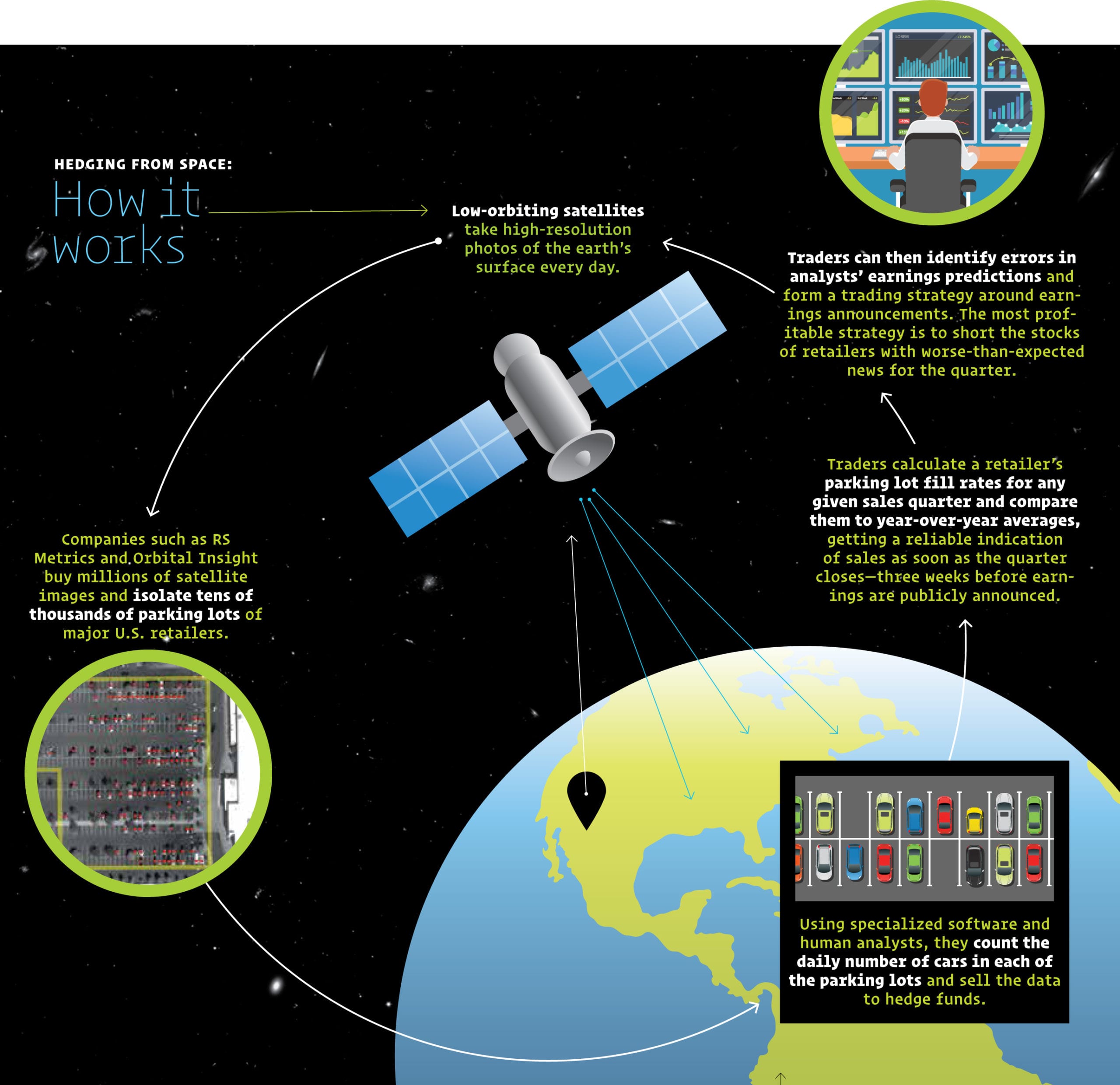

Big data—such as satellite imagery of parking lots—offers investors with deep pockets unprecedented insights. But is it fair?

Hedge funds and other sophisticated traders have been formulating a profitable new strategy in recent years—all thanks to satellite images of retailers’ parking lots.

Berkeley Haas Assoc. Prof. Panos Patatoukas obtained 7.6 million satellite images of 86,000 individual stores across the U.S. owned by 44 major retailers—including Walmart, Target, and Whole Foods—to perform the first independent analysis of the strategy. He and Assoc. Prof. Zsolt Katona determined that by counting cars in parking lots and calculating year-over-year changes, traders can anticipate a retailer’s earnings news and hedge their stock. It takes a substantial amount of money and expertise to process, but there’s a big payout: careful market timing can earn them up to 5% above a typical benchmark return.

For Patatoukas, who is passionate about democratizing access to financial information, the strategy raises concerns about a widening technology-fueled chasm between Wall Street and Main Street investors. We asked him how the rise of big data is changing the game even as investing is more accessible than ever.

What is “alternative data”?

Non-financial information that’s relevant for forecasting financial outcomes and helps investors formulate trading strategies. Usually these are complex, big data sets, such as credit card transactions, website usage, geolocation data, and satellite images.

Sophisticated traders have always sought out any and all information to gain an edge. How is this different?

Until recently, skilled traders like hedge funds had access to the same reports, earnings calls, SEC filings, and other public sources of information as everyone else. Technology is creating new data sources that often require special expertise and funding to access, so the information is out of the reach of regular investors.

Why your concern?

Although hedge funds have been gleaning information from satellite data since 2011, it remains an exclusive strategy and the information is not making it to regular investors. Otherwise we would see price adjustments. We found that individuals are net buyers of the same retailers that the hedge funds are betting against. In other words, these gains come at the direct expense of Main Street investors.