Oil Market Impacts of COVID-19

Economists can’t predict the future, but economics can help improve policy today.

Oil markets aren’t the first thing that hardly anyone thinks about when reading updates on the novel coronavirus. The health threat is frightening, and the economic impact will be devastating for many low wage and service workers.

Still, the pandemic is also roiling oil and related markets in ways that will have enormous effects on economic activity and lives worldwide. At the same time, it is reminding us of economic lessons that previous shocks have taught. So now seems like a good time for a refresher.

In the oil market, small demand/supply mismatches can cause outsize price responses.

In the last month, crude oil prices have fallen nearly 40% in response to quite modest projected demand reductions and supply increases. The International Energy Agency last week revised its forecast for world crude oil demand in 2020 to be a 90,000 barrel per day (bpd) decline from 2019, from its previous estimate of about a 1 million bpd increase. That’s in a global market of 100 million bpd. Its revision to forecasted demand for later years was even smaller. Combined with a small supply increase (discussed next), that was all the revision necessary to drive a huge price drop, not just for 2020 but for years into the future. We saw the same phenomenon in 2008, 2014 and earlier price crashes.

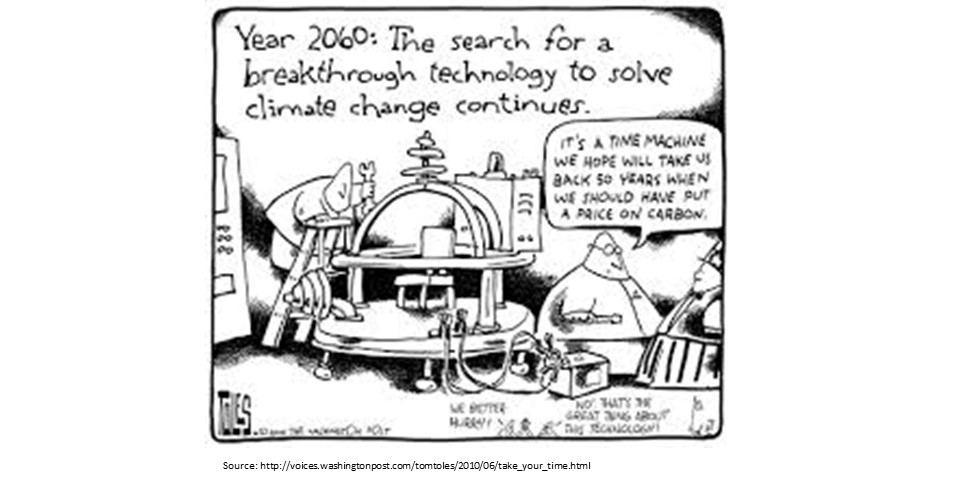

The fact that even small demand/supply mismatches can trigger big price effects is important not just for analyzing these unexpected market disruptions, but also for what they say about the challenge of fighting climate change. To make progress on reducing GHG emissions, we will need massively greater cuts to oil consumption. The last month should remind us that such cuts will almost inevitably result in very low oil prices. That makes the challenge to sustainable technologies all the greater.

OPEC is a cartel designed to undermine competition in the oil market, albeit with uneven success.

When Saudi Arabia announced a week ago that it would essentially revert to competitive behavior, that meant amping up output by only 1-3 million bpd. We’ve seen competition break out in oil markets before, for instance in 1985, 1999, 2008 and 2014. In most such cases it has taken years to put some form of effective OPEC agreement back together again.

But let’s not forget, the prices today are what a competitive oil market looks like. This is how most other commodity markets operate. The Saudis aren’t pricing below their cost or undermining the crude market. They are just departing from their usual cartel practice.

US oil producers have not been part of the cartel, but they have made very good money going along for the higher-price ride. Their investments in production capacity have been a bet that Saudi Arabia will keep restricting its own output while cajoling the other OPEC+ members to maintain “oil market stability” as the OPEC members like to call it. At least for now, that appears to be a bad bet.

Subsidizing losing companies is not likely to help workers much

The widespread bankruptcies and restructurings that will likely soon follow among US shale oil producers who banked on high prices is also part of the competitive process. Many in the industry, and some politicians, are arguing that the federal government should aide (i.e., subsidize) the industry through low-interest loans or reduced drilling royalties. They argue this is necessary to prevent widespread economic impacts to oil-producing regions, such as west Texas or North Dakota.

But unless the subsidies are huge, they are likely to have very little impact on those regional economies. Drilling new wells is expensive and much of the US activity was barely profitable when oil prices were in the $50-$60 dollar range. Unless the aid to US drillers is some form of output subsidy that offsets nearly all of the recent price decline – which could cost north of $50 billion per year — new well activity will still plummet and associated jobs will be lost.

On the other hand, once a well has been drilled it has a fairly low marginal cost of production and is seldom economic to shut down prematurely. So the subsidies generally aren’t necessary to keep them going.

Bottom line: short of massive subsidies, we would be paying oil companies to continue doing what they would have done anyway in a low-oil-price environment. Job losses would be barely affected by the subsidies. The money would just go to oil company shareholders (and executives). If the federal government did go for massive subsidies, it would prop up some drilling activity, but at a ridiculous cost per job. And as Lucas discussed last week, the cost of raising the revenue to pay those subsidies has its own job-killing impacts.

We didn’t raise tax rates on US oil producers when they were sweeping in the cash. It’s hard to see why we should start subsidizing them now that they are drowning in debt.

A unit of GHG emission or other pollutant imposes just as much cost on society when the polluter is in financial distress as when it is thriving.

The European airlines want a bailout in the form of delaying carbon pricing for them. Other industries will likely follow suit, asking for relief from environmental fees and regulations, because the economic downturn has hurt their bottom line. But their suddenly-declining profits have nothing to do with emissions costs. If governments feel the need to bail out airlines and other industries, they should do that directly and transparently, not by subsidizing the cost of the pollution they emit.

And, by the way, the price of jet fuel has plummeted in the last month by much more than any proposed new GHG price would add to their cost. The airlines’ problem is on the demand side. Their capacity, and fixed costs, adjust slowly. When the economy is booming, that leads to scarce seats and big profits. What we are seeing now is the other side of that coin.

The role of economic analysis

Policymakers sometimes express frustration with economics because it can’t provide reliable predictions about the future. But predicting the future requires knowing how all the relevant factors that will change going forward, a pretty tall order. What economics can do is help explain why markets are behaving as they are today and how specific policies are likely to change those outcomes. That won’t solve all our problems, but it sure can help keep us from making them worse.

I’m still tweeting interesting energy articles/blogs/research (and occasional political views) @borensteins

Keep up with Energy Institute blogs, research, and events on Twitter @energyathaas.

Suggested citation: Borenstein, Severin. “Oil Market Impacts of COVID-19” Energy Institute Blog, UC Berkeley, March 16, 2020, https://energyathaas.wordpress.com/2020/03/16/oil-market-impacts-of-covid-19/

Categories

Severin Borenstein View All

Severin Borenstein is Professor of the Graduate School in the Economic Analysis and Policy Group at the Haas School of Business and Faculty Director of the Energy Institute at Haas. He received his A.B. from U.C. Berkeley and Ph.D. in Economics from M.I.T. His research focuses on the economics of renewable energy, economic policies for reducing greenhouse gases, and alternative models of retail electricity pricing. Borenstein is also a research associate of the National Bureau of Economic Research in Cambridge, MA. He served on the Board of Governors of the California Power Exchange from 1997 to 2003. During 1999-2000, he was a member of the California Attorney General's Gasoline Price Task Force. In 2012-13, he served on the Emissions Market Assessment Committee, which advised the California Air Resources Board on the operation of California’s Cap and Trade market for greenhouse gases. In 2014, he was appointed to the California Energy Commission’s Petroleum Market Advisory Committee, which he chaired from 2015 until the Committee was dissolved in 2017. From 2015-2020, he served on the Advisory Council of the Bay Area Air Quality Management District. Since 2019, he has been a member of the Governing Board of the California Independent System Operator.

Professor Borenstein, Thank you for this timely blog.

1. It is difficult to attribute the present drop in oil price to a small change in oil supply. The present drop in oil price is in response to persistent over supply of oil by the US, OPEC, and non-OPEC as well as continued contraction of oil demand as a result of the corona virus and reduced level of economic activity. Increased recent US crude oil production largely shale limited OPEC ability to affect oil price through limits on production. This introduced a significant element of market contestability. This further limited the effect on oil price of small changes in oil supply and geopolitical factors such as Iranian, Libyan, or other oil production disruptions.

2. US oil producers, largely independent and smaller firms, have called on the US government to intervene on the oil price issue. The Texas Railroad commission, for the first time since the 1970’s, expressed interest in limiting US oil production and discussed its concerns with OPEC. It is important to point that this call for support was not endorsed by all O&G producers.

3. The US oil and gas industry is suffering through the oil price collapse. IOCs are reducing production, cancelling capital projects and reducing or eliminating dividends. Shale O&G are in a particularly rough situation given their high debt situation and an oil price close or below their short run marginal cost. The near term outlook is for: no new O&G shale wells being drilled, reduced production, bankruptcies, and M&A.

4. The oil industry including shale will survive this price drop and the corona virus without aid from the US government or OPEC and will emerge in a fairly competitive position. The oil price drop is likely to help transform the oil industry further into energy and integrated oil/petrochemical industries. Shale, unencumbered with debt will survive to await improved price conditions.

5. A major byproduct of fracking has been the immense availability of natural gas leading to major expansion in the petrochemical industry in mainly Pennsylvania and Texas. These investments will also survive the oil price drop and the corona virus. Their major challenges will remain: climate change, regulatory and environmental concerns, and fluctuating and lower petrochemical margins.

6. Natural gas is largely produced in association with oil production. The higher profit margin crude oil receives had throughout history led to downplay in investments in natural gas: gathering, processing, and grid expansion. This in turn have lead with the entry of fracking to increases in flaring of gas and methane emissions. The oil price collapse in combination with the corona virus is resulting in close to 10% drop in oil demand worldwide. Lower oil production in the US is leading to lower natural gas production and lower flaring. This however is not likely to translate in natural gas shortages nor in significant improvements in natural gas margins.

7. The drop in the price of oil as well as the corona virus creates an opportunity to reexamine natural gas and the oil industry role in the energy transition. Natural gas has already proven its value as a substitute for coal, fuel oil, and diesel in power generation. Climate change and the ability of the oil industry to transform itself into an energy industry will remain the key factors governing its survival.

8. The following lists four key areas where government assistance can benefit the O&G and shale industries and advance the climate issue:

1. Given the proper regulations and incentives, the oil industry is in position to take a leading position in the development of clean aviation and automotive fuels and to take a leading position in the development of energy intensive industry fuels.

2. US government assistance can prove fundamental in transforming the oil industry into energy and integrated oil/petrochemical industries a step that can prove crucial to both the environment and the survival of the industry.

3. Support must be linked to reduction in the carbon footprint of O&G and shale industries in the US and other countries they operate in. The following illustrates the major effort required in reducing the carbon footprint of O&G and shale industries. https://science.sciencemag.org/content/361/6405/851/tab-e-letters

4. Further incentives are needed for the industry to embark on decarbonization of industrial use of fuels through use of H2, sequestration, and energy efficiency. The following presentation illustrates key technical and legislative issues surrounding the issue of industrial decarbonization given energy intensive industries’ high temperature processes. https://itif.org/events/2020/03/05/decarbonizing-industrial-heat

9. I will be glad to receive comments on my response and to answer any questions.

Thank you to Richard and Robert above for your thoughtful response regarding the longer term role of new innovative nuclear power. I will give those comments some thought. As Carl Zichella knows, my company has been supporting WECC in its long term scenario analysis for reliability in the Western Interconnection. So looking out to 2035 and beyond is completely appropriate. It looks as if the new nuclear designs do s a better job of confronting the waste disposal issue and the full life cycle cost of managing that stuff. But those longer term costs still concern me. Clean up in the event of accidents (bound to occur) also concern me in light of the costs the Japanese are confronting with Fukishima.

As mentioned earlier though if storage gets to a new more innovative chemistry (MIT says this is needed) for the next quantum leap in costs and features, who knows what may be possible.

The two MIT studies that I saw recently on storage costs (and have been referenced in earlier blogs’ commentaries), those are obsolete already, and storage costs have fallen by half. Those studies appeared to be guided by the nuclear engineering department at MIT, with the apparent biases. Storage is already quite cost effective, and once we acknowledge that distributed storage can be handled by the EV parked in our driveway, the cost goes way down. (See other comments about how many days of average household use are in a Tesla battery.)

Gerald, the U.S. Energy Information Administration, not an investment bank or starry-eyed activist, lists the average cost of installed Li-ion grid batteries at $1,200/kWh. At that price, enough capacity to power California’s grid for a single day of cloudy, calm weather would cost an astronomical $938 billion – five times our state’s annual budget. Add solar and wind capacity to charge the batteries (we’re assuming existing capacity will be contributing to our grid), add enough additional batteries for a safe margin of above-average demand, add additional batteries to make up for 15% resistance and bi-directional inversion losses, and we’re well over $2 trillion – for batteries which will need to be replaced every 10-12 years.

https://www.eia.gov/todayinenergy/detail.php?id=36432

“As mentioned earlier though if storage gets to a new more innovative chemistry (MIT says this is needed) for the next quantum leap in costs and features, who knows what may be possible.”

I, and MIT chemists, and any high-school physics teacher know what is not possible – for advanced technology to bend immutable laws of thermodynamics, or create energy where there is none. There is no credible energy balance analysis which can show wind and solar are capable of powering an electrical grid, batteries notwithstanding. It’s smoke and mirrors.

Re: Fukushima – to compare that facility to Gen 2 or 3 U.S. plants, held to the most demanding standards in the world in their construction, maintenance, and operation, is like comparing the safety of passengers on the Hindenburg to those on a Boeing 787. Under the domes you see covering the reactors at Diablo Canyon is reinforced concrete 4.5 feet thick, specifically designed to withstand any foreseeable explosion from within, and the impact of any airplane from without.

For a good comparison of U.S. nuclear safety culture to that of Japan, compare the outcome of nearly-identical Loss of Coolant Accidents (LOCAs): Fukushima-Daiichi Unit 4 vs. Three Mile Island Unit 2. There is no comparison.

Again, for other readers, I have posted a link in this blog where I already showed earlier the errors in Carl’s calculations and his misinterpretation of the EIA study (which appears to have been done incorrectly).

Just read a piece in the NYTimes about the impact on the California economy. It had impacts including in the areas of the entertainment complex, tourism, agriculture as well as others common across the board like retail and restaurants. This made me think about the possibility of entering a period of “stagflation” as we work out of this. Inflation driven by new regulations and labor standards (a maybe a lack of workers in some areas) driving up real costs. Of course there will be other areas driving down costs like lower energy costs, lower financing costs, and a lack of demand in many areas, so not sure we can get to stagflation overall. The CA housing bubble may also be bursting, which would be a good thing as well to drive down cost of living.

Another key question is how to reboot and restart the economy from the beating it is taking? Demand may need to be primed with a lot more than lower interest rates. I can see another stimulus bill being needed. Imagine Biden coming into office under similar circumstances as Obama,

“Imagine Biden coming into office under similar circumstances as Obama,”

Yes, I can imagine it. Another Republican administration disaster that a Democrat administration has to clean up. History repeats itself.

I fully agree that we should not provide subsidies for the oil producers. Let the drilling companies go broke. The world doesn’t need any more new wells producing oil and gas that will further contribute to global warming.

In any event, as we transition to electric vehicles the demand for petroleum-based fuels will plummet. Stopping the drilling today will soften the blow that the industry will inevitably suffer. Maybe Putin and the Saudis are actually doing us a favor.

In contrast, I think the government should provide low-cost or even interest-free loans to the airlines to keep them from going bankrupt. We need the airlines and further concentration of the industry will only reduce competition even further.

“Let the drilling companies go broke.”

Amen, Bob. Any temporary impact on global economy (“temporary” used relative to the duration of extended climate change, or < 1 myr) will be insignificant compared to the threat posed to species diversity in general, and Homo Sapiens in particular, from global warming and ocean acidification.

Electrification of energy by any and all means will be essential. It will briefly take the form of a combination of mass-produced nuclear and renewable resources, until there can be no doubt the intermittency, expense, and land use of renewables is only extending the clean energy transition and limiting its efficacy.

Commercial air travel will likely be powered by ion propulsion systems. First developed for rockets, no physical barriers prevent them from being adapted to aviation. Spills / leakage of spent nuclear fuel are inevitable, as fission is adapted to various applications, but (as it does now) any added environmental radiation will represent an infinitesimally-smaller threat to life on Earth than that presented by fossil fuels.

Carl,

I just don’t see how we get back to mass produced nuclear power here. Wouldn’t mass produced solar, wind and storage with smart demand side management be faster and cleaner? The time it would take to build that nuclear (unless we are talking about rapid use of the smaller pilot plants people are playing with and even those I am not sure about) and their non-competitive cost would seem to kill them. Subsidizing nuclear based on carbon emissions is not needed if we allow limited use of gas for a period. Limited use of natural gas to assure reliability until storage was sufficient also seems like a path forward. If we do this all at utility scale so it can be easily financed and built this seems good to me.

My other question though is the coming and current collapse in demand and the restructuring of energy markets to take the excess capacity into account. A lot of energy providers will have excess capacity and lost revenue. Their finances will be damaged. We need to play this out in the short term before there will be a consensus for any fundamental reshaping of energy industries.

“I just don’t see how we get back to mass produced nuclear power here. Wouldn’t mass produced solar, wind and storage with smart demand side management be faster and cleaner?”

Gerald, obviously I can’t speak for Carl, but let me comment on your statement.

I agree, that it will take at least a decade before a new generation of nuclear reactors can enter service in significant quantity. In the interim building renewables and some storage while using natural gas to accommodate renewables intermittency is our only “green” option. However, as renewables penetration increases, this option will become exponentially more expensive. the seasonality of renewables will require overbuilding of capacity by at least a factor of two (which is still cheaper than attempting to rely on storage, assuming that is even physically feasible given the gargantuan scale required). If new SMRs start to enter service around 2030-2035 they can greatly offset the high renewables costs while displacing natural gas generation. So the role of new nuclear will be to ameliorate the costs of achieving zero carbon emissions.

It is not clear to me that we will (or should) ever phase out all natural gas usage in the power sector because of the uncertain and unreliable production of renewables – wind power in particular. Historical production data from both California and Texas both reveal that wind power drops to near-zero for consecutive days on end. Only a flexible resource, e.g., a gas-fired combustion turbine and demand response can compensate for that kind of volatility. Gas-fired plants will only run a small number of hours per year so they will produce a limited amount of GHG but they will produce a great deal of value in keeping the lights on.

If we’re looking out a decade, it’s difficult to project what might happen with either technology. We’ll be able to see if SMRs and advanced nuclear are able to deliver low cost and low risk power or if storage technologies continue their rapid advance facilitated by transportation and communication technology demands. It’s too early to favor one over another. We only need to look at how solar and wind advanced over the last decade to see what could happen, and battery technology seems to be following a similar path.

“However, as renewables penetration increases, this option will become exponentially more expensive. the seasonality of renewables will require overbuilding of capacity by at least a factor of two (which is still cheaper than attempting to rely on storage, assuming that is even physically feasible given the gargantuan scale required).”

The best estimates for overbuild I’ve seen are 1.3. These come from a study by Richard Perez and Karl Rabago. I see no evidence costs will increase exponentially as we scale up renewables. So far we’ve see quite the opposite. I believe the cost trajectory is shaped much like a load duration curve so things will be roughly linear until we get to the last 5 to 10% of load. It’s in this tail section where costs would ramp up exponentially. This is exactly why we’d want to use natural gas as a backup resource. Gas is plentiful, affordable and (assuming electrification of heating and transportation) over 90% cleaner than we are now currently. Better yet we already have most of the gas infrastructure we’ll need to back up RE.

I find Borenstein’s article well off the mark. Our oil infrastructure is critical to our national security and economic health. If we allow OPEC and Russia to hobble it then who’s to say they won’t turn around and crank up the price some time in the near future when we’re trying to recover from COVID? Isn’t this the whole point of what the Saudi’s are doing? And you call this competitive behavior? Please… This is gaming… Why should we let them game the market when we have other options? Why not simply embargo OPEC and Russian oil temporarily and have the federal government set and/or regulate the price of oil for a few months? Why not just threaten to embargo OPEC and see what happens?

When you think about it supporting US oil is actually a method of reducing carbon at this point. You have to remember that a significant portion of our natural gas supply is associated gas. If the US oil industry collapses then the natural gas supply will ratchet down. If the natural gas supply ratchets down it means more coal. More coal means more carbon as well as more NOx, SOx, Mercury and PM.

Even before the COVID crisis the US was headed towards the largest reductions in carbon emissions we’ve ever seen thanks to a 35% reduction in coal generation. This reduction in emissions in due to low gas prices, mild weather and new RE. If gas prices shoot up we’re only looking at a 15% reduction in coal in 2020. If we temporarily support oil and by extension gas then we could conceivably see coal use drop by 40 to 50%. The health and environmental benefits of this could be as high as 50 to 100 billion dollars.

https://www.fastcompany.com/1727949/coal-costs-us-500-billion-annually-health-economic-environmental-impacts

“When you think about it supporting US oil is actually a method of reducing carbon at this point. You have to remember that a significant portion of our natural gas supply is associated gas. If the US oil industry collapses then the natural gas supply will ratchet down. If the natural gas supply ratchets down it means more coal. More coal means more carbon as well as more NOx, SOx, Mercury and PM.”

I think you’re overthinking it, Hugh. To support your hypothesis, you’d have to show the US oil industry would collapse without federal subsidies. Good luck with that one.

That’s a gross mischaracterization Carl. Walk through the arrow analysis. US oil production will fall if $20/barrel prices are sustained. A good chunk of our gas supply is associated gas so gas production will likely fall and gas prices will likely rise in a sustained $20/barrel scenario. If gas production falls and gas prices rise we’ll naturally see more coal. More coal means more emissions. The external costs of these extra emissions are considerable.

I’m not suggesting federal subsidies for O&G. I’m suggesting a temporary embargo and/or the threat of an embargo and/or countervailing duties.

There’s a high probability the Saudis and Russians don’t know what they’re doing here. It’s simply a bluff. We’re nearly self-sufficient in oil. We can and should call their bluff here.

Gerald, the chief reason nuclear is exorbitantly expensive in the U.S. is that we’ve never had mass-produced power plants. Every plant is a one-off, with its own set of plans, schematics, permits, approvals, etc. etc. – and problems. And mistakes.

If by “pilot plants” you’re referring to small modular reactors, NuScale Power has finished the preliminary design of a plug-n’-play, 12-module nuclear plant. It will deliver 684 MWe (net) for about $3B, or about one-third the cost of current Gen-3 mainframe reactors like Westinghouse’s AP-1000.

NuScale Boosts SMR Capacity, Making it Cost Competitive with Other Technologies

https://www.powermag.com/nuscale-boosts-smr-capacity-making-it-cost-competitive-with-other-technologies/

“Wouldn’t mass produced solar, wind and storage with smart demand side management be faster and cleaner?…Limited use of natural gas to assure reliability until storage was sufficient also seems like a path forward…”

Currently, no grid in the world is capable of meeting customer demand with storage for more than a few minutes. A cursory examination of consumption in California shows why.

Total 2018 energy consumption on CAISO was 285.5 terawatthours (TWh), or 782 GWh/day. Using that for example, the cost of a battery system capable of powering California for a single cloudy, calm day, using a capacity-weighted average cost for Li-ion batteries of $1,200/kWh (EIA), would be $938 billion – five times California’s state budget. There are a number of complicating factors which would drive up the cost to multiples of that figure, but it’s plain to see powering CAISO with batteries, for even several hours, would be hopelessly impractical (calling it a pipe dream would be apropos, given the interest shown by natural gas purveyors in that course of inaction).

“Demand-side management” is the euphemism commonly used by renewables/gas promoters to shift the obligation of providing adequate electricity capacity to electricity customers. “The problem is not that intermittent, variable solar and wind can’t sufficiently meet customer demand – it’s that customers use too much electricity at all the wrong times!” they might say, proposing time-of-use pricing that costs everyone more, but places the greatest burden on disadvantaged customers as a cost in convenience.

Despite EI blog contributors who will endlessly nit-pick this assessment, renewables + storage is not even close to affordable, realistic, or practical – and was never meant to be. Leaving small, modular nuclear as the only viable possibility for decarbonizing electricity completely by 2045, as mandated by SB-100.

Carl,

Please don’t repeat your badly erroneous mathematics on storage costs. Others can read through how I dissect your calculations in this previous blog post. No need to regurgitate it here: https://energyathaas.wordpress.com/2020/01/06/fossil-fuels-are-dead-long-live-fossil-fuels/

Richard, nonsense. Batteries are not energy – they’re physical assets. To be able to provide California with one average day of clean electricity from batteries (never mind peak capacity), you’ll need 782 GWh of battery storage all at once. Not a kWh here, a kWh there.

That capability will require a minimal capital investment of $968 billion. You’ll need added solar and wind capacity to charge it, while existing capacity is powering the grid.The batteries will need to be replaced every 10-12 years. Impossible, at a fraction of the price.

I refer readers to the following (MIT Technology Review):

“The $2.5 trillion reason we can’t rely on batteries to clean up the grid

Fluctuating solar and wind power require lots of energy storage, and lithium-ion batteries seem like the obvious choice—but they are far too expensive to play a major role.”

https://www.technologyreview.com/s/611683/the-25-trillion-reason-we-cant-rely-on-batteries-to-clean-up-the-grid/

Please, don’t continue to waste everyone’s time.

I guess you’re right and all of those companies investing in storage technology are wrong, and they’ll all–everyone of them–will fail miserably since you’re so smart. More seriously, don’t you question your assumptions if the entire market, staffed with hundreds of smart people, have come to the completely opposite conclusion that you have, and that you are the ONLY person I’ve seen make this calcuation? Don’t you see that you’re calculation is off at least an order of magnitude vs. the MIT study, even as poorly done as it is?

Richard –

If there are errors in my mathematics or calculations you haven’t shown what they are. Instead, you continue to insist we can overcome the inability of solar and wind to meet customer demand in real time with an imaginary system of batteries, at a cost of nearly $1 trillion, without a shred of evidence such as system is practical or even possible. If my analysis errs it’s only by being too generous:

1) The limited lifetime of Li-ion batteries would require the initial $938 billion investment be repeated every 10-12 years.

2) I haven’t included costs of added wind and solar generation necessary to charge the batteries.

3) I haven’t included costs of energy wasted by internal resistance and bi-directional inversion losses characteristic of battery storage (~15%).

4) I haven’t included costs of added transmission necessary to adapt a grid of radial topology – one designed to distribute centralized generation efficiently to where it’s needed – to one designed to enrich solar and wind investors.

See:

The $2.5 Trillion Reason We Can’t Rely on Batteries to Clean up the Grid

https://www.technologyreview.com/s/611683/the-25-trillion-reason-we-cant-rely-on-batteries-to-clean-up-the-grid/

You haven’t posted how much the cost of investing in the equivalent amount of new nuclear at $8,000+/kW would be? (I posted my calculation in the other link that I’ve posted here.)

I had not posted my previous analysis showing the significant errors in a detailed manner in Carl’s analysis of storage costs in this blog comments thread (I had done that in the Nuclear Jobs blog from last week.)

https://energyathaas.wordpress.com/2020/01/06/fossil-fuels-are-dead-long-live-fossil-fuels/

“More seriously, don’t you question your assumptions if the entire market, staffed with hundreds of smart people, have come to the completely opposite conclusion that you have, and that you are the ONLY person I’ve seen make this calcuation?”

Fortunately, who-you’ve-seen-do-what wouldn’t occupy a passing thought, and I’m proud to say my calculations are in alignment (±10% margin of error) with the hundreds of smart people you describe. We all come to the same conclusion: it’s not only possible to make a lot of money selling snake oil, it’s possible to convince other smart people what they’re selling isn’t snake oil at all – that, while stuffing fistfuls of cash into their pockets, they’re making the world a better place.

I wouldn’t deny anyone the right to enjoy the fruits of their labor, unless it’s at the expense of the health of the planet my kids will inherit. Gotta draw a line somewhere.

No, you’re calculations are not in alignment with those working on battery storage and electric vehicles. I’ve shown that multiple times across several blog posts. Others on this comment thread agree. You stand alone. You’re misinterpretation of the EIA value is particularly egregious and inconsistent with the industry standards as I’ve pointed out and supported with references elsewhere.

Great column, Severin. While prices may fluctuate, its good to be reminded that other factors do not — including the consequences of our carbon addiction.

Severin,

Always good to read your insights and analyses. I am involved in some scenario analysis at WECC and recall working with you while at GBN. This means I am thinking about key uncertainties and some longer term scenarios. What comes to mind for me is increasing supplies of almost all forms of energy with shrinking or very slow growth in demand. As you point out this leads to pleads for government intervention to subsidize players or to artificially keep prices up in some way so consumers can do the subsidizing. As you also point out this path will not allow us to make the big changes we need to address climate change. Putting this together seems to indicate a future of growing climate change events which will impact economic growth which will extend the time in which fossil fuels will be available and competitive. Bad news With economies sill loving cheap energy as a basis for economic growth (I am thinking the developing world), I don’t see a way out of this…