Can We Electrify Our Food?

Clean electricity could decarbonize an important part of our food system, but not without policy innovation.

The clearest path to deep decarbonization of the economy is to supply cheap abundant clean energy and then to electrify as many things as possible. This can take a big bite out of the carbon footprint of transportation and buildings. Can it also help with agriculture?

One area where electrification can help our food system is the production of fertilizer. Modern agriculture uses vast amounts of fertilizer. Industrial ammonia production, the root of all major fertilizers, accounts for an estimated 1.8% of all global GHG emissions. Producing a ton of ammonia involves twice as much carbon as producing a ton of steel and four times more than producing a ton of cement (see here). Like steel and cement, ammonia is an absolutely essential part of the modern economy, and while application can and should be more efficient, there is no viable option for maintaining our food supply that involves dramatic reductions in ammonia.

Ammonia can be decarbonized by using hydrogen made from electrolysis powered by clean energy. This is one way of getting our food onto the electrification bandwagon. Clean hydrogen subsidies in the Inflation Reduction Act might be enough to spur a switch to low-carbon ammonia. But, demand forces and policies affecting other end uses, like transportation and steel, seem poised to pull green hydrogen into other sectors instead, even if the decarbonization potential for fertilizer production is greater.

“Knock, knock. Are there any decarbonization solutions here in this ammonia plant?” (Source: GE)

As a result, I think there’s a good case for considering an additional policy to create a demand pull for decarbonizing ammonia. My modest proposal is for a low-carbon standard for fertilizer production. This would work by capping the average carbon content of fertilizer produced in the market, and ratcheting down this average over time.

A low-carbon fertilizer standard isn’t a perfect policy, and it would take careful planning to mitigate any impact on food prices. It does, however, have the benefit of being a feasible policy that could target a significant portion of the emissions from the food system without directly regulating farmers. There may be better policy ideas–my objective in this post is not to ardently defend such a standard, but rather to stimulate discussion around policy that can decarbonize agriculture, where I fear that policy thinking is lagging despite the immense size of the problem.

We need more policy ideas in agriculture

Agriculture in the US is typically assigned about 10% of all greenhouse gas emissions (explained here), but once you loop in the emissions of inputs, power use, transportation and waste, the food system accounts for perhaps a third of all GHGs. Some of this would be addressed by improvements in the transportation and power sectors, but there are a number of other pieces of the puzzle that are going to require a policy push that works backwards from the root source of emissions and thinks creatively.

Unfortunately, mitigation policy in agriculture is plagued by two major problems. First, many of the emissions that come from actions on a farm–like fertilizer application, manure management and burping cows–are especially difficult to measure and thus to regulate or incentivize.

Second, the agricultural sector seems especially resistant to anything that adds cost or inconvenience to producers. Exhibit A is the increasingly regular scene of tractors plugging European highways to protest environmental rules.

These farmers aren’t just here for a joy ride. They are letting you know to look elsewhere for deep decarbonization. (Source: BBC.)

It seems that every policymaker’s favorite agricultural policy is the one that pays the most money to farmers. But, paying for mitigation in agriculture creates the same efficiency problems and unintended consequences that have been undermining offset programs in other domains.

Against this backdrop, a focus on fertilizer production holds some key benefits.

How do we decarbonize fertilizer production?

Everywhere on earth, industrial production of ammonia (NH3), gets its hydrogen from the steam reformation of methane (CH4). The excess carbon separated from the methane becomes CO2 and goes into the atmosphere.

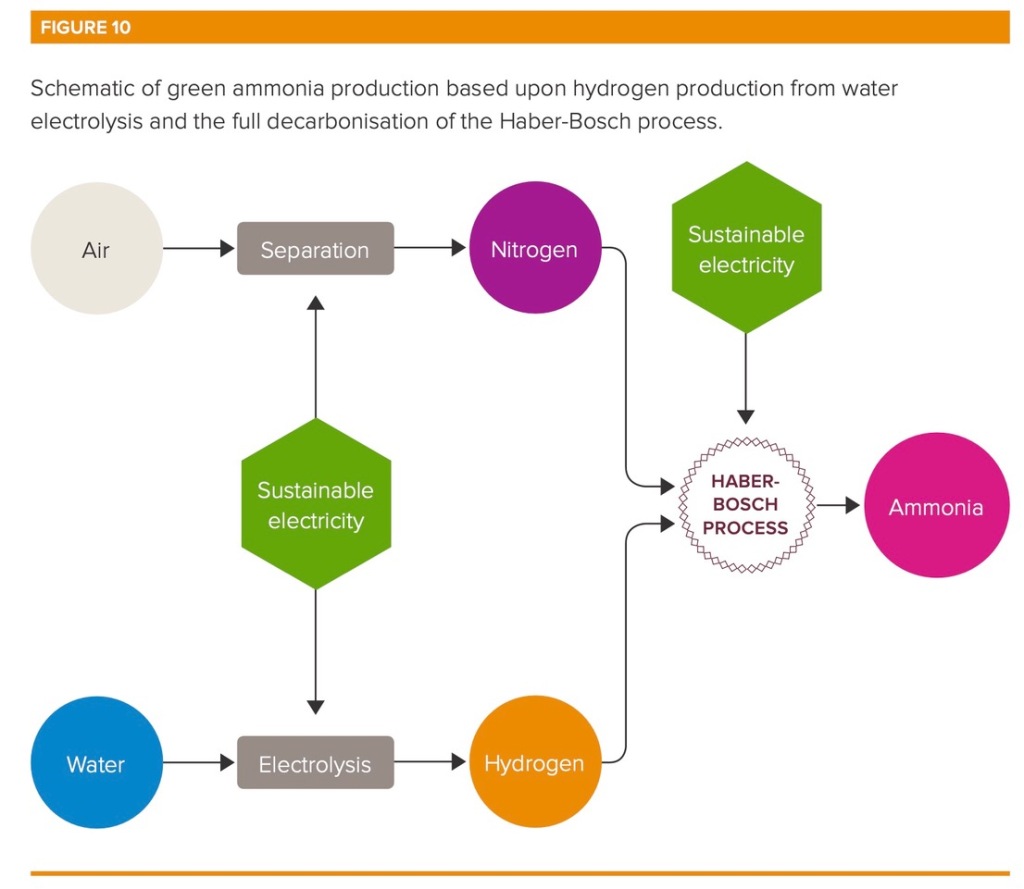

To decarbonize, one option is to capture and sequester the CO2. The other option, which is my focus here, is to use electrolysis, powered by clean power, to supply the hydrogen. This gets methane, and carbon, out of the supply chain altogether. This is a proven process, but commercialization is still limited because of its higher cost. Other advances that improve processing and reduce energy input in ammonia manufacturing can make an important contribution to reducing the carbon footprint of ammonia production, but on a road to net zero we will likely need green hydrogen leading the way.

(Source: Royal Society Policy Briefing)

A switch to “green ammonia” requires no change or adjustment on the part of farmers–the low-carbon fertilizer is exactly the same product once it reaches an agriculturalist. In terms of political economy, this moves the point of regulation at least one step away from the farmers themselves.

If we want to have a policy that requires green ammonia production, we need to verify that the electricity used is truly green and isn’t raising emissions elsewhere in an interconnected grid. This is the same problem I wrote about previously around the Treasury’s struggle to establish eligibility rules for clean hydrogen tax credits. This is not simple, but, when compared to the difficulty of measuring on-site agricultural emissions, this measurement challenge is manageable.

The remaining task then is to find a policy approach that can promote decarbonization without raising the cost of fertilizer production so much that it creates an overwhelming backlash.

IRA subsidies provide one piece of the puzzle. Do we need another?

The Inflation Reduction Act has already created an incentive for green hydrogen through generous tax credits. These might be enough to make clean hydrogen cost competitive without raising the price of fertilizer. It was certainly sufficient to spur initial investment announcements around hydrogen production. Do we really need more policy?

If clean hydrogen can substantially beat conventional sources because of subsidies, ammonia producers would eventually retool their plants and make a switch. This viability, however, depends on the stringency of Treasury rules, and on the future prices of natural gas and costs of renewable power. Some, including the Department of Energy, are concerned that Treasury’s rules might be too strict and could stifle growth. Relevant big policy planning documents–like DOE’s hydrogen roadmap and the IEA’s ammonia roadmap–identify the creation of reliable demand as a top imperative for seeding a cleaner industry. A requirement that ammonia facilities use a growing percentage of clean hydrogen would create predictable demand, pairing a demand pull factor with the supply push from the IRA.

If fertilizer producers are not willing to pay a premium for clean hydrogen over conventional hydrogen, they will be outbid for cleaner hydrogen by other applications, like steel, shipping and trucking, where buyers will pay a premium due to a mix of regulations (in the case of trucking) or voluntary corporate buyers trying to push down their footprint (in the case of steel, and eventually shipping). Another real possibility is that green hydrogen, fueled by US tax credits, will be turned into ammonia and then shipped to Europe, where fertilizer production is subject to the EU’s carbon cap and trade and is facing a phase out of free allocations it receives that are aimed at preventing offshoring.

Normally economists applaud this sort of allocation–clean hydrogen should go to whichever sector values it most. The problem here is that differences in willingness to pay across these applications or locations is not necessarily reflecting where hydrogen has the greatest social value, including their abatement potential. Differences come not only from real differences in value by end use, but also from uneven policy coverage and the quirks of corporate voluntarism. At present, US agriculture is poised to be left behind, even while the (potential) clean hydrogen boom offers the only viable path for decarbonization.

What should we do?

The economist’s preferred solution would be to simply price carbon, equally and evenly across sectors. This would create a demand pull from fertilizer producers to the extent that cleaner hydrogen is the best method of abatement. But, pricing carbon isn’t on the table for the US at present, and this would substantially raise the cost of fertilizer. Any policy that raises the cost of food production is going to meet with substantial political resistance at any time, but this is doubly true while inflation remains a concern.

Thus, I reach the conclusion that we should consider some form of a technology neutral performance standard, or feebate, for low-carbon fertilizer that is designed to limit price impacts. If green hydrogen is someday cheaper than conventional hydrogen, we might have a belts-and-suspenders moment: a standard would be non-binding and unnecessary. Otherwise, a standard could help firm up demand for green hydrogen, help seed a green ammonia industry (which has other potential uses, like in shipping), and ensure that fertilizer production doesn’t simply fall to the back of the green hydrogen queue because other end uses are already motivated by sector-specific factors.

Could a standard avoid raising prices? Economic theory shows that performance standards can sometimes decrease carbon intensity of a sector without raising overall prices. The reason is that while a performance standard creates an implicit tax on dirtier sources, it creates an implicit subsidy on the cleaner sources. Such a policy does the same thing as a feebate, which creates a set of subsidies for clean products funded by taxes on the dirtier ones. Feebates have been used effectively in several countries to make cars cleaner.

The average effect of a standard on fertilizer prices depends on how price sensitive the clean and dirty production process are, but there is good reason to believe that a performance standard would pass on less cost to fertilizer prices than would a carbon tax that achieves similar pollution reductions. This is doubly true while IRA subsidies are pushing the clean input close to parity. We would need modeling to understand how a standard would interact with IRA subsidies and to quantify the trade-offs between policy stringency and price effects. Sometimes our blog posts report on established research findings; today I’m identifying new research needs.

More generally, developing a performance standard requires a lot more thought. We have plenty of examples of well-intentioned policies creating bad incentives later on, and it would be a grand challenge to use a patchwork of policy incentives across sectors that harmonizes social value well. I won’t claim to have gotten too far in thinking about the complications, but when I went looking for policy analysis and ideas aimed at decarbonizing our food system, I found a minimum of resources.

Perhaps I was just looking in the wrong place or failing to use the right AI-augmented search tool. I hope you all have better references and better policy ideas than mine. But, it is well past time to get started understanding our options for decarbonizing agriculture, and this seems to me one of the easiest places to start.

—

Follow us on Bluesky and LinkedIn, as well as subscribe to our email list to keep up with future content and announcements.

Suggested citation: Sallee, James. “Can We Electrify Our Food” Energy Institute Blog, UC Berkeley, March 11, 2024, https://energyathaas.wordpress.com/2024/03/11/can-we-electrify-our-food/

Categories

James Sallee View All

James Sallee is a Professor in the Agricultural and Resource Economics department at UC Berkeley, a Faculty Affiliate at the Energy Institute at Haas, and a Faculty Research Fellow of the National Bureau of Economic Research. Before joining UC Berkeley in 2015, Sallee was an Assistant Professor at the Harris School of Public Policy at the University of Chicago. Sallee is a public economist who studies topics related to energy, the environment and taxation. Much of his work evaluates policies aimed at mitigating greenhouse gas emissions related to the use of automobiles. Sallee completed his Ph.D. in economics at the University of Michigan in 2008. He also holds a B.A. in economics and political science from Macalester College.

“The clearest path to deep decarbonization of the economy is to supply cheap abundant clean energy and then to electrify as many things as possible. This can take a big bite out of the carbon footprint of transportation and buildings.”

It seems Germany (1) and CA have spent decades ignoring this part of your statement-….“to supply cheap abundant clean energy” as the path taken to date ignored the “and then” part of your assertion.

It would have helped if affordable, as in costs per kWh, was tracked over time as that’s the metric that counts!

Mark Miller

PG&E is a BIG for-profit corporation and not a publicly owned municipal utility like Alameda County Water District where the board is elected by the populace at large not by a few greedy stake holders. When Californians have had enough of the “Corporate Greed”, they will form their own local utility like Alameda, Sacramento and Palo Alto have. Until then, just pay up to the “BIG THREE”.

At this time, with less than 100% GHG free electricity generation, due to the large net losses of energy, around 50% at the electrolysis step, any renewables … new, co-located, timed to be fully synced with electrolysis consumption … would have a more beneficial impact in GHG CO2 reduction, if it offset fossil fuels in electricity instead. If you have a windfarm that produces electricity, that gets stored in a battery, distributed, converted back to AC … net efficiency would be around 80%. If you instead use electrolysis to convert to H2, you lose 50% the first step, still have to transport H2, etc. So now you need at least 2X more renewables instead of just using steam reformation. I haven’t worked out the thermal efficiencies for apples-to-apples … but what is really needed is a method where the H2 creation step is more than 50% higher efficient. If a working carbon tax existed broadly, right now, the proposed path would fail.

Soil is a major store of carbon so moving away from this type of farming could be a better way of de carbonizing farming see https://www.soilassociation.org/take-action/organic-living/why-organic/better-for-the-planet/

On a net cost basis measured in declining yield vs reduced input costs, this may be a more cost effective solution than using green hydrogen (which is likely to be very expensive and diverts renewable generation from direct use).

It’s worth noting that there’s a direct-electrification pathway to producing nitrogen fertilizer that’s seemingly far less energy-intensive than electrolyzing hydrogen and then doing Haber-Bosch. Not clear on the details, but it involves using lasers to create plasma, similar to how lightning creates nitrates that can naturally fertilize soil. There’s a California-based startup called Nitricity that’s pursuing this (they’ve done some great podcast episodes on The Interchange with Shayle Kann and My Climate Journey), and a team of Australian and Chinese researchers wrote a paper about this technique.

This is great. I don’t know much about the lasers to food pathway, but I’ll say the bigger point here is that it is important that any policy be structured with enough tech neutrality that advances like this, or ones we haven’t even thought of yet, have a level playing field to compete with existing pathways to produce a clean end product.

There is a lot of merit to the feebate idea. Following are some comments contextualizing this approach:

A straightforward performance standard would require all entities in a regulated sector to meet a carbon intensity (CI) standard (e.g., tons-CO2e per ton-fertilizer). Unlike a carbon tax, or cap-and-trade with allowance auctioning, a standard imposes no taxation burden on industry beyond the technology cost for complying with the standard.

A performance standard can be made more flexible and efficient by allowing GHG credit trading: Entities that cannot easily comply with the standard can buy GHG credits from others who can easily overcomply. Allowance trading has no effect on total emissions; it only reallocates the compliance burden in an economically optimal manner. The regulation imposes a limit on the industry-average CI (i.e., total tons-CO2e divided by total tons-fertilizer), and the trading market determines the credit trading price (marginal compliance cost, $/ton-CO2e). If there is a mismatch between the standard and the industry-average CI, then there will be an imbalance in the and supply demand of credits, causing prices to rise or fall until the industry-average CI matches the standard. A regulated entity will effectively pay a carbon price, not on its total GHG emissions, but only on the portion of its emissions that exceed what is allowed by the standard. If its emissions are less than what is allowed by the CI standard, then the difference is negative and the entity profits from credit sales.

The drawback of a tradable standard is that prices can be volatile and there is no guarantee that prices won’t exceed the industry’s ability and willingness to pay. If the standard is sufficiently lax to reasonably assure cost acceptability under worst-case predictive assumptions, then prices could collapse and the regulation will achieve much less GHG reduction than would be possible within limits of cost acceptability.

This drawback can be overcome by modifying the policy to regulate the carbon price rather than the CI. GHG trading transactions are replaced by direct payments to and from the regulator at a predetermined carbon price, and the market determines the CI in response to the price incentive. This is similar to a carbon tax, except that a regulated entity only pays a fee on the portion of its emissions in exceedance of what its emissions would be at the industry-average CI. If the difference is negative, the entity receives a rebate (subsidy) based on its better-than-average emissions performance. This “feebate” policy is self-funding and revenue-neutral within the regulated industry.

Feebates can very effective catalyze commercialization of nascent decarbonization such as low-carbon ammonia. The initial carbon price could be very high without imposing significant costs on industry. For example, if low-carbon ammonia has 1% market share, then a feebate with a $1000/ton-CO2e carbon price would be equivalent to a $10/ton-CO2e carbon tax in terms of the cost impact on conventional ammonia. But the marginal incentive for decarbonization would be the same as a $1000/ton-CO2e tax. As low-carbon ammonia gains market share, bringing down the industry-average CI, fees on conventional ammonia will increase and the carbon price might need to be adjusted downward to keep fees capped at an acceptable cost threshold. But by that time low-carbon ammonia will have achieved economies of scale that would make it less reliant on rebate subsidies.

This contrasts with conventional carbon taxes, which have an initially low and rising price (e.g., California’s cap-and-trade system operated from 2014 to 2020 effectively as a carbon tax near the floor price, which started at $10/ton-CO2e and increased by 5% per year). Emerging technologies such as low-carbon fertilizer need an initially high and declining, not initially low and increasing, carbon price incentive.

A feebate is equivalent to a carbon tax with output-based refunding of tax revenue: GHG emissions are taxed at a predetermined carbon price, and the tax revenue is refunded to the taxed industry in proportion to output (e.g., at a uniform rate per ton-fertilizer). The clearest precedent for this type of policy is the Swedish regulation of stationary-source NOx emissions in the 1990s.

Feebates could be equally effective at decarbonizing cement under California’s SB 596 legislation, which requires CARB to “develop a comprehensive strategy for the state’s cement sector to achieve net-zero emissions of greenhouse gases associated with cement used within the state as soon as possible”. It could similarly apply to regulate steel used within the state.

Thanks for all this detailed addition! Very much what I had in mind, but a few steps further.

Then we could use grain ethanol to make electricity!

“Everywhere on earth, industrial production of ammonia (NH3), gets its hydrogen from the steam reformation of methane (CH4). The excess carbon separated from the methane becomes CO2 and goes into the atmosphere.” Methane is 40 times the greenhouse gas as CO2. Methane is seeping out of the ground at ever faster rates in the artic tundra as global warming heats up the permafrost. Capturing that methane and converting it to CO2 and H2O in the possess of “burning” for heat, hot water or cooking in the home or even making Ammonia would make more sense than letting it continue to escape into the atmosphere. I agree with the author that fracking for methane, that is much harder to do today and can pollute our aquifers to make Ammonia, is wrong but capturing the bio-released Methane and converting it to Ammonia and CO2 would be better for the planet than releasing it into the atmosphere as is happening right now in Northern Europe, Asia and North America.

Honestly I’m not familiar with any process for economically capturing methane that is leaking from permafrost. We certainly should be doing what we can to limit methane leaks from the gas system.

Utilities use methane capture at stockyards by covering the biomass with a large plastic cover and capture the released methane and process it. A methane detection satellite was just launched last week that can spot methane leaks, both natural and man-made. The larger outflows could be covered and captured just as the methane at stock yards. Sink holes sometimes form and they concentrate the methane that is heavier than air and have been set on fire to lessen the impact and danger to the surrounding countryside. Those sink holes could be covered and provide methane for the Ammonia production. All it would take is profit motive to get industry to make the effort to collect it over fracking or oil well tapping.

Hi Jim, taxing beef would be a good start. Best…Ted

Agreed on the efficiency merits! However, that seems like the most politically explosive version!

Hi Jim, Testing be a good start. Best… Ted Steck