Tag: Social Impact

Reflection, risk, and reward in social impact for Katrina Gordon, MBA 17

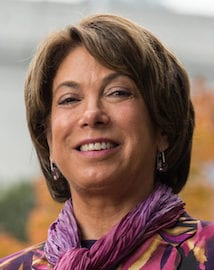

Prof. Adair Morse joins Biden administration as a treasury department deputy

Adair Morse, an associate professor of finance at the Haas School of Business, has been named to the Biden Administration’s treasury department as deputy assistant secretary of capital access in the Office of Domestic Finance.

The U.S. Department of the Treasury, led by Prof. Emeritus Janet Yellen, announced the appointment today.

“I’m thrilled to have the opportunity to serve in the Biden Administration and to join the team at treasury, serving the people of this great country,” said Morse, the Soloman P. Lee Chair in Business Ethics, who is taking a leave from the Haas Finance Group to commit to her new role.

“We will miss Adair at Haas, where she has conducted groundbreaking finance research and launched the Sustainable and Impact Finance (SAIF) initiative with (former Haas Dean) Laura Tyson to train many new leaders in the field,” said Dean Ann Harrison. “She has already made an impact in helping small businesses in California through her work on the California Rebuilding Fund. I have no doubt she will have an even greater impact on a national scale.”

The Office of Domestic Finance develops policies and guidance in the areas of financial institutions, regulation, capital markets, and federal debt finance. Its community and economic development division coordinates small business finance and development, housing policy, capital access, and issues related to underserved communities.

Morse, who holds a PhD in finance from the University of Michigan’s Ross School and two master’s degrees from Purdue University, joined Haas in 2012 from the University of Chicago’s Booth School of Business. Her research interests include equity issues in financial services and algorithms, small business survival, sustainable investing, discrimination and corruption, venture capital, and pension management. The unifying theme in her work, she has said, is “leveling economic playing fields.”

“Adair’s groundbreaking research has looked at important issues, like small business survival in the city of Oakland, consumer lending discrimation in fintech, and the pervasiveness of corporate fraud,” said Prof. Catherine Wolfram, associate dean for Academic Affairs and chair of the faculty. “As a pioneering, creative thinker in so many areas, she will have plenty of opportunity to bring her financial and social impact leadership to the table.”

As a pioneering, creative thinker in so many areas, she will have plenty of opportunity to bring her financial and social impact leadership to the table. —Prof. Catherine Wolfram, chair of the faculty

Morse has spent much of the pandemic using her finance expertise to try to help small businesses. Last spring, Morse and Tyson began working on a strategy to use public capital to attract private lenders to provide low-interest credit to help vulnerable small businesses get through the crisis. They first helped develop a program with the City of Berkeley, and then worked with others—including Yellen, who was then on Gov. Newsom’s Task Force on Jobs and Competitiveness—to implement an innovative public-private loan structure at the state level. Their work helped launch the California Rebuilding Fund, run by the Governors’ Office of Business and Economic Development (GO-Biz) and aimed at some of the state’s smallest businesses in under-resourced communities.

At Berkeley Haas, Morse also ran the Haas Impact Fund and Sustainable Investment Fund curriculum, managing two endowment funds with Haas students. The Sustainable Investment Fund is the first and largest student-led Socially Responsible Investing (SRI) fund within a leading business school.Until recently, Morse served on the Governance and Allocations Committee of the California Rebuilding Fund, as well as on the expert panel for the Norwegian sovereign wealth fund, advising on issues of sustainability and innovation.

Jessie Tang, MBA 20: On track to create positive change through impact investing

Haas Voices: Luis Alejandro Liang on being “paperless, not powerless”

Haas Voices is a new first-person series that highlights the lived experiences of members of the Berkeley Haas community. Our first perspective is by “double Bear” Luis Alejandro Liang, BS 12, EWMBA 23, who is among the approximately 644,000 Deferred Action for Childhood Arrivals (DACA) recipients granted special immigration status because they were brought to the U.S. as children. Liang’s path to Berkeley was challenging—he’s been accepted three times. He shares his story below.

Many times over these past four years, I’ve woken up in fear. Fear of deportation. Fear about what was going to happen to our community. Fear that ICE could knock on my door and take me away.

I grew up in Sinaloa on the Pacific coast of Mexico. I’m half Chinese, half Mexican. I grew up multicultural—going to Catholic church on Sundays but celebrating Chinese New Year. I started helping my family in their Chinese restaurant when I was six years old. I was surrounded by entrepreneurs.

When I was 14, my mom moved me and my three little sisters to Orange County because she wanted to provide us with better chances. I entered high school as a sophomore without knowing any English. It was a culture shock, but I wanted to honor my mom’s sacrifices by excelling academically. I was put back in algebra, even though I was taking calculus when we left Mexico. As a senior, I got into a couple of UCs, but my first scholarship was taken away because I didn’t have a social security number.

So I decided to go to Fullerton College. In high school, I had been really shy because I was new, so I didn’t know anything about things like AP classes or honor society. When I got to community college, I decided to get involved. I joined the Puente Program, which is mostly for Latino students to help get us into four-year colleges. I was really active, working long days because I was also a tutor. The Puente Program gave us a tour of all the UCs. That was the first time that I actually went to visit the campuses.

When I visited Berkeley I fell in love. I remember the Campanile, Sather Gate and thought of all the famous people who went there, including Mexican presidents.

I knew that I wanted to study business. I also knew that I was gay by that time too, and that San Francisco was LGBTQ friendly. I knew I could be myself at Berkeley.

My dream came true when I got accepted to Haas as a junior and received the prestigious Regents’ and Chancellors’ Scholarship, given to the top 2% of students. But when I went to the financial aid office, they again took away my scholarship because I still didn’t have a social security number. I was crying, and the woman who broke the news to me was crying too.

They again took away my scholarship because I still didn’t have a social security number. I was crying, and the woman who broke the news to me was crying too.

I remember seeing the César E. Chávez Student Center in front of me and I just went in and I started walking around. I thought, “If this is César Chávez’s building, there’s going to be a Latino person here who can help me.” I ended up meeting Lupe Gallegos-Diaz, director of the Chicano Department at Berkeley. Lupe became a support for me when I returned to community college more determined to achieve my dreams.

I became more politically active, creating the Fullerton College Dream Team to support undocumented students. In 2010, I got into Berkeley Haas for the 2nd time, having raised $70,000 to cover my tuition.

When I graduated, I was a first-generation Berkeley Haas grad deemed ineligible to work in the U.S. I felt lost, but by then I knew I wasn’t alone. My life took a turn when President Obama passed DACA in 2012, extending opportunities previously unavailable to those of us brought to the U.S. as children. A door of possibilities opened up and led me to a job at Salesforce, helping non-profit organizations leverage technology to amplify their impact.

My life took a turn when President Obama passed DACA in 2012.

Being the first DACA employee at Salesforce motivated me to use my voice in a space where underrepresented groups lack a sense of inclusion. I worked with the chief equality officer on a podcast about diversity and inclusion, served on the leadership board of multiple employee resource groups, and came out of the shadows by sharing my story on a video called “Proudly Me.”

In 2013, another dream came true when I traveled to the White House and met President Obama after I received the LGBT DREAMers Courage Award, which honors individuals who have shown courage and perseverance in the face of injustice.

Still focused on social impact at my current job at Twilio, I decided it was time to go back to school for an MBA. I applied to the Berkeley Haas Evening and Weekend MBA program and got into my dream university for the third time, starting last fall. My focus is to become a chief social impact officer and a social leader at a company. In my classes, surrounded by fellow Type As, I’m learning things that I put into practice at my job. I love the community and I can’t wait to get back to campus.

Growing up, I thought that life would change the day I could finally get my residency—that something would change inside of me and that things were going to be better. But as the years passed, thinking that way made me believe that I was incomplete and something was missing. But being paperless doesn’t make us powerless. We have purpose and an eagerness to give back, by creating communities, by finding the power in helping people. I now find so much joy in helping other “Dreamers” get into school and finding their dream jobs.

But being paperless doesn’t make us powerless. We have purpose and an eagerness to give back, by creating communities, by finding the power in helping people.

There are 11 million undocumented immigrants living in the U.S., not by choice, but because we needed to survive. I hope to highlight the narrative of joy, love, and pride that comes from living a life dedicated to serving our families’ and communities’ dreams.”

Luis Liang, an account manager in social impact at communications company Twilio, is passionate about advocating for human rights and supporting Latinx, LGBTQ, and undocumented immigrant communities. Liang has served as a board member for the Association of Latino Professionals for America, The Greenlining Institute Alumni Association, and on several corporate Employee Resources Groups.

Berkeley Haas offers graduate certificate in sustainable business

Berkeley Haas this week launched a new certificate that will equip MBA students to become sustainability leaders.

The Michaels Graduate Certificate in Sustainable Business is named in honor of the parents of Charlie Michaels, BS 78. Michaels, with his wife, Doris, gave $1 million to support the new certificate program, noting his parents’ commitment to the importance of values and business ethics.

Dean Ann Harrison called the new certificate an important addition for Haas. “We need to make sustainability an integral part of doing business,” Harrison said. “Future business leaders will need to design new models and financial structures, policies, and industry solutions to address the world’s most pressing sustainability challenges. The Michaels Graduate Certificate in Sustainable Business will train our students to evaluate operational, financial, and strategic decisions using a sustainability lens.”

We need to make sustainability an integral part of doing business. —Dean Ann Harrison.

The certificate, approved for rollout in the current spring semester, evolved from initiatives launched across campus by faculty and students who are passionate about both sustainability and social impact, said Michele de Nevers, executive director of sustainability programs at Haas.

“This new certificate addresses a pressing need to empower new leaders with the capacity to lead the economic and social transition to a climate resilient, low-carbon, and equitable future,” de Nevers said.

To earn the certificate, students are required to complete at least nine graduate-level units of approved courses drawn from electives in the existing MBA curriculum. Students must first take two foundational courses—Energy and Environmental Markets and Business and Sustainable Supply Chain—that introduce sustainability concepts critical to energy and the environment, natural resources, and supply chains.

They will then choose an in-depth course to dive deeper in a particular area, such as impact investing, entrepreneurship, clean tech, energy infrastructure, or food systems. The certification culminates with a final project that will focus on developing strategic and sustainable business solutions or bringing clean technology to market.

About 15 to 20 students are expected to complete the certificate within the first year, said Pete Johnson, assistant dean of the full-time MBA program and admissions.

De Nevers said the certificate will equip graduates to bring a sustainability perspective to their work across all types of organizations.

“We hope that they will see opportunities to create value across industry roles, whether it’s through increasing energy efficiency, eliminating waste in supply chains, or pursuing new business opportunities in clean technology,” she said.

For more information about the certificate click here.

Q&A: Michele de Nevers on making Haas the top b-school for sustainability

As the executive director of Sustainability Programs at Berkeley Haas, Michele de Nevers has spent the past few months working closely with Dean Ann Harrison to shape the school’s long-term sustainability vision.

De Nevers might well be the perfect person for the newly created job: Her impressive career has included teaching graduate students in Barcelona about international climate change policy to co-authoring a paper for the Center for Global Development that argued that developing countries should receive performance payments from richer countries for keeping their tropical forests intact and reducing deforestation.

At the World Bank, where she spent three decades, she managed environmental projects ranging from pollution reduction to conservation of biodiversity. And she led global consultations on the corporate Strategic Framework for Development and Climate Change, a strategy report that outlined the World Bank Group’s plan to respond to new development challenges posed by climate change.

In this interview, de Nevers discusses how Haas can deepen its existing sustainability strengths through efforts to support faculty, students, and programs.

Haas News: Can you summarize your vision for sustainability at Haas?

Michele de Nevers: Our vision is to make Haas the No. 1 business school in terms of sustainability. That means a focus on leadership: developing our future leaders who will go out into the world and actually implement the transformation of economic and social systems—energy, transportation, land use, cities—that will be required to avoid and respond to the impacts of climate change.

How do you define what sustainability means to our community?

At the most basic level, I think it’s important that every Haas graduate comes away with basic literacy on sustainability, which means understanding the challenges, the opportunities, and the risks that will be needed to manage in the business world. This includes leading the efforts to reduce greenhouse gas emissions to net zero by 2050, responding to the impacts of climate change, and working toward building climate resilience. Future business leaders will need to manage stresses on natural resources, particularly water scarcity in western states like California. And they will also need to manage the social side of sustainability, which will increasingly determine support from constituents—shareholders, employees, customers and communities.

At the most basic level, I think it’s important that every Haas graduate comes away with basic literacy on sustainability.

What is Haas already getting right?

Haas is already doing a lot. About 20% of the professional and ladder faculty are working on environmental, social, or governance areas that can be considered part of sustainability. There are many areas where we are very strong, have huge recognition, and a great reputation. Examples include the Energy Institute, which has a very deep bench, and a critical mass of experts from the ladder faculty, and the Sustainable and Impact Finance Initiative (SAIF), which is hugely popular with students. The Fisher Center for Real Estate and Urban Economics is transitioning its program toward sustainability through low-carbon built environment (LCBE) projects, which give students opportunities for hands-on experiential learning in local communities. The Center for Responsible Business helps students work directly with leading companies on Corporate Social Responsibility (CSR) issues. The Sustainable Food Initiative links food, land use, and regenerative agriculture, and the Center for Equity, Gender & Leadership (EGAL) addresses the social side of sustainability, including diversity, equity, and inclusion and the gender-pay gap. What we are hoping to do is to build on these pillars of strength, and deepen and reinforce each of these areas, some of which need additional financing and ladder faculty support.

What we are hoping to do is to build on these pillars of strength, to deepen and reinforce each of these areas, some of which need additional financing and ladder faculty support.

Another example of sustainability on campus is Chou Hall, which continues to have considerable support from the Haas community.

The Haas Sustainability Task Force, led by Danner Doud-Martin, is terrific. Her group includes faculty, staff, and students, a whole community that’s passionate and motivated, working on making Chou Hall and the rest of campus Zero Waste. They’re looking at initiatives to reduce paper and plastic use, to encourage reusables, and to make travel carbon free. Working with the task force can give students the hands-on experience that potential employers are looking for. Haas is really in the lead here.

How is sustainability included in the curriculum?

In the recent review of the core curriculum the faculty agreed to weave sustainability considerations into the core courses. This is already happening in several courses. One of my next areas of inquiry is to work with the faculty to examine what’s in the curriculum for core courses, and to collaborate in areas where we might be able to help to build in sustainability. We need to look at whether we need to commission more case studies or provide other kinds of support. We also need to figure out how to fund and support more faculty research on sustainability.

What do you and Dean Harrison consider the top funding priorities for sustainability efforts at Haas?

The main priority for Haas is to raise money to hire more ladder faculty, to expand funding for student research and for fellowships, and to provide reliable funding for the centers and institutes and for capstone programs like Cleantech to Market (C2M). So, fundraising is important. Luckily Dean Harrison is very good at that, and she’s on it.

Haas ranks among top schools in Better World Ranking

Berkeley Haas was among the top US business schools ranked by Corporate Knights in the 2020 Better World Ranking.

Haas rose to #19 this year, climbing steadily from #39 in 2017 to #23 last year, as the school increased its offerings and research related to diversity, equity & inclusion, corporate social responsibility, cleantech, and sustainability.

Corporate Knights examined 151 business schools, drawn from the most recent Financial Times top 100 global MBA programs, to determine the top 40 schools that incorporate sustainability into their teaching and research.

Schools are evaluated on five performance indicators (with weighting in brackets): core course integration of sustainability (30%), faculty research publications on sustainability topics per faculty in calendar year 2019 (30%), number of citations per faculty for those publications (20%), sustainability-focused research institutes and centres (10%), faculty gender diversity (5%), and faculty racial diversity (5%).

Maura O’Neill: Creating and inspiring impactful entrepreneurship

Haas and Berkeley Law faculty help build plan to save California small businesses

The Haas School of Business and Berkeley Law played a critical role in developing the State of California’s new fund to support small businesses devastated by the coronavirus pandemic.

The California Rebuilding Fund, a new public-private partnership announced last week by the Governors’ Office of Business and Economic Development (GO-Biz), uses government-backed capital to support the state’s small businesses. The fund is targeted particularly toward the smallest firms and entrepreneurs from communities that have been historically disenfranchised.

“The state put many groups together to try to get the best of the best ideas,” said Berkeley Haas Assoc. Prof. Adair Morse, who helped develop the structure for the fund. “We all came together to try to optimize a plan for the people of California.”

The state put many groups together to try to get the best of the best ideas.

The pandemic has left 30% to 40% of California’s small businesses on the verge of failure, according to Mark Herbert, vice president of California’s Small Business Majority.

Haas’ efforts to help save small businesses began when Morse and Prof. Laura Tyson—concerned about the impact of shelter-in-place closures—began crafting a strategy to attract private and institutional capital to help healthy small businesses make it through the crisis. Their work took shape in the City of Berkeley’s Save our Small (SOS) Business Recovery Loan Fund, launched in March.

“Speed is of the essence”

That project led to new work on the Governor’s initiative when Tyson connected Morse to Berkeley Law’s Susan (Suz) Mac Cormac, a lecturer in social enterprise and a corporate partner at the firm Morrison & Foerster. After coronavirus struck, Mac Cormac started providing pro bono legal advice to struggling small businesses in need of loans by hosting office hours through a partnership with the Law School. She saw the state’s work as a way to amplify that work.

Morse, Mac Cormac, and Tyson quickly spearheaded a group called CASE (the California Small Business Enterprise Task Force). Tyson connected the team to former Fed Chair Janet Yellen, a professor emeritus at Haas, and a member of the state’s Task Force on Business and Jobs Recovery.

Yellen embraced their ideas and the trio was invited to testify with many other groups involved with the effort during the California Infrastructure and Economic Development Bank’s (IBank) board meeting this week.

IBank has received $25 million from the state to collaborate with the private sector to drive capital to Community Development Financial Institutions (CDFIs) and other mission-based lenders. The loans are expected to start going out next month.

Tyson called the initiative a game changer for struggling businesses and applauded the efforts of many groups on the project.

“Speed is of the essence in bridging this gap for businesses that were healthy, but now at risk of failure through no fault of their own,” Tyson said. “We’re fortunate that so many people—with expertise in finance, law, economics, and public policy—put their heads together, and the governor’s office made it happen so quickly.”

“We will need more”

Mac Cormac said the work that her team did negotiating with lenders and philanthropists on behalf of small businesses blended well with the work Tyson and Morse were doing on the business side, designing loan structure. The goal, she said, is to make sure that the loan terms are transparent to avoid excessive fees or red tape.

Mac Cormac said she felt a moral obligation to act when small businesses started shutting down and clients started calling her for help.

“There’s been this desperate, desperate need and I’m hoping this will help,” she said. “I think it will help, but we will need more because it’s going to be bad for quite awhile.”

Morse added: “We’re so pleased with the outcome and what that money allocated will mean to these small businesses that are struggling to keep the lights on.”

Supporting small businesses

The program has three main ways it will support small businesses:

- A loan fund that will make flexible, affordable loans to small businesses with 50 employees or fewer through participating community lenders. The loan fund will be accepting applications on this website, which will be available in the coming weeks.

- A free resource guide, built and updated by pro-bono lawyers at Morrison & Foerster that includes county by county guidance on reopening, other financial resources available, and the latest on commercial eviction moratorium. The guide is also available in Spanish here.

- Free virtual office hours staffed by expert lawyers so that small businesses have a place to get specific questions answered. Office hours are held weekly.

MBA student volunteers step up to help Oakland’s small businesses

After the coronavirus outbreak shuttered hundreds of small businesses in Oakland in March, Shan Ouyang joined a group of Berkeley Haas MBA students who hit the phones to help owners navigate financial survival.

Failing to connect with the first four owners on her list, Ouyang, MBA 20, finally reached a hardware store owner. She spent an hour, mostly listening. “He was just closing the store and he wanted to discuss his difficulties, how much his revenue was down,” said Ouyang, who with 30 MBA students is volunteering through a program launched by the Sustainable and Impact Finance (SAIF) initiative at Berkeley Haas with the City of Oakland.

The program aims to assist hundreds of small business owners who face language, technology, or income barriers to help them access federal relief funds including Small Business Administration (SBA) loans, the SBA’s Paycheck Protection Programs, and unemployment insurance.

The students have split into four teams contacting small business owners working in partnership with District 6 in East Oakland, (the district of Oakland Council member Loren Taylor, MBA 05), the Black Cultural Zone and the Black Economy Rapid Response Network, the Greenlining Institute, and the Chinatown Chamber of Commerce.

“Stepping up in a tangible way”

Before starting their work, all of the MBA volunteers participated in an April 11 training with the City of Oakland. Marisa Raya, a senior economic analyst for special projects with the city, who has collected data since the start of the business closings, gave some of the business owners the heads up that the Haas students would be calling.

Students who speak Mandarin, Cantonese, Spanish, and other languages were matched with business owners in need of language support.

“It’s been inspiring to see the MBAs step up and take the initiative in a tangible way,” said Jessie Tang, MBA 20 and project co-lead, whose mother, an immigrant from China, ran a small business when Tang was younger. “The biggest challenge we’ve had is getting people to pick up (the phone).”

When they do get an owner on the line, Kat Baird, program director for SAIF, said the students are using their business school background coupled with the city’s training to inform and answer questions.

While phone banking may seem old fashioned, Baird said it’s the best way to reach people right now who may not have Internet access or be receiving the most updated information about loans and federal aid in their native language.

“Many of the business owners are confused about the programs available to them and may have given up after they got refused by one program,” said Baird, who is spearheading the program for Haas through SAIF, which is part of the Institute for Business & Social Impact at Haas. “These programs are developing every day and we want the owners to know that these programs exist.”

“A very human conversation”

Tang said the first two businesses she reached were a fortune cookie factory and a funeral home. The funeral home owner surprised her, she said, by asking about her well-being, instead of letting her ask him how he was doing.

“We’re just here to have a very human conversation,” she said. “In training, they talked about empathic listening and to provide resources that they may not know about. The challenge right now is there’s so much uncertainty.”

We’re just here to have a very human conversation.

Ouyang, a native of China who speaks both Cantonese and Mandarin, said she’s called 24 owners so far, mostly restaurants and small grocers in Chinatown. The hardest part for many, she said, is not knowing when they can reopen. “They’re just waiting,” she said. When students get legal questions they can’t answer, they refer business owners to a Berkeley Law program that matches small business owners with Berkeley Law students who will help them navigate the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Tang said it’s perhaps most difficult when there’s little she can do to help an owner, like a kettle corn business owner she spoke with who had no website. She suggested maybe selling the kettle corn online, but he told her that the business isn’t set up for manufacturing and shipping. “There’s nothing you can do right now,” he told her.

Dalton Guthrie, MBA 20, who is making calls to businesses in the Black Cultural Zone, said the volunteering experience led him to apply for a contract job with the federal Small Business Administration (SBA), administering disaster loans.

Guthrie, who enrolled in the student-led Berkeley Haas MBA course Dialogues on Race this semester and researched ways that race influences the distribution of community resources, said despite race-conscious initiatives at the local level, he’s witnessing the negative impact of insufficient federal policies in real time in Oakland.

“A lot of businesses with the social connections, the privilege, and the financial literacy have so much of an edge up,” he said. “When you have a pot of money, the people who are going to get there first aren’t the people who are going to need it the most.”

When you have a pot of money, the people who are going to get there first aren’t the people who are going to need it the most.

Still, Baird said that a meeting this week with community partners brought some hopeful news.

“Despite all the problems with federal programs the businesses we’re working with are starting to get funds, access to loans and to see some support come through,” she said.

Berkeley Haas and City of Berkeley unite on small business loan fund

When the coronavirus pandemic hit, Berkeley Haas Assoc. Prof. Adair Morse and Prof. Laura Tyson immediately began thinking about ways to make it possible for cities to attract private and institutional capital to help small businesses make it through the crisis.

Their idea has now taken root locally, with a new partnership between Berkeley Haas and the City of Berkeley’s Mayor Jesse Arreguín and Vice Mayor Sophie Hahn to pool private and public money into a small business loan fund.

Last week, the Berkeley City Council approved creation of the Save our Small (SOS) Business Recovery Loan Fund, to support businesses with fewer than 50 employees that have already felt the severe impact of the economic shutdown to slow the spread of the coronavirus.

The news comes as the $349 billion federal government program meant to keep small businesses afloat during the pandemic ran out of money last Thursday, just two weeks in.

Small business loan and grant programs by the federal, state, and local governments have been keeping the lights on, but when shelter-in-place ends, small businesses need working capital to restock, pay employees, and catch up on credit and rent, said Morse, who proposed the loan program to the Berkeley Mayor’s office with Tyson, Distinguished Professor of the Graduate School.

Both are founders of The Sustainable and Impact Finance (SAIF) initiative at Berkeley Haas, a program founded last year to use impact investing and sustainable finance to drive positive change and opportunities. Helping Berkeley’s small business community to rebound is perfectly aligned with SAIF’s mission, Morse said.

“Many municipal programs are already helping small businesses to keep the lights on, but in the medium term, small business survival will require more capital,” Morse said.

One key SOS loan fund supporter is Kirsten MacDonald, CEO of the Berkeley Chamber of Commerce, who says about 98% of local businesses are considered small businesses.

There’s a lot at stake with the recovery and a lot of anxiety coming from local business owners ranging from hairdressers to small nurseries and retailers, she said. “I don’t think anybody knows what the aftermath of this is going to be like (for business),” said MacDonald, who wrote a statement of support to the city for the SOS Fund. “The city should be looking at any and all ways to provide financing at a low rate to small businesses,” she said.

Many municipal programs are already helping small businesses to keep the lights on, but in the medium term, small business survival will require more capital.

More federal and state money may come, but the goal of the SOS fund is to support businesses that were healthy and viable before the pandemic and help them weather the crisis. “It’s imperative to support viable, forward-looking businesses that can, in turn, support our economy through owner successes, employee wages, and return on property,” Morse said.

Mayor Arreguín called the program “a creative way for the city, campus, and community to come together to support one of Berkeley’s most important resources, our small businesses, in this time of unprecedented need.”

“We want all ideas and support on the table for our business community,” he said.

While the City of Berkeley will manage the program’s loans, Morse and Tyson are working with the SAIF team to design the loan terms and to build the model used to make the loan decisions.

“This program is so well-structured,” said Ben Mangan, executive director of the Center for Social Sector Leadership at Haas, who will help the SAIF team with outreach in the investing community. “Once we have a few leaders who take the plunge and invest I think we’ll see a quick uptick in participation.”

The Berkeley Mayor’s office is looking for a financial institution to partner with on distributing the five-year loans. The financial institution will offer private investors a fixed-income product, something like a WWI Liberty Bond for COVID-19, that will yield a 1% to 2% return, Morse says. The rest of the funding to back the loans will be provided by local government and philanthropy.

While the City of Berkeley will market and manage the fund, Morse said Haas will help get the word out to private wealth and asset managers through its network.

“We hope to have this done and ready when businesses are allowed to open again,” Morse said. She added that she hopes the fund will become a model for other communities.

Social impact interns leverage MBA for the greater good

When Daniel Diaz, MBA 20, joined Kennemer Foods in the Philippines as a fellow last summer he wanted to streamline cash payment processes between cacao farmers and their buyers. Diaz pitched the idea of using digital wallets to access cash payments via cell phone, an idea that quickly faded.

“Many farmers had basic phones and telecom companies weren’t offering money transfer services via text,” said Diaz, a former fellow at Kennemer Foods, which provides agronomic assistance, including financing, access to export markets, and crop management, to smallholder farmers. “Plus, a lot of these areas either lack internet or have spotty internet, so digital wallets weren’t going to work.”

Instead, Diaz pitched prepaid debit cards as an alternative payment method, which the company is now considering.

Diaz was one of nine full-time MBA students who received stipends from the Haas Social Impact Fund (HSIF) to cover the cost of social impact internships for the summer. Each spring, the HSIF organizes a fundraiser asking classmates to donate a day’s pay that they’d receive from a corporate internship.

Last year, students raised nearly $25,000–the most money since the program launched in 2004–and awarded summer stipends ranging from $1,000 to $6,000 to cover travel expenses, salary, and living expenses.

A grant enabled Pang Sittakaradej, MBA 20, to spend her summer at Small Enterprise Assistance Fund (SEAF), a Washington, D.C.-based social impact investment firm serving small to medium-sized businesses in emerging countries. While there, she created a “gender-smart” manual for equity firms looking to invest in companies dedicated to promoting gender equity policies.

Sittakaradej, a native of Thailand, said she’s grateful for her classmates who donated to HSIF because it allowed her to explore the social sector, a career field that she wants to pursue after graduation.

“To them, making a donation may have been a small gesture, but to me it was a huge help,” she said.

Aanchal Kawatra, MBA 20, said the HSIF grant enabled her to work at Roco Films, bridging her passions for social impact work and media entertainment. Over the summer, Kawatra developed a communications strategy or “pitch kit” to help Roco Films raise money for social impact documentaries.

“Getting funding helped me believe in the students at Haas,” said Kawatra. “Haas actually cares about these [social impact] issues and students who care about these issues. They provide for the students who want to make an impact in this world.”

Fundraising for the HSIF is scheduled for April 20-24, but donations to the fund are accepted year-round here.

To apply for HSIF funding, submit an application by April 24 or contact Paula Fernandez-Baca, MBA 21, MBA Association’s vice president of community to learn more.

Aanchal Kawatra, MBA 20, worked at Roco Films last summer.

Q&A: Andrew Hening, MBA 17, on solving chronic homelessness

As director of Homeless Planning & Outreach for the city of San Rafael, California, Andrew Hening used what he learned in his Evening & Weekend MBA classes to spearhead programs that helped lead to a 28% reduction in chronic homelessness in just two years in Marin County.

We talked to Hening, MBA 17, who grew up in Richmond, Virginia, and previously aspired to be a lawyer, about how he created new approaches to homelessness and why he believes that housing people isn’t as intractable a problem as many people believe.

When did you get interested in working on behalf of homeless people?

After college, I moved back to Richmond to work as a paralegal and study for the LSAT. To my surprise, I quickly realized the law wasn’t for me, and I started taking time off to volunteer in the community. I’d done a lot with youth and tutoring, but then I participated with a Project Homeless Connect event, which is essentially a resource fair for people living outside. It was my first exposure to homelessness, and it had a huge impact on me. Between that experience and my dad, a carpenter, losing his job during the recession, I decided that I had to do something to help economically marginalized people. With that goal in mind, I found AmeriCorps VISTA, which is the domestic version of the Peace Corps, and accepted a job as Santa Clara County Project Homeless Connect Coordinator in 2010.

You’ve been at your current job in San Rafael since 2016. What were some of the challenges you faced after you started?

My first City Council meeting was standing-room-only for a hearing about whether or not the city should revoke the use permit for a local nonprofit. There was this polarized community conversation around whether we needed to provide more services in the community or get rid of existing ones because they were enabling the problem. The truth was somewhere in between. We realized community frustration was really stemming from a small minority of the homeless community – the long-term, chronically homeless. While just 20% of the overall homeless community, these folks often exhibit untreated mental illness and generate other nuisances like public defecation. Importantly, these are also extremely vulnerable people – dying over 20 years earlier than their housed peers. We knew all of these people by name, but year after year they weren’t getting prioritized. In fact, four or five agencies might be serving the same person. There was no coordination, no strategy. So we said if we can figure out a system for them, we can start to fix this.

What happened after you started identifying the chronically homeless?

Our new process is shockingly simple. First and foremost, we finally prioritized chronic homelessness. We made vulnerability the top criteria for getting housing placements, which put the chronically homeless at the top of our housing list. Next, for people at the top of our list, we provided housing subsidies using Section 8 vouchers, a government program that requires people pay a third of their income on rent while the subsidy covers the rest. Additionally, the county hired dedicated landlord recruitment staff with property management experience, which was 200 percent more effective than relying on social workers to recruit landlords. We’ve now brought together county supervisors and city council members and created a public-private coalition with the Marin Community Foundation and the private sector to create even more housing. Finally, every person that gets a housing voucher also gets intensive wraparound services. We like to say that housing is essentially healthcare for these high-needs people.

What are some of the outcomes that you’ve tracked?

During our 18-month pilot that started in March of 2016, we housed 23 of the most visibly, chronically homeless people in the community. After validating this approach, we scaled it and over the last two years housed over 170 of the most vulnerable people in our community. Ninety-five percent of these people are still housed, and in San Rafael we’ve seen a 54% reduction in EMS transports and an 86% reduction in police department calls after people are housed. Amazingly, providing services and housing is roughly 50% cheaper than letting people languish on the streets.

How did your MBA courses help you when you were both designing the new program and educating the community about what you were doing?

Being in the EWMBA program was amazing because I was constantly bringing fresh ideas back to the team — so many things that seemed tangential to homelessness but weren’t. For example, from our operations class, I was seeing ways to apply supply chains and turnover to our housing placements and the speed at which people become and resolve their homelessness.

I also had an incredible mentor in Sara Beckman. After starting to learn design thinking during Applied Innovation, I did an independent study with Sara and also took her course on slums at the Jacobs Institute. Seeing the big picture and using data to analyze it — that really made a big difference. For months I had a floor-to-ceiling sticky note map on the wall in my office trying to map the flow of people through our homeless system of care. It helped make the case to policymakers that the system needed to change.

Do you think that the success you’ve had in Marin County could be replicated in larger cities like San Francisco or LA?

That’s my hope. It’s hard to believe, but in 2017, just as our new strategy was scaling up, Marin County had the 7th highest per capita rate of homelessness in the entire country. We had success here because we got all of the partners in the same room. We identified the people we needed to house, made a list, and started housing them. That’s a lot harder in a big city, but I think it can be scaled by creating smaller jurisdictions inside a city, including smaller populations of a couple of hundred people, as well as leveraging technology to communicate and coordinate.

The other tricky part is staying focused on housing. Across California, only about 30% of people who are homeless have access to shelter. It’s a humanitarian disaster, but the solution is more than housing. To the extent that communities invest in emergency shelter, it comes back to the idea of the operational supply chain: what is the pathway to permanent housing?

You’re writing a book about what caused modern homelessness. What is the goal?

I started writing this book about what’s causing this modern homelessness crisis after I finished the EWMBA program. I spent two years researching and writing. Now I’m finalizing a book proposal. The goal is to get it out to the general public, providing stories and solutions to end this. It’s so easy to talk about the negative stuff. I’m hoping to make people feel empowered to make a difference.

Haas unveils revamped sustainable and impact finance program

Katharine Hawthorne, MBA 20, came to Haas to build a career in impact investing.

She’s found plenty to dive into so far—as co-president of the Haas Private Equity Club, a principal of the school’s student-run social impact fund, and a summer intern at Patamar Capital in Jakarta, helping to make investment decisions in high-growth companies in South and Southeast Asia.

Now in her second year at Haas, she’ll be able to go even deeper, in a newly expanded sustainable and impact investing program that Berkeley Haas rolled out last week. The program, called Sustainable and Impact Finance, or SAIF, is focused on three sectors: sustainable investment, impact investment, and impact entrepreneurship.

Moving to the next level

By creating the new pathways, the program will better position students who aim to work in sustainable and impact finance as public fund managers or private equity investors, or in the startup world.

Assoc. Prof. Adair Morse spent the past year developing the new program with Prof. Laura Tyson, faculty director for the Institute for Business and Social Impact (IBSI).

SAIF includes new courses, expanded activities, research projects, internships, and student investment fund management opportunities in impact finance, which differs from traditional investment finance because investors aim for both positive financial return and a positive impact on environmental, social, and governance (ESG) outcomes, as well as social justice. In class, students learn how to evaluate a company based on its ESG performance.

“With SAIF, we’re continuing the Berkeley Haas tradition of thought leadership in sustainability and impact in finance and entrepreneurship,” Tyson said. “There’s deep interest in sustainable and impact investing careers at Haas, and our existing courses and activities, including the student-run Haas Socially Responsible Investment Fund, have been enormously successful. SAIF will build on this strong foundation, enabling us to move to the next level in an organized, targeted, and meaningful way that keeps pace with rapid changes in sustainable and impact investing and impact entrepreneurship.”

“Haas needs to continue to lead the way in these areas,” said Morse, faculty director for SAIF. “The world is changing and we have issues of climate change, supply chain transparency, gender diversity, and social justice to take care of and this should be fully integrated into the business curriculum.”

A pioneer in corporate social responsibility

In a recent Wall Street Journal article, Haas was ranked the top graduate business school in sustainable finance and investing, according to data from the QS World University Rankings. The school is a pioneer in social impact investing, with efforts beginning during the late 1950s when late Dean Budd Cheit launched the first courses on corporate social responsibility. Haas now offers a total of nine courses devoted to the topic, more than any other school, as well as several others that cover related topics such as social impact metrics and impact ventures.

SAIF’s three tracks are designed to emphasize different aspects of impact investing. The course pathways are:

- Sustainable investment: This track trains students to be managers of and investors in sustainable/responsible/ESG investment portfolios, primarily in publicly traded stocks and bonds. First-year courses include “Financial Information Analysis” and “Sustainable Portfolio Construction,” followed by a full year of investment work with the $3 million Sustainable Investment Fund. The fund, formerly called the Haas Socially Responsible Investment Fund, was founded in 2007 and has graduated over 90 students. Enrolled students become fund managers, analyzing investments and constructing and managing a portfolio.

MBA students who have managed the Sustainable Investment Fund at Haas, formerly called the Haas Socially Responsible Investment Fund. Photo: Jim Block - Impact investment: Impact investing, a term coined by the Rockefeller Foundation in 2007, includes investments that generate financial returns and create a positive impact. This track prepares students for investment careers in private equity, venture capital, and real assets. Courses include “Impact Finance & Entrepreneurship” and “Impact Venture Partners: Portfolio.” Another course, “Impact Investing Practicum,” places student teams with impact investors to complete pre-vetted projects. Haas has placed seven teams, a total of 20 students, over the past several years in projects for clients including Omidyar, Salesforce, Patagonia, Cambridge Associates, and Gratitude Railroad.

Jessie Tang, MBA 20, worked on an impact investing project for Gratitude Railroad. - Impact entrepreneurship: This track helps students understand social impact financing from both a fund perspective and a startup perspective. Courses include “Impact Startup Launchpad” (previously Social Lean Launchpad), and “New Venture Finance.” Haas entrepreneurship lecturer Jorge Calderon leads the pathway, which includes management of a new fund called Berkeley Impact Venture Partners. The fund has a dual strategy: The “catalyst fund” provides startup teams at the pre-seed stage with $5,000 grants, while the “scale fund” helps startup teams, on or off campus, that are further along in their development with larger market rate equity investments. Electives for students in this track include “Food Innovation Studio,” “Impact Disco,” and “Social Impact Metrics.”

Jessie Tang, MBA 20, said the pathways are a great way to formalize all of the program’s offerings. “I like that they’re trying to put more of a framework around this,” said Tang, who was on a team assigned last spring to an Impact Investing Practicum project with Gratitude Railroad, an alternative investment platform committed to solving environmental and social problems. “They’re working out ways to help the students navigate the course offerings in a better way.”

Growing interest in impact investing careers

Additional members of the SAIF team, who helped develop parts of the program and will also teach courses, include William Rindfuss, executive director of strategic programs, Julia Sze, a lecturer in social leadership, Ben Mangan, executive director for the Center for Social Sector Leadership, Nora Silver, founder and faculty director with the Center for Social Sector Leadership, and Assoc. Prof. Panos Patatoukas, who is launching new research on impact finance.

Tang, who will be the Graduate School Instructor (GSI) for the Impact Finance & Entrepreneurship class Morse is teaching this fall, is among a growing group of Haas students and alumni working in social and impact investing, including Patrick Hamm, MBA 20, who was a research analyst intern at Parnassus Investments, a pioneer in socially responsible investments, in San Francisco last summer; Adrian Rodrigues, MBA 18, who is co-founder and managing partner of Hyphae Partners, which works with businesses to develop and finance regenerative business models; Zeina Fayyaz Kim, MBA 16, an associate partner at NewSchools Venture Fund in Oakland, a national nonprofit venture philanthropy fund focused on public education; and Zach Knight, MBA 15, who is a co-founder and partner of Blue Forest Conservation, which works to protect forest health through a forest resilience bond.

Global Social Venture Competition celebrates 20-year anniversary

Pedro Moura and Jessica Eting, both EWMBA 18, built a rewards-based online and mobile savings account designed to appeal to people who underutilize banking services. Their hard work led to the launch of startup Flourish Savings, which has now earned a place at the April 5 Global Social Venture Competition (GSVC) finals.

“It takes a lot of expertise, research, and partnerships to tackle wicked problems like helping low-income and immigrant communities learn to trust banks, save money, and build credit,” Moura said. “We’re hoping that the judges will see how our idea has the potential to change the way people handle personal finance.”

The competition, which is celebrating its 20th year, will be held during the Future of Social Ventures Conference at Haas.

Flourish, along with Respira Labs, founded by Dr. Maria Artunduaga, UC Berkeley/UCSF MTM 18, Nerjada Maksutaj, MBA 20, and Nikhil Chacko, MBA/MPH 20, are the two Haas teams competing in the finals—among more than 20 global teams in this year’s competition.

A vision of a better world

GSVC has come a long way since its founding in 1999 by five MBA students—Lia Fernald, Alison Lingane, and Denise Yamamoto, MBA 00, and Nik Dehejia and Sara Olsen, MBA 01. Their idea was to provide social entrepreneurs with mentorship, feedback, and a chance to hone their funding pitches.

Jill Erbland, GSVC’s program director, has watched the program’s number of partners and its international appeal to students grow since she arrived at Haas in 2007. This year, 11 partners hosted 12 regional semi-final events—and the competition had a record-breaking 692 applicants hailing from 67 countries. To date, GSVC has distributed more than $1 million in prize money, and helped more than 7,000 teams move closer to achieving their vision of a better world.

“In 1999, creating viable companies that had social impact was a nascent idea, even for Berkeley Haas,” Erbland said. “Our steady growth has been fueled by other universities prioritizing social impact and entrepreneurship educational programs.”

Following footsteps

The competition has launched a number of Haas student-led social impact ventures, including Indiegogo—co-founded by Danae Ringelmann and Eric Schell, MBA 08—and Revolution Foods—co-founded by Kristin Groos Richmond and Kirsten Saenz Tobey, MBA 06.

Flourish Savings’ co-founders are hoping to follow in their footsteps. Eting, the daughter of immigrants, and Moura, an immigrant himself, met in Senior Lecturer Sara Beckman’s Applied Innovation class. They soon discovered a common interest in helping people build savings habits, reduce reliance on debt, and achieve financial security. A pilot program demonstrated that participants saved an average of $192 in the first four months of using Flourish.

This is Eting’s second GSVC event. About 10 years ago, she was an attendee and guest of her boss, who had judged one of the regional competitions. “I was in awe of the people who were pitching, and I never once imagined it’s something I would be doing,” she said.

Meantime, Respira Labs aims to help people who struggle with chronic obstructive pulmonary disease (COPD), a progressive lung disease that obstructs breathing. The team is pitching a wearable lung-function monitor that that uses audio-signal processing and machine learning to alert patients, caregivers, and doctors when inhalers, medication, or medical care is needed. The data collected could be used to predict and prevent flare-ups of COPD, which afflicts 16 million Americans, according to the CDC.

Artunduaga met her Haas colleagues at Berkeley SkyDeck. Maksutaj said her family has been affected by COPD and was quick to embrace the startup’s mission. Chacko came to the team with a passion for solving health crises in low- and middle-income countries, to which the World Health Organization (WHO) attributes 90 percent of global COPD deaths.

“GSVC’s global focus is especially important to us because our long-term ambitions go beyond the U.S.,” Chacko said.

The full conference includes more than the GSVC final presentations and judging. This year’s sessions are organized around the theme “Technology for Good,” and sessions include “The Future of Food: A Design-Thinking Session with IDEO,” “Financial Inclusion and Technology” with speakers from Mastercard and PayPal, and “The Promise and Peril of Emerging Technologies in Social Impact.”

Attendees will also be able to watch presentations from all the finalists and meet GSVC co-founder Sara Olsen, who is serving as a judge this year.

Undergrads tie for win at National Diversity Case Competition

A plan to build an inclusive new small-format Target store in Oakland netted a Haas undergraduate team a first-place tie with the host school at The National Diversity Case Competition (NDCC). The 8th annual event was held at Indiana University’s Kelley School of Business Jan. 18-19.

The Team: Team captain Claudia Diaz, BS 19, Kiara Taylor, Alec Li, and Frances James, all BS 20. The team’s advisor was Mary Balingit, assistant director of admissions & outreach for the undergraduate programs, and the undergraduate lead for inclusion & diversity. Faculty coaches were Haas Lecturers Steve Etter and Krystal Thomas, along with Erika Walker, assistant dean of the undergraduate program.

The Field: 168 undergraduates from 42 business schools around the country, competing for a total of $20,000 in prize money.

The Challenge: Choose a neighborhood and develop a strategy for the location, design, and merchandising of a new small-format Target store, as well as address ways to help the community integrate Target into their neighborhood. Target asked the students to consider community engagement, marketing, the supply chain, delivery options, finance & logistics, and diversity & inclusion.

The team’s plan: To build a small-format Target in downtown Oakland, called The Town’s Target, with a locally-owned café to be operated by a local food entrepreneur. The cafe would double as an incubator—a residency program that would allow that local entrepreneur to build clientele and develop an exit strategy to launch a business at the end of two years, at which time a new entrepreneur would take over the café. The café would include a mural painted by an Oakland artist collective, and a community space for local social justice organizations to meet. Electronic lockers in the store would house customer’s hot lunches or purchases and be accessible to people with disabilities and farmer’s market produce would be delivered daily, along with locally sourced products, like coffee, chocolate, and apparel.

What made them winners: Storytelling, originality, and depth of content. Competition judge Zain Kaj, CFO of GE Global Supply Chain at GE Healthcare, said the team’s ideas were “creative and delivered with passion and a genuine sense of inclusion and celebrated what the weekend was all about.”

The competition provided the perfect platform for the team “to showcase how we’re living our culture out loud,” Walker said. “The Defining Leadership Principles were in full effect and I’m so proud of the team for its authentic approach and positive energy. It’s a well deserved win!”

James opened the team’s 15-minute presentation in a unique way—with spoken words.

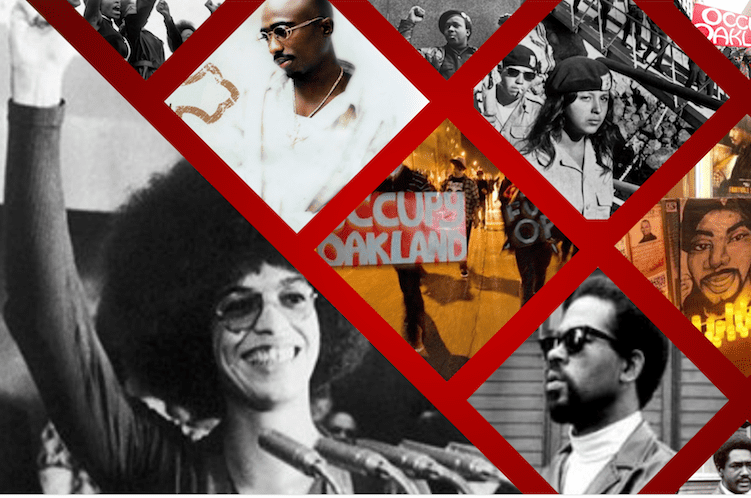

Oakland

The land of culture, the home to change

The Brown Berets carried the torch for Chicano freedom

Black Liberation ignited

The voices of Malcolm X and Angela Davis heard loud and clear—they called for more

Oscar Grant killed, a flawed police force at fault

Black Lives Matter, they yelled, Black Lives Matter!

Tupac preached about changes, America needs change

Said forgive but don’t forget, always keep your head up

All of these voices came to form the Oakland we know

But it has become so much more…

Li designed a stunning visual presentation, with collages representing Oakland’s rich history. “We hit every emotion,” he said. “We made them laugh, and made them cry.” Taylor had great command and presence in the room, Balingit said.

The secret sauce: Diaz’s slow and steady delivery of her personal story of growing up in a low-income community in South Central Los Angeles—a food desert, she said, where your choices were either “McDonalds or Jack in the Box because there were no fresh strawberries or apples.” A Haas senior and a social justice warrior, Diaz served as team captain, and “the person who had to rally everyone together,” Taylor said.

The Haas Factor: Questioning the status quo. When the students read the case they boiled it down to one word: gentrification. Then they focused on Oakland, and how gentrification has impacted the city. That led them on a tour of Oakland with Balingit, where they drove past shuttered mom and pop stores and discussed the homeless problem and how lower income people were priced out. They decided that every aspect of their case must prioritize inclusion and the needs of the community. The approach was very “Berkeley,” Balingit said, referring to the focus on social justice.

Most memorable experience from the competition: A standing ovation from the crowd. “We could not get out of that building when we were done,” Taylor said. “We were literally held back.” At that moment, James said, “we knew we had made an impact.”

The students got to bring their whole authentic selves to the competition, Balingit said. “They brought such a fresh, innovative and risky approach but still won the hearts of everyone there,” she said. And another fun outcome: they all finish each other’s sentences now—and might just be friends for life.

New fund launches for social impact startups

Maggie Fried, MBA 19, spent years working for nonprofits before coming to Haas.

Now, Fried is getting a chance to make a different sort of impact as one of four Portfolio Fellows who are working to support social impact startups on campus through the new Berkeley Haas Social Venture Fund (BH-SVF).

“I came to Haas to learn how to grow a business and provide strategic support,” said Fried, who is focused on food, water, and health-related startups. “To be able to put into play what I’ve been learning is so meaningful to me.”

The BH-SVF program’s mission is two-fold: it provides experiential learning opportunities for graduate students interested in impact investing, while also giving student-led social ventures financial support, mentoring, and resources.

Launched in spring 2018 by Haas entrepreneurship lecturer Jorge Calderon, the fund allots two types of awards: a resource award, which provides ventures with an expert network, mentoring from the Portfolio Fellows, and office space, among other benefits; and a financial award that grants up to $5,000 to social ventures developing businesses. Recipients also get three months of dedicated coaching from a network of advisors, who are primarily UC Berkeley and Haas alumni.

Fried is among four full-time MBA students who have been named Portfolio Fellows in the new program, which is an independent study course. She joins Stephanie Solove, MBA 19, who is focused on education and the workforce, Jessie Tang, MBA 20 (financial services and housing), and Sam Roth, MBA 19 (energy and the environment). Fellows are already experiencing the value of the new program. “I’m meeting people across Berkeley’s social entrepreneurship space, serving as an advocate, and supporting these entrepreneurs as they build out their ideas,” Tang said.

Portfolio Fellows conduct multiple rounds of due diligence and weigh in on financial award decisions made by the fund’s managing council, which includes Calderon as chair, and Haas Lecturer Julia Sze and Senior Lecturer Sara Beckman.

The first grant recipient is Pedi-Ed, a health education non-profit co-founded by Ahaana Singh, BS 19 (public health), Caroline McGuire, a senior majoring in integrative biology, and Boston University senior Adam DeAngelo. Pedi-Ed produces illustrated videos explaining severe health conditions to pediatric patients and their families. With their initial award, Singh said she hopes to hire full-time staff, increase outreach, and expand the range of medical topics in the startup’s video library.

Among the fund’s goals is to support 10 to 20 social venture startups per semester, said Calderon, who is also a social impact fellow at the Haas Institute for Business and Social Impact and a previous recipient of the Richard H. Holton Teaching Fellow Award.

“The fund addresses the growing interest Berkeley students and alumni have in pursuing careers that integrate positive social or environmental impact with business innovation,” he said. “BH-SVF joins a rich ecosystem of entrepreneurship and impact innovation, campus programs, clubs, and courses that are collectively preparing future leaders who go beyond themselves.”

Haas alumni play a critical role with the the new fund, Calderon added. “We are lucky that Berkeley alumni constantly offer to help our students,” he said. “The fund incorporates their interests by providing them with a unique way to be part of the learning process as not only donors, but mentors and advocates. ”

The fund’s first donor is the Sanaya Shah Memorial Fund, created by members of the Berkeley MBA for Executives class of 2017 in memory of the daughter of classmate Sumit Shah and his wife, Astha Shah. “They have been wonderful to work with on our shared vision and we appreciate their thoughtfulness and offer of support,” Calderon said.

In the future, there are plans to scale the program by partnering with additional alumni and others interested in expanding social entrepreneurship at Berkeley.

Startups interested in applying for a BH-SVF award must address a pressing social or environmental issue. Teams should include at least one current Berkeley student as a founder and should a demonstrate commitment to building their social venture. The fund is open to both for-profit and nonprofit business models.

From improving safety to installing solar: social impact interns make change

Last summer Hugh G. Martin, MBA 19, made his inaugural trip to Africa, where he worked to equip off-the-grid homes in Tanzania with solar power.

“A highlight for me was seeing the looks on families’ faces when they used a TV in their homes for the first time,” says Martin, who worked for ZOLA Electric, which aims to bring solar power to one million homes in Africa over the next few years.

Martin, who also traveled to Kenya during his internship, was among 13 students, all MBA 19s, who received summer internship stipends from the Haas Social Impact Fund (HSIF). Since launching in 2004, the fund has helped students interested in the social-impact sector close the gap between what they could have made at a corporate internship versus what they would make at a social-impact internship. Each applicant received $500 to $7,000 that could be used to pay salary, living expenses, or travel expenses.

Each spring the HSIF holds a fundraiser asking peers to donate one day of pay that they’d expect at a corporate internship, according to Kevin Phan, MBA 19 and the MBA Association’s vice president of community. Students raised about $25,000 this past spring.

Claudia Luck, MBA 19, spent her summer at Yellowstone National Park as a consultant, analyzing the impact an increasing number of guests are having on visitors’ safety within the park. Her project required the use of four park databases and interviews with dozens of stakeholders to help the park determine how to best organize the 100-plus members of its Visitor Resource Protection division.

Luck, who worked at Adobe as a client training manager before coming to Haas, said she interviewed rangers, emergency medical technicians, justice center specialists, detention center workers, and entrance station attendants to understand how an increase in visitors would impact the park workers’ time and resources.

“I just loved the idea of spending three months way outside of my box—pursuing my passion for hiking, seeing Yellowstone, and working for the government,” Luck says.

For Hannah Levinson, MBA 19, an internship kept her closer to Berkeley. She worked for consulting firm Third Plateau on a mission to refresh the San Francisco Unified School District’s Arts Education Master Plan. For part of her work, she held focus groups with underrepresented minority students in the Bayview and Mission districts to better understand their arts education needs.

Levinson said she took away a lot about how to conduct unbiased interviews and construct questions through her Third Plateau consulting experiences. “For example, asking a leading question gets a biased response,” she says. “I made a point of getting feedback after every interview, and it helped me to shape my questioning.”

More HSIF student internship stories are available on ImpactMBA, the Center for Social Sector Leadership’s Medium channel.

Fundraising and applications for the Haas Social Impact Fund will open in April 2019, headed by Midori Chikamatsu, MBA 20, incoming vice president of community. Donations to the fund are accepted year-round here.

Enhancing financial inclusion among bottom-of-the-pyramid entrepreneurs in Mexico

On the corner of a bustling, working-class neighborhood in Mexico City, Maria González has run a small photography business for years.* Recently, she took out a bank loan to purchase a new digital camera and printer that enabled her to produce high-quality images and deliver them at a rapid speed. González’s clients noticed her improved service and spread the word—new customers flooded her store. A few steps down the same street, Andres Perez owns a bookstore that would benefit from renovations. While these improvements would presumably attract much needed customers, Perez refuses to take out a bank loan. He explains that bank loans are stressful, require too much paperwork, and are meant for people with money or assets.

Financial inclusion brings major benefits to individuals like González and entire economies. By allowing people to invest in their future, smooth consumption, and manage risk, access to and use of a range of financial services help reduce poverty and inequality. Yet, access to financial capital is often cited as a barrier to growth for microentrepreneurs in emerging countries. In these countries, 40 percent of formal micro-, small- and medium-size enterprises are financially constrained.

But, as Perez’s story demonstrates, unmet financial needs among microenterprise owners may also be a result of low demand for the formal financial services available to them. Despite the availability and benefits of loans through banks and microfinance institutions (MFIs) in Mexico, take-up rates of formal financial products among microentrepreneurs is often surprisingly low. For example, only 4 percent of eligible applicants take up the credit available to them from Mexican bank and MFI Compartamos Banco. A new report by the Institute for Business & Social Impact at the Haas School of Business, University of California, Berkeley, in partnership with the Mastercard Center for Inclusive Growth, surveys microenterprise owners clustered at the bottom of the pyramid in Mexico and investigates possible reasons for their disinterest in formal financial services.

The formal versus informal financial system

The new report presents evidence that small business owners in Mexico prefer informal financial networks to the formal financial system. In the sample of more than 1,300 Mexican microentrepreneurs, over 75 percent do not consider borrowing from the formal financial system in times of economic need. Rather than take out a bank loan or MFI credit, more than two-thirds of these entrepreneurs would prefer to draw from their personal savings or borrow money from a friend or relative, and about 10 percent would sell belongings in exchange for cash. Interestingly, this is true among microentrepreneurs in the sample across all levels of education, suggesting that it is not lack of information or understanding that is compelling these small enterprise owners to avoid formal financial products.

The report goes further, inquiring what features of formal bank and MFI loans are unappealing to microentrepreneurs. Their aversion to collective loans stands out as an explanation. To guarantee high repayment rates, discourage risky projects, and increase accountability, formal banks and MFIs will often require microenterprise owners to apply for credit with a group of peers or neighbors. All group members would be penalized if the loan is not fully repaid. While collective loans are designed by banks and MFIs to increase credit availability to microentrepreneurs without collateral or prohibitively high interest rates, this design feature appears to discourage eligible borrowers in Mexico. Even in times of economic distress, the majority of Mexican microentrepreneurs surveyed would prefer an individual loan, citing as reasons personal responsibility for repayment, flexibility of credit to individual business dynamics, difficulty in meeting group eligibility requirements, and higher loan amount disbursed.

These results suggest that specific design features of formal bank loans and MFI loans intended to serve microentrepreneurs clash with their preferences, and inadvertently keep them on the periphery of the formal financial system.

Technology and financial inclusion

Cell phones and digital technologies are likely to provide the platforms necessary to increase financial inclusion for microentrepreneurs in the informal and formal economy. The report finds that over three-fourths of microenterprise owners in the sample own a cell phone. However, only 14 percent of cell phone owners use their mobile device for business-related transactions. Mobile channels—perhaps developed by formal financial institutions—could be used to track transactions, customers, and revenue to determine eligibility for individual loans, as well as monitor credit dispersion and repayment rates. Targeted programming that encourages business-related cell phone usage and training could lead to efficiency gains and unleash potential for microentrepreneurs. The cell phone market in Mexico is projected to keep growing, providing opportunities for value-added services that have the potential to increase financial inclusion and market share for microenterprise owners.

These findings suggests that digital technologies might enable banks and other financial institutions to design better products that encourage microentrepreneurs to engage in the formal financial system. Indeed, mobile money and other forms of digital finance are likely to be the major channels for accelerating progress on financial inclusion in Mexico and other emerging market economies. Of course, in addition to technology, there are various factors that influence a microentrepreneur’s demand for a loan, including low trust in formal banks and the government, fear of debt, sensitivity to interest rates, and lack of information.

Strivers in Mexico

To facilitate smooth transactions between banks and microentrepreneurs, banks must be familiar with microentrepreneurs’ business profiles, characteristics, and motivations. The report points out that microenterprise owners in Mexico vary significantly with respect to their level of education, number of clients per week, volume of sales, and amount of loans received in the past year. These findings indicate that it might be possible to determine the demand for financial products by individual microentrepreneurs based on their level of education or the size of their business.

As financial inclusion increases, some microentrepreneurs may be especially well positioned to benefit. The report proposes a framework to identify and classify this particular category of microentrepreneurs, termed “strivers” by the Mastercard Center for Inclusive Growth. Strivers are operating enterprises with two to 10 employees in rapidly growing market segments. They are poised to thrive and contribute to inclusive employment and economic growth within their communities, but are lacking the tools to increase their competitiveness and fully realize their business potential. The majority of respondents (60%) surveyed in the report are strivers by this definition.

Strivers, like most of the microentrepreneurs in the sample, prefer informal and individual loans, and are likely to own a cellphone. For strivers in Mexico, mobile devices may serve as important tools for information, training, and capital that lead to growing market share. The majority of the Strivers in the sample chose to be entrepreneurs over pursuing formal jobs; have a distinct sense of agency in their lives; and, as a result, believe that they have more control over their business outcomes.

Going forward

This report provides an initial window into the lives and decisions of microentrepreneurs and strivers in Mexico. It highlights their need for credit to stimulate growth; specific barriers that keep them from taking-up loans from formal financial institutions; and the potential for mobile phone technologies to increase their engagement with these institutions. Impact-oriented design and evidence-based evaluation of financial products tailored to the needs of microentrepreneurs have the potential to vastly increase financial inclusion in emerging economies around the world. Bold approaches are necessary to realize the vision of sustainable growth for this promising segment of the economy.

*Names have been changed to maintain anonymity.

RESOURCES

Laura D. Tyson is Interim Dean of the Haas School of Business and Faculty Director, Institute for Business & Social Impact, University of California, Berkeley.

Byron Villacis is a PhD candidate, University of California, Berkeley.