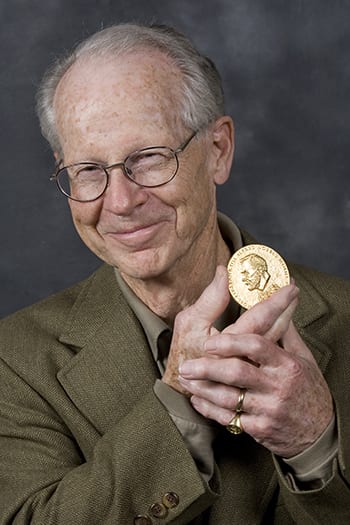

Haas economist John Harsanyi, who taught at the business school from 1964-1990, shares this year’s Nobel Prize in economics with John Nash, Princeton, and Reinhard Selten, Bonn-Germany, for their contributions to game theory.

Ever played a card game and wondered if there was a way to predict its outcome? You are not alone. Social scientists ponder similar questions. The mystery of unraveling what may happen next, of being able to foresee a piece of the future, if you will, has intrigued humans since the dawn of civilization.

Mathematician John von Neumann and economist Oskar Morgenstern broke the first ground on this subject when they designed models for fairly controlled environments: two participants who have all the information about the rules of the game and about their opponent. The result of their findings, Theory of Games and Economic Behavior, published 50 years ago, became the foundation for the study of game theory.

New milestones in the development of modern game theory soon followed. John Nash discovered that in all games there are equilibria when their participants pursue their best possible strategies in light of what the others are doing. John Harsanyi expanded on Nash with a model for games in which participants don’t have all the information about their opponents – thereby making game theory a practical tool for real-life competitions and negotiations.

After Harsanyi had published his new model in the 1960s, it took fellow economists years to start implementing his findings. On October 11 at 4:30 a.m., however, proof that Harsanyi’s ideas had fully penetrated mainstream economics came in the form of a phone call from Sweden, announcing that he was one of three winners of the Nobel Prize. Fellow game theorists John Nash of Princeton University and Reinhard Selten of Bonn, Germany, who distinguished among different kinds of equilibria, share the award and the $933,000 prize with the Berkeley scholar.

“I was very pleased about the award because it’s the first Nobel Prize in economics awarded for work in game theory,” says Harsanyi. “I am also very pleased for the other two recipients. It so happens that I met both of them at a conference on game theory at Princeton in 1962 and have the highest possible respond for their work.”

Analyzing Real Life

Game theory is a mathematical model of human behavior that analyzes how people make decisions in competitive situations such as gambling, bidding, or bargaining. It has become a significant tool for analyzing real-life conflicts, such as a labor negotiations, international political conflict, price wars, and most recently federal auctions. The theory emanates from studies of games such as chess or poker, where plays plan their moves based on expected countermoves from competitors. These interactions also characterize many economic situations, and game theory has proven useful in economic and political analysis.

In 1964, when Harsanyi joined the Haas faculty, he was asked to be one of 10 game theorists to advise the US Arms Control and Disarmament Agency on its negotiations with the Soviet Union. “We discovered that we couldn’t advise them on this matter because these negotiations represented a game with incomplete information, in which each side knew little about the other side.”

Harsanyi developed a systematic procedure to convert any incomplete-information game into an equivalent complete-information game containing random moves. He described this new theory in a three-part article entitled “Games with Incomplete Information Played by Bayesian Players,” which is now the basis for all work on games with incomplete information. “The concept of incomplete information was known for a long time, but no one ever analyzed it systematically,” says Harsanyi.

Fellow Nobel winner Reinhard Selten spent two years at Haas collaborating with Harsanyi and other faculty in the late ‘60s and early ‘70s as a visiting professor. The principal result, A General Theory of Equilibrium Selection in Games, turned out to be an 18-year project for co-authors Harsanyi and Selten. The book provided for the first time a way of choosing a unique equilibrium – a choice for each player that is best against the others’ choices.

Selten also worked with Haas Professors Austin Hoggatt on experimental economics and later with Tom Marschak, with whom he co-authored a book, General Equilibrium with Price-Making Firms, and two articles.

Selten, who lives outside Bonn in an area called the Seven Mountains, is the first German to win the Nobel Prize in economics. A mathematician by training, Selten showed through his research how players’ behavior might change if they knew they were going to play again the next day.

A more recent application of game theory was the Federal Communications Commission’s auction for the narrowband spectrum for the next generations of wireless services, used for advanced paging the messaging.

“Issues of auction design are vitally important,” says Haas Professor Michael Katz, who is currently on leave as chief economist of the FCC. “Getting things right means that the spectrum will be allocated to those who will bring the most valuable services to the public”. All the telecommunications companies participating in the auction used game theorists to advise on their multimillion dollar bids.

From Budapest to Berkeley

John Harsanyi, born in Budapest in 1920, started his career in his father’s pharmacy. “I didn’t have the slightest interest in that particular human endeavor,” Harsanyi admitted during his October 11 press conference. “But being of Jewish origin, I realized that I shouldn’t study a very theoretical subject, and studying [pharmacy] allowed me to defer my service in a forced labor unit.” Harsanyi even planned to enroll in the Ph.D. program, but no professor could take him.

“Finally, there was a very liberal-minded botany professor and he took me as a student. But then came the problem that I was supposed to produce a dissertation. For this purpose, I had to get a plant and cut it into very thin slices with a razor blade, and I somehow just couldn’t do it. The idea was to slice it so thin that it was completely colorless. Well, mine was the most beautiful green you could ever see. And then the Germans occupied Hungary in ’44 and all military deferments – especially of Jewish people – were withdrawn.”

Harsanyi was drafted into a labor unit of the Hungarian army stationed near Budapest. When the Nazis took over the Hungarian government completely in 1944, they started deporting these labor units to Austria. “Most of the people who were deported never came back, mainly because they didn’t get enough to eat. However, I was taken to a railway station in Budapest, and I stood there for several hours until the train would come to take us to Austria. And though I’m a very slow thinker, I realized there was only one way out. Luckily we were in civilian clothes. So I took off my backpack and my armband that showed I was in labor units, and walked out. There was a gendarme whose task would have been to ask for my documents, but he didn’t.” A Jesuit friend then gave Harsanyi refuge in a monastery.

Speaking Freely

After the war, Harsanyi enrolled at the University of Budapest to earn a Ph.D. in philosophy, which was his real interest. He accepted a teaching appointment in sociology under a very liberal Marxist professor. “He had the ambition to have an interdisciplinary department with communists, socialists, and non-Marxists like myself,” says Harsanyi. “And-though in Budapest there was no free speech since the communists had taken over-in the department you could talk as freely as you liked. I made very bad jokes at the expense of my Marxist friends, and nobody cared about this. But the situation became much worse six months later, and they started remembering my bad jokes, and they remembered them as being much worse than they really were. So the result was that in June 1947 my professor told me I should voluntarily resign.”

In the meantime, Harsanyi had met his future wife Anne in a course he taught. “She is now a very punctual lady, but in those days she wasn’t,” he recalls, “and unfortunately my course started at nine o’clock, and she was often late. So one day I said, ‘Miss don’t you know when the class starts?’ She got very annoyed with me, and that was the start of our acquaintance.”

After resigning from the university, he worked in his father’s pharmacy; Anne was still a student in psychology. “She was harassed all the time that she was going out with me-this ‘anti-Marxist fascist,’ as they called me. They tried to force her to break up with me-which she didn’t. So, finally, in 1950, we realized that it was really too hot for us and left Hungary. That was, I think, the wisest decision we ever made. It was a dangerous thing to do, but it would have been more dangerous to stay behind.”

Academia Down Under

They soon made their way from Austria to Australia, where Harsanyi worked in a factory and took night classes at the University of Queensland, Brisbane, until he was offered a teaching appointment in 1954. Building on Nash’s published work, Harsanyi made an important discovery in game theory, which unfortunately Lloyd Shapley (now at UCLA) had published four years earlier. “I was a little isolated in Australia,” Harsanyi explains. “I sent my paper to the American Economic Review, and they enlightened me about the facts of life-but, in any case, I learned something.”

In 1956 the Harsanyis first came to California and he received his Ph.D. in economics from Stanford in 1959. His mentor there, 1972 Nobel laureate Kenneth Arrow, advised him to take a lot of mathematics and statistics courses. When Harsanyi submitted his dissertation, Arrow said, “This is all right, but you know we are not a mathematics department, we are an economics department. You have to add at least one economic example.” Harsanyi did that and submitted what he describes as “one of the shortest economic dissertations ever.”

Harsanyi began teaching at UC Berkeley’s business school in 1964. When he retired in 1990, he was awarded The Berkeley Citation at a conference held in his honor, at which Arrow was one of the presenters. Later, Harsanyi’s friends Selten and Horace W. Brock edited a Festschrift for Harsanyi’s 70th birthday-Rational Interaction: Essays in Honor of John Harsanyi.

Considering Alternatives

“In more than four decades of scholarship, John Harsanyi has probed the idea of rationality in human affairs,” former Haas Dean Raymond Miles wrote at the time of Harsanyi’s retirement. “His work centers on two difficult puzzles. The first is the formal study of what it means for rational persons to take ethical positions or make moral judgments, and how a society of rational but distinct individuals can properly choose among the alternatives it faces. The second has been game theory, that is to say that rigorous formulation of appropriate behavior for rational persons who are in conflict with other rational persons. Professor Harsanyi’s contributions to both puzzles have been absolutely fundamental.”

Harsanyi’s work on ethics, social choice, and welfare economists showed that once a culture adopts utilitarianism–the 19th century notion that one person’s satisfaction can be measured against another’s–then it has an array of powerful tools to use in choosing among alternative policies, laws, and institutions.

At his press conference, Harsanyi expressed hope that game theory would help private and public institutions make better decisions. In the long run, he explained, better decision making will lead to a higher standard of living and more peaceful and more cooperative political systems.

His own experience with the socio-political forces in his native Hungary under German occupation and under Communist rule have shaped Harsanyi’s interest in ethical and moral dilemmas and the power of social forces. “These experiences of course gave a special bias to my interest in social and political questions,” Harsanyi says, “because I realized how important it is to live in a democratic society, and more important, in a liberal society in which people are free to express their opinions, free to associate with other people, and free to lead the life they want to lead.”

Berkeley Haas welcomed the two largest MBA classes in the school’s history this semester: 291

Berkeley Haas welcomed the two largest MBA classes in the school’s history this semester: 291

The Full-time and Executive Berkeley MBA Programs achieved top global rankings in América Economia and Forbes, respectively.

The Full-time and Executive Berkeley MBA Programs achieved top global rankings in América Economia and Forbes, respectively. Dean Rich Lyons has been honored by

Dean Rich Lyons has been honored by  For the past several years, Haas School Professor Emeritus Oliver Williamson had been on the so-called “short list” to receive the Nobel Prize in Economics.

For the past several years, Haas School Professor Emeritus Oliver Williamson had been on the so-called “short list” to receive the Nobel Prize in Economics.

Judges at the 2018 UC Berkeley

Judges at the 2018 UC Berkeley

Assoc. Prof. Jonathan Kolstad, who uses big data and behavioral economics to investigate the complexities of the health care system,

Assoc. Prof. Jonathan Kolstad, who uses big data and behavioral economics to investigate the complexities of the health care system,

Prof. Andrew Rose, an international finance scholar who has taught macroeconomics to three decades of Berkeley Haas students, has received the Haas School’s highest faculty honor: the Williamson Award.

Prof. Andrew Rose, an international finance scholar who has taught macroeconomics to three decades of Berkeley Haas students, has received the Haas School’s highest faculty honor: the Williamson Award.