go to the same cool or non-popular places, they are more likely to be similar in their preferences.

Companies love knowing where potential customers are hanging out at any given moment. By “geo-fencing” or using GPS data, companies can target customers based on their exact location and send promotional messages directly to their phones. A new study by Zsolt Katona found that location data is a better predictor—up to 19% more accurate—of consumer behavior than information about demographics (age, income, education) and psychographics (values, lifestyle, and personality).

Wikipedia Readers Get Shortchanged by Copyrighted Material

How intellectual property hampers access to digital information

When Google Books digitized 40 years worth of copyrighted and out-of-copyright issues of Baseball Digest magazine, Wikipedia editors realized they had scored. Suddenly they had access to pages and pages of player information from a new source. Yet not all information could be used equally: citations to out-of-copyright issues increased 135 percent more than issues still subject to copyright restrictions.

Those are the results of a new study, “Does Copyright Affect Reuse? Evidence from Google Books and Wikipedia,” conditionally accepted in Management Science. By studying how copyright laws restrict the free exchange of information, author Abhishek Nagaraj also found pages that could benefit from copyrighted information received 20 percent less traffic than pages that could benefit from out-of-copyright information. That presents a significant disadvantage to Wikipedia readers. Copyrighted images suffered even more lack of distribution or reuse because they cannot be paraphrased and repurposed like written information.

Perhaps more importantly, the study’s findings suggest how an Internet without copyrighted material may be better used to create new content, and not just allow people to consume what’s already out there.

“There is a big debate about what copyright restrictions do to the diffusion of knowledge. Some people say copyright laws have not caught up with the digital age,” says Nagaraj, an assistant professor of management at UC Berkeley’s Haas School of Business.

“There is a big debate about what copyright restrictions do to the diffusion of knowledge. Some people say copyright laws have not caught up with the digital age,” says Nagaraj, an assistant professor of management at UC Berkeley’s Haas School of Business.

With just about everything available online now, Nagaraj chose to study Baseball Digest for several reasons. First, it is one of only a small number of publications that Google Books digitized in its entirety (in 2008). Second, Baseball Digest ‘s copyright status changed over time; the copyright of issues published before 1964 was never renewed and therefore, all pre-1964 issues entered the public domain 28 years after their respective publication dates. At the same time, issues published in 1964 and after are not subject to renewal and remain under copyright, at least until 2020. These conditions gave Nagaraj the ability to study citation variation—under copyright and not under copyright—of the same publication. Third, Nagaraj contends that baseball’s popularity would make his experiment “economically meaningful.”

Nagaraj created two samples based on the digest’s publication years and on 541 players’ Wikipedia pages. The players were all nominated for the Baseball Hall of Fame and made their professional debuts between 1944 and 1984. By creating a “quality metric” for each player based on the number of times they played in an all-star game, Nagaraj ensured that each player in the sample had a significant baseball career. The result was a dataset that counts the number of citations to Baseball Digest on each player’s Wikipedia page as well as the number of images and word citations.

The data revealed three primary results: 1) There was no variation in using information from copyrighted and out-of-copyright sources before the Google Books digitization process; 2) After Baseball Digest was digitized, Wikipedia editors started using both non-copyrighted and copyrighted information but moreso of the former; and 3) The effects varied by the type of content. Text material was reused regardless of its copyright status. For example, factual information that Babe Ruth hit a homerun moved from the Digest to Wikipedia smoothly because it could be rewritten. However photos of players and teams were reused more rarely because they could not be reproduced with any variation unrestricted by copyright protection.

“Well-known players like Yogi Berra were less affected by this variation because there are enough alternative sources of information besides Baseball Digest,” explains Nagaraj. “But there are many players for whom we have limited information. People seeking information about these players are most hurt by copyright law.”

This deficiency in the transfer of knowledge impacts not only Internet users who are looking for information but also users seeking to create new content. Nagaraj hopes his work will provide evidence for re-evaluating the value of copyright laws.

“The loss from future copyright extensions is likely to be high. If we want to incentivize new creative work using historical information, we need to fix the system,” says Nagaraj.

When Google Books digitized 40 years worth of copyrighted and out-of-copyright issues of Baseball Digest magazine, Wikipedia editors realized they had scored. Suddenly they had access to pages and pages of player information from a new source. Yet not all information could be used equally: citations to out-of-copyright issues increased 135 percent more than issues still subject to copyright restrictions, according to a study by Abhishek Nagaraj.