International Trade Policies Subsidize Pollution

Lower trade barriers on dirty industries effectively subsidize climate change.

Photo by chuttersnap on Unsplash

In my new working paper and cool accompanying video released today, I assess how international trade policies affect climate change. I ask: how and why do tariffs and trade policies like quotas differ between clean and dirty goods?

Two ideas motivate this question. First, most researchers believe that climate change policy is less stringent than it should be. Global trade policy could be a powerful lever for change since around a quarter of the world’s carbon dioxide (CO2) is emitted in the supply chain supporting international trade. Imposing taxes on traded goods (i.e., tariffs) that are proportional to CO2 has the potential to help address climate change.

Second, many countries have proposed pairing climate change policy with a tariff on CO2-intensive traded goods (i.e., a “carbon border adjustment” or “carbon tariff”). In this new paper, I show that countries’ trade policies essentially already have carbon tariffs, but these policies are subsidizing CO2 emissions instead of penalizing them.

A New Fact: The Environmental Bias of Trade Policy

My paper finds that existing tariffs are lower on dirty goods (carbon-intensive goods) and tariffs are higher on cleaner goods (less carbon-intensive goods). This pattern appears in most countries and years, and also for other trade barriers like quotas. In Figure 1, each circle represents a specific industry and country in the global economy. The downward-sloping red line shows that dirtier industries face lower tariffs, which is the opposite of a carbon tariff.

Figure 1: Tariff Rates are Lower on Dirtier Goods

Note: data represent all countries in the world. Each circle is one industry in one country. Red line is the linear trend.

This environmental bias is large. By putting heftier trade barriers on cleaner goods, the world is on average imposing an implicit subsidy of $85 to $120 per ton of CO2. In other words, trade barriers are rewarding CO2 emissions, and by a large amount. By contrast, many researchers who study climate change think we should have a carbon tax (not subsidy) of $40 to $50 per ton (narrative version, technical version).

Imagine two bundles of goods that arrive at a port somewhere in the world and suppose producing one of these bundles emitted an additional ton of CO2. The dirtier bundle will face $85 to $120 less in mean tariffs and other trade barriers.

The paper shows that the 2018-9 trade war, which raised tariffs on some dirty industries like steel and aluminum, only slightly attenuated this pattern.

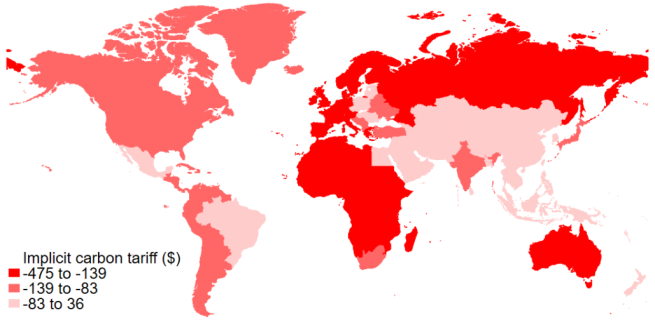

Figure 2 shows that, ironically, some of the countries with the largest trade-policy subsidy to CO2 are places like Sweden and Germany that traditionally care the most about the environment. Some of the countries with the smallest trade-policy subsidy to CO2, like Saudi Arabia and Iran, are traditionally less concerned about the environment.

Figure 2: Difference in Trade Policies Between Clean and Dirty Goods, by Country

Note: more negative numbers represent a larger subsidy to CO2.

Summed across countries, this amounts to a global implicit CO2 subsidy of $550 to $800 billion per year. As a benchmark, direct subsidies to fossil fuel consumption, such as Venezuela’s subsidies to motor fuel or Saudi Arabia’s oil subsidies, have a global total of $530 billion.

Why? The Influence of Lobbying on Trade and Environmental Policies

I arrive at a simple explanation for the bias: industries convince governments that they need cheap inputs.

I consider many explanations for why dirty industries receive low levels of protection, such as rates of political contributions, unionization, and worker wages.

The variable that best explains this pattern of trade policy is the extent to which an industry sells to other firms rather than to final consumers. Economists call this variable “upstreamness.” For example, firms that manufacture copper ingots are upstream—they mostly sell to other manufacturers. Firms that manufacture sunglasses are downstream—they mostly sell to final consumers.

It turns out that more upstream industries are systematically dirtier. The three most upstream manufacturing industries in the U.S. economy are also three of the dirtiest—petrochemicals, copper smelting, and aluminum smelting.

Upstream industries also have lower trade barriers. This pattern has been true at least since the 1960s, when economists began referring to this pattern as “tariff escalation”—as you move from upstream to downstream industries, tariffs escalate. The X-shaped picture in Figure 3 shows both of these patterns—in moving from upstream to downstream industries, trade protection increases but CO2 emission rates fall.

Figure 3: Upstream Industries Have Lower Trade Protection and Higher CO2 Emission Rates

Note: NTB stands for non-tariff barriers, such as quotas. Data represent all countries in the world.

For example, the copper smelting and refining industry is upstream, with a CO2 intensity of 0.8 tons CO2 per thousand dollars of output, and an average tariff of 0.02% (a twentieth of a percent). The optical goods manufacturing industry is downstream, with a CO2 intensity of 0.3 and an average tariff of 1.5%.

Figure 4: Copper Refining and Smelting is Upstream, Dirty, and has Low Tariffs; Sunglasses Manufacturing is Downstream, Clean, and has High Tariffs

Source: Wikipedia Commons

Why do upstream industries receive less protection? Downstream firms want cheap inputs so they can produce at low cost. They lobby for low protection on dirty, upstream goods. By contrast, the main groups who lobby for low protection on cleaner downstream goods are final consumers, who are poorly organized. It is easier to organize 5 large electrical equipment manufacturers to lobby for cheap copper than to organize 325 million Americans to lobby for cheap sunglasses.

What Does It Add up to?

Using a mathematical model of trade, production, and pollution for all goods in all countries, I find that if countries had similar trade policy for clean and dirty goods, global greenhouse gas emissions would fall by about the same amount as the effect of two of the world’s largest actual or proposed climate change policies—the European Union’s Emissions Trading System (a cap-and-trade market for CO2) and the Waxman-Markey Bill (a 2009 US cap-and-trade plan). This effect is similar whether countries change trade policy for all goods to the level currently faced by clean industries, or dirty industries, or the average; the key feature is for countries to impose similar trade policies on clean and dirty industries.

Imposing similar trade policies on clean and dirty goods is among the only environmental policies which may appeal to both dirty industries and environmentalists. These strange bedfellows might support this policy because it can maintain protection of dirty industries (at least relative to clean industries) while decreasing global CO2 emissions.

Climate change and the environment are rarely part of the debate over tariffs and other trade barriers. The evidence in this paper shows how making the environment part of those policy conversations could provide large benefits.

Keep up with Energy Institute blogs, research, and events on Twitter @energyathaas

Suggested citation: Shapiro, Joseph. “International Trade Policies Subsidize Pollution” Energy Institute Blog, UC Berkeley, May 4, 2020, https://energyathaas.wordpress.com/2020/05/01/international-trade-policies-subsidize-pollution/

Categories

Your use of the terms “dirty” and “clean” strikes me. “Dirty” industries don’t make dirt, they make something else with dirt as a byproduct of production. CO2-intensive processes involve combustion, right? Which in addition to producing CO2 often produce smoke, soot, ash, airborne toxins, oxides of sulfur and nitrogen, VOGs, airborne heavy metals .. basically the whole gamut of pollutants. So couldn’t tariffs on “dirty” products be kept low not to keep those products cheap, but to export pollution? If it has the consequence of “rewarding” decisions to produce CO2 elsewhere, and if we want to reduce overall carbon production then trade policy isn’t the answer, it’s demand reduction regardless of whether the product is made in China or California.

We’ve already tariffed serious pollutants. The tariffs are called “catalytic converters,” “smokestack scrubbers,” and a whole slew of mandated other items. It worked, and the air today is cleaner in most parts of the world is cleaner than in the 70s. In those other parts of the world who won’t follow sensible guidelines, we have two choices: Nuclear war, or invent clean alternatives which are actually cheaper. The second option, IMHO, is preferable and fortunately is now expected for general (vs niche, such as grid load leveling) use within 7 years. We are now so close to the change happening naturally that government heavy handed ness literally cannot change the trajectory enough to make a meaningful difference.

You would think this is great news, but I have found it seems to distress many people.

A fascinating finding. I’d be interested to learn more about how the costs of achieving the carbon reductions via trade policy modifications compare to the costs of ECTS + Waxman/Markey. Again, thank you for this work!

It’s all pretty much moot at this point. The Clean Energy Disruption is finally kicking off, and with solar and battery prices dropping exponentially for over 60 years now and looking like they will continue to do so for another 20, there is absolutely no policy which will be able to keep “dirty fuel” cheaper than clean energy for more than an extra year or two. Since that’s not enough to make a bit of difference in the final outcome, it’s better for everyone to accept a tad more polluting (we aren’t giving up catalytic converters, for example) to help boost the global economy. Wealth, not high prices, brings clean energy to everyone. https://www.youtube.com/watch?v=2b3ttqYDwF0

Interesting premise, however it would be helpful if you addressed at least two additional areas: (1) how are your classifying and differentiating between the ‘carbon intensive’ and ‘non carbon intensive goods, and (2) what happens to the eventual consumer costs and carbon production if instead of importing ‘carbon intensive’ products and materials, those production processes were instead moved to the importing country? In essence, the ‘carbon intensive’ products mentioned in this article identify inputs to basic manufacturing processes that are essential to many other industrial and consumer products. Changing the tariff structure on fundamental manufacturing inputs may change the ultimate consumer costs of the final products being produced, however it is also likely it may also change where those inputs are mined, processed and produced which will in turn change carbon production.

Regarding the upstream/downstream differential, could another contributing factor be that the upstream industries support (actively or tacitly) higher tariffs on the downstream products, as the resulting higher prices/values for those goods allows the downstream manufacturers and retailers to pay more for the inputs from the upstream producers?

Great video. Although my son doesn’t know it yet, this just became part of his school-at-home curriculum this week. Thank you for making important and complex matters accessible to a broad audience.

With respect to the question about why upstream industries receive less protection, is it also possible—in addition to the reasons cited—that tariffs, being inherently political, produce more effective headlines and great voter response when applied to the downstream items that are a tangible part of consumers’ lives?