FinTech funding rounds bounced, following a couple of slow weeks. A total of $909m was raised across 23 deals, a significant jump from last week’s 12 rounds that collectively secured $107m.

The ten biggest deals of the week secured $839m, including three deals that exceeded $100m. US-based cybersecurity platform Rapid7 collected the largest deal, topping its coffers up with $260m. Coming in at a close second was US-based consumer brand FinTech Ampla, which netted $258m in credit financing.

The final deal over $100m was a $120m investment raised by Shop Circle, a UK-based developer of eCommerce tools.

Like most weeks, the US was home to most of the deals, however, it wasn’t an overwhelming majority. The country recorded eight deals: Rapid7, Ampla, CLARA Analytics, Momnt, Certa, Alix, Firstcard and Numeral.

The Uk and Israel both recorded three deals. The UK companies to were Shop Circle, Opna and Mindgard, while the Israel companies were ThetaRay, Upwind and Pynt. Switzerland was the only other country to have more than one deal, these were GenTwo and DGTAL.

Other countries recording a funding round this week were France (Akur8), Sweden (Treyd), Norway (Strise), Spain (Inari), Singapore (iMin Technology), Canada (Automat), and Egypt (Sehatech).

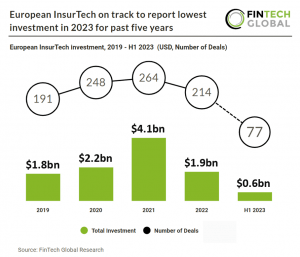

In terms of sectors, InsurTech proved to be the most popular with five deals (Akur8, CLARA Analytics, Inari, DGTAL and Sehatech). Despite the strong week, 2023 has proved to be a slow year for the InsurTech sector. In the first six months of the year European InsurTech investment in H1 2023 reached $595m, a 46% drop from H1 2022. In terms of deals, its current trajectory, 154 transactions in 2023, a 28% reduction from last year’s levels.

In joint second for deals this week were CyberTech (Rapid7, Upwind, Pynt and Mindgard), and PayTech (Ampla, Shop Circle, Treyd and iMin Technology).

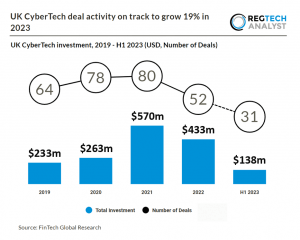

Another recent report from FinTech Global highlighted the UK CyberTech market. During the first six months of the year UK CyberTech deal activity reached 31 transactions in H1 2023, a 14% drop from H1 2022. However, if the second half could keep this pace it could see a 19% increase YoY. Unfortunately the investment totals are not set to grow. UK CyberTech investment reached $138m in H1 2023, a 54% drop from H1 2022.

GenTwo, Alix and Firstcard were the three WealthTech funding rounds this week, while ThetaRay, Certa and Strise were the three RegTech deals. Automat and Numeral represented the Infrastructure and enterprise software space this week, as did Momnt for marketplace lending and Opna for ESG FinTech.

Here are the 23 funding rounds from the past week.

Rapid7 secures $260m in latest convertible senior notes offering.

Rapid7, known for its quest to foster a safer digital realm by streamlining cybersecurity, announced a significant shift in its financial position today.

The company has confirmed the pricing of convertible senior notes, upped to an impressive $260m. This principal amount, due in 2029, was initially presented to qualified institutional buyers in a private placement following the directives of the Securities Act of 1933.

Notably, the original offering was set at $250m but saw a boost in anticipation of demand. Additionally, an option is on the table for initial purchasers to increase their uptake by another $40m if they so wish. Finalisation of this sale is keenly anticipated on September 8, 2023, given the standard closing conditions are met.

Diving deeper into the specifics of these notes, they will operate as general unsecured obligations of Rapid7. They will carry an interest rate of 1.25% per annum, set to be paid out twice a year, every March 15 and September 15, starting in 2024.

The notes are structured to mature on March 15, 2029, unless earlier arrangements are made for their conversion, redemption, or repurchase. An appealing aspect for potential investors is the initial conversion rate. This stands at 15.4213 shares of Rapid7’s common stock for every $1,000 of the principal note amount, equating to a conversion price of roughly $64.85 per share. This price tag flaunts a notable 32.50% premium over the reported sale price of the company’s stock as of September 5, 2023.

Upon conversion, holders of these notes can expect returns in cash, shares of the company’s common stock, or a mix of the two, subject to Rapid7’s discretion. Provisions have been made to redeem the notes for cash, either in full or partially, if specific conditions related to the company’s stock price are met, starting September 21, 2026. Similarly, there are conditions in place for noteholders should there be a “fundamental change” within the company’s structure.

Rapid7 has projected net proceeds from this offering to hover around $253m, potentially going up to $292m if initial purchasers go all-in on their additional purchase option. A significant chunk, approximated at $201.5m, of these net proceeds is earmarked to repurchase Rapid7’s 2.25% Convertible Senior Notes due in 2025.

The company also intends to allocate around $31.7m from the offering’s net proceeds to fund the capped call transactions they’ve described. Beyond these specific allocations, Rapid7 plans to channel the remainder into various corporate areas. This includes investment in product development, sales and marketing, general and administrative purposes, and bolstering their working capital. The possibility of the funds fuelling acquisitions or strategic investments is not off the table, though no immediate plans are in sight.

Tied to the 2025 note repurchase, Rapid7 anticipates certain holders will engage in hedge position adjustments. This may lead to a purchase of the company’s common stock or the initiation or unwinding of various derivatives tied to it. Similarly, as part of the note pricing, Rapid7 has partnered with financial institutions for capped call transactions, hoping to mitigate potential dilution of the company’s common stock upon any note conversions.

Rapid7’s business endeavours have always been centred on their vision for a digitally secure world. The company’s dedication to making cybersecurity more straightforward and accessible has earned them the trust of over 11,000 global customers. Their solutions integrate cloud risk management with threat detection, enabling businesses to curtail vulnerabilities and neutralise threats swiftly.

Keep up with all the latest FinTech news here

Copyright © 2023 FinTech Global

Consumer brand FinTech Ampla locks in $258m credit deal with top-tier investors

Ampla, described as a foremost provider of financial solutions specifically tailored for consumer brands, has shared news of a significant financial milestone.

The company has successfully secured a $258m credit warehouse, an achievement made possible with the collaboration of two financial giants, Goldman Sachs and Atalaya Capital Management. This influx of capital is set to energise Ampla’s Growth Capital products and fortify its mission to build the definitive platform for Consumer Brands.

Pioneering the way, Ampla has an established reputation for empowering consumer brands with an array of innovative financial solutions. Their approach has witnessed an evolution, reflecting the changing dynamics of the consumer brand landscape over recent years.

This freshly acquired funding is designated for further product enhancement. Aiming to serve consumer brands holistically, Ampla’s portfolio already boasts of Growth Capital, Digital Banking, Insights, and the newly introduced Visa Corporate Card. Their achievements speak for themselves. Recently, they celebrated crossing over $1.5bn in originations and managing a whopping $6.0bn transaction run-rate on their platform.

Shop Circle raises $120m to develop eCommerce tools

Shop Circle has secured $120 million in Series A funding to further develop its suite of eCommerce tools.

The move is set to enhance the London-based organisation’s position as as a one-stop shop for software for eCommerce merchants.

The round was led by 645 Ventures and 3VC, along with prominent participation from established supporters QED Investors and NfX, with the credit facility provided by i80 Group.

Luca Cartechini, the CEO and Co-Founder of Shop Circle, said: “We’re thrilled to announce the successful close of our Series A funding round, which will enable us to continue building and expanding our suite of e-commerce tools.

“Our vision has always been to create a comprehensive operating system for e-commerce brands, providing them with the necessary technology to excel in today’s competitive market.”

Following its 2022 launch, the company revealed a burgeoning tech suite, aimed to empower eCommerce merchants and brands to scale their businesses with ease. Over the last 18 months, the firm has gone from strength-to-strength, boasting a customer base of more than 100,000 e-commerce brands worldwide, and an astounding 360% YoY growth.

Shop Circle is now aiming to deepen its technical consultation offering, to further bolster its comprehensive platform by leveraging AI to offer hyper-personalised data-driven insights.

ThetaRay’s AI-powered global payment solution nets $57m funding

ThetaRay, a player in next-generation AI-driven secure global payments with a presence in diverse locations, has bagged $57m in funding.

The firm has successfully raised a whopping $57m. This growth round was prominently led by Portage, and it also saw considerable participation from existing investors such as JVP, OurCrowd, and others.

ThetaRay stands out in offering a cloud-based transaction monitoring and screening solution. Through its patented AI technology, the company can swiftly and accurately oversee financial transactions. This unique approach ensures smooth and secure fund flows across the globe, building trust in transactions. Consequently, Banks and FinTechs can effectively leverage this to expand their ventures, enter fresh markets, maximise internal resource use, and importantly, minimise financial crime risks.

With this fresh influx of capital, ThetaRay is in an even stronger position to fast-track its global expansion plans. The firm aims to meet the increasing market demand, especially from Banks and FinTechs eager to transition from outdated systems to innovative financial crime detection technologies.

The global trade arena has lately been experiencing challenges, with payment networks turning more risk-averse. This shift has resulted in a 40% drop in global interbank corridors, making international payments more complex, unpredictable, and expensive. However, ThetaRay is flipping this downside, promoting financial inclusion and unlocking myriad business possibilities across different regions and sectors. The company’s impact is evident – they’ve witnessed a more than tenfold increase in client numbers in the past two years. This rise has also seen their existing clientele base expand exponentially, resulting in ARR shooting up by over 5x.

Israeli cybersecurity startup backed by Steph Curry’s Penny Jar raises $50m

Israeli cybersecurity startup Upwind has raised $50m in a funding round which featured Steph Curry’s Penny Jar Capital.

The financing round led by Greylock Partners, Cyberstarts and Leaders Fund, but also featured participation from the firm which is backed by the four-time NBA champion, brings the company’s total funds raised to $80 million since it was founded last year.

It is anticipated that the funds will be used to boost the startup in its quest to shift the paradigm in regards to cloud security.

Upwind CEO Amiram Shachar, said: “In the past year, we worked with hundreds of CISOs and security engineers, to get a mile-deep understanding of their biggest security challenges and priorities.

“Through this process, we discovered major hurdles facing security teams and understood that the right, most complete way to solve them is at runtime. Upwind is shifting the paradigm of cloud security and redefining CNAPP (Cloud Native Application Protection Platform) with runtime insights.”

InsurTech disruptor Akur8 scores $25m investment

Akur8, a firm specialising in next-generation insurance pricing via Transparent AI, has successfully closed a new funding round to the tune of $25m.

This new injection of funds elevates the company’s total financing to over $60m.

The latest funding round comes four years after Akur8 first introduced its platform to the market. New to the investor list this time is FinTLV, a global InsurTech and FinTech venture capital fund rooted in Tel Aviv. Also taking part in this funding round is Guidewire Software, Inc., joined by Akur8’s historical investor, BlackFin Capital Partners.

Diving deeper into what Akur8 offers, the company is on a mission to transform the insurance pricing landscape. Utilising Transparent Machine Learning, Akur8 provides unprecedented speed and accuracy throughout the pricing process for insurers without compromising on auditability or control.

According to Brune de Linares, Chief Client Officer at Akur8, the latest funding will be utilised to “accelerate the transformation of insurance pricing even further, fuel our growth in key markets such as the US and APAC, and equip P&C and health carriers with a state-of-the-art, integrated pricing solution that we have been building and refining tirelessly.”

The company is planning a significant in-person event in Tel Aviv on September 4, in collaboration with FinTLV. This event, part of the InsurTech Israel 2023 Global Summit, aims to gather 120 actuaries from Israel’s insurance industry and will serve as a platform for nurturing this nascent partnership.

CLARA Analytics secures $24m in latest funding round

CLARA Analytics, a provider of artificial intelligence (AI) technology for insurance claims optimisation, has completed a $24m Series C funding round.

The latest investment brings the firm’s total capital secured to $60m, and it now aims to enhance its platform’s AI capabilities, including generative AI, predictive modelling and natural language processing (NLP).

This round was led by new investor Spring Lake Equity Partners, with participation from existing investors including Aspen Capital Group, Oak HC/FT and QBE Ventures.

CLARA Analytics CEO Heather H. Wilson, said: “Insurers are facing increased pressure to manage losses and expenses, and they have awakened to the value that AI can generate in claims management.”

Swiss FinTech GenTwo secures $15m Series A investment

GenTwo, a firm specialising in the securitisation of both bankable and non-bankable assets, has accumulated $15m in a Series A raise.

This significant fundraising effort was spearheaded by US investor, Point72 Ventures. Following this, Pete Casella, the Senior Partner and Co-Head of FinTech investments at Point72 Ventures, is set to grace GenTwo’s board of directors with his presence.

Diving into GenTwo’s origins, the company was birthed in Zurich in 2018. Central to its operations is the innovative GenTwo PRO platform, a groundbreaking financial engineering network. Through this platform, investment professionals are empowered to securitise and swiftly introduce various assets or investment strategies to the market as bankable securities.

One of the company’s standout features is its ability to make previously perceived as alternative and non-bankable assets like real estate, digital assets, and even fine art, accessible to every investor. When one considers that the global market for such assets stands at an astounding $78tn, the potential of GenTwo’s offerings becomes clear. Serving the increasing demands of asset managers and their clients, the company delivers fresh, diversifying financial products that promote active portfolio management.

GenTwo’s growing influence is evident. They’ve catered to over 250 clients across 26 nations, introduced in excess of 1,200 investment products, and currently oversee more than $3bn under service.

Merchant lender Momnt raises $15m

Leading FinTech Momnt has announced that is has secured $15m in its latest capital raise, as it looks to shape the future of financial technology.

The Atlanta-based organisation raised the funds with support from investment leaders TruStage Ventures, as well as participation from Saluda Grade Ventures, existing investors, and a new investment from a fund within Rockefeller Asset Management.

The firm, which specialises in real-time lending and payment solutions for businesses, believes it is now better poised than ever to drive transformative changes in lending and financing.

Barclay Keith, CEO and Co-Founder of Momnt, said: “Momnt is committed to shaping the future of financial technology by providing innovative solutions that empower businesses and customers alike.

“With this investment, we are better poised than ever to drive transformative changes in lending and financing and we’re excited to welcome Rockefeller Asset Management as an investor.”

Momnt launched its platform in 2020 in the home improvement industry and has since grown to become one of the preeminent market leaders in point-of-sale financing.

Enterprise automation leader Certa celebrates $15m Series A raise

Certa, an enterprise automation platform, has proudly announced its Series A investment round, achieving a total of $15m.

This significant funding round was steered by Point72 Ventures and saw participation from several esteemed investors, including tech luminary Justin Kan, Dropbox’s co-founder and CEO, Drew Houston, as well as Mantis VC and several other contributors.

Diving deeper into Certa’s functionalities, the company primarily addresses the challenges related to vendor and partner onboarding. These processes, frequently found within enterprises, are notoriously lengthy, unclear, and strenuous. The increasing concerns around data security, the mounting privacy regulations, and the growing focus on ESG (Environmental, Social, and Governance) magnify these challenges. Certa’s solution lies in its capability to diminish onboarding durations and enhance transparency by automating the complete third-party lifecycle tailored for enterprises.

With this new infusion of capital, Certa plans to further its mission of streamlining cross-company cohesion. “The modern business ecosystem requires an increasing amount of collaboration between companies, but the process for enabling this cross-company cohesion is often a manual, time-intensive experience,” Certa founder and CEO Jag Lamba said. “It doesn’t need to be this way. Our platform was built out of necessity to help our customers onboard third-party vendors, partners, and customers quickly and efficiently so they can get back to business.”

Furthermore, Certa offers businesses an opportunity to connect securely and effortlessly. Its state-of-the-art software directs entire workflows across various segments like compliance, procurement, privacy, information security, and financial systems. A remarkable feature is its low code/no-code technology, enabling procurement teams to autonomise vital processes without leaning on IT support.

To date, Certa has facilitated the onboarding of over a million firms from 120 nations, delivering its services in 17 languages. Some of its esteemed clients, a list boasting the names of top-tier retailers, aerospace entities, credit card corporations, tech behemoths, and several others, were actively involved in heralding Certa’s Series A announcement.

Treyd secures $12m to expand product offering

Stockholm-based FinTech company Treyd has secured a $12m extension of its Series A funding, as it looks to expand its product offering.

The investment brings the firm’s total investment to $25m, as it aims to expand its existing markets, enhance their core product offering, and work towards achieving profitability.

The round is led by Swedish investment company Nineyards Equity, together with Antler, Zenith VC, and J12 Ventures.

Peter Beckman, CEO and co-founder of Treyd, told Tech.eu: “Since launching the ‘sell first, pay suppliers later’ category three years ago, we’ve had an overwhelming response from the brand and retail community.

“Today, we’re helping the growth of hundreds of the most exciting fast-growing SMEs across the UK and Nordics. With this latest investment, we will be able to yet further improve our support of these and many more companies, by fundamentally upgrading our platform and product offering.”

Treyd has made significant strides in the retail industry by providing upfront payments to suppliers on behalf of growing retail businesses, through its ability to help retail businesses thrive by allowing them to sell products first and pay suppliers later.

This offering has enabled the growth of hundreds of small and medium-sized businesses (SMBs) across the United Kingdom and the Nordics.

Strise secures $10.8m in series A to redefine AML automation

Strise has secured $10.8m in its series A funding round, as it looks to redefine anti-money laundering (AML) automation.

Having bagged the capital in the round led by VC giant Atomico, the Norwegian startup is set to utilise the funds to drive its international expansion across key European markets, starting with the UK and increasing its customer base across the financial, insurance, legal, and other industries.

The Nordic AML vendor will also deploy the funding to further enhance its end-to-end AML product offering, solidifying its place as a leading disruptor in the fight against financial crime and ensuring safer and more transparent business dealings.

Marit Rødevand, CEO and co-founder of Strise, said: “If banks don’t adapt to AI, they risk falling behind. With crime and regulations becoming more complex, traditional methods aren’t enough.

“Without automation, fighting financial crime becomes costly and inefficient. Strise is leading the way in this change – we help AML and compliance teams work faster, detect crime more accurately, and stay compliant, protecting their reputation in the process.”

The round also featured participation from existing investors, as well as a litany of high-profile angel investors., including; Camilla Giesecke (Klarna COO), Phil Chambers (founder of Peakon, exited to Workday), Allison Pickens (former COO of Gainsight), Riya Grover (CEO and co-founder of Sequence), and Francois Callens (former CFO of Depop).

As part of the announcement, it was also revealed that Atomico Partner Don Hoang, a former senior executive at Uber and Revolut, will join the Strise board.

Climate FinTech Opna seals £5.2m ($6.4m) deal for corporate-carbon project link-up

Opna, a London-based climate FinTech company, formerly known as Salt, has recently garnered attention in the finance world.

The startup has successfully secured a seed funding amounting to $6.5m (£5.2m), according to a report from UKTN. The investment round was spearheaded by the VC firm Atomico and saw participation from previous investors like Pale Blue Dot, MCJ Collective, Angelinvest, and Tiny VC.

Founded in February 2022, Opna is on a mission to “rebuild trust” in the voluntary carbon markets. These markets serve as a conduit for carbon emitters to buy carbon credits. These credits are generated from initiatives that either remove or curtail greenhouse gas emissions. Opna offers a unique platform that allows corporates to discover such carbon projects, facilitates their financing, and provides a digital portfolio for corporates to oversee these financed climate initiatives.

Opna has clear plans for this newly acquired funding. The primary objectives include amplifying awareness of their platform, broadening the range of carbon projects available, refining their technology, and recruiting new talent.

Opna’s founder, Shilpika Gautam, emphasised the increasing trend of corporates directly financing carbon projects to meet their net zero commitments. However, businesses often find it challenging to mobilise capital due to factors like lacking expertise, steep transaction costs, and outdated infrastructure. The firm noted that currently, only 7% of companies are on track to meet their net zero pledges. Opna aspires to be the bridge connecting corporates to carbon projects, addressing these challenges.

Pynt secures $6m for cutting-edge API security solution

Pynt, a firm specialising in API security, has announced the general availability of its pioneering security autopilot tool for APIs and bagged $6m.

The company successfully secured $6m in its latest seed funding round. Leading the investments was Joule Ventures, and the round also saw significant contributions from Dallas VC and Honeystone VC.

APIs serve as essential conduits, allowing software components to interact seamlessly. These interfaces have become integral to modern-day applications, exemplified when a smartphone weather application accesses real-time meteorological data through the weather bureau’s API.

With over 83% of today’s internet traffic being API-related, security vulnerabilities within these systems are a growing concern, highlighted by recent breaches experienced by companies like X (formerly Twitter Inc.) and LinkedIn Corp.

Pynt intends to enhance its API security autopilot tool with this funding. This unique offering aims to simulate white-hat hackers, utilising human-like reasoning to pinpoint vulnerabilities, all before real-world hackers can exploit them. Moreover, Pynt’s solution seamlessly integrates with popular API development platforms, such as Postman, offering a holistic, automated security solution for developers.

Offered in both freemium and enterprise packages, Pynt already boasts a clientele that includes several Fortune 500 companies. Its platform not only identifies vulnerabilities but also produces in-depth reports, dashboards, and invaluable insights on remedial measures.

Alix, the pioneer in wealth transfer, secures $5.5m investment

Alix, described as “the world’s first seamless wealth transfer platform”, is stepping forward to reshape the manner in which global asset transitions are managed.

The firm recently celebrated an impressive $5.5m seed funding round, with significant backing from San Francisco’s Initialized Capital, according to a report from Forbes. This round also garnered support from other prominent investors such as Magnify, Scribble, American Family Ventures, and Alumni Ventures.

Dedicated to revolutionising estate transfers, Alix ingeniously blends empathetic AI technology with human expertise. This harmonious blend is designed to assist users through every phase of the sometimes daunting estate settlement voyage.

While it remains undisclosed exactly where these fresh funds will be channelled, indicators suggest that Alix intends to enhance its technical platform, expedite collaborations, and bring new talents onboard. All these initiatives aim to position Alix as the ultimate solution in the WealthTech sector, especially considering the daunting prediction by Cerulli Associates of a $84tn asset transfer in the US alone in the coming 25 years.

Initialized Capital managing partner Jen Wolf commented on the platform’s profound potential: “Alix gives every family the tools needed to compound wealth across generations, starting with estate settlement,” she said. “What I appreciate most about Alix is how it not only brings modernisation and simplification to the weighty work of wealth transfer, but does so with compassion at a time when you need it most.”

Further information came to light in an exclusive conversation with Alix’s co-founder and CEO, Alexandra Mysoor. Not only does she bring to the table vast e-commerce and international exposure, but she also graces the board of directors for Security National Financial Corporation.

Inari bags $5.2m to revolutionise global insurance tech infrastructure

Inari, described as a “core technology infrastructure provider for the global insurance and reinsurance industry”, has successfully secured $5.2m in a seed funding round. This was led by Caixa Capital Risc, operating through Criteria Venture Tech.

The funding positions the Barcelona-based firm, Inari, as a global frontrunner in (re)insurance technology services. This boost in finances will further accelerate Inari’s ambitious long-term growth strategy. This includes plans to expand their teams in both Barcelona and London, stepping into new regions to grow its geographical influence, and developing additional features using their innovative technology to meet the demands of their existing and potential (re)insurance clientele.

Established in 2017, Inari’s mission is to empower its clients to function as next-gen insurance and reinsurance entities. This holds true for both newly established ventures and long-standing industry veterans. They boast a global clientele that includes MGAs, Insurance Carriers, Lloyd’s Syndicates, and Reinsurance companies scattered across regions such as Europe, the US, Asia, and Bermuda.

Inari offers a comprehensive suite of services such as core insurance policy administration, underwriting dashboards, and bordereaux management systems. Their platforms, which are cloud-based and natively API-enabled, aim to simplify the intricate policy lifecycle and manage the challenging aspects of daily (re)insurance processes. With proprietary technology for data capture, the platform facilitates agile, digital-first underwriting and risk management, promising enhanced operational efficiency, data accuracy, and cost reductions.

The recent funding round saw participation from three key investors: the leading investor, Caixa Capital Risc, a venture capital offshoot of Spanish holding company CriteriaCaixa, CDTI – a prominent public tech development organisation in Spain, and another industry leader.

Inari CEO Frank Perkins commented, “Today’s announcement validates inari’s vision, value and year-on-year track record as part of our mission to revolutionize the (re)insurance industry, establishing inari as a core technology provider that is trusted and valued by the insurance industry and is attracting talent and investors. The funding will support enhancements to our product offering, enable us to add to our team’s insurance industry and technology expertise and to expand globally”

Furthermore, Mr Perkins expressed his optimism and gratitude for the team’s relentless efforts and the unwavering support of their progressive client base.

iMin Technology raises $5m to accelerate its global expansion

College-focused FinTech platform Firstcard raises $4.7m in funding round

Firstcard, a firm crafting superior banking experiences for college students, has proudly declared its recent seed funding triumph of $4.7m.

Notable contributors to this round encompass a selection of venture capitalists and angel investors, specifically the AngelList Early Stage Quant Fund.

The origin story of Firstcard is deeply rooted in personal experience. Founded by immigrant entrepreneur Kenji Niwa, who also boasts of a successful startup sale in Japan, he founded Firstcard during his MBA tenure at UC Berkeley Haas Business School. It was during this time that Kenji personally faced hurdles while trying to access financial products as an international student, and simultaneously observed the financial challenges plaguing his fellow students.

To address these pain points, Firstcard has unveiled its Credit Builder Card, a game-changer in student finance. This product empowers students to commence their financial journey with a strong foundation, focusing on credit building without the common concerns of credit history, over-spending, or even the dread of rejection. The Firstcard platform goes beyond just a credit card offering; it provides a comprehensive banking solution where students can earn notable cash back from specific merchants, and soon, enhance their savings with an impressive 4.25% APY via the Firstcard Plus subscription.

Features of the Firstcard Credit Builder Card are especially student-friendly: they can track and build credit scores, maintain healthy financial habits through a deposit equals spend model, secure approval sans credit history or location-based constraints, grow cash steadily, enjoy cash back from a vast network of partners, and much more – all without the unexpected sting of hidden fees.

In a heart-to-heart conversation, Firstcard CEO Kenji Niwa revealed, “We built Firstcard because students are provided with very little knowledge to manage their finances coming out of college. We started Firstcard with an ambitious mission: to help students succeed in their financial journey by changing the culture of finance and making financial products accessible to all students – no matter who they are, where they are from, or what their credit history is.”

Recent findings by Firstcard have shown that half the college student population steers clear from credit cards due to fears of irresponsible spending and potential rejections. Additionally, a FICO study highlights that almost 29% of Gen Z consumers are either without a credit score or uncertain about it. Recognising this gap, the Firstcard executive trio – Kenji Niwa (CEO), Daniel Junqueira (CTO), and Ma Qing (CMO) – took the initiative to create the Credit Builder Card specifically to address students’ credit challenges.

GenAI startup Automat raises $3.75m

Mindgard’s AI cybersecurity gains £3m ($3.74m) seed funding boost

London-based cybersecurity startup, Mindgard, which specialises in AI security tools, has garnered significant attention in the financial sector with its recent funding success.

The company announced that it has secured a seed financing of £3m, according to a report from UKTN. The funds came from esteemed investors IQ Capital and Lakestar.

Mindgard, a brainchild of Lancaster University, has developed a pioneering platform that allows businesses to rigorously test the security of their AI models. What sets them apart is their claim that their platform can interoperate with “almost any” existing cybersecurity system.

The company is aiming to capitalise on the surging popularity of large language models (LLMs) which power advanced chatbots like ChatGPT and Bard.

Established just last year by Garraghan, Steve Street, and Dr Neeraj Suri, Mindgard’s foundation is deeply rooted in academic research from Lancaster University. The firm’s credentials are further solidified with its memberships in Nvidia’s Inception Programme and the Microsoft for Startups Founders Hub.

Mindgard CEO Dr Peter Garraghan commented, “Today’s businesses are rapidly embracing LLMs and other AI technologies. Although these enterprises understand the need to secure their AI assets, the cybersecurity that worked for them in the past won’t help guard their AI against the next generation of cyber threats.”

DGTAL clinches €3m ($3.2m) in strategic funding to boost AI-driven insurance tools

DGTAL, a firm offering a SaaS platform with AI capabilities for insurance portfolios, has announced a significant €3m in strategic funding.

The latest investment has seen 1750 Ventures, the venture capital division of German VGH Versicherungen, coming on board as the anchor investor. They were joined by Gossmann & Cie. Subsequent shareholders to enter the frame include Swiss software corporation DEON and the team at DGTAL.

The genesis of DGTAL dates back to 2021. Since its inception, led by Dr. Florian Herzog and Arndt Gossmannd, the firm embarked on a mission to leverage AI in utilising unstructured data within claims files. This exploratory endeavour bore fruit, leading to a successful prototype capable of drawing unprecedented insights from vast volumes of unstructured data, signaling a major transition for the domain of claims management.

Currently, DGTAL’s technology is utilised to audit, evaluate, and assess claims portfolios. When looking at the bigger picture, claims settlement stands out as the central pillar of any insurance scheme, accounting for roughly 75% of the premium. The integration of AI into this segment is poised to reap financial savings exceeding €100bn annually, restricted to the European market.

Arndt Gossmann, the CEO of DGTAL and Managing Partner at Gossmann & Cie. shared his vision: “AI will change the way insurance works. I want DGTAL to become a major technology enabler of this paradigm shift. The strategic investment of VGH Versicherungen and the financial commitment of my partners at Gossmann & Cie. is great confirmation of what our team has built. Working with investors that know what they are talking about is the best call for action for a CEO. Working with an amazing team to support the change of an entire industry is an honour.”

On the investment’s significance, Chlodwig Reuter, Senior Partner at Gossmann & Cie. remarked, “Being well anchored in the insurance community, we see the importance of digital transformations and the power of AI for redefining how insurance works. The investment in DGTAL translates our sector experience and our firm strategic belief in technology.”

San Francisco’s FinTech Numeral secures $3m in seed funding for high-volume accounting

San Francisco-based company, Numeral, is at the forefront of redefining accounting for high-volume businesses.

In their latest funding move, Numeral has secured $3m in an oversubscribed seed round. The investment was spearheaded by Bienville Capital and saw contributions from AngelList Quant Fund, executives from Kruze Consulting, and accounting magnates of high-volume entities.

Diving into its functionalities, Numeral has introduced its cutting-edge real-time subledger for businesses handling high volumes. Since its inception last June, the platform has gained momentum and has been embraced by a spectrum of high-volume firms like AllTrails, Gabb Wireless, Scribd, Hipcamp, and Elysium Health.

With the newly acquired funds, Numeral plans to channel the capital towards bolstering their workforce and doubling down on their product development efforts. Their mission To transform the accounting sector by addressing prevalent challenges like data fragmentation, accounting intricacies, and the mounting volume issues that fast-evolving businesses grapple with.

Central to their offerings is a contemporary subledger, meticulously crafted to manage an infinite transaction influx. This subledger proves instrumental for transaction-level cash reconciliation, revenue analysis, and data harmonisation.

Egypt’s healthtech star Sehatech secures $850,000 in latest funding push

Egypt-based Sehatech, a trailblazer in the healthtech sector, recently broadcasted its latest successful venture.

The firm confirmed that it has successfully garnered $850,000 in capital. This financial support hails from both A15 and Beltone Venture Capital, the latter being an arm of the renowned Beltone Holding Company.

Diving deep into Sehatech’s offerings, their primary focus rests on the innovative use of technology. Their aim is to modernise and automate the intricate and often convoluted connections between insurance companies and healthcare providers. This includes the critical aspects of claim management and approval processes, also known in industry parlance as third party administration (TPA).

In today’s age, the mechanism for executing a medical insurance policy stands as a tedious and error-prone process. Sehatech, with its advanced rule-based engine, is on a mission to overhaul this system. Their objective is to expedite medical approvals, claims, and the billing journey, all the while curtailing financial drains caused by human errors and deceit.

Sehatech CEO Mohamed Elshabrawy expressed, “We are thrilled to have the support of A15 and Beltone Venture Capital in our mission to transform the healthcare industry in Egypt and the broader region. Digitising the TPA industry will have a significant social impact on how millions of patients consume healthcare services, making healthcare more accessible and affordable for everyone.”

With their digital platform, Sehatech promises enhanced transparency, swift process timings, and precise claim settlements. This innovative approach will undoubtedly uplift the healthcare experience for patients, streamline operations for providers, and optimise financials for insurers.

Keep up with all the latest FinTech news here

Copyright © 2023 FinTech Global