How soaring housing costs in major cities impact the entire nation

The high cost of housing in places like the San Francisco Bay Area and New York affects more than people’s pocketbooks. It’s also stunting economic growth—and not just in these regions but in the nation as a whole. The reason: Fewer people can afford to move to these cities where productivity is much higher.

These and other surprising findings come from a 2019 study in the American Economic Journal: Macroeconomics by economists Enrico Moretti of the Berkeley Haas Real Estate Group and Chang-Tai Hsieh at the University of Chicago.

While productive, the finance- and tech-saturated cities of New York, San Francisco, and San Jose have contributed just 5% of the nation’s economic growth from 1964 to 2009. That’s because of the sneaky way that higher housing costs eat up the high wages in these areas, the economists determined. Meanwhile, 82% of the nation’s economic growth for the period came from 152 cities in the South, the Rust Belt, and other large metropolitan areas.

Here’s the rub: If the highly restrictive housing and land use laws in the most productive cities were relaxed to the level of the median U.S. city, economic output in these regions would be more than 36% higher, and 3.7% higher in the nation as a whole, according to the study’s most conservative estimates. That would translate into a $3,685 raise for each worker in the U.S., they calculated.

Though the data analyzed stopped at 2009, Moretti says that, if anything, “the problem is definitely more acute today.”

No Constraints

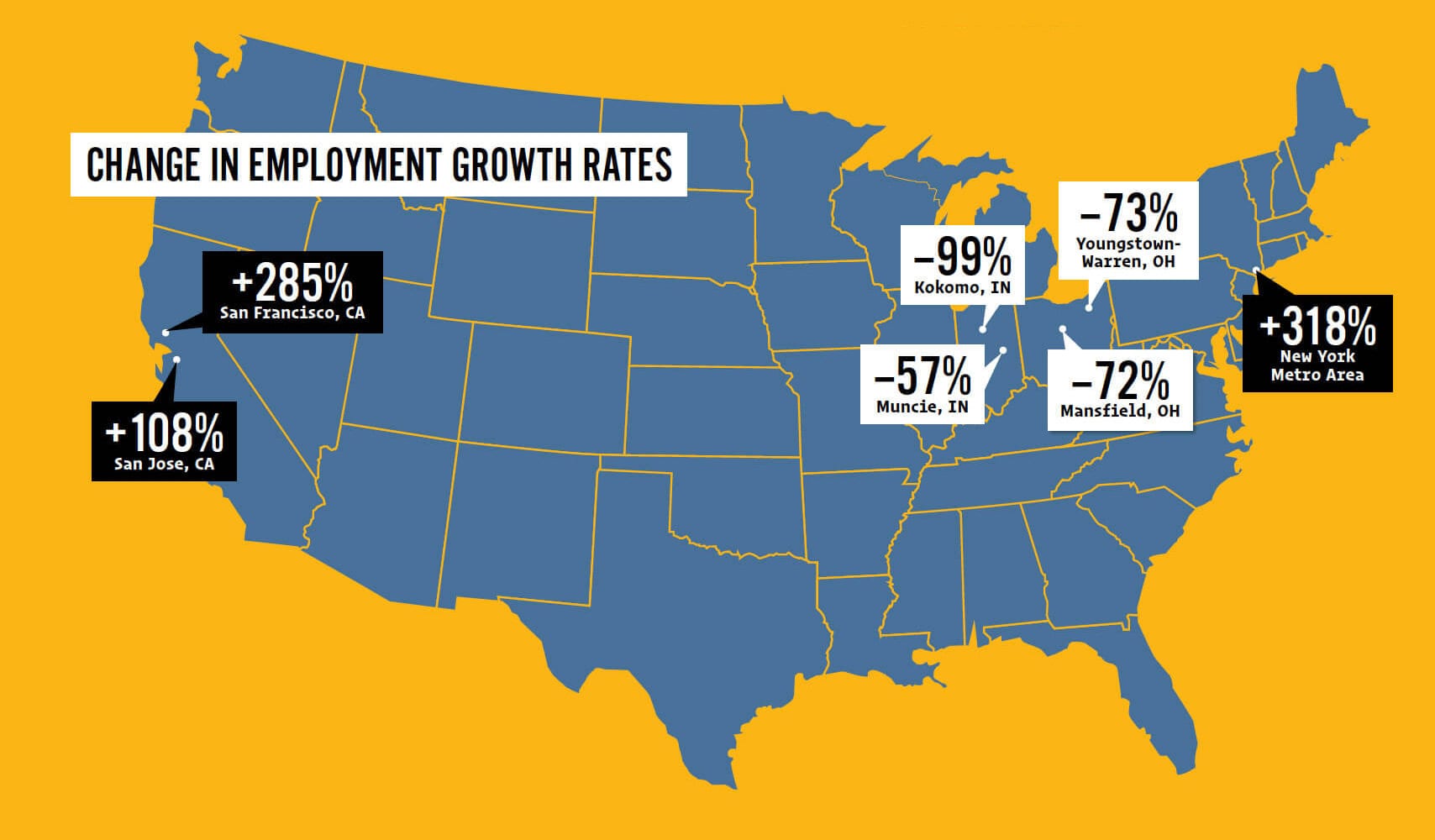

What would happen if housing costs weren’t a factor, and people could move anywhere for a job? Moretti and Hsieh developed a statistical model that showed employment and economic growth would boom in more productive cities currently constrained by stringent land-use laws and shrink in cities with looser regulations.