Convincing Consumers to Adopt Dynamic Electricity Pricing

If utilities offer sign-up incentives they can attract the right customers.

Every few days I get a mailer from a bank or credit card company enticing me to sign-up for their product with an offer of a cash bonus or airline miles. The constant flow of this mail shows that banks think it’s a good strategy to get consumers to sign up. Recently published research by Koichiro Ito, Takanori Ida and Makoto Tanaka finds that offering up-front incentives can also be an effective strategy for energy policymakers.

The authors conducted a randomized field experiment that offered households a bonus if they signed up for a dynamic electricity pricing plan. They found that, not surprisingly, the incentive increased sign-ups. But what was really powerful about the incentive, and not obvious, was that the right amount of incentive can attract the households that policymakers most want and, moreover, these incentives can be tailored to different customer types to further increase benefits.

More Frequent Price Swings

Most US electricity consumers pay the same price for each unit of electricity they use, whatever the time. Many California consumers recently moved to a time-of-use rate that increases every afternoon between 4 and 9pm. However, the costs to produce electricity can swing up and down from one hour to the next and jump to very high levels on the few days when the grid is strained. Utilities have to absorb these costs, which are reflected in wholesale market prices, in order to offer the flat or time-of-use price to consumers. At times this means purchasing expensive electricity generated by inefficient power plants that are expensive to operate. Consumers are unaware of how high the true costs are because they get to pay the usual rate.

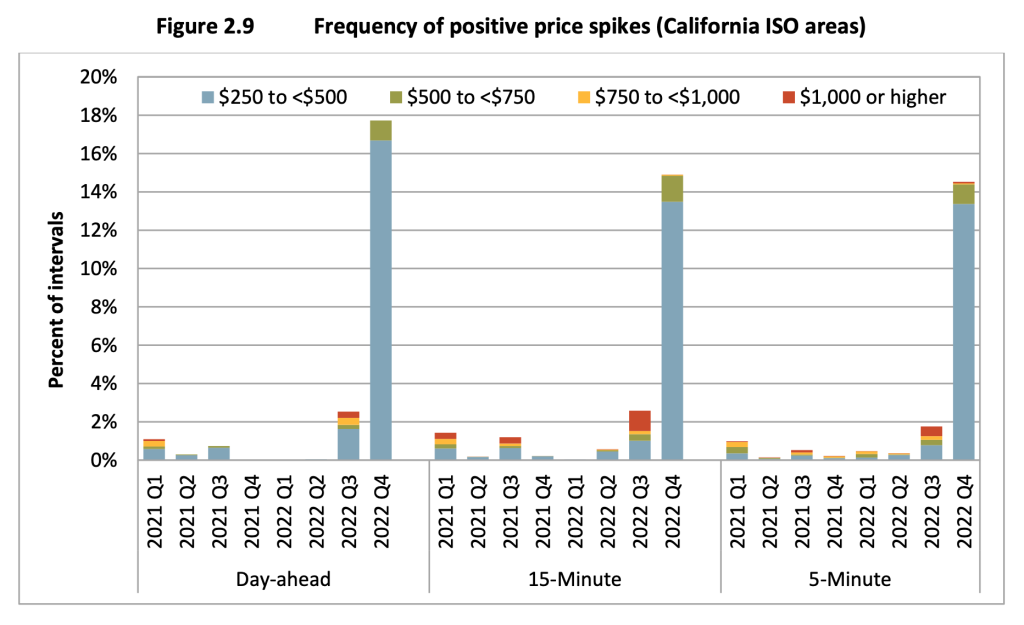

The swings in wholesale market prices are large. In the California Independent System Operator’s area in 2022, one percent of the time prices exceeded $250 per megawatt-hour (five times the average noon price), sometimes exceeding $1,000 per megawatt-hour (20 times the average noon price). Prices swung negative too, about one percent of the time. When prices are negative, wind and solar power plants may shut down, undermining the economics of these carbon free energy sources. The frequency of really high prices and negative prices increased in 2022 relative to the year before. As more wind and solar energy join the grid and electricity demand is buffeted by climate change-driven weather events, extreme prices could become even more common.

A powerful policy response, such as dynamic electricity pricing, could reduce these wholesale price fluctuations. These plans provide consumers an opportunity to save money by decreasing their use when electricity prices are high and increasing their use when prices are low or negative. Economists have long advocated for dynamic pricing because it better aligns demand with supply.

California policymakers are moving in this direction. The California Energy Commission (CEC) has adopted standards that require electricity providers to offer dynamic pricing as an option to all of their consumers by 2027. Later this month, the California Public Utilities Commission will consider a policy that would significantly expand dynamic pricing pilots for the state’s two largest utilities, a step toward meeting the CEC’s goals. This new research into consumer incentives comes at the right time to be rolled into the pilots and increase adoption.

Setting and Targeting Incentives

Ito, Ida and Tanaka note that policymakers have typically not required consumers to switch to dynamic electricity pricing. Instead, policymakers have approved programs that require consumers to proactively join. In the experiment, some consumers were offered an incentive to encourage sign-up. Others were not.

The authors found that a sign-up incentive increased the voluntary take-up rate from around 30% to almost 50%. They then analyzed what sorts of customers were encouraged by the incentive. The value of dynamic pricing programs comes from attracting consumers who will change their electricity usage in response to price changes. A program that hands out lots of incentives to customers that do not make any meaningful changes is expensive for the government to run and provides little benefit.

The researchers found that the households enticed by the incentive indeed were the ones that respond to the price changes. Many of these consumers were at risk of seeing higher bills on the dynamic pricing rate, but the incentive convinced them to sign on. The incentive offset the possible loss. The opportunity to change their demand could make them clear winners. The additional households also included ones that were relatively more nervous about giving up the certainty of their traditional flat rate. The incentive was enough to convince them to take a chance with the new rate.

But how high should sign-up incentives be set? Higher incentives attract even more households. However, the research demonstrates there is a downside to setting the incentive too high. If the sign-up incentive is ratcheted up, the additional households that join are less responsive to the dynamic prices than the households that join at a lower incentive level. Also, among the costs of signing up for a new pricing plan is the effort of going through the switching process and the ongoing attention a household needs to devote to managing electricity usage. When I’ve received offers of a cash reward to open a new bank account my mind goes to these costs – all the sign-up forms, learning how to use a new website, etc…Setting a really high sign-up incentive can lure consumers who are more likely to get frustrated with the burden.

As with most papers that study a specific program (in this case a program in Japan) the research doesn’t give policymakers and utilities everywhere a precise dollar number incentive that should be used in every instance. But it does provide guidance for how to think about the decision.

The authors also provide some very implementable results on the value of targeting an incentive. Their analysis shows how easy-to-get data about households, such as historical electricity use, can be used to set targeted incentive levels and increase benefits. In California, I would suggest policymakers consider climate zones too. This research adds to a robust set of studies on how to design and roll out peak electricity pricing. This includes research addressing how to set the peak and off-peak prices, when to trigger peak pricing and the significant benefits of using an opt-out design (as opposed to an opt-in design). With more peaks and troughs coming to the grid every year, it’s time for utilities and policymakers to put these lessons into practice.

Follow us on Bluesky and LinkedIn, as well as subscribe to our email list to keep up with future content and announcements.

Suggested citation: Campbell, Andrew. “Convincing Consumers to Adopt Dynamic Electricity Pricing” Energy Institute Blog, UC Berkeley, January 16, 2024, https://energyathaas.wordpress.com/2024/01/16/convincing-consumers-to-adopt-dynamic-electricity-pricing/

Categories

Andrew G Campbell View All

Andrew Campbell is the Executive Director of the Energy Institute at Haas at the University of California, Berkeley. At the Energy Institute, Campbell serves as a bridge between the research community, and business and policy leaders on energy economics and policy.

You appear to be recommending a two-level price. (“This includes research addressing how to set the peak and off-peak prices, when to trigger peak pricing ….”) But as your graph shows, the true variation in hourly cost levels (cost, not price) is quite high. Any pre-set fixed prices, and any prices forced to be only two levels, will leave out a lot of situations where some additional customers would have found it worthwhile to respond. Finally, a two-level price exacerbates demand blips during a few minutes near the time of price change, such as 9pm. Once again, utilities don’t want to expose customers to realistic incentives.

Also, real time prices for consumers used to be esoteric. But for anyone charging an electric car, they have a big highly responsive load. And response logic can be built into the chargers, which takes care of FlbrkMike’s concerns.

Finally, paying any kind of RTP alters the value of installing photovoltaics. Even though solar generation is not going to respond to hourly price changes, the annual value of solar generation will be affected.

@Roger Bohn, thanks for your reply to my earlier comment. While I agree with you up to a point, I believe that in the “real world” it won’t be quite that simple. My own situation is pretty unusual, but heading in the direction that I think should be a goal for many of us. When we moved into our home in 1999 (it was built 10 years earlier) it used propane for space heating, water heating and clothes drying. Since 2018, in addition to our PV system, we have converted all of our propane appliances to heat pump units, and added a 20 kWh storage battery and Level 2 EVSE to charge the 77 kWh battery in our EV. This was not done as a single project, but piecemeal as appliances were ready for replacement. All of our home, except for the kitchen stove and oven, pool equipment, and EVSE are powered through the protected loads panel, and we run off of the storage battery from 4 pm until midnight. Battery and EV (when required) are charged between midnight and 6:00 a.m. (the super off-peak period at SDGE). At this point in time, V2H availability is very limited, much less intelligent V2G which seems like a long way down the road. Then if you consider trying to optimally manage all of the other technologies along with the EVSE, it becomes very complex. I do OK managing the system to the current TOU tariff, but throwing in RTP be very challenging.

With new construction the control task would be easier, if all of these appliances were installed and integrated during construction, but there are many more existing homes that need retrofitting than new ones going up.

I’m inclined to agree with the earlier comment by FlbrkMike: “Sure, many people will jump on an up-front incentive but how many consumers have the capability to understand, much less the time to deal with, dynamic pricing?”

Let’s take a brief stroll down Memory Lane on real-time pricing (RTP) in California: LAT reporter Michael Parrish highlighted in July 1995 that the CPUC planned to have RTP be part of electricity deregulation:

“Under deregulation, a time-of-use meter will tell customers how much power they are using each 15 minutes, half-hour, or other specified period of time during the day. Utilities would then offer rates that change over the course of the day–depending on the cost of generating the power at that moment–allowing customers to lower their power bills in various ways.”

But the 1996 deregulation bill, AB 1890, didn’t even inlcude the consumer option for RTP. Why? Though a few environmental groups such as NRDC believed that RTP could be an effective way to reduce peak demand, consumer groups like TURN were not keen about the idea. Moreover, the state’s electricity reserve was so abundant then and, correspondingly, wholesale prices so low — and “highly likely” to remain low for the foreseeable future — that RTP wouldn’t really make much difference, right?

Well, once we found out the hard way that this would not be the case, RTP surfaced again. Severin had a brief chat about it with Gov. Davis at the Western Governors Association meeting in 2000, and in early January 2001, he and Frank Wolak came to the governor’s office and met with me (then Davis’ Senior Policy Analyst) to talk about RTP and market manipulation. (They gave me a draft of their key study of the latter that was published in 2002: Severin Borenstein, James Bushnell, and Frank Wolak. “Measuring Market Inefficiencies in California’s Restructured Wholesale Electricity Market.” American Economic Review.)

Frank, Severin and I, along with Energy Commissioner Art Rosenfeld and CEC advisor Mike Jaske, put together a proposal for a several small pilot projects in early 2001 for just commercial and industrial customers. We concluded that including residential customers would be asking too much. Unfortunately — or otherwise, depending on one’s perspective — the CPUC refused to consider the pilot programs. And my staff counterparts in the legislaure were not at all enamored of the RTP prospect — which I understood given the electricty crisis. But I also understood that not having a rate structure with no demand elasticity dynmaic was not a good thing either.

Over the course of the next few years, that shared understanding led to the “I’ll-meet-you-halfway” proposal for time of use rates and CPUC rulemaking.

I’m glad that 20 year’s after the ill-fated effort to establlish RTP pilots near the end of the electricity crisis, Gov. Newsom signed an Executive Order to do so. And, as Andrew notes, there are reasons to be optimistic about expansion.

That said, as Michael Parrish noted in the concluding paragraph of his July 1995 LAT article, an Edision exec said “that for customers who don’t want the bother, any likely deregulation plan would require the utility to continue to offer averaged rates, as it does now.”

I still think that most customers ultimately “will not want the bother,” even with an upfront incentive. TOU is enough! But I would be happy to be proved wrong.

Back in 1996 we did not have “Smart Tesla Power Walls” or “Sun Vault” battery systems. Programming batteries daily to charge up at the bottom end of the pricing then start discharging into the house at peak times was not available then. 30% tax credits for battery systems as a stand-alone energy saving systems was not available then. Today, we can do that with special low interest rates for consumer financing. Since the system would work charging and discharging daily without being part of the NEM3.0 system since it would never put energy back onto the grid and would act more like an uninterruptable power supply or back up generation system all that would be needed is a computer-controlled transfer switch and battery. Program and forget. Most residential peak hour Grid loads would disappear, customers’ bills would go down and Solar companies would just sell batteries without needing to sell solar panels and they could stay afloat after NEM3.0 curtailed the solar panel sales. Set a start date in 3 years’ time and start pushing for the battery switching low-cost City and county permits and streamlined application forms for the systems NOW.

I undertand that we didn’t have the battery systems you mention in 1996 or during the energy crisis. Indeed, the sort of metering described by the LAT reporter in 1995 was more aspirational than commercially operable, so it can be argued that all those years ago RTP wasn’t quite ready for prime time. (But by the early 2000s, we certainly could’ve done the pilot projects.) That said, once again I will cite a comment from FlbrkMike, but this time from his response to Roger Bohn’s comment, in regard to your contention that “all that would be needed is a computer-controlled transfer switch and battery. Program and forget.” As FlbrkMike observed, “I believe that in the ‘real world’ it won’t be quite that simple.” Someday, likely so, but not now or in the near future.

California’s Utility PG&E has issued devices that allow the utility to control air conditioning thermostats to cut them back “on Demand'” and give a discount to those who install them. Same could apply to all the rest of the residential loads other than refrigeration or Battery backup power transfer switches. Tesla has already built that into the Powerwall smart computer that control the transfer of energy with an app.

We could start with up to date communications. Many people continue to believe midday power is most expensive, nighttime the cheapest.

An excellent article but the successful future of dynamic pricing will mean a system where the consumer does not suffer any significant inconvenience from adopting it. This will mean linking energy using appliances to automatically monitor the electricity price real time and adjust energy usage accordingly. For example, electric cars and batteries could be set at sell electricity into the grid at $0.50/kwh, charge at $0.10/kwh with the owner setting a minimum charge needed, say 30% normally but prior to a long trip or scheduled power outage they could be set to require 100%. Similarly, water heaters, freezers and refrigerators could be set to shut off when electricity prices are high then start again when prices are low, with limits on the allowable temperature range. I can see a future where AI systems learn from the data accumulation when the likely best time to use electricity and when the best time to charge into the grid. Eventually I imagine that these AI models will look at weather forecasts and determine the best time to charge and discharge depending on expected renewable energy generation. This should also ease the grid delivery capacity problems. On my utility bill, electricity costs about $0.09/kwh at the generator, but I am buying from $0.28-$0.46/kwh depending on the time of day. This extra cost appears to be just the cost of maintaining the grid. Easing the strain on the grid by using it close to 100% capacity should save hugely on electricity cost. Perhaps incentives to switch to dynamic pricing should subsidize appliances that are automatically connected to the internet and perform dynamic pricing.

A friend in the UK already has a system that monitors the price of electricity per half hour in his home. He says it is quite frightening at times to look at what it costs and delay using an appliance until the price comes down. Even a system this crude may start to show the public the benefits of dynamic pricing.

The break-even point on a gasoline generator is based on the price of gasoline and the price of electricity it would replace. At $1.00 per gallon, it could break even at 10 cents per kilowatt hour. At $4.00 per gallon, it could break-even at 40 cents per kilowatt hour. Utilities know this and always base their prices just below the break-even price for self-generation compared to the price of gasoline at the pump. This is why they are now trying to increase the basic meter charge since there would be a net loss if one switched over to “backup power” when they can collect money all the time. Only by going completely “off-grid” and getting rid of the utility meter and service can you beat the utilities. Now the saying goes.” The only sure things are death and taxes and utility bills.”

An excellent article but the successful future of dynamic pricing will mean a system where the consumer does not suffer any significant inconvenience from adopting it. This will mean linking energy using appliances to automatically monitor the electricity price real time and adjust energy usage accordingly. For example, electric cars and batteries could be set at sell electricity into the grid at $0.50/kwh, charge at $0.10/kwh with the owner setting a minimum charge needed, say 30% normally but prior to a long trip or scheduled power outage they could be set to require 100%. Similarly, water heaters, freezers and refrigerators could be set to shut off when electricity prices are high then start again when prices are low, with limits on the allowable temperature range. I can see a future where AI systems learn from the data accumulation when the likely best time to use electricity and when the best time to charge into the grid. Eventually I imagine that these AI models will look at weather forecasts and determine the best time to charge and discharge depending on expected renewable energy generation. This should also ease the grid delivery capacity problems. On my utility bill, electricity costs about $0.09/kwh at the generator, but I am buying from $0.28-$0.46/kwh depending on the time of day. This extra cost appears to be just the cost of maintaining the grid. Easing the strain on the grid by using it close to 100% capacity should save hugely on electricity cost. Perhaps incentives to switch to dynamic pricing should subsidize appliances that are automatically connected to the internet and perform dynamic pricing.

A friend in the UK already has a system that monitors the price of electricity per half hour in his home. He says it is quite frightening at times to look at what it costs and delay using an appliance until the price comes down. Even a system this crude may start to show the public the benefits of dynamic pricing.

I’ve come to believe that consumer adoption of dynamic pricing *is not* the obstacle to implementing dynamic pricing. It’s the utilities. When utilities see an advantage to real-time-pricing (RTP), they are pretty good at getting customers to adopt, at least commercial customers who have the largest and probably most flexible demand. But I expect that’s true for residential customers, too, if the benefits are high enough.

Way back, folks at LBNL studied many such programs around the country and have suggested as much. Georgia Power is one of the first and biggest success stories. Here’s a quote from one of their old reports:

“A substantial portion of Georgia Power’s C&I customers have chosen to participate in RTP. Overall, 43% of eligible customers and 82% of eligible load was enrolled in one of the two RTP tariffs in 2004. The market penetration rate for RTP-HA alone was even higher, with more than 90% of eligible customers and eligible load participating. RTP has been popular among all C&I customers, but it has had a particularly strong draw among new Georgia Power customers, since they are able to receive a reduced CBL when they enroll in RTP. Of the new customers that Georgia Power signs up each year that are eligible for RTP, typically 70-80% enroll in RTP (GPC 2004b). In comparison, the market penetration rate among customers that were previously on a different rate (and thus have not generally had the opportunity to receive a CBL below their historical firm load level) is closer to 25% (GPC 2004b).”

The “CBL” is the “customer baseline load” that effectively sets the fixed charge on a customer’s RTP tariff. So GP enticed participation by offering lower fixed charges to new commercial and industrial customers that helped Georgia Power grow its base load. That, in turn, helped them to justify new base load power plants with big CapX and associated rate of return (see the Vogl nuclear plant).

Over here in Hawai’i, the University of Hawaii, one of Hawaiian Electric’s largest customers, has all but begged the Utility for a RTP tariff. The PUC and CA seem open to the idea of a pilot RTP for UH, but Hawaiian Electric has shown zero interest.

The problem? I can only guess that HECO can’t make money off of RTP like GP could. Hawaii has a decoupling rule and all new power generation is competitively bid out to independents. HECO has a nominally fixed amount of revenue for all capEx expansion, too. But they are requesting substantial sums of extra capX (and rate of return) for distribution upgrades. One wonders, however, if some of those grid upgrades might not be necessary with genuine local marginal cost pricing (LMP). One wonders if anyone could really sell power to the grid at avoided cost (presently around 15-20 cents/kWh) that new entry would render much of HECO’s remaining oil-fired power plants obsolete, long before they are able to recover their big upgrade costs.

The lesson here: Utilities need the right incentives. Hawaii recognized this problem in principal and embraced regulatory reform. But that regulatory reform appears clumsy to me and doesn’t seem to be working. The details differ from place to place, but I believe this is a general problem and the key obstacle to dynamic pricing.

After The utilities soaked the new rooftop solar customers with NEM3.0 of a 75% drop in value for generated rooftop solar power being sent to the grid and the proposed “Wealth Tax” monthly service fee taking more money away from families, do you even hope to think they would vote to get $10,000.00 monthly wintertime heating bills like Texans got two years ago from their “dynamic pricing” from their utilities. Utilities should be building either low cost, low Maintenace “Peaker Power Plants” or Battery storage stations, like the one they built at “Moss Landing”, and store all that curtailed energy from wind and solar during the early daylight hours so release it at the peak demand times. Right now, only the wealthy homeowners can afford to do that with overpriced residential back up battery systems. Just like the large commercial solar farms that can build 100,000 solar panels into a field, why not place the battery storage systems adjacent to those arrays so they can keep producing late into the afternoon and evenings at low cost rather than buy expensive energy from racketeer’s like ENNRON.

I think you must be kidding here. Sure, many people will jump on an up-front incentive but how many consumers have the capability to understand, much less the time to deal with, dynamic pricing? Based on occasionally following utility related conversations on Nextdoor, most residential customers haven’t yet come to terms with Time-Of-Use. Even for those with the knowledge and experience to understand how it would work, who has the time or the flexibility to follow and react to dynamic pricing this closely? Most consumers, except for maybe the “energy geeks,” value stability in their utility rates and wouldn’t want to deal with something like this. Personally, I might be tempted to try it out except that the CPUC is now moving to penalize me for major investments I made in PV in 2012 and 2018, on the good faith assumption that I would be able to realize the benefits promised with NEM 2.0 for 20 years. Why would I trust them to follow through on promises made with any future program? I’m sure that there are plenty of early solar adopters who feel the same way that I do, and these are probably among the customers that otherwise might be early and willing participants.

Another observation is that consumers do not like the “opt-out” design. Many in the SDG&E territory felt betrayed (even more than usual) by the utility when they used opt-out in the transition to TOU, and now more recently to the CCA model. No matter how much you announce these things it goes right over a lot of heads, and they get very angry to find that they have been switched without their explicit opt-in.

If we still lived in CA we would have signed up to get $2000/MWh for changing our behavior to provide more juice to the grid with our old PV system (by cutting our demand for AC, irrigation, any well pump activities, not running the electric dryer or the guest house electric heater, etc.) or just by cutting our load if the time frame was outside the time our pv system was generating.

The grid faced quite a few challenges during the heat wave as denoted in the report-

…”The maximum import bid cap allowed imports to bid up to the hard bid cap ($2,000/MWh) in some hours when bilateral market price indices were high. in these Hours with the $2,000/MWh bid cap closely matched hours when the CAISO declared EEA2 and EEA3 alerts. The $2,000 bid cap attracted a limited quantity of additional imports into CAISO market. • Penalty prices were scaled up to $2,000/MWh on days with high bilateral market prices. During the heatwave, both the 15-minute and 5-minute prices in the CAISO rose above $1,000/MWh, exceeding day-ahead prices in many intervals. Real-time prices were often set by penalty prices intervals.”….

Mark Miller

I think the elasticity of demand will increase significantly when it is commonplace that Thermostats and EV charging automatically adjust to electricity price signals, saving money for customers without their attention. This automation will increase based on the number of customers benefitting from variable prices, the number of EV’s owned, and policy encouragement….

Here’s an idea. Why not give incentives to consumers to install electric energy storage? This way, during the times when wholesale energy costs are 5x (20¢/kWh, but being sold at $0.60/kWh Δ$0.40 as opposed to noon when Δ is $0.20) consumers can become generators and put energy on the grid. With current rate plans, the utilities would only have to pay 2X for this energy during high consumption with the minimal investment of the incentives. The Δ would then be $0.52 which would work out much better for the utilities.

An added bonus would be less requirement for maintenance because the stresses on the grid would be much less (distributed generation). Of course this benefit is not realized if the CPUC would require the utilities to lower their rates, a concern that can easily be put a$ide.