The High Cost of Nuclear Jobs

Backers see job creation, but I see high costs for ratepayers.

“The project workforce has reached an all-time high with approximately 9,000 workers now on site. With more than 800 permanent jobs available once the units begin operating, Vogtle 3 & 4 is currently the largest jobs-producing construction project in the state of Georgia.” — Georgia Power, Press Release, February 11, 2020.

I understand why Georgia Power is emphasizing the jobs created by the Vogtle nuclear power plant project. Many policymakers, and perhaps even some utility commissioners, view these jobs as a significant benefit. I’m happy for the workers who are employed on this impressive project.

But when I see 9,000 workers on site, and 800 permanent jobs, I don’t see job creation. I see high costs for ratepayers. Electricity bills are already going up to pay for Vogtle.

These higher electricity rates hurt households, particularly lower-income households for whom bills are a larger share of the household budget. Higher electric rates also hurt small- and medium-sized companies and lead energy-intensive companies to move elsewhere.

The broader point is that counting jobs created in one sector misses the overall impact. Promoting labor-intensive energy sources makes energy more expensive if they aren’t cost effective, which leads to lost jobs in other sectors. Energy is an input into almost everything, so making it more expensive hurts the economy and reduces growth.

Not the Time for Economic Stimulus

During a recession, many economists will argue for short-term Keynesian-style economic stimulus. There are times when this makes sense, but now is not one of those times. Despite the recent volatility in the stock market and virus-related uncertainty, the United States is not in a recession. Friday’s job report showed a national unemployment rate of only 3.5%. In Georgia, it is even lower.

What this means is that Vogtle is not creating many jobs. If it weren’t for the Vogtle project, the vast majority of these talented people would be working elsewhere in the economy. They would be somewhere else, doing some other job, creating value in another industry. When we employ workers in one place, we give up the gains we would have enjoyed from them working elsewhere. This is the opportunity cost of labor, and during good economic times, the opportunity cost is high.

There is also a fundamental mismatch between multi-year projects like this and fiscal stimulus. For fiscal stimulus you need jobs that can be quickly deployed at the right moment, and then pulled back when the economy starts to recover. Nuclear projects aren’t like that.

Unusually Labor-Intensive

Perhaps I’m being unfair in singling out nuclear. There is a tendency across energy sectors to talk about job creation. Not coincidentally, job creation tends to be discussed more often in relatively labor-intensive sectors (like rooftop solar and weatherization), than in less labor-intensive sectors (like grid-scale renewables).

But the labor costs for nuclear are striking. The sheer scale and complexity of the Vogtle project requires an unusually large labor force, many of them highly-skilled, highly-specialized engineers. These high labor costs are one of the reasons why it costs so much to build a nuclear power plant.

Perhaps even more striking are the ongoing labor costs. Georgia Power anticipates 800 permanent jobs at Vogtle once the new units are operational. A natural gas combined cycle plant of similar generation capacity would employ less than 100. That is a big difference. Nuclear power is not only capital-intensive, but it is also labor-intensive.

What About The Future?

Can we view the Vogtle project as an investment in human capital? Will the skills learned on the job at Vogtle position U.S. workers on the vanguard of a growing market? Could this investment be a way of moving the entire economy to a different equilibrium path?

Maybe, but I doubt it. The Bureau of Labor Statistics doesn’t see bright prospects for U.S. nuclear engineers. There are dozens of nuclear reactors currently under construction worldwide, but only Vogtle 3 & 4 in the United States, and it’s not clear whether U.S. workers and U.S. firms will be able to leverage their experience at Vogtle to join these international projects.

It seems more likely that the primary legacy of Vogtle will be higher electricity rates. Ratepayers will be paying for this $25+ billion project for a very long time. Higher electricity rates will raise the cost of doing business for everyone, leading to fewer jobs throughout the economy. Just because it is harder to point to these jobs in a press release doesn’t mean they are any less real.

Keep up with Energy Institute blogs, research, and events on Twitter @energyathaas.

Suggested citation: Davis, Lucas. “The High Cost of Nuclear Jobs” Energy Institute Blog, UC Berkeley, March 9, 2020, https://energyathaas.wordpress.com/2020/03/09/the-high-cost-of-nuclear-jobs/

Categories

Lucas Davis View All

Lucas Davis is the Jeffrey A. Jacobs Distinguished Professor in Business and Technology at the Haas School of Business at the University of California, Berkeley. He is a Faculty Affiliate at the Energy Institute at Haas, a coeditor at the American Economic Journal: Economic Policy, and a Research Associate at the National Bureau of Economic Research. He received a BA from Amherst College and a PhD in Economics from the University of Wisconsin. His research focuses on energy and environmental markets, and in particular, on electricity and natural gas regulation, pricing in competitive and non-competitive markets, and the economic and business impacts of environmental policy.

In social project evaluation, jobs are a cost, not a benefit. If there is substantial unemployment, that enters in as a slightly lower social cost of labor, but it’s still a cost. And if nuclear fails a social cost-benefit test (including the benefits of avoided pollution), how do you explain why a private company chose to take it on, when private evaluation would only be worse? Is there a sort of “green Averch-Johnson effect” in play? If you just convince the regulator that your project is “sustainable,” maybe they will allow it (along with higher rates), thereby increasing your profits even though the project is inefficient.

Without knowing much about the background; is there not some valuing retaining the nuclear knowledge that us part and parcel of a major project like that?

The UK had great nuclear expertise and lost it – the new generation plants are being built by the French and Chinese.

Lucas, this is a nice perspective.

Remember that nuclear is a lot like wind and solar: a lot of the power produced costs at times when the grid has little need for it. In order to be really useful, all three technologies need storage. Wind and solar because they are not always there. Nuclear because it runs at full output even during low-demand periods. For example, when the Diablo Canyon plant was built in California, PG&E also built the Helms Pumped Storage facility … in order to store the overnight production of Diablo Canyon for later use. Modern wind and storage plants are also being built with storage — and consistently being acquired by utilities for less than half the cost of nuclear WITHOUT storage.

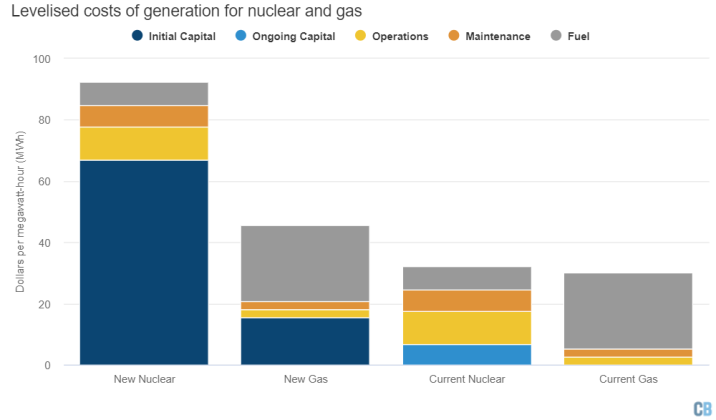

I would have found it more useful had you used Lazard 12.0 as your source for cost comparison, as it includes wind, solar, and other alternatives. The nuclear costs that you show were generic, and do not reflect the $28 billion cost of Vogtle (nor the massive consumer investment in Vogthe, through CWIP payments). Lazard shows all of its work, so it’s easy to make adjustments for a localized analysis.

https://www.lazard.com/perspective/levelized-cost-of-energy-and-levelized-cost-of-storage-2018/

For perspective, the following ranges:

Nuclear: $112 – $189

Coal: $60 – $143

Gas Combined Cycle: $41 – $74

Wind: $29 – $56

Utility-Scale PV: $36 – $46

Residential PV: $160 – $267

“Lazard shows all of its work, so it’s easy to make adjustments for a localized analysis.”

Jim, Lazard manages funds invested in solar and wind farms worldwide. Check out the Lazard Global Sustainable Equity Select Fund (LZGEIU), or the company’s 2019 SEC application to exempt it from regulations designed to protect independent investors from conflicts of interest within the company:

“[Lazard] states that the investors in each Fund will have been fully informed of the possible extent of such Fund’s dealings with Lazard and of the potential conflicts of interest that may exist.”

https://www.federalregister.gov/documents/2019/12/09/2019-26407/lazard-asset-management-llc-and-lazard-esc-funds-llc

What would lead you to believe Lazard’s “analysis” is anything more than advertising, designed to enhance the value of investments of both professional clients and Lazard employees?

Lazard’s analysis is comparable to many other analyses, including the CEC’s Cost of Generation report, and even EIA reports.

https://ww2.energy.ca.gov/almanac/electricity_data/cost_of_generation_report.html

Not surprising, but apparently you don’t read your own references: there is no LCOE for nuclear in CEC’s Estimated Cost of New Utility-Scale Generation in California: 2018 Update.

That the California Energy Commission conspicuously ignores nuclear isn’t surprising, either. Commissioners have largely served as a rubber stamp for California’s natural gas industry, shamelessly accepting lucrative “consulting” work for gas clients despite multivarious conflicts of interest. After all, an accurate assessment of nuclear’s costs, one that doesn’t depreciate plants on the wasteful 30-year timescale required for wind and solar farms, might apply brakes to CEC’s rush to consign Diablo Canyon to oblivion. It shows nuclear to be the least expensive method of generating clean, dispatchable electricity – by far:

“While it is expensive to build a nuclear plant, the fuel costs are low and the capacity factor high, so the longer it operates the cheaper it becomes. Similarly for wind and solar, expensive to build but no fuel means the longer they are operating the cheaper they become. On the other hand, the longer fossil fuel plants operate the more expensive they become because it is all about the fuel.”

These costs are for the entire life-span of the units, after running them to death. These costs are separate from investments, taxation, subsidies, loan structure, and other costs that are associated more with pricing and financing than with what the actual costs are to produce that energy.

Costs not captured include electrical grid upgrade, connectivity of renewables and buffering of their intermittency by rapid cycling of fossil fuel plants as presently practiced in this country, and non-carbon-tax externalities such as pollution and health care costs associated with energy sources, especially for coal.”

The Naked Cost of Energy: Stripping Away Financing and Subsidies

https://www.forbes.com/sites/jamesconca/2012/06/15/the-naked-cost-of-energy-stripping-away-financing-and-subsidies/

EIA agrees: the higher cost of labor at a nuclear plant is more than offset by a minimal cost of fuel, making nuclear plants 34% cheaper than coal plants and 27% cheaper than renewables + gas to run on a daily basis:

https://www.eia.gov/electricity/annual/html/epa_08_04.html

Your attack on Lazard was a broadside on all of its cost estimates, not just nuclear. I was pointing out that the work for the CEC was consistent with Lazard for the technologies that overlapped. So the point is that Lazard does not appear to show the bias that you claim. If you can show other recent estimates (not from 2010) that differ substantially from Lazard’s then you can try to make your case.

As I have told you specifically on this site several times, we conducted analysis of nuclear costs for the 2009 and 2014 updates. Those were not published because the costs were so high that the CEC staff deemed the technology not feasible. In addition, new nuclear is banned from California by state law.

I’m not attacking Lazard, I’m pointing out an undeniable conflict of interest. If Lazard employees stand to profit by promoting renewable energy, there a possibility their analysis could be influenced by monetary gain. That’s a fact.

Who paid you to perform your cost analysis of Diablo Canyon? I ask, because if it was an entity which stood to gain by closing the plant (or keeping it open) your analysis would immediately become suspect. That’s the reason reputable analyses aren’t commissioned by entities with a financial interest in the results. It’s why MJ Bradley’s analysis, and the “Joint Proposal” made up of parties hand-picked by PG&E, were garbage.

“Those were not published because the costs were so high that the CEC staff deemed the technology not feasible.”

Either that, or

“The study reported the costs were unrealistically high so PG&E could win CPUC approval to bury Diablo Canyon after capital cost recovery was complete.”

Since California Public Utility Code requires all CPUC decisions to be “in the public interest”, there’d be no reason not to publish an accurate study, regardless of the result. It would deserve to see the light of day – and especially, to be shared with ratepayers. Wouldn’t you agree?

Are you saying that ratepayer groups cannot provide an analysis of the costs of nuclear plant because they stand to gain from lower rates if the plant is too costly compared to alternatives? Because that’s who I did the analysis for, several times. None of my analyses were conducted for parties that stood to gain in other ways financially. And we have found that the Lazard analyses were in line with ours and other sources that we reviewed. Your suggestion of bias by Lazard is an attack on their analysis.

Don’t confuse the CEC, who I did the COG report for, and the CPUC. They have different informational and regulatory roles. I suggest that you research those roles before you comment further.

I don’t know, I’d have to know what ratepayer groups paid your bill, especially since you don’t seem to want to name them. Isn’t it in the public’s interest to know who’s financing research recommending the elimination of 22% of Caliifornia’s clean energy?

Both Peevey & Weisenmiller had known ties to California fossil fuel interests. Like Lazard, there have been ongoing COIs for decades – from the top down.

Jerry Brown’s Secret War on Clean Energy

http://environmentalprogress.org/big-news/2018/1/11/jerry-browns-secret-war-on-clean-energy

To paraphrase Upton Sinclair: “It is difficult to get anyone to appreciate the value of nuclear energy, when his salary depends on his not appreciating it.”

Jim,

Nuclear plants per se DO NOT require storage if their total capacity within a control area can be fully accommodated at the system’s diurnal minimum loads. Pumped storage was coupled with nuclear plants to allow overbuilding the capacity and, more recently, to facilitate the arbitrage of day – night energy prices.

This starkly contrasts with renewables, which produce output on a random, intermittent basis, this need storage to compensate for this randomness. In addition, renewables suffer from a serious seasonal cycle (at least at CONUS latitudes) which requires either a massive amount of storage or roughly installing double the renewable capacity needed to meet the summer load so it can meet the winter load.

To argue that there is some parity between nuclear plants and renewable resources is misleading.

Now let’s turn to Lazard’s LCOE estimates. You are correct in stating that they are transparent in stating the underlying assumptions. But how many people look at those assumptions? And of those that do, how many have the knowledge to understand what they are looking at?

Here is one example. Lazard’s levelizes a resource’s capital costs using the weighted average cost of capital for a typical developer. That WACOC includes the effects of income taxes imposed on the equity return. While that’s appropriate for calculating the PPA price the developer requires to fully recover his upfront investment in the project, it is not appropriate for evaluating the project’s cost from a societal perspective. Why? Because income taxes are not true resource costs, rather they are transfer payments from the PPA off-taker to the state and federal governments. Furthermore, the Miller-Modigliani principle of finance informs us that in the absence of income taxes changing the debt-equity ratio has no effect on the value of the WACOC.

Lazard’s does appear to recognize that comparing energy resources from a societal perspective requires backing out all of the government subsidies because it calculates LCOEs on both a subsidized and unsubsidized basis by backing out the effects of the ITC (and the TPC for wind). However, Lazard’s fails to recognize that income taxes imposed on equity returns, but not on debt returns, produces a further subsidy for projects heavily financed with debt.

No, it is not easy to adjust Lazard’s estimates to reflect reality.

Trying to chase down all of subsidies and market distortions is impossible. I’ve tried this in earlier versions of the CEC’s Cost of Generation report: https://ww2.energy.ca.gov/almanac/electricity_data/cost_of_generation_report.html. You are also making the historic assumption that markets have few other imperfections, which is very far from the truth, and why we have governments in the first place. (Your presumptions about finance theory also are incorrect–just spend some time looking at utilities’ WACC vs market returns and the extreme divergence over the last 8 years, as I did in submitting testimony in California.)

Richard,

Exactly where are my “…presumptions about finance theory…” incorrect? My comment was based on the Miller-Modigliani proposition I. Where do you think these two economists got it wrong? You do know that Modigliani was awarded a Nobel for this work, don’t you?

It is true that subsidies permeate our economy. That doesn’t mean we should simply throw up our arms and ignore them. All subsidies are not equal. It is worth identifying the large ones and adjusting for them. I’m sorry to hear that you were unsuccessful in your work for the CEC – itself a huge font of energy subsidies.

And were I to “…spend some time looking at utilities’ WACC vs market returns and the extreme divergence over the last 8 years…” what would I find? That the actual returns of utilities differed from the respective WACCs? That’s not uncommon as it is an artifact of the regulatory treatment the utility receives.

Back in the late 1960s (or early 1970s, I forget) Professor Ezra Solomon (Stanford GSB) published an article in the Bell Journal of Economics that pointed out that the diversity between a regulated utility’s book value and market value was entirely determined by the difference between its cost of equity capital and the rate of return on equity that it was allowed to earn.

MM’s capital asset pricing model has been shown not to match empirical market metrics. I showed yet another example in my testimony. It’s a useful conceptual framework, but it doesn’t work well in practice due to many market imperfections.

You haven’t shown that the renewable subsidies are “large” relative to anything else. And it’s not only subsidies that create market imperfections and failures. You called for a two corrections and then concluded that was sufficient. There are many other subsidies, and you can start with the fossil and nuclear subsidies as well, but that’s far from the end.

The artifact of regulatory mechanisms that you cite is just another example of a large market imperfection that distorts the “efficient” societal outcome. But as has been shown, achieving a partial equilibrium efficient outcome does not assure an efficient general equilibrium. You have to fix everything, not just small parts at the margin to achieve the result you’re aiming for.

Richard,

“MM’s capital asset pricing model has been shown not to match empirical market metrics. I showed yet another example in my testimony. It’s a useful conceptual framework, but it doesn’t work well in practice due to many market imperfections.”

It sounds like you are confusing the Capital Asset Pricing Model (CAPM) with the MM proposition. Can you email me a copy of your testimony? Send it to rborlick@borlick.com.

“But as has been shown, achieving a partial equilibrium efficient outcome does not assure an efficient general equilibrium. You have to fix everything, not just small parts at the margin to achieve the result you’re aiming for.”

Well now you are on the “second-best” argument, which was exhaustively discussed in the 1970s. If you really believe you have to “fix everything” you will be paralyzed into doing nothing.

Fred Kahn rejected that conclusion and asserted that we should do the best we could with the information we have, including the price cross-elasticities for close substitutes and complements (eg., natural gas vs electricity).

All modern capital pricing theory are closely linked.

You are asserting that making just those two fixes make up most of the flaws in the markets. You haven’t demonstrated that, and a small change in partial equilibrium does not prove that you have gotten to a better solution in general equilibrium. In addition, a dynamic solution can differ substantially from a static solution. The latter is too often plagued by status quo bias.

Richard, you are sounding more and more like a lawyer than someone trained in economics and finance.

“All modern capital pricing theory are closely linked.”

Closely linked? Exactly what is the close relationship between the MM proposition (which asserts that capital structure doesn’t affect the entity’s cost of capital except for the subsidy provided to debt financing) and the Capital Asset Pricing Model (which establishes a causal relationship between an entity’s cost of equity capital (ROE) and the covariance between the entity’s ROE and the ROE of the total market (or a close proxy such as the S&P 500 index) plus the riskless interest rate)?

Incidentally, my earlier comments I never brought up CAPM – you did.

“You are asserting that making just those two fixes make up most of the flaws in the markets. You haven’t demonstrated that, and a small change in partial equilibrium does not prove that you have gotten to a better solution in general equilibrium. In addition, a dynamic solution can differ substantially from a static solution. The latter is too often plagued by status quo bias.”

My earlier comments never explicitly addressed the issue of partial vs. general equilibrium solutions or the static vs. dynamic dimension. All I said was that, from a societal perspective, we should be comparing the LCOEs of competing alternatives after we strip out their respective subsidies.

I agree, that accounting for all of the subsidies is virtually impossible because the effects of income taxes affects the prices of all of the input resources that go into construction each resources, as well as in the prices of the fuels they consume and their non-fuel operating costs. However, these are not all of the same order of magnitude and very likely much less than the investment tax credit or the production tax credit that renewables receive.

Lastly, just because the subsidy issue is difficult to unravel does not mean we should simply ignore it. That’s a cop-out (as we used to say when I lived in California during the golden age of the 60s).

Then show that the subsidies to non renewables are of a smaller magnitude, rather than simply making an assumption (be sure to include the environmental damages that occur to public goods). And my point is that there are many other market failures that distort prices that cause a divergence from an “efficient” outcome. I assert instead, focus on what are the actual financial outcomes rather than on an unachievable hypothetical outcome. Economists have focused too much on the “efficiency” Holy Grail while ignoring the many other impacts that policymakers and citizens actually care about.

Piece of cake.

“Over the past six years, 2011 through 2016, renewable energy received more than three times as much help in federal incentives as oil, natural gas, coal, and nuclear combined, and 27 times as much as nuclear energy.”

Analysis of U.S. Energy Incentives, 1950-2016

https://www.nei.org/resources/reports-briefs/analysis-of-us-energy-incentives-1950-2016

It’s not even close.

Yep, let’s ignore the huge subsidies to fossil fuels over the last century that has led to its current low cost of production, and the defense industry spending on nuclear weapons that directly subsidized power generation. Oh, and let’s ignore the need to provide federally-subsidized insurance to nuclear plants because they are uninsurable from private source. You’re cherry picking (and what about the clear financial interests of the NEI that should disqualify them due to their obvious bias?)

“Yep, let’s ignore the huge subsidies to fossil fuels over the last century that has led to its current low cost of production, and the defense industry spending on nuclear weapons that directly subsidized power generation. Oh, and let’s ignore the need to provide federally-subsidized insurance to nuclear plants because they are uninsurable from private source….”

Richard, the past subsidies – the defense industry development of nuclear reactors, in particular – are sunk costs. They should play no role in or choices between nuclear and renewables today.

However, your other point, re subsidized insurance for nuclear plants, is a valid one and I have in the past asked myself how would one place a monetary value on it (but never went any further).

Since technology subsidies are intended to be dynamic measures that boost a particular choice, so called “sunk costs” do matter. That fossil fuels now have a resource advantage matters. Claiming that we somehow can come to an “efficient” outcome if we just ignore what has happened in the past that gives an advantage to a certain group is naive and strongly endorses status quo bias.

“Since technology subsidies are intended to be dynamic measures that boost a particular choice, so called “sunk costs” do matter. That fossil fuels now have a resource advantage matters. Claiming that we somehow can come to an “efficient” outcome if we just ignore what has happened in the past that gives an advantage to a certain group is naive and strongly endorses status quo bias.”

Richard,

Achieving an efficient outcome is a conditional state based on what exists today – not with what you think would be a better starting point if you could go into the past and undo prior decisions. You may wish that prior resource allocation decisions were made differently and that what exists today is inequitable but that’s an argument a lawyer, not a competent economist, would make.

I repeat: from an economic efficiency perspective sunk costs are irrelevant. From time to time we all make silly statements. I urge you to rethink your aforementioned comment.

“You may wish that prior resource allocation decisions were made differently and that what exists today is inequitable but that’s an argument a lawyer, not a competent economist, would make.”

That is your ideological position about what economists can contribute to. You would argue that economists can say nothing about the distribution of wealth, yet that is the most salient point that policymakers ask of us. I profoundly disagree with your opinion (not factual) on what we can discuss. Ignoring initial resource allocations is a false god for economists in looking for policy recommendations. Yes, you can choose to continue to be irrelevant (and to protect the status of the wealthy since “sunk” allocations don’t matter), or you can engage in the dynamic nature of the economy and point out where past policy missteps and even outright theft have led to resource misallocations today.

“That is your ideological position about what economists can contribute to. You would argue that economists can say nothing about the distribution of wealth, yet that is the most salient point that policymakers ask of us. I profoundly disagree with your opinion (not factual) on what we can discuss. Ignoring initial resource allocations is a false god for economists in looking for policy recommendations. Yes, you can choose to continue to be irrelevant (and to protect the status of the wealthy since “sunk” allocations don’t matter), or you can engage in the dynamic nature of the economy and point out where past policy missteps and even outright theft have led to resource misallocations today.”

Richard,

If you want to be an advocate pontificating on the issue of what is fair and whose ox deserves to be gored, that fine. Lawyers do that all the time and often change their tune depending on which client they are representing.

However, if that’s you want to do for a living you shouldn’t be presenting yourself as an unbiased, expert witness. That constitutes intellectual dishonesty.

Robert, we have a fundamental disagreement about the role that the economics profession fulfills. Professional journals are now filled with articles about the impacts on and of equity. Answering the question of distribution of outcomes is not solely the role of lawyers.

“Robert, we have a fundamental disagreement about the role that the economics profession fulfills.”

Richard, we finally agree on something. Yes, we have fundamentally different views on the role of economists.

“Professional journals are now filled with articles about the impacts on and of equity. Answering the question of distribution of outcomes is not solely the role of lawyers.”

I never said that economists cannot address distribution issues – so long as they do so in a descriptive manner. That is different from taking an advocacy position regarding what is fair. Once you get into making value judgments your credentials as an economist and expert witness adds no credence to your observations. Incidentally, as you well know, you are hardly alone in crossing that line.

And this equally valid analysis which shows $20B in fossil fuel subsidies annually. https://www.vox.com/energy-and-environment/2017/10/6/16428458/us-energy-coal-oil-subsidies

Far be it from me to defend fossil fuel in 2020. But on a dollars-to-megawatt basis, money has been spent several orders of magnitude more effectively on developing efficient extraction and refining techniques for oil, than on the pitiful ROI from intermittent, unpredictable solar and wind. When a customer plops down $30G on a new car or truck, they need to be transported at their own initiative. You know, when a woman is ready to give birth, or when someone’s spouse is having a heart attack (it’s why we don’t have cars with sails on top of them)?

“…and the defense industry spending on nuclear weapons that directly subsidized power generation…”

Research into an atomic bomb and nuclear power began as twin projects in England, under the auspices of a group scientists known as the MAUD Committee, at the Universities of Birmingham, Bristol, Cambridge, Liverpool and Oxford. It was partly funded by a chemical company, but mostly by the universities themselves. No government subsidies. As interest in both applications grew, it became readily apparent this newfound, abundant source of energy had multiple applications. Now, I have no idea what you mean when you claim “spending on nuclear weapons that directly subsidized power generation,” but there’s no doubt technology and research was shared between programs for nuclear weapons and power generation. Why wouldn’t it be?

Conversely, no substantial amount of photovoltaic solar technology has been shared between military and civilian realms, for the simple reason it’s not that useful in either. Why would it be?

“Oh, and let’s ignore the need to provide federally-subsidized insurance to nuclear plants because they are uninsurable from private source.”

Is your source for this information a Greenpeace handout somebody gave you in a Trader Joe’s parking lot? Every nuclear plant in the U.S. has private insurance – it’s a requirement:

“Currently, owners of nuclear power plants pay an annual premium for $450 million in private insurance for offsite liability coverage for each reactor site (not per reactor). This primary, or first tier, insurance is supplemented by a second tier. In the event a nuclear accident causes damages in excess of $450 million, each licensee would be assessed a prorated share of the excess, up to $131.056 million per reactor. With 98 reactors currently in the insurance pool, this secondary tier of funds contains about $12.9 billion.”

https://www.nrc.gov/reading-rm/doc-collections/fact-sheets/nuclear-insurance.html

Because the first tier of coverage has never been exceeded, insurance on U.S. nuclear energy, in its entire existence, has never been “subsidized” by one dime of taxpayer money.

This information is easy to find for people who want to know. But somehow, I seem to end up debating quasi-religious zealots who really don’t want to know. Why wouldn’t they want to know? I don’t know, and I really don’t care.

Solar PV got a big boost from NASA due to its usefulness in space travel and satellites. The cumulative subsidies to fossil fuels, especially when we account for the unpaid environmental damages that have led to our current global crisis, are tremendous.

If you don’t understand how Price-Anderson works and how it greatly subsidizes insurance rates that would otherwise be paid for by nuclear plants, then we really can’t discuss this further.

I’ll leave it to others to judge relative zealotry. I’ll point out again that I was on the side that supported retirement of Diablo Canyon, and only one party opposed it–yours.

“If you don’t understand how Price-Anderson works and how it greatly subsidizes insurance rates that would otherwise be paid for by nuclear plants, then we really can’t discuss this further.”

I thoroughly understand Price-Anderson. That it greatly subsidizes insurance rates, in any way, shape or form, is a lie, and the only reason you “really can’t discuss this further.”

You can argue with a number of academic studies that show the industry is subsidized, e.g., this one. https://www.cato.org/sites/cato.org/files/serials/files/regulation/2002/10/v25n4-8.pdf

Anyone who considers a Cato Institute screed a “study” might even believe global warming began in 1975:

“Global warming is indeed real, and human activity has been a contributor since 1975.”

https://www.cato.org/research/global-warming

Again, anyone who disagrees with you must simply be wrong….

If you have a problem with the Cato study, please be specific in you criticism. Simple dismissal doesn’t further anyone’s understanding of the issues.

That the right-wing, pro-business Cato Institute might view renewables+gas as a worthy vehicle for exploitation is nearly as predictable as CEC bureaucrats with longstanding financial ties to California’s natural gas industry doing the same.

None of the propaganda they’ve produced is worthy of peer review or being classified as academic (“relating to education and scholarship”), though I suppose in some perverse interpretation it can be considered “educational”. I’m as free to dismiss propaganda from Cato as that from Solar Unlimited, Cosmic Solar, Inc., Sol R Us Electrical Engineering, or any of the other entities hungering for a piece of Diablo Canyon’s energy pie. And I do. : )

That was one of several studies, includinng in peer reviewed journals that came to the same conclusion.

Richard,

You have evaded my earlier question re the CAPM model vs, the MM proposition. I get the impression that you not understand these very different financial concepts – which is ok. However, if that’s the case, admit it, rather than going off asserting that my “presumptions about finance theory also are incorrect.” Show me where I am wrong.

In the 2014 Cost of Generation report we show how differences in financial structure changes the costs of technologies. The financial parameters were drawn from an industry survey of power project financing firms.

Was the 2014 Cost of Generation report an academic study appearing in a peer-reviewed journal? Or was it commissioned by a private entity, with a vested interest in the result?

Really??? Have you not been paying attention through all of these discussions? As I have repeated, it was done by the California Energy Commission and I was a consultant to the staff. They had no vested interest in the outcome, unless you believe that the government always has some conspiracy going on. I’ve posted the link several times here.

Really??? You believe former California Energy Commission Chairman Robert Weisenmiller, co-founder of MRW Associates, which boasts of its “singular focus on power and gas markets”, that it’s “ideally placed to help clients take advantage of the changes in market structure and industry regulation”, would have no interest in opening up 18 trillion watthours of electricity to natural gas interests? That it might compromise his ability to simultaneously serve the best interests of the people of California?

https://www.mrwassoc.com/about-our_firm.php

His position as CEC Chairman would certainly have made Weisenmiller “ideally placed,” wouldn’t it? Not a conspiracy, but a garden-variety conflict of interest – a distinction which inexplicably confounds you.

Weisenmiller no longer has any financial interest in MRW. He sold his partnership share when he moved to the CEC. Please show clearly how he personally would benefit financially from closing nuclear plants.

Please show clearly how Weisenmiller couldn’t have benefited in advance of his divestiture.

Weisenmiller wasn’t in a decision making position before he divested his interest in MRW. His sale of his partnership share occurred as he became a CEC commissioner. I’m not sure what decisions you are referencing that occurred before then.

I’m surprised I have to mentioned this, but if we are talking about the long run, shouldn’t we add in some discussion of carbon taxes and the social cost of carbon (SCC)? For example, in this Sept. 24, 2018, Nature Climate Change article, the authors estimate the global median SCC is US$417 per tonne (metric ton or 2,204 lbs.), or 18.9 cents per lbs: http://www.nature.com/articles/s41558-018-0282-y

According the the US. Energy Information Administration (EIA), one KWh of electric generated with natural gas produces 0.92 lbs. of carbon dioxide: http://www.eia.gov/tools/faqs/faq.php?id=74&t=11

Combining the two figures produces a figure for SCC of 17.4 cents per KWh of electricity produced with natural gas. The SCC for a KWh or nuclear electric power is far lower, while the one-time amount of CO2 produced in construction is much higher for nuclear, due mostly to the large amount of cement used to build a nuclear power plant. Perhaps I’m wrong, but I think incorporating SCC would tip the scales in favor of nuclear power.

Michael – in various incarnations other states have adopted Zero-Emission Credits (ZECs). They work as sort of a carbon-tax-in-reverse: instead of punishing consumers for emitting carbon, they reward electricity generators for emitting none, with a percentage credit charged to ratepayers on each bill at a rate corresponding to EPA’s Social Cost of Carbon.

Ohio’s version (HB-6), passed last year as part of a sweeping overhaul of emissions goals, eliminated the state’s Renewables Portfolio Standard (RPS) entirely. Instead of renewables being awarded “credits” for generating electricity whether it was needed or not, generators were rewarded with ZECs for clean generation that powered Ohio only when it was needed.

The outcry was immediate – and continues to this day, with ongoing litigation and challenges (all have been defeated) sponsored by natural gas and renewables interests. After 12 years of Ohio’s RPS, and $billions in payments charged to ratepayers, it had increased the renewables share of Ohio electricity by only 3% – and residents had had enough. Though solar and wind farms are entitled to Ohio’s ZEC just like nuclear, ZECs can’t be traded – so excess solar electricity generated at noon can’t be magically applied to dirty generation after the sun goes down. In essence, they’re suing the state because they’re now being paid what their intermittent, variable generation is worth, and it’s not worth as much as they thought it was.

Much to the dismay of solar/gas interests here, ZECs are coming to California – sooner, than later.

Michael,

You are not wrong. We need to account for the social cost of carbon when comparing generation resources.

That said, I’m surprised at the high figure the authors you cite came up with. In contrast to their $417 per tonne, in 2016 the US Interagency Working Group on the Social Cost of Greenhouse Gases produced median annual estimates for 2020 to 2050, ranging from US$30 to US$70 per tonne. However, the methodologies used to produce these estimates are rather speculative.

Whatever the right number is, both new and existing nuclear plants should be getting credit for avoiding these costs. In particular, we should be making every effort to keep our existing nuclear plants in service as long as is safely possible. Their construction costs (and the related SCC costs) are sunk at this point in time and have no relevance to whether they operate or are retired.

I think the decision to close Diablo Canyon should be revisited and given explicit credit for avoiding GHG emissions. To claim that the energy and capacity that it now provides will be replaced by conservation, storage and renewables is magical thinking. The replacement resources will be gas-fired generation.

Paul,

Gene is NOT talking about merchant nuclear plants. What he described are plants that enter into long-term contracts with large customers, or communities, that wish to hedge their future costs of electricity.

One only needs to look at studies of what is likely to happen to electricity prices as renewables penetration increases. In order to maintain supply reliability the renewables will have to be overbuilt to accommodate the seasonal cycle and/or massive investments in storage or gas-fired peakers that run only a few hours per year when renewable energy output drops to near zero (a common phenomenon for wind energy, as we see happening in California and Texas).

Frankly, I don’t see how we will reach zero-emissions by 2045 or 2050 without a fleet of new generation of nuclear power plants. If you do I would like to see the studies upon which you are basing that conclusion. And please, don’t cite Jacobson’s work. It has been debunked.

Entering into a PPA with an entity other than a utility for direct sale is the definition of a merchant power plant.

Well, Richard, you got me there.

I tend to think of a merchant plant as one that either sells into the spot market or enters into successive short-term contracts with buyers. Based on discussions with Gene Preston, had in mind a long-term PPA that allowed the nuclear plant to substantially recover its capital investment through the life of the PPA (and which would allow the developer to get debt financing). That’s a fundamentally different situation than the existing nuclear plants are in.

Correct. Power plants fall into 2 categories–utility owned that are ratebased and costs recovered on a fixed basis largely regardless of performance and for which ratepayers bear the brunt of risks, and merchant that deliver through PPAs or short term market transactions based on plant performance, and in which investors bear a higher share of risk than UOG owners.

I was not thinking of a merchant plant and signed ppa agreements. I was thinking of a new format not yet implemented anywhere in which a number of individuals or companies decide they want to build their own power plant and have the up front cash to do so. Instead of a ppa they own the plant and run it. This is not unlike the STP nuclear plant in which a number of individual companies decided they would pay for and finance the plant. Each company provided the construction funds in different ways. For example CPL had to borrow their construction in progress and for a 17 year build time the total accumulated amount of money invested made the plant uneconomical. However in Austin’s case the cash flow was paid for with some borrowing but not treated as CWIP because the cash flow money was paid in rates up front. When the plant came on line the total cost of the plant was much less on the books because it did not include the CWIP interest. A short while later when our economy was swinging wildly between high interest rates and inflation the Austin owners did some refinancings that left us with almost no debt after those refinancings. We were sort of playing the markets with out debt and it worked making the STP a very economical plant. The energy cost is about 1.8 cents per kWh and the debt is paid off. Doesn’t get better than that. Poor CPL got stuck with all that debt. Later AEP bought CPL and AEP being interested in just coal plants sold off their interest to Houston and San Antonio. Stupid Austin missed a great opportunity to buy more nuclear because we had a tree hugger general manager and he got us into a 100 MW 2 billion dollar wood burning plant. Wow what a fiasco that turned into. The moral of the story is don’t ever hire a non engineer to run a company!

So lets say we had 1 million people each put in $10,000 cash to purchase just 1 kW of power all the time. That’s 8000 kWh per year at almost zero energy cost for 40 years. That’s a hell of a better investment in my portfolio than solar panels. A recent posting by a fellow here in Austin wanted to know what we thought about his interest in a $50,000 solar setup what would supply a major portion of his energy. I thought it was a bad deal, especially compared to a personal investment in owning my own nuclear plant. Wouldn’t you like to own your own nuclear plant so when someone complains you can tell them to go jump in the creek!

LOL!

Gene,

Back in 1985 I did a cancel vs. complete analysis of STNP for the Public Utilities Commission of Texas. It concluded that completing the plant was more economic, from a societal perspective, than cancelling and replacing it with an equivalent amount of coal-fired capacity. However, the cost-benefit ratio varied among the four owners. Austin Energy reaped the highest net benefit even though it wanted out. In contrast, it was a net loser for CPL, primarily because they claimed a high cost for building an equivalent amount of capacity. I only examined the “to go” costs of completing the plant and implicitly took into account the interest accrued during construction for the remaining construction period. All of the costs incurred in the past, including CWIP were sunk so they were irrelevant to the cancel vs. complete decision.

The PUCT fired me when its lawyers read my preliminary report and threatened to sue me if I divulged the results. However, at the urging of the utility owners, a judge ordered to PUCT to make public the report.

It was a politically charged environment. I keep thinking that a group of customers can just do their own thing can’t they? Actually federal rules separate generation and transmission but why cannot customers build their own generation projects? It seems so logical to me.

The high cost of creating jobs by building nuclear power plants equally applies to offshore wind. The poster child for this are the two offshore wind projects approved by the Maryland Public Service Commission (MPSC) in 2017. Maryland electricity customers will subsidize these projects to the tune of $2 billion (present value dollars) over the 20-year lives of the PPAs that the state entered into.

The MPSC justified this huge subsidy based on its consultant’s projection that the two projects would create 9,700 direct and indirect full-time equivalent jobs (a FTE represents a full-time job lasting one year). So each of those jobs will cost Maryland electricity consumers about $206,000.

Granted, these jobs will require highly skilled construction labor paying around $100,000 per year plus perhaps another $20,000 in benefits (e.g., health insurance, life insurance, 401K contribution and the employer’s half of the FICA contribution). But wouldn’t everyone be better off if the state just randomly mailed out $120,000 checks to unemployed construction workers?

Even worse, these projects are clearly not cost-beneficial and almost certainly the MPSC violated the Maryland Offshore Wind Act of 2013, which explicitly required it to apply a cost-benefit test that the Act described in substantial detail.

And to top this off, the MPSC’s own consultant concluded that the these offshore wind projects will actually INCREASE greenhouse gas emissions in the PJM footprint because they will simply energy from the offshore wind projects for energy that would have been produced from onshore wind projects located in Western PJM that employs coal-fired generation more intensively.

How insane is this?

So this reasoning justifies building overprices nuclear power plants?

No. It argues for not entering into heavily subsidized, overpriced PPAs with offshore wind developers.

I can support subsidizing a few small offshore projects to gain experience with this resource and to help drive down its cost. But to make huge, multi-GW commitments to offshore wind, as some of the East Coast states are doing is insanity. These decisions are politically driven, rather than being based on rational economic analysis.

That said, I also support subsidizing the development of a new generation of small, modular nuclear reactors. The US is falling way behind Russia and China in this field. Even Canada is ahead of us in nuclear reactor development (to their credit).

That’s completely off topic, which is a standard distraction tactic.

Small modular reactors are specifically relevant to the high cost of nuclear jobs. Due to 1) the inability of current investors to view anything beyond a 5-year ROI window, and 2) the need to view climate change through a 100,000-year environmental-impact window, creative minds at the companies NuScale Power, Inc., GE-Hitachi Nuclear Energy, and others have recognized the potential for small, inexpensive, passively-safe reactors built on assembly lines.

A market for mass-produced SMRs would put a lot of the highly-paid people at Vogtle out of work – engineers forced to make project-specific decisions, corrections, re-certifications, etc. – but reduce the financial and environmental cost of electricity dramatically. It would put a lot of the people papering the land with solar/wind farms, or those peddling “non-wires alternatives”, and other renewable snake oil, out of work. But it would also create opportunities for them helping to expand SMRs worldwide – to make a real difference in the fight against climate change. Aka, opportunities for them to be useful.

Richard,

“That’s completely off topic, which is a standard distraction tactic.”

My comments regarding offshore wind are not off topic.

The subject generally addressed in this thread is that of justifying high-cost projects (e.g., new nuclear plants) based on job creation. I merely used a recent offshore wind procurement to demonstrate the idiocy of the job creation approach.

BTW, will you be sending me a copy of your testimony re utility cost of capital? I would like to review it.

You can find the testimony here, searching under 2020 Cost of Capital, Testimony and EDF.

https://pgera.azurewebsites.net/Regulation/search

Ah, so “Environmental Defense Fund” is paying your bill. EDF defends the environment, do they? Seems more like they defend drilling the environment for oil & gas.

“One of EDF’s largest donors is oil, gas and renewables investor Julian Robertson, who has donated $60 million to EDF and sits on EDF’s governing board.

“EDF lobbies for subsidies for wind and solar that would directly benefit Robertson and other members of EDF’s board of directors.

“Environmental Defense Fund (EDF) is one of the most influential anti-nuclear organizations in the United States with revenues of $158 million in 2016.

“EDF is actively seeking to replace nuclear plants around the country including in the states of California, New York, Illinois, Ohio, and Pennsylvania with natural gas and renewables.

“EDF is working alongside the American Petroleum Institute (Big Oil & Natural Gas) to lobby against saving nuclear plants in Ohio and Pennsylvania.

“EDF has since the 1970s sought to close nuclear plants directly and indirectly by lobbying for laws including federal subsidies and renewable energy mandates that discriminate against nuclear.”

http://environmentalprogress.org/edf

Wasn’t EDF the group that was paid $6 million by Shell / Exxon / Chevron, ostensibly to research ways to prevent fugitive methane? That’s a lot of money for a study. Seems it would be better spent plugging holes in their pipelines, if the purpose of the payment was to prevent fugitive methane.

Boy, anybody who disagrees with you must be tainted by greed! Instead of attacking each messenger who keeps bringing the same message, you should address the message itself. Why are Lazard’s and EDF’s underlying analyses that come to similar conclusions in error? Just asserting that they must be wrong simply because of who they are will not lead to a fruitful discussion. We have already shown the errors in your earlier analyses–now show the errors in others’ analyses.

I’ve addressed the message itself and you ignore it, as you have on several other occasions.

Comparing intermittent, variable renewable energy to dispatchable, baseload energy, as Lazard does, is comparing two different products – apples / oranges. To pretend they’re somehow “competing” with each other assigns zero value to availability – to the capability of a resource to meet customer demand.

Though grids that offer truly “100% renewable” electricity exist in a a few places in the world (Brazil and Iceland are two), renewables in the U.S. are 100% dependent on backup with natural gas. To calculate a truly levelized cost of electricity for solar and wind, add the cost of natural gas backup, the cost of added transmission, fuel wasted by rapid cycling of gas peakers, ancillary services like voltage / frequency regulation etc. as EIA does. Then, Instead of assigning a pitiful 30-year depreciation schedule to plants capable of operating 80 years or more, double construction costs for renewables: two solar or wind farms that last half as long.

Then, we have an accurate comparison. Lazard doesn’t do it for the simple reason it would make their investments look bad. And if you think Lazard (or any investment bank) would publish data that makes their investment portfolio look bad, you know nothing about marketing or finance.

You are offering a standard (and valid) critique of levelized cost of energy (LCOE) that has been offered for several decades. But most importantly, this is NOT specific to Lazard’s analysis–it’s also applicable to just about any other analysis that compares costs of different technologies, including DOE/EIA, CEC, CPUC, just about any other state energy agency, most academic and consulting studies. You haven’t offered a critique that is unique to Lazard that would show that they have a bias–they are just following standard analytic practice. The analysis you are proposing is conducted in integrated resource plans that look at systemwide costs. However, trying to pull out singular technology costs and assigning cost responsibilities is quite difficult–I’ve tried to do it myself in this type of setting. If we want a simple, quick comparison of technology costs, we are left with a method much like that used by Lazard. There are potential enhancements, but that holds for all of these types of analyses, not just Lazard’s as you are accusing them of.

Carl,

I fully agree that LCOE cannot be used to compare an intermittent resource (e.g. wind and solar) with a resource capable of reliably producing energy 24/7. While it doesn’t take an intelligent person more than a few moments of thought to realize this, EIA held an all-day workshop on the subject back in 2013. EIA produced an alternate measure that can compare disparate energy resource, i.e., the Leveled Cost of Avoided Energy (LACE). Anyone interested in learning about LACE can go to:

https://www.eia.gov/renewable/workshop/gencosts/

I would urge all the “greenies” to do so.

“However, trying to pull out singular technology costs and assigning cost responsibilities is quite difficult–I’ve tried to do it myself in this type of setting.”

Agree with you here, Richard. Anyone who has tried to assign a cost to health externalities of carbon emissions, for example, ends up producing a report of not much value to anyone. From the point of view of readers, error bars are magnified by a factor of two or more, to compensate for the possibility of misdirected assumptions or personal biases swaying results one way of the other.

An accurate LCOE for new nuclear plants would consider all externalities, including fuel storage costs, security costs, costs imposed by fuel availability, property values near nuclear plants, benefits to local economy, costs of a disastrous accident, medical costs of worrying about a disastrous accident, etc. – then assign a value corresponding to each from the product of two factors: its negative impact multiplied by its chance of occurrence (weighted by some constant in accordance with the precautionary principle).

By the numbers, most externalities for nuclear plants fall below a 5% level of statistical significance. Yet they’re often grossly overweighted – they’ve somehow become significant. Why? Whether personal or monetary bias (or both) are at play, they’re inaccurate. When Jacobson et al, for example, calculate the carbon emissions of nuclear energy (it produces no significant carbon emissions) based upon the CO2 emitted by burning cities, the result of nuclear Armageddon, the result of a rogue nation successfully enriching fuel from a nuclear plant, then developing a bomb etc. etc. etc. we’ve just crossed into The Twilight Zone. Reason, obviously, is no longer In The House – it has fallen victim to ideological or financial bias.

EIA’s LCOE estimates a cost for “Advanced Nuclear” which, because it doesn’t yet exist, relies on educated guessing. NuScale estimates the cost of its SMR will be a fraction of EIA’s cost – but a conflict of interest exists there, too. All to say – the value of future LCOEs, for 2025 or later, is limited. Accurate LCOEs for existing plants are easy to determine though, so when I see future operating costs for Diablo Canyon mysteriously skyrocketing after 2025 (after its capital costs have been repaid), or irrational comments like “baseload will no longer play a significant role” on the CAISO grid, there’s obviously personal / financial bias at play. And in the public’s interest, or in the interest of protecting the environment, it makes no sense to shut down the source of 22% of California’s clean electricity based on a biased analysis.

If you took the time to read the testimony and workpapers in the DCPP retirement application, as I did, you would understand how the post 2025 cost estimates were developed and documented. Againj, dismissing everything that you disagree with as being invalid due to personal and/or financial bias does absolutely nothing for advancing the discussion. Be specific in your critique of specific data and calculation problems. You still haven’t described HOW Lazard’s estimates are uniquely biased from the industry standards (which are generally consistent with Lazard’s findings.) Is it that 99% of the industry is biased against your viewpoint, and therefore must be incorrect?

“If you took the time to read the testimony and workpapers in the DCPP retirement application, as I did, you would understand how the post 2025 cost estimates were developed and documented.”

I and other members of Californians for Green Nuclear Power have read every word of the PG&E’s application to abandon DCPP (A16-08-006) and of the rulings and testimony therefrom, investing thousands of hours fighting the obscene graft driving the shutdown of California’s largest source of carbon-free generation – all without receiving a dime (in fact, investing considerable sums of our personal savings). That’s the main difference between you and us, isn’t it?

At least 99% of the extended Natural Gas / Renewables (NGR) industry – Chevron, Royal Dutch Shell, members of the Western States Petroleum Association, the Solar Energy Industries Association, the American Wind Energy Association, the former administration of Pacific Gas & Electric, Trident Winds, Monterey Bay Clean Power, Envrionmental Defense Fund, Natural Resources Defense Council etc. – is biased against our “viewpoint”. They’re frothing at the mouth for their share of the profits from 18 TWh of electricity up for grabs if Diablo Canyon shuts down (not to mention, the $millions of taxpayers’ money in intervenor compensation, not to mention fees due their attorneys and consultants). Given 18 TWh of replacement electricity will, by every indication, result in both 9 MT of added CO2 emissions and higher electricity rates, every one of them has a substantial conflict of interest with protecting the environment / the interests of ratepayers.

It’s already been shown EDF has a conflict of interest with keeping the plant open – that’s a fact. From whom else have you received payment who might profit from the shutdown of DCPP?

I hesitate getting into this food fight over the Diablo Canyon closure but it is worth noting that at least one environmental organization (Environmental Defense Fund) supports keeping our existing nuclear plants in service. EDF’s website states:

“When a nuclear plant is retired today, there is a greater chance the plant will be

replaced by a natural gas plant than a renewable energy plant. This might change in

the future as the cost of renewables continues to decline, with more grid

modernization and improved capability to integrate renewables. ZEC programs can

postpone the retirement date for some nuclear plants, until a time when the retiring

nuclear plant might be more likely to be replaced by a renewable energy plant than a

natural gas plant.”

The full article is available at:

http://blogs.edf.org/energyexchange/2017/04/17/why-we-still-need-americas-nuclear-power-plants-at-least-for-now/

It’s not just those industry players that you list who recognize that nuclear power is not an economic resource as of now–it’s also EVERY significant ratepayer group who participated in that proceeding along with the CCAs (who I represented, not EDF–you again have mistakenly jumped a conclusion about who I’m working for on a particular issue) and every valid environmental group. It really is 99% of the community and analysts who stand opposed to your conclusion. That’s the cold truth. Again, rather than cast aspersions as though you are the only “saint” among us, address directly the issues in which costs were overestimated. Note that the CPUC has already roundly dismissed your group’s arguments, as well as every other party in that proceeding.

“the $millions of taxpayers’ money in intervenor compensation, not to mention fees due their attorneys and consultants”

It’s ironic that you make this statement–your group got over $200K in intervenor compensation through the CPUC in that very proceeding (and its from ratepayers, not taxpayers.)

I remember that column well, Robert. As far as I’m aware, it was EDF’s first acknowledgement of nuclear’s value in the fight against climate change, and a ray of hope. But alas, it was an anomaly. I can only guess what closed-door arguments ensued, but both EDF and author/staff attorney John Finnigan have since renounced his op-ed – if not in word, in action.

Last year Finnigan was part of the team opposing Ohio bill HB-6. The bill, which proposed the replacement of Ohio’s ineffectual Renewable Portfolio Standard with a Zero-Emission Credit (ZEC), was intended to level the economic playing field for the state’s two nuclear plants.

http://blogs.edf.org/energyexchange/2019/04/29/firstenergys-next-desperate-idea-300-million-a-year-from-ohio-taxpayers/

That EDF and fossil fuel allies lost, then lost their appeal, served to confirm nuclear energy in the U.S. is not going away any time soon. No doubt, it played a part in Pennsylvania’s recent decision to join the Regional Greenhouse Gas Initiative, a multi-state program that levies a price on carbon, which in turn extended the life of Beaver Valley Nuclear Power Plant – and potentially, four other nuclear plants in Pennsylvania.

We’re not having a food fight, Robert. To paraphrase Harry Truman: I’m just telling the truth, and for some the truth feels like getting hit in the face with a cold tuna sandwich.

Carl,

LOL!

Food fight or not, you can call me Bob.

Still waiting for disclosure of these unnamed “ratepayer” groups who financed your efforts, Richard. Were they the ones who have made a cottage industry out of bilking ratepayers, paying themselves luxurious administrative salaries under the cover of a 501(c)(3) “non-profit” organization? It would certainly be in ratepayers’ interest to know who they were.

After all, a six-figure salary could make working to shut down California’s largest source of carbon-free electricity a very lucrative endeavor.

You can see many of them on our website.

Excuse me if I reject out of hand what constitutes a “valid environmental group” from someone on the payroll of CCAs – the mendacious middlemen promising customers “80% renewable” or “100% renewable” electricity, then delivering the same electricity being served to every customer in PG&E’s service area. Or what constitutes a “significant ratepayer group”, among choices hand-picked by the utility they claim to oversee, from someone in their employ.

Speaking of which: we still haven’t learned which “ratepayer group” collected your fee for you – from ratepayers? Seems all might want to know what purpose your payment is serving when their rates are only going up.

“It’s not just those industry players that you list…it’s also EVERY significant ratepayer group…along with the CCAs….”.

They’re all industry players, Richard, playing the public for every dime they can squeeze out of a bloated, fake promise of clean energy, with fossil fuel at its core. Nuclear’s not uneconomical, but too economical – that’s the cold truth.

“It really is 99% of the community and analysts who stand opposed to your conclusion…”

Nonsense. 100% of the community is opposed to electricity rates and carbon emissions which mysteriously skyrocket after supposedly-uneconomical nuclear plants are replaced by natural gas plants (and a few pretty windmills, spinning in the breeze).

I think you’ve well reiterated that you and your group stands alone. Can you please identify another “legitimate” group that is not tied directly to the nuclear industry or the County of San Luis Obispo that supported your position in the retirement case?

“Can you please identify another “legitimate” group that is not tied directly to the nuclear industry or the County of San Luis Obispo that supported your position in the retirement case?”

How is the County of San Luis Obispo tainted?

Diablo Canyon is located in SLO. That county relies heavily on that economic activity, and a bailout for the County was a key component of the settlement.

Can you please identify the ratepayer and/or other group(s) by whom you’ve been employed relating to applications before the California Public Utilties Commission involving SONGS and/or Diablo Canyon Power Plant?

As I said, go to our website and look at the projects list there. I’m not doing your research for you. And you still haven’t answered my questions.

“As I said, go to our website and look at the projects list there. I’m not doing your research for you. And you still haven’t answered my questions.”

I suppose I could hunt around the web for what might be your website, then hunt around the possible candidates for your list of projects, but providing that information is your job (assuming your intent wasn’t to be ambiguous).

Me, I’m still waiting on an answer to this question: do you believe former California Energy Commission Chairman Robert Weisenmiller, co-founder of MRW Associates, which boasts of its “singular focus on power and gas markets”, that it’s “ideally placed to help clients take advantage of the changes in market structure and industry regulation”, would have no interest in opening up 18 trillion watthours of electricity to natural gas interests – including entities which were clients only weeks earlier?

Though it’s a rhetorical one, I ask to determine whether you’re forthcoming on this matter.

You’re free to go through my clients list as I’ve said. To be honest, my client list is so long that I don’t want to expend the effort

As to Weisenmiller, asked and answered. He had already divested his interests and effectively retired with no further commercial interests in these actions. Plus you overlook the interests of the 4 other commissioners (and there’s been several in several of the slots in that time period.) The CEC is a much more decentralized agency than the CPUC and a single commissioner can’t command the agency easily.

Plus Weisenmiller had no direct communication with the Cost of Generation report preparation. It is a staff document that the commissioners receive as information in other deliberations.

And I disagree the burden is on me to show my purity. Your burden is to show that I’m somehow tainted. Others following this discussion know that I have a broad base of clients that include state agencies, local governments in a variety of roles, ratepayer groups across agriculture, manufacturers and small businesses, and different environmental groups. We don’t work for energy IOUs or for power generators. The list is too long to give names; again you can find those on our website.

“You’re free to go through my clients list as I’ve said. To be honest, my client list is so long that I don’t want to expend the effort”

Well I certainly don’t want to exhaust you by forcing you to defend your argument – but I have no idea what your website is, and I really don’t care. What I care about is portraying either San Onofre or Diablo Canyon as a casualty of market forces, or the failings of an expensive, unsafe technology. They’re neither. Both are victims of natural gas and renewables profiteers, post-Fukushima, seizing upon an opportunity to replace them with vastly less efficient, less reliable, dirty energy, at an immense cost to both CA ratepayers and the environment. And with your lame, pretentious posturing, I’m almost forced to believe you’re a member of that club.

“The quote is from page 1 in the Executive Summary. It demonstrably proves the point that SCE and Sempra continued to recover costs.”

Besides the fact SCE’s quote demonstrably proves nothing, that’s not what I asked. I asked:

“Would utilities which have retired plants, based on their own arbitrary assessment the retirement was “premature”, be permitted to take a loss on their tax returns for all the years they weren’t productive but “should” have been?”. It was after you had written it would be “correct for calculating a historical industry capacity factor, the retirement of plants of the same vintages as currently existing plants should be included as 0% for the years of premature retirement.”

In that case SCE/Sempra would have lost not only their capital investment, but the value of all the energy generated during that period as well. Assuming SONGS had 40 years of life left, that’s 740 trillion watthours of clean electricity – and there is no possible way the IRS would approve a >$100 billion tax deduction on that basis.

“Your burden is to show that I’m somehow tainted…”

By blindly accepting corrupt CPUC’s finding that “the settlement reflected a reasonable compromise…negotiated at arms’-length” you’ve shown it for me (thanks). Chairman Michael Peevey, after all, had already admitted its terms had been pre-negotiated during a secret 2013 meeting at a hotel in Warsaw, Poland, and seven ex-parte (and illegal) phone conversations between 2013-2015.

With this “arms’-length” agreement it’s hard to tell whether was he referring to the combined length of his arm + that of Edison VP Stephen Pickett, or an average of the two. Were you at the Warsaw meeting?

I’m sorry that you don’t understand utility ratemaking practices at the CPUC or how utilities actually recover their investments and expenses, and that you are unwilling to invest the time necessary to obtain that understanding. I’ve presented the evidence that your assertions are wrong and you now have the links to find them. I really can’t make heads or tails of your last post so I won’t respond to the particulars, because I can’t sort through it. I’ve answered every thing you’ve asked for within reason and answered all of your unsubstantiated assertions.

Oh, I understand very well what “utility ratemaking practices” are at the CPUC. It isn’t nearly as complicated as you make it out to be, so let me break it down for others:

1) President of Southern California Edison (SCE) “retires”. Ostensibly due to his extensive industry experience, CA governor with extensive holdings in natural gas appoints him to head California’s Public Utilities Commission. In that role he will ostensibly be protecting the public interest from exploitation by a vast utility monopoly, one providing service to 12 million residents. But it’s not just any vast utility monopoly – it’s the one by which he was formerly employed.

2) Governor’s sister, also with vast holdings in natural gas, is appointed to the Board of Directors of Sempra International, parent company of the nation’s largest natural gas utility, Southern California Gas.

3) Current Board at the utility monopoly, freed by 2005 deregulation to make unlimited campaign donations and from restrictions on lobbying, showers Sacramento with $millions in campaign donations, ostensibly with only the public’s best interests at heart.

4) New head of CPUC makes a secret deal with Edison to shut down the second largest source of clean energy in the state, San Onofre Nuclear Generating Station (SONGS). Edison stands to make untold $billions, over a period of decades, when over 97% of SONGS’s carbon-free electricity is replaced by electricity generated by burning natural gas – and Edison’s own subsidiary is profiting on the sale of that gas to ratepayers.

5) In 2018, CPUC is charged with regulating itself: with holding its former chairman to account for what is not only a conflict of interest, but criminal conspiracy. Unfortunately (but unsurprisingly), it’s as bad at regulating itself as it is at regulating California utilities.

“Charles Langley, executive director of Public Watchdog: “What we are seeing is a complete failure of our regulators to enforce the law. This settlement is the approval of a criminal conspiracy…that was hatched in a hotel room in Warsaw, Poland.” If all the parties agree to the CPUC decision (that is likely), ‘the commission will be released from a federal lawsuit that is likely to expose criminal activity by former Commissioner Michael Peevey.'”

https://www.sandiegoreader.com/news/2018/jul/27/ticker-wipes-peeveyedison-collusion-criminal-in/

Commissioners at the California Energy Commission are appointed by the same governor who appoints those at the California Public Utilities Commission – one with vast holdings in natural gas.

It’s not hard to connect the dots here. In fact, it’s extremely hard to not connect the dots, and for that I credit your tenacity. You repeatedly attempt to defend challenges by cloaking yourself in experience with the very criminal network of public officials perpetrating this fraud on ratepayers – by “not making heads or tails” out of what is obvious to everyone else.

Ok, you can continue to believe your fantasy about how this works. Yes, there’s corruption, but not as extensive as you believe. There’s a reason that Peevey was forced out. And while there is political pressure, there’s also civil servants at each of those agencies that carry out their jobs with integrity and resist that pressure. I’m not sure why you believe the NRC staff and commissioners are above reproach while these other agencies are corrupt cesspools. That one is more agreeable with your worldview while the others oppose it is the only explanation that I can see.

Nice analysis.

Future nuclear plants are not likely to be owned by utilities charging “ratepayers” but instead owned by the individuals who purchase capacity in those plants because they see some economic advantage. Who will be the successful future rate payers, those relying on wind and solar or those relying on nuclear. I guess only the future knows.

Eugene, I think you are referring to merchant nuclear generation. The existing merchant nuclear plants have been looking for state support (IL, PA, OH, NJ, CT, NY) or shutting down. I can’t think of any new nuclear plant being built on a merchant basis, anywhere. Can you?

What are the financial assurances that are provided through this contractual arrangement to handle the long term decommissioning and waste storage matters? The reason why LSE utilities own these plants is it provides assurance through an established entity that has cost of service ratemaking authority. Without that, such large infrastructure projects become too risky.

“What are the financial assurances that are provided through this contractual arrangement to handle the long term decommissioning and waste storage matters?”