Column: As help pours in for World War II vet, 102, with huge bill, SoCalGas wants a rate hike

I had just read dozens of offers from readers who wanted to help a 102-year-old World War II veteran pay his outrageous $526 gas bill, for a tiny one-bedroom apartment in Hollywood, when I got an email from the Southern California Gas Co.

Was the company writing to offer a price break to the vet? Or maybe to apologize for the heart palpitations felt across Southern California, where millions of homeowners and restaurateurs have been crushed by monthly bills that were double, triple and quadruple normal amounts?

No. SoCalGas was notifying me of its request to raise rates in 2024 and beyond. The company invited me and other customers to “make comments and raise concerns” at virtual hearings to be held March 6 and 15.

If you just can’t wait that long to let the company know what you think about rate increases, and your fingers are not frozen, you can type up your comments and leave them on the California Public Utilities Commission website. And you wouldn’t be the first to do so.

“This is inhumane!” wrote Janet from Los Angeles, who said she and her two young children “have to wear snow gear inside the house” because they can’t afford to keep the heater on.

World War II veteran Paul Hult has an already tight budget with costs for home healthcare. Now, astronomical gas charges in recent months are threatening to wipe him out, his family says.

This must be “a cruel joke,” wrote Nina from San Clemente, one of hundreds to plead with the CPUC to reject rate hikes.

“How dare you,” wrote Martti of Los Angeles. “People are suffering and shivering because of your vile and disgusting price gouging.”

Similar sentiments ran through the responses to my column about veteran Paul Hult, who was already down to his last dollars because of the cost of in-home care when he got his shocker of a gas bill.

Veterans wanted to help a fellow veteran, older adults wanted to help a fellow traveler, and indignant SoCalGas customers wanted to blast the utility. One of the most livid was actress Mimi Rogers, who stands ready to lead the charge against the utility.

“This is disgusting,” Rogers told me by phone, saying she thinks customers should unite and withhold payment. “This is price gouging.”

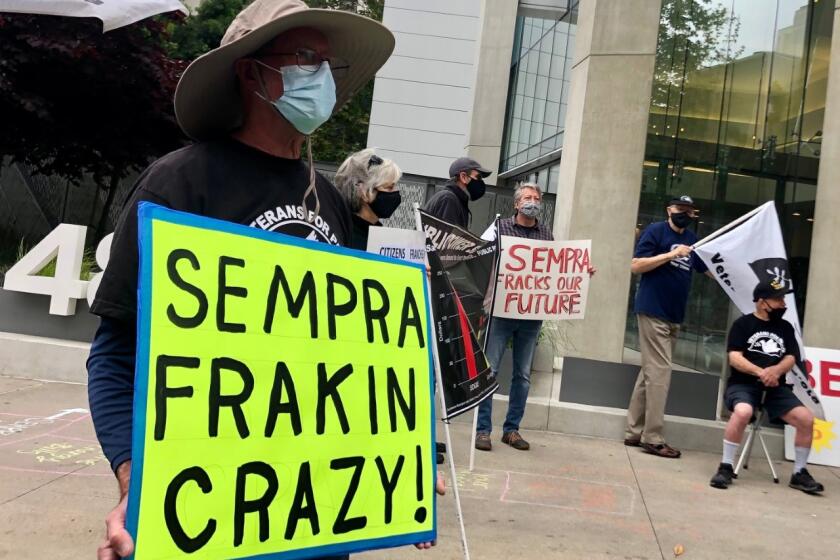

The actress, who plays a no-nonsense attorney in the “Bosch: Legacy” series — based on former L.A. Times reporter Michael Connelly’s fictional detective Harry Bosch — said she’s been studying up on SoCalGas and doesn’t like what she’s learned. The utility’s parent company, Sempra, is lining up lucrative natural gas contracts in Europe, and paying its executives obscene amounts of money while SoCalGas sticks it to customers, Rogers said.

When I mentioned some of SoCalGas’ explanations for the price hike — which include rising wholesale prices and supply and storage issues — Rogers wasn’t having it.

“They have failed miserably, which means Sempra has failed miserably, which means they should be bearing the brunt of the cost — not ruining people’s lives and putting restaurants out of business,” Rogers said. She told me her own gas bill had ballooned, but she was more concerned about the principle of the matter and the people who are hard-pressed to pay.

“This is as disgusting and horrible as Exxon Mobil recording record profits during the pandemic, especially during the last year, with faux gas shortages,” Rogers said. “I feel like Peter Finch in ‘Network.’ I’d love to go on camera and say, ‘People of California, no, don’t take this, don’t accept this. This is wrong on every level and let’s have a sit-in, let’s have a protest.’ ”

It’s easy to share Rogers’ indignation if you saw my colleague Terry Castleman’s reporting on Sempra Energy’s executive compensation numbers for 2021. Chief Executive Jeffrey Martin raked in $25 million while two other Sempra poohbahs hit jackpots of $8 million and $7 million.

Those three, Castleman reported, “have also accumulated pension benefits … totaling nearly $60 million.”

If you didn’t pop a vein reading that, you might when I tell you that SoCalGas announced Monday that it is coming to the rescue by committing $10 million “to support low-income families, seniors and small-restaurant owners impacted by unprecedented regional gas market prices.”

SoCalGas has 21.8 million consumers, so you do the math.

To be fair, the natural gas economy is nuanced, energy markets are complicated and prices are always subject to fluctuation. California imports the majority of its natural gas, which puts it at the mercy of suppliers, and the massive Aliso Canyon gas storage site has had reduced capacity since the leak scandal in 2015.

SoCalGas warned in late December that “shockingly high” bills were coming our way due to an “unprecedented cold snap” that drove up wholesale prices in the West, and pipeline problems in Texas were another factor. The company, which said it doesn’t profit from passing along inflated wholesale prices, provided links to payment assistance programs, and said bills will soon be coming down sharply.

But as Gov. Gavin Newsom said in requesting a federal investigation, the factors cited by SoCalGas and other companies “cannot explain the extent and longevity of the price spike.” Newsom wanted investigators to look at the possibility of market manipulation, among other things.

Severin Borenstein, a UC Berkeley energy economist, told me that gas prices in the East did not rise sharply like they did in the West. And price hikes from Pacific Gas & Electric in Northern California were nowhere near as high as those imposed by SoCalGas, which argued that it was merely passing along the higher price it had to pay on the wholesale market.

The three top executives at Sempra Energy, the parent company of SoCalGas and SDG&E, made $40 million in 2021, with pension benefits of $60 million awaiting them at retirement.

“PG&E was much more hedged,” Borenstein said, meaning it was able to use stored gas purchased at lower prices rather than get stuck at the checkout stand just as wholesale prices skyrocketed.

“There’s room for anger at the CPUC for not requiring more hedging,” Borenstein said, as well as anger at both the CPUC and gas companies for not addressing storage issues. “And I think there’s room for anger at all the people who say there’s no need to worry about natural gas because we’re getting off of it.”

We’re not getting off of it anytime soon, Borenstein said.

There is, for all of this, some good news to report on Paul Hult.

The veteran had been doing fine on income and benefits from Social Security, a railroad pension and the VA until he fell a year and a half ago and burned through his savings to pay for in-home aides. That’s why his gigantic gas bills were such a blow.

Hult is a proud man who told me he didn’t want financial help, but his step-grandson Jim Moreno was planning to take out a loan to help pay for in-home care. Readers — many of them veterans — wouldn’t take no for an answer and offered financial help and advice on assistance programs for seniors, veterans and low-income residents.

Moreno has since set up a GoFundMe page for Hult, who told me he’s still uncomfortable about accepting help, but humbled by such a generous response.

“It’s great to know that people think of you that way,” he said.

Steve.lopez@latimes.com

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.