If the Grid is Getting Greener, How Can EVs Be Driving Dirtier?

And what does this mean for our vehicle electrification goals?

A humanitarian crisis in Ukraine. Record-high gasoline prices. A new IPCC report urging climate action or else. If you drive a fossil-fuelled vehicle (FFV), you now have some intense reasons to reconsider your vehicle fuel choice.

We’re all hoping that the geopolitical situation will improve in the coming months. But the climate crisis is not going anywhere. So now is a good time to lean into our vehicle electrification goals. And commit to keeping this policy pressure up, even when Putin and high gas prices fall out of the headlines.

How hard to push on electric vehicle (EV) market penetration depends in part on how much carbon weight we’ll drop if we meet our EV targets. It’s relatively straightforward to count the GHG emissions avoided by taking FFVs off the road. Accounting for offsetting increases in EV-caused emissions is more complicated.

Two new papers take a stand on how we should be estimating the electricity sector emissions impacts of vehicle electrification. As is often the case, economists and engineers disagree. In this case, I hope the engineers turn out to be right.

How many tons of carbon in an EV mile?

The GHG impacts of EV driving depend a lot on the carbon intensity of the grid you’re plugged into. To convert your kWhs into carbon emissions, you could use an average carbon intensity. A quick google search will tell you that U.S. electricity generators emit about 0.85 lbs of CO2 per kWh generated on average. Easy.

But your economist friend will point out that putting one more EV on the road impacts electricity production on the margin. So, she’ll explain, you should instead be thinking about the GHG emissions intensity of the marginal generator that ramped up to meet your EV demand.

Thanks, econ-friend. But how big a difference will it really make if I use an easy average versus this harder-to-pin-down marginal emissions rate? This is the point of departure for a new paper written by a team of great environmental economists we’ll call HKMY (Stephen Holland, Matt Kotchen, Erin Mansur, and Andrew Yates).

The Economists’ Take

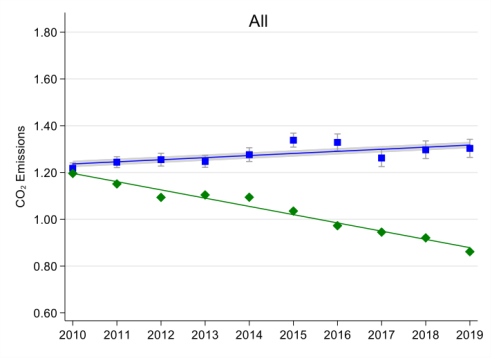

HKMY start with some cool graphs to show how the average carbon intensity of US electricity generation has fallen by around 28 percent since 2010 (green line), while the marginal emissions rate has increased by 7 percent (blue line).

One unfortunate implication: while the grid has been getting greener, my EV has been driving dirtier! The graph below shows how our marginal emissions rates have been creeping up.

What’s driving this increase? A number of factors (e.g. low natural gas prices, increased investment in renewable energy) are pushing coal plants to the margins of the market, but not out of the market entirely. Coal plants are increasingly the ones responding to demand changes.

HKMY argue that this widening gap between average and marginal emissions rates has important implications for how we evaluate the emissions impacts of our EV policies. They use Biden’s EV target- 50% of new car sales by 2030– as an example. They assume that hitting this target would increase electricity demand in 2030 by ~176 TWh. They estimate the GHG emissions from the grid increase caused by this demand increase using (1) the grid-average emissions rate and (2) their marginal emissions rate estimates, respectively.

GHG emissions increases estimated using their preferred marginal rate are significantly (more than 50 percent ) larger than the emissions increases implied by the average rate. They conclude that using an average emissions intensity, versus the marginal emissions rate, “will produce a significantly over-optimistic forecast of the GHG emissions reduction benefits”.

I really like this paper. But I don’t love this punchline. The marginal emissions rate favored by HKMY is a very precise and credible estimate of how an incremental increase in demand increases electricity sector emissions, holding the structure of the power system fixed. This is the right number for estimating the emissions from charging my Chevy Bolt today. But I’m not convinced that it’s the number we should be using to estimate the emissions implications of charging 50 million new EVs in 2030 and beyond.

An anticipated electricity demand increase of 4-5 percent over the next decade could easily induce new capacity investments and non-marginal operating changes. Anticipating this response- and what it might imply for GHG emissions- requires detailed grid optimization and dispatch modeling. Economists – myself included- are getting queasy just thinking about all the assumptions that this kind of modeling requires. So here’s where the engineers come in.

The Engineers’ Take

The point of departure for this new paper by NREL’s Pieter Gagnon and Wesley Cole is that (1) the power system of tomorrow will look different than today and (2) a significant increase in vehicle electrification will cause power system planners to make additional investments and operational changes. They use a capacity expansion model to predict long-run power system planning and operations under a baseline scenario. They then ask (the model) how system emissions would change with a permanent 5% increase in electricity demand (very close to the total load change used by HKMY).

If we take their projections for how a 5% electricity demand increase will increase emissions as the “truth” – a leap of faith- we can then ask how close we get to this truth using different accounting approaches. In addition to the two approaches considered by HKMY, G&C introduce a third way. They calibrate a “long-run” marginal emissions rate that captures (in a model-based way) how increased demand will change emissions via changes to grid structure and operations.

G&C find that calculations using the base-year average emissions rate get much closer to the “true” (modeled) emissions than the HKMY-endorsed marginal rate because their model predicts that the EV load will induce more investment in zero-carbon generation. Their long-run marginal emissions rate (LRMER) performs best of all. To make a coarse comparison, I used an NREL LRMER to approximate the annual emissions impact of 51 million EVs on the road by 2030. The figure below contrasts these estimates.

Notes: This graph summarizes the estimated annual GHG emissions impact of 51 M EVs – the approximate 2030 target- using HKMY’s estimate of the electricity demand increase (176 TWh). The blue bar uses the 2019 HKMY grid average rate; the red bar uses the 2019 HKMY marginal emissions rate. The green bar uses an LRMER that assumes the NREL “mid-case” scenario.

A caveat with this LRMER approach is that the underlying grid optimization model makes many assumptions about future technology costs, grid operations, etc. For example, it assumes that load increases are perfectly anticipated and optimally planned for. Real-world responses to electricity demand increases will surely be messier. That said, using the marginal rate estimated by HKMY assumes load increases are not planned for at all, which also seems unlikely.

EVs will move multiple margins

A big advantage of HKMY’s approach is that they use real data that capture changes in the actual functioning of the real-world electricity grid. The disadvantage is that their estimates assume that planners and operators and investors do not change their behavior when they see 50 million new EVs coming online. The engineers are more optimistic – or realistic?- about the grid’s ability to optimally plan and respond.

Who’s got it right? It really depends on where we go from here. If we sit idly by as new EVs plug into the grid, the economists’ assumed complacency will bear out, and the climate impacts of vehicle electrification will fall short.

Economists and engineers can agree on the importance of making concurrent investments in a cleaner, greener grid in order to optimize the climate impacts of EV adoption. If we can rally to coordinate cleaner grid investments (renewables and storage!) and operations (demand response and smart charging incentives) in anticipation, realized GHG reductions will get closer to – or even exceed- the engineers’ vision.

Keep up with Energy Institute blogs, research, and events on Twitter @energyathaas.

Suggested citation: Fowlie, Meredith. “If the Grid is Getting Greener, How Can EVs Be Driving Dirtier?” Energy Institute Blog, UC Berkeley, April 11, 2022, https://energyathaas.wordpress.com/2022/04/11/if-the-grid-is-getting-greener-how-can-evs-be-driving-dirtier/

Categories

Source: TechCrunch

Source: TechCrunch

Another way to look at marginal emissions in many states is to factor in the RPS requirements. By 2030: California 60%, CT 44%, DE 28%, HI 40%, IL 25%, ME 80%, MD 50%, Massachusetts 41.7%, MN 26.5%, NV 50%, NM 40%, 70%, UT 25%, VT 75%, VA 30%, DC 100%. Plus others with lower requirements or complications, like price caps.

In Massachusetts, over 40% of my EV marginal energy would come from additional renewables, at essentially zero carbon. With the rest at the mostly gas margin, even assuming no other effect on the supply mix.

I’m not sure how that works out as a net change for gasoline ICE, but it should be a big improvement compared to the chart above.

That would indeed be another way to look at marginal emissions – a way that uses renewable energy credits (RECs) to cut the emissions you’re actually generating in half.

When you’re charging your EV at night in Massachusetts, 40% of the “marginal energy” (whatever that means) with which you’re charging it is never coming from renewables. Never. If your utility sold you the electricity, then bought RECs corresponding to the “renewable attributes” of an equivalent quantity of solar energy generated at a solar farm, the CO2 emitted by the gas plant that generated your nighttime electricity don’t disappear into thin air. Both you and the customer of the solar farm who actually used its electricity are taking credit for those attributes, aren’t you? If not, the solar farm’s customer would have to take responsibility for your emissions – and heaven knows, no solar farm owner is that honest.

FYI, you can download a 2022 Net Energy and Peak Load by Source spreadsheet from ISONE here:

https://www.iso-ne.com/isoexpress/web/reports/load-and-demand/-/tree/net-ener-peak-load

The most recent available month is February ’22. When you charged your EV at night in February, on average:

.46% of your electricity came from wind (less than half of one percent)

5.8% of your electricity came from Canadian hydro

0.0% came from solar

Doesn’t matter how many RECs your traded, collected, or framed and hung on the wall.

In California and other states with (annual percentage of kWh sales volume based) Renewable Portfolio Standards (RPS) and growth of electric load the meta model is fairly simple. e.g. when the RPS is 60% and an average customer gets a new EV that drives 16,000 miles per year on 4,000 kWh of increased kWh sales, the utility is permitted to meet that with up to 40% fossil kWh and no less than 60% renewables while also meeting the rest of their load that same way. The RPS policy percentage sets the long run mix of that much qualifying renewables and the rest can be fossil. Notice it does not matter how much other pre-existing generation types (like fixed large hydro and fixed nuclear a utility had, the RPS is the applicable math governing meeting load growth on the margin (e.g. the load caused by buying EVs and heat pumps).

I think of this as the Policy Margin that drives utility (or CCA) procurement of new renewables.

The Community Choice Energy providers in San Mateo and Santa Clara Counties have 100% carbon free self administered RPS. So the purchase of electrifications like EVs and heat pumps, creates new load that results in new commitments to building new renewables to meet that annual volume with matching annual volumes of renewables.

At the behavioral level we can reduce the short term need for throttling up intermediate and peaker fossil fired power plants by doing more charging in sunny duck belly hours when the CAISO has excess renewables. This is especially true on weekends, so I moved laundry and dishwasher use into those sunny weekends too. I think of this as the Operational multi hour Margin.

This article lacks any meaningful description of what exactly the term it keeps using, “marginal emissions,” really means. And I know why. Because the source article doesn’t usefully describe it either — which is why that source article is junk.

Yes, “marginal emissions” are when you have unusually high demand and have to use peakers.

1. But HOW MUCH energy is coming from peakers?

2. WHAT are the marginal emissions being compared to — to the increasingly cleaner baseload? Because if marginal emissions are being compared to cleaner baseload emissions, then it is plainly wrong to imply that the system is getting dirtier!

3. WHY are they tying increased peaker use to EVs, which rarely charge during the high demand?

And

1. Why the failure to take into consideration that technology is in flight that leads to the reduction in the need for peakers?

2. Why the failure to take into consideration plans already in flight to make baseline even cleaner and reduce the need for peakers?

3. Why the failure to take into consideration that EVs, through V2G at times of high demand, will actually REDUCE marginal emissions?

BAH!!!

Jason, no, “marginal” does not mean “at the highest-load hour.” it means “the last resource dispatched to meet load in each hour, averaged over the hours” either by hour or by load. So these computations include the marginal fuel at night in April.

Sorry Meredith, but the economists get it (closer to) right. The engineers are mxing apples and oranges just as was done for ZEB.

If you want to look at what the average EV (or electric appliance) is emitting in terms of GHG, then using the average of the grid is just fine. So you can use the average to sort out what the impact of your existing EV. But that is a stock characterization question not an evaluation of policy options.

Wen making an economic decision about which car (or appliance) to buy, the impact is at the margin. That is the grid is going to have to marginally increase the amount of electricity it provides by adding capacity. Since almost all available renewables (and nuclear) are already utilized by the grid, that added generation is from fossil fuels–like a gas turbine.

Sure the grid can get greener by building more non-fossil-fueled generation, but that should not be credited towards electric cars (or appliances). It’s as intellectually weak as saying that adding PV to a home improves its efficiency. It is a good thing to make the grid have a lower carbon profile and that should be pursued. The grid may get green over the long term, but adding an EV (or electric appliance) makes it browner.

So to first order buying a new EV is closer to buying a CNG car–at least in terms of carbon. It is still an improvement over gasoline and has potential storage advantages, but the real savings come from changing the grid mix and when evaluating electrification one must include the browning of the grid.

During the early to mid-2000s, I co-authored several studies on the estimation of marginal emissions rates in the electricity sector. You’ll find a good overview of the thinking from that era in this 2007 WRI/WBCSD publication from their GHG Protocol initiative: https://www.wri.org/research/guidelines-quantifying-ghg-reductions-grid-connected-electricity-projects. (See also papers from that era by Murtishaw and Sathaye (LBNL) and Lazarus and Kartha (SEI).) The scenario in the two studies you describe is the converse of the scenarios we were examining, which were aimed at estimating *avoided* GHG emissions rather than induced emissions, but the principles are the same. In those papers we discussed two key concepts, the operating margin (how changes in demand affect the operations of existing plants) and the build margin (how changes in demand affect the construction of new capacity). As a general rule, we assumed that changes in demand affect the operating margin in the short-run and the build margin in the long-run. Basically, both of the papers you discuss could be right, but in different time frames.

Once I moved to the CPUC, this OM/BM framework became the basis of the calculation of emissions avoided by technologies funded by the Self-Generation Incentive Program. One important consideration in calculating the build margin is whether an RPS or similar policy is in place. If so, then the electricity demand avoided or induced should include the percentage of renewable generation required by the RPS targets. If the jurisdiction in question has a cap and trade program in place (acknowledging that California’s cap is susceptible to leakage in the electricity sector), it’s possible that individual measures have no effect on emissions.

Meredith: Good thinking — contrasting the engineer and the economist. For the economist, how are the “grid optimization” requirements for good modeled outcomes mediated by “rate design” (price signals)? Currently EV energy rates are skewed toward night-time charging (gas-fired.) The engineer might say that grid optimizing operations should be commanded and controlled, with cost recovery tracking cost causation of the optimized operation. For the engineer, since the macro outcome (substituting EVs for combustion engines) is commanded, how are costs controlled and recovered (made affordable and equitable)? BillJulian

Meredith, the grid is not getting greener – in 2021 grid emissions were higher for the first time in 15 years, and for many the change was expected:

• The #2 source of CO2 emissions in the U.S., after gasoline, is now natural gas.

• The #1 driver of increased gas consumption is adoption of solar and wind – not “cheap natural gas”.

• Including fugitive methane emissions, gas is responsible for over twice the CO2e (CO2-equivalent) emissions of coal per unit of energy.

• The effectiveness of solar and wind at reducing carbon emissions is inversely proportional to their market penetration, a well-understood phenomenon for which there are no practical workarounds.

• By any knowledgeable assessment overcoming the intermittency of renewables with batteries, or shuttling electricity around the country on a national grid, would be hopelessly impractical.

• Though over half of U.S. states have decided to maintain their nuclear plants or build new ones, California is replacing San Onofre and Diablo Canyon with 9 billion watts of imported coal- and gas-fired generation from plants in Utah and Wyoming. It is conveniently hidden under the heading of “unspecified imports”.

• In recognition of grid reliability problems brought on by adoption of wind and solar, Senate Bill SB 423 has officially labeled any fuel which facilitates adoption of renewables a “firm zero-carbon resource” – including gas, coal, and oil. Yes, it’s official in California – burning coal generates zero carbon emissions.

• The Southern Gateway, a $20-billion transmission corridor, is being built by utility PacifiCorp to enable California to export its emissions to other western states.

• As calls to reconsider closing Diablo Canyon grow louder there are at least 4 pieces of legislation winding their way through the California legislature specifically designed to prevent it by any means possible. They have nothing to do with lowering carbon emissions; they have everything to do with generating 18 trillion watthours of additional energy each year with natural gas and coal, and the $billions in profit it will mean for PacifiCorp parent Berkshire Hathaway Energy.

If readers on Haas’s Energy Institute Blog are tired of reading my pro-nuclear rants, I’m just getting warmed up. Buying electric vehicles without zeroing carbon emissions from power plants will only put a hard limit on emissions reductions when we least afford to do so. Our challenge is not spending more money or developing new technologies, but addressing the dangers of irrational fear and ignorance. In comparison to those, the dangers of nuclear energy are trivial.

Wow. What a lot of nonsense. Clearly a nuclear marketing screed.

1. How do you read the bills language to include fossil fuels, unless they are 100% CCUS:

“Firm zero-carbon resources” are electrical resources that can individually, or in combination, deliver zero-carbon electricity with high availability for the expected duration of multi-day extreme or atypical weather events, including periods of low renewable energy generation, and facilitate integration of eligible renewable energy resources into the electrical grid and the transition to a zero-carbon electrical grid.

2. “over half of U.S. states have decided to maintain their nuclear plants or build new ones.” Which states have done anything affirmative to “maintain their nuclear plants”? NY, IL, CT, NJ. Plus OH as result of bribery, now rescinded.

Build new ones? SC tried, and the utilities building the plant effectively went bankrupt. GA is continuing to allow Southern Co. to poor money into completing Vogtle, but it’s not clear that the additional costs will be recoverable. Wyoming is encouraging a NuScale plant at a retiring coal-plant site. Anybody else?

So maybe 6 or 8 states?

3. Can you estimate the amount of fossil energy that can be imported to California without violating the RPS requirements that are binding on LSEs?

4. Gateway South (you got the name wrong) would connect Utah to Wyoming’s wind resources, as well as gas and coal. It does not connect to California

Paul,

1) Your edit of SB-423’s language, to falsely present it in a pro-renewables light, is noted. The excerpt from 25305.5(b) is not

“…electrical resources that can individually, or in combination, deliver zero-carbon electricity with high availability…”

as you claim, but

“…electrical resources that can individually, or in combination, deliver electricity with high availability…”

That’s a big difference. Any dispatchable fuel (including natural gas) “can individually, or in combination, deliver electricity with high availability…and facilitate integration of eligible renewable energy resources into the electrical grid” – can’t it? SB-423, and your edit, were deliberately written to mislead – to promote the illusion natural gas might serve as a suitable, clean energy substitute for Diablo Canyon, and it can’t.

2) Majority of US states pursue nuclear power for emission cuts

https://apnews.com/article/climate-technology-business-nuclear-power-environment-and-nature-cfb21ab68a9e7005cc08873f2a5a7031

3) RPS requirements only apply to long-term contracts. PacifiCorp’s substantial coal output to California (and that from Intermountain in Utah) are all short-term contracts, mostly concealed by CA utilities under the category of “unspecified imports”.

4) Do you really believe PacifiCorp is building Energy Gateway South (you got the name wrong, too), a 500kV DC transmission line, in hopes of powering the flourishing metropolis of Gunlock, Utah (pop. 210)? Or in coming years, they might extend that line 52 miles to connect to Southern California Edison’s Harry Allen/Eldorado transmission line, and make some return on their investment?

Carl, re SB 423, you’re both right. Sec. 2 of the bill contains Paul’s definition and Sec. 3 contains your definition. The definition of eligible resources changed multiple times throughout last year. The original version of the bill referred to specific technologies such as geothermal and offshore wind. Later versions referred to “non fossil-fuel based” resources. The 09/07 version included the version found in Sec 3 of the chaptered version of the bill, which was finalized on 09/14. My guess is that during that week someone noticed that with all of the changing definitions they had neglected to require that “firm zero-carbon resources” actually be zero carbon and fixed one occurrence but not the other. Regardless, both sections only require the Energy Commission to study such resources, Sec. 2 in a one-off report and Sec. 3 on an ongoing basis in the IEPR. Since the legislative intent is clear, and the resource class is named “firm zero-carbon,” the CEC is obviously not going to study coal or gas a qualifying resource.

Here’s the definition from 25305.5(c): “firm zero-carbon resources” are

electrical resources that can individually, or in combination, deliver

electricity with high availability for the expected duration of multiday

extreme or atypical weather events, including periods of low renewable

energy generation, and facilitate integration of eligible renewable energy

resources into the electrical grid and the transition to a zero-carbon electrical

grid.

It’s a misinterpretation to ignore the portion of this definition that uses the words “zero carbon” to claim that it allows natural gas or even coal to fill this role, especially given the preamble that these zero carbon firm resources are shall be on line in 2045 when all generation is to be 100% carbon free.

As for planned use of nuclear by states, it’s all talk until projects are actually approved and construction is started. There are few to none planned projects so far.

Here’s Amory Lovin’s response published today in Utility Dive on whether nuclear power should be considered in future resource plans:

https://www.utilitydive.com/news/nuclear-energy-should-not-be-part-of-the-global-solution-to-climate-change/620392/

Thanks for the blog post on an important topic! My coauthors and I have a paper on this same broader topic, but with a focus with the interaction with carbon policy. Our empirical results are similar to those by HKMY, although we aren’t looking at trends over time, and we also perform a different projection into the future than the NREL engineers.

Here’s the NBER Working Paper:

https://www.nber.org/papers/w28620

Here’s an ungated version of the working paper:

https://www.cesifo.org/en/publikationen/2021/working-paper/carbon-policy-and-emissions-implications-electric-vehicles

The EVs are three to four times less energy usage per mile on the road than ICE. I charge up my Tesla exclusively in town with my own solar panels. You may not be taking the amount of CO2 used to just produce gasoline. The 3 to 4 times is magnified to 6 to 8 times if the energy used to extract and produce gasoline is included. I consider your analysis as very lacking. Someone else posted an article the EVs are going to bring down the grid. Folks the grid is failing before the EVs even arrive. There is no other option to phasing out the burning of gasoline in cars than to make the switch. Get used to it. Support it.

Gene Preston

https://egpreston.com

Good thinking. Should have mentioned VTG vehicle to grid. Already EV bus charging systems in LA are providing grid services, improving power factor, responding to demand signals. See Apparent.com .

A car charged during excess clean power availability times adds zero carbon and in California such times are often.

You also don’t mention the advent of gen4 innovative nuclear power which tenders such hand winging entirely moot.